[ad_1]

As we speak, we noticed broadening of participation by evaluating the share change of the cap-weighted model of the S&P 500, SPY (+1.50%), versus the equal-weighted, RSP (+2.25%), which exhibits that at present’s RSP superior 52% greater than SPY.

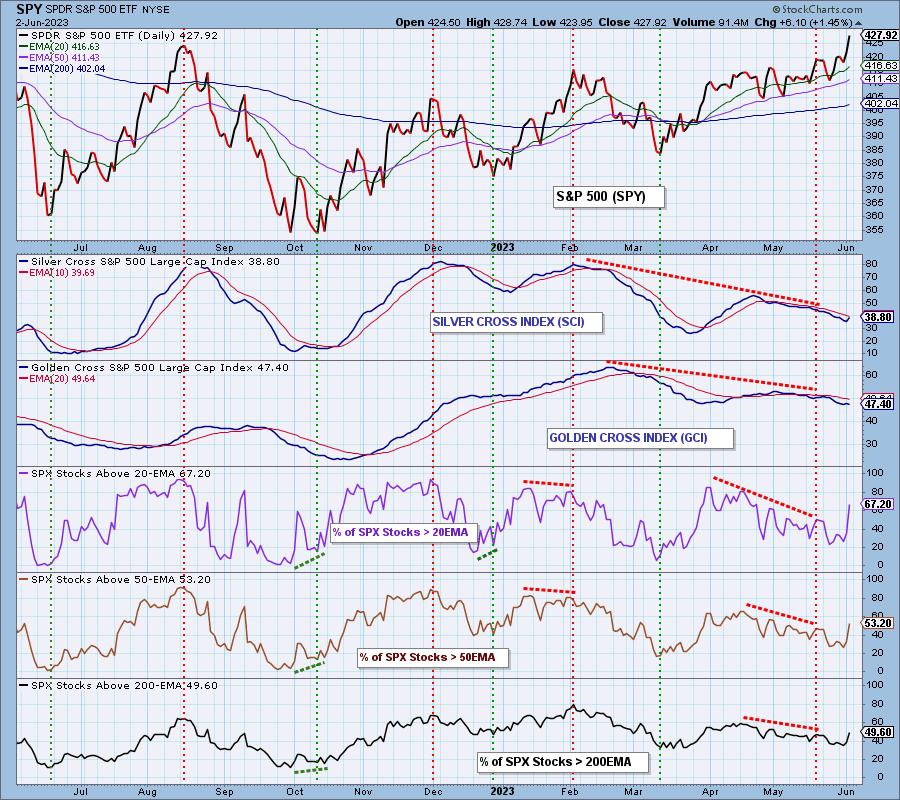

Our largest beef with the SPY rally was that it wasn’t broad. It was narrowed to huge mega-cap shares, and the remainder weren’t collaborating. Simply have a look at our bias chart beneath. Discover the place the Silver Cross and Golden Cross Indexes had been at related worth ranges, studying within the 70s and 80s. We’re setting a brand new excessive, and these indicators present broad participation has been virtually nonexistent as they learn within the 30s and 40s.

As we speak noticed a giant shift as participation of shares above their 20-/50-/200-day EMAs skyrocketed to and previous our 50% bullish threshold.

The rally within the SPY has confounded us and, in the event you have a look at the comparability between the SPY and RSP, you will perceive why. RSP’s worth chart is what the SPY ought to’ve seemed like, but it surely did not. Why? The distinction is capitalization. It labored within the SPY’s favor, however not in RSP’s.

RSP’s breakout from the declining development seems good and bolsters the brand new participation numbers we see on the chart above.

Conclusion: That is solely someday’s motion, however we expect it exhibits a turning level. We have typically been requested what it could take for us to maneuver to the bull camp, and we at all times reply “bias”, we have to see the broader market collaborating. We’re seeing that now.

Study extra about DecisionPoint.com:

Watch the newest episode of DecisionPoint on StockCharts TV’s YouTube channel right here!

Technical Evaluation is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Useful DecisionPoint Hyperlinks:

DecisionPoint Alert Chart Listing

DecisionPoint Golden Cross/Silver Cross Index Chart Listing

DecisionPoint Sector Chart Listing

Value Momentum Oscillator (PMO)

Swenlin Buying and selling Oscillators (STO-B and STO-V)

DecisionPoint isn’t a registered funding advisor. Funding and buying and selling selections are solely your duty. DecisionPoint newsletters, blogs or web site supplies ought to NOT be interpreted as a advice or solicitation to purchase or promote any safety or to take any particular motion.

Erin Swenlin is a co-founder of the DecisionPoint.com web site alongside along with her father, Carl Swenlin. She launched the DecisionPoint day by day weblog in 2009 alongside Carl and now serves as a consulting technical analyst and weblog contributor at StockCharts.com. Erin is an lively Member of the CMT Affiliation. She holds a Grasp’s diploma in Info Useful resource Administration from the Air Pressure Institute of Know-how in addition to a Bachelor’s diploma in Arithmetic from the College of Southern California.

Carl Swenlin is a veteran technical analyst who has been actively engaged in market evaluation since 1981. A pioneer within the creation of on-line technical assets, he was president and founding father of DecisionPoint.com, one of many premier market timing and technical evaluation web sites on the internet. DecisionPoint makes a speciality of inventory market indicators and charting. Since DecisionPoint merged with StockCharts.com in 2013, Carl has served a consulting technical analyst and weblog contributor.

Study Extra

Subscribe to DecisionPoint to be notified every time a brand new submit is added to this weblog!

[ad_2]