[ad_1]

In Could, financial uncertainty persevered within the face of debt ceiling debate, and one other rate of interest hike by the Fed.

Though, this didn’t cease small companies from their summer time hiring ramp up, albeit at decrease worker wage charges than seen final yr.

One other month, one other charge hike from the Federal Reserve – policymakers continued to pump the brakes in Could, as they continue to be break up on whether or not extra intervention is perhaps obligatory in coming months. Homebase seeks to assist make clear how the broader financial surroundings is affecting small companies and their workers as summer time approaches by analyzing behavioral knowledge from greater than two million workers working at multiple hundred thousand SMBs.

Abstract of findings: SMB employment exercise elevated, however wage charges decreased for the primary time since 2021.

- Employment exercise at small companies elevated in Could; as spring turns to summer time, small companies are experiencing a seasonal enhance.

- Retail and Meals & Drink are displaying energy, persevering with to outpace their historic seasonal progress.

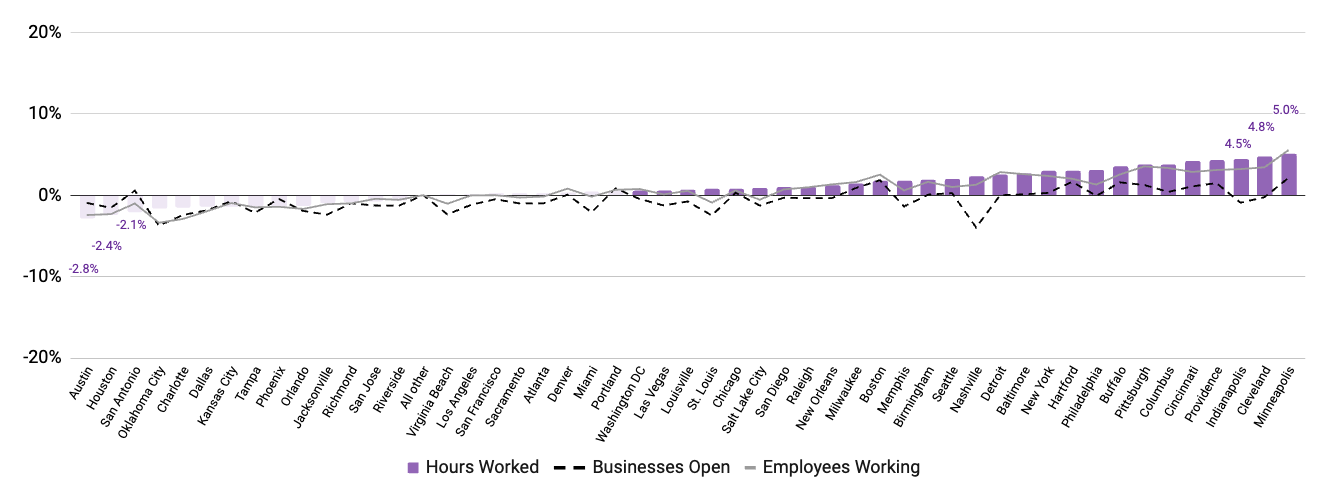

- Spring climate variation is probably going driving regional variations – heat climate within the Midwest and storms in Texas translated into assorted enterprise exercise.

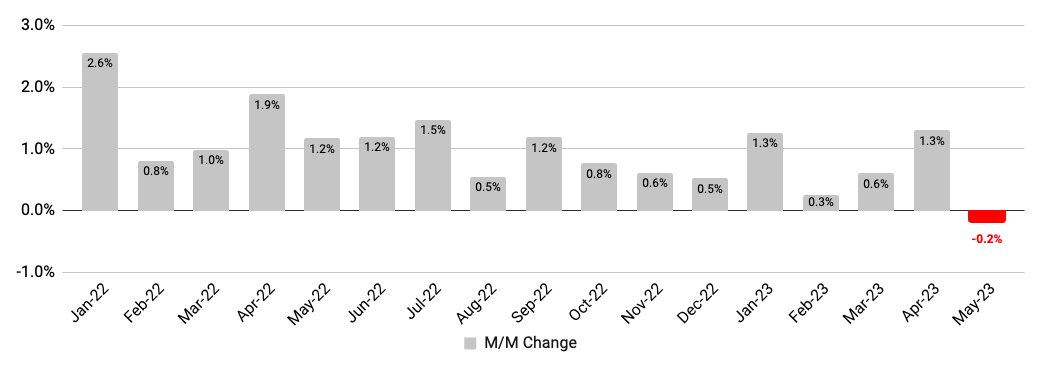

- Wages declined from April to Could (-0.2%) for the primary time since 2021, as decreases present a cooling labor market.

