[ad_1]

SPX Monitoring Functions: Lengthy SPX on 2/6/23 at 4110.98.

Monitoring Functions GOLD: Lengthy GDX on 10/9/20 at 40.78.

Lengthy Time period SPX Monitor Functions: Impartial.

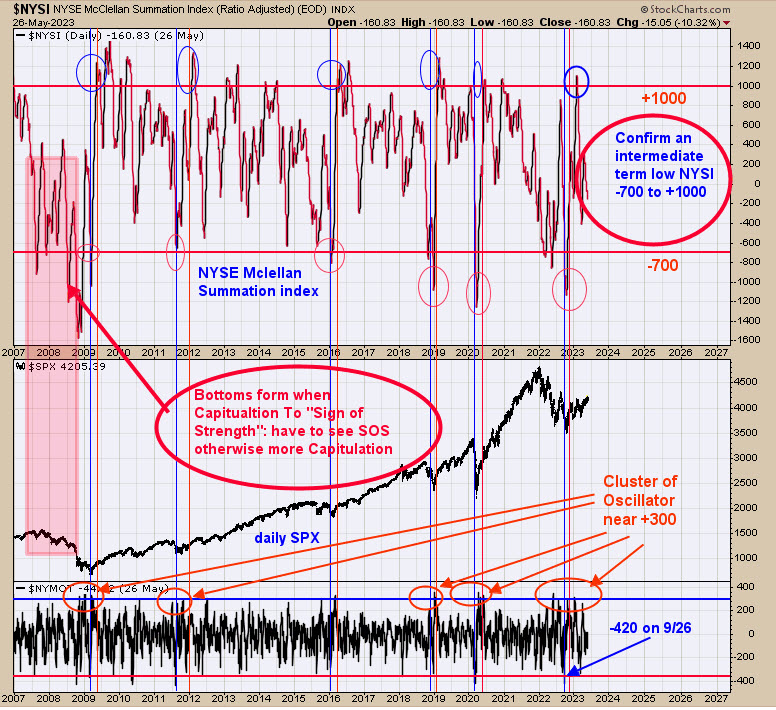

The quick time period image is just a little messy, with an open hole for Might 5 close to 407 SPY that also might be examined. However the larger image appears to be like advantageous. Above is the NYSE McClellan Summation index, going again to 2007. Capitulation occurs when the Summation index falls under -700 (marked with blue traces). Capitulation have to be adopted with a “Signal of Energy” to substantiate a backside available in the market. A “Signal of Energy” is a Summation index studying above +1000 (marked with crimson traces). As you’ll be able to see, capitulation within the Summation index under -700 appeared in October of final 12 months, and a “Signal of Energy” with a Summation index above +1000 got here in January of this 12 months, confirming a market backside. Bottoms type when capitulation to “Signal of Energy” varieties. Should see “Signal of Energy” of capitulation, or in any other case there might be extra capitulation, which is what occurred within the 2008 decline.

Final Thursday, we mentioned, “Above is the month-to-month SPY going again to 2020. The retracement from the March 2020 low to the January 2022 got here in rather less than 50%. A 50% retracement suggests at the very least a take a look at of the earlier excessive (close to the 470 SPY) or the midway level of the transfer up (which provides goal to 610 SPY). A “Signal of Energy” was carried out in March and closed above the neckline of a head-and-shoulders backside affirmation this sample. This head-and-shoulders sample has measured goal to 460 vary and never removed from the January 2022 excessive close to 470. The underside window is the month-to-month Sluggish Stochastic (momentum indicator), which turned up final October. Momentum guidelines all indicators and momentum is up for the SPY.” Including to the above, discover that Might quantity is larger than April quantity and a bullish signal.

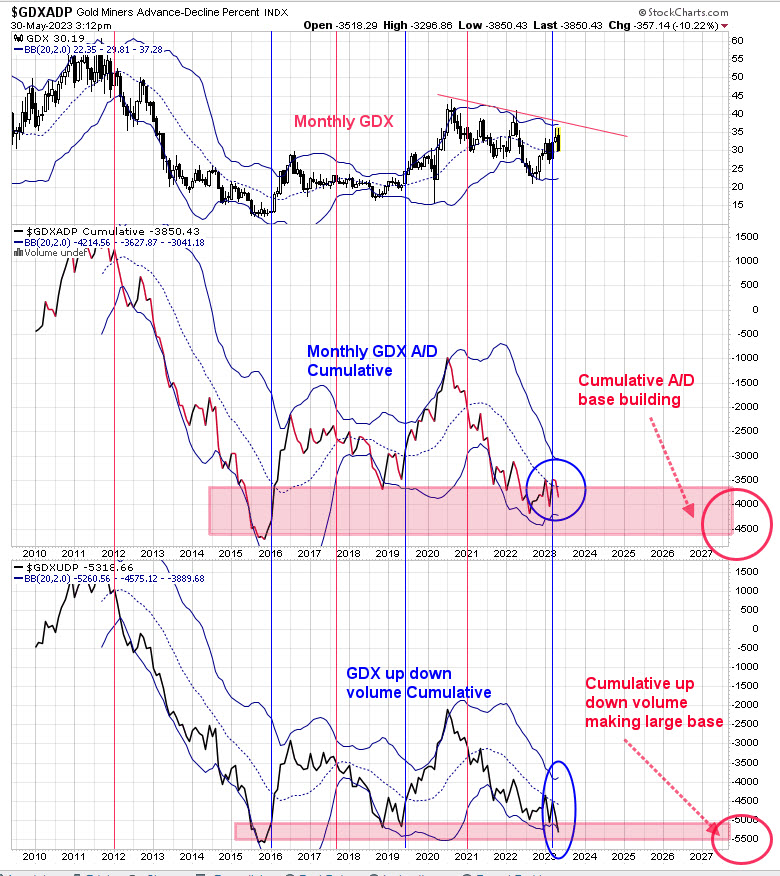

Above is the month-to-month cumulative up down quantity and advance/decline for GDX. We took a better look on the month-to-month GDX during the last week. What seems to be creating is a basing interval for each indicators going again to 2016. The underside window is the GDX month-to-month Cumulative Up Down quantity. This indicator is close to matching the low of 2016 and is under the 2019 low and a assist space. The subsequent larger window is the GDX month-to-month cumulative Advance/Decline. This indicator is under the 2019 lows and above the 2016 low. Each indicators closed above their mid-Bollinger bands again in March of this 12 months, and each closed under their mid-Bollinger since negating March’s purchase sign. We wished these two indicator went again extra in time, as that might have gleamed extra info. GDX seems to be constructing a really giant base that might produced an prolonged rally.

Tim Ord,

Editor

www.ord-oracle.com. Ebook launch “The Secret Science of Value and Quantity” by Timothy Ord, purchase at www.Amazon.com.

Indicators are supplied as common info solely and usually are not funding suggestions. You’re answerable for your individual funding selections. Previous efficiency doesn’t assure future efficiency. Opinions are primarily based on historic analysis and knowledge believed dependable; there isn’t any assure outcomes might be worthwhile. Not answerable for errors or omissions. I could spend money on the autos talked about above.

Subscribe to High Advisors Nook to be notified every time a brand new publish is added to this weblog!

[ad_2]