Employment exercise at small companies elevated in Could

As spring turns to summer time, small companies expertise a seasonal enhance

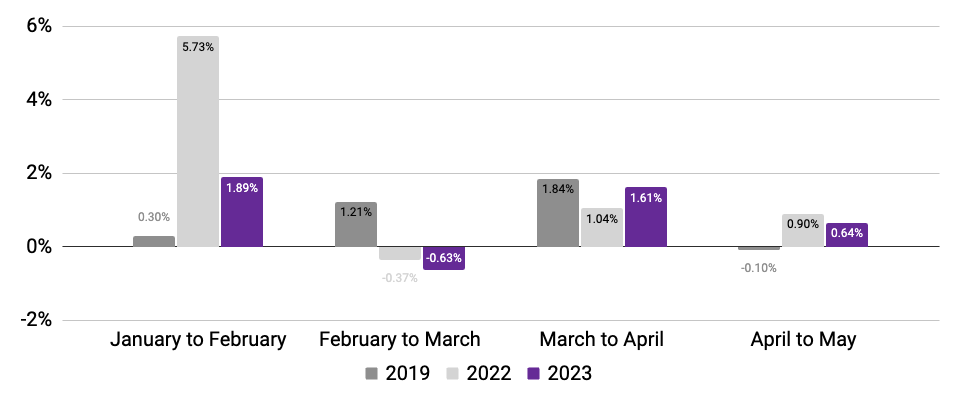

Workers working

(Month-to-month change in 7-day common, relative to January of reported yr)

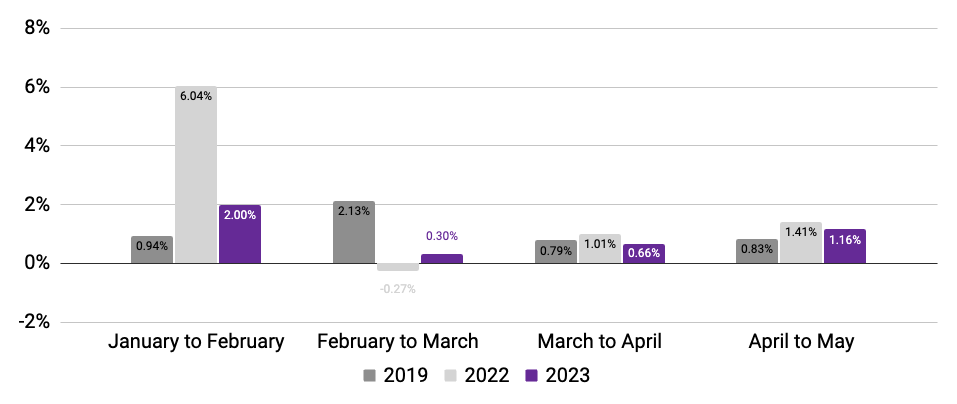

Hours labored

(Month-to-month change in 7-day common, relative to January of reported yr)

Knowledge usually compares rolling 7-day averages for weeks encompassing the twelfth of every month; April 2023 knowledge encompasses subsequent week to account for Easter vacation. Supply: Homebase knowledge.

Retail and Meals & Drink are displaying energy, persevering with to outpace historic seasonal progress

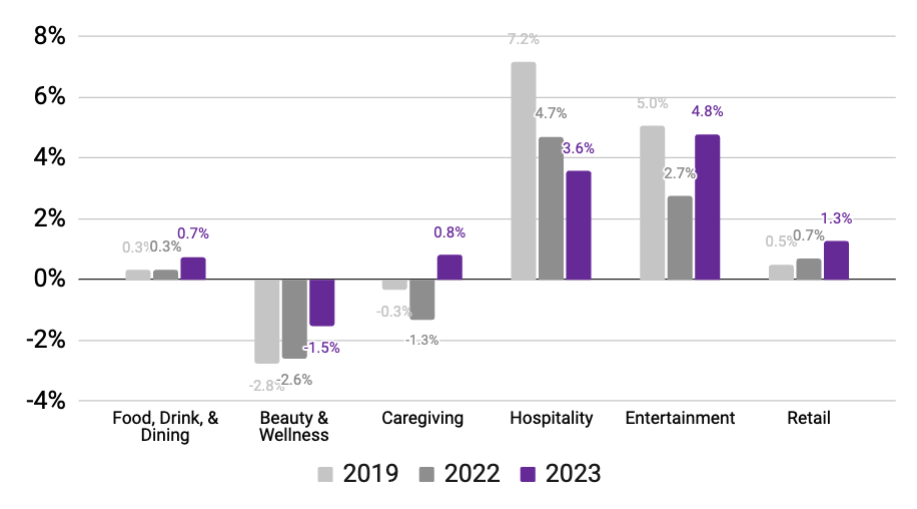

Whereas most industries have picked up via Could, Retail, Meals & Drink, and Caregiving (1.3%, 0.7%, and 0.8%, respectively) have exceeded their seasonal progress benchmarks most importantly.

Hospitality (3.6%) and Leisure (4.8%) noticed the strongest will increase from April to Could, although their progress fell wanting earlier years.

P.c change in workers working

(Mid-Could vs. mid-April, utilizing Jan. ‘19 and Jan. ‘23 baselines)1

1. Could 12-18 vs. April 7-13 (2019) and Could 7-13 vs. April 16-22 (2023). Pronounced dips usually coincide with main US Holidays. Supply: Homebase knowledge

Spring climate possible driving regional variations

Heat climate within the Midwest and storms in Texas translated into assorted enterprise exercise

Be aware: Could 7-13 vs. April 16-22. Supply: Homebase knowledge

After yet one more rate of interest hike, wage charges declined month over month for the primary time since 2021

Wage inflation

Month-over-month change in common hourly wages

Be aware: Knowledge consists of people who’ve been repeatedly employed and energetic since January 2022. Supply: Homebase knowledge.

Hyperlink to PDF of: Could 2023 Homebase Primary Avenue Well being Report Should you select to make use of this knowledge for analysis or reporting functions, please cite Homebase.

[ad_2]