[ad_1]

Final week, Nvidia posted an impressive efficiency, pushed by strong synthetic intelligence-related companies (because of ChatGPT). On Thursday, the corporate recorded its third largest day by day achieve in market capitalization in historical past (about $184 billion). The corporate is even poised to affix the elite trillion greenback membership, with its market cap now at over $963 billion. Its share worth closed the week at about $390, a stage not seen since July 2020.

The AI chip growth can also profit different firms that are just like Nvidia, as an illustration, Hewlett Packard Enterprise Co, which is described as a worldwide edge-to-cloud firm, actively partaking within the provision of knowledge know-how, know-how and enterprise merchandise, options and companies. It operates by varied segments, specifically Compute (basic objective servers for multi-workload computing, workload optimized servers for demanding purposes), Excessive Efficiency Computing & Synthetic Intelligence (HPC&AI) (gives {hardware} and software program options to assist particular use circumstances), Storage (gives workload optimized storage product and repair choices), Clever Edge (gives wired and wi-fi native space community, campus and information middle switching, software-defined wide-area-network, community safety and related companies to allow safe connectivity) and Monetary (which gives versatile funding answer and consumption fashions that assist enterprise transformation).

In truth, HPE is working in collaboration with Nvidia in an effort to ship an industry-leading portfolio of optimized AI options. Each search to achieve a serious aggressive benefit available in the market, by combining HPE’s confirmed, simple, dependable and safe IT deployments with Nvidia’s world class AI know-how. Might Hewlett Packard Enterprise convey excellent news about its Q2 2023 earnings that are scheduled to be introduced this Tuesday (30th Could), after market shut?

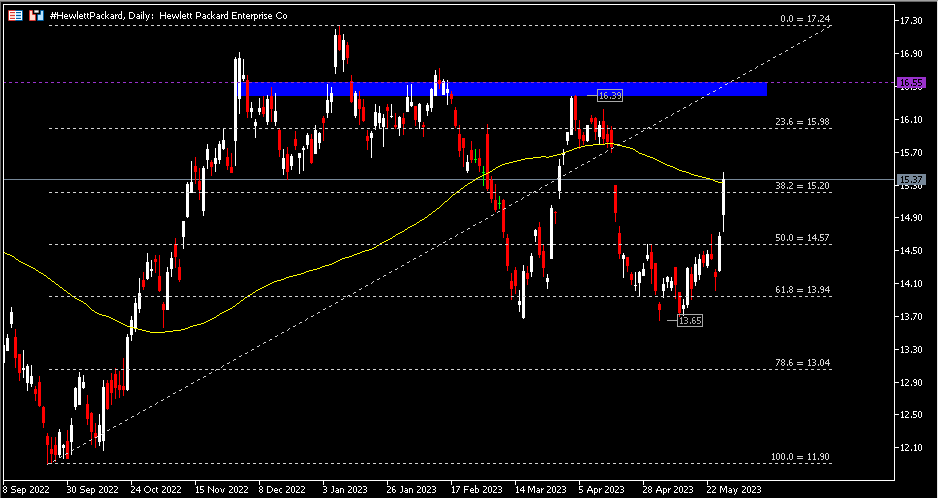

Fig.1: Reported Gross sales of HPE versus Analyst Forecast. Supply:CNN Enterprise

Fig.1: Reported Gross sales of HPE versus Analyst Forecast. Supply:CNN Enterprise

Within the earlier quarter, HPE’s gross sales income achieved the very best Q1 efficiency since 2016, at $7.8B, up 12% from the identical interval final 12 months. Its annualized income run-rate (ARR) additionally exceeded $1B for the primary time, following 26% positive aspects from the prior-year interval. Phase outcomes displayed that 44.9% of the full income was generated from the Compute section, at $3.5B. Each the HPC&AI and Clever Edge segments have been recorded at $1.1B, Storage income at $1.2B, and Monetary Providers income at $0.873B. It’s value noting that income progress of the HPC&AI section was recorded on the quickest tempo, at +34% (y/y).

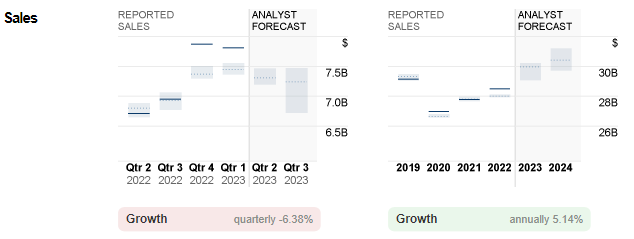

Fig.2: Reported EPS of HPE versus Analyst Forecast. Supply: CNN Enterprise

Fig.2: Reported EPS of HPE versus Analyst Forecast. Supply: CNN Enterprise

EPS of HPE in Q1 2023 was $0.63, up +10.53% from the earlier quarter and up +19% from the identical interval final 12 months. Within the coming quarter, consensus estimates for gross sales stood at $7.3B, down -6.85% from the earlier quarter, however up 9% from Q2 2022. Then again, EPS is anticipated to hit $0.49, down over -22% from the earlier quarter, however up +11.4% from the identical interval final 12 months.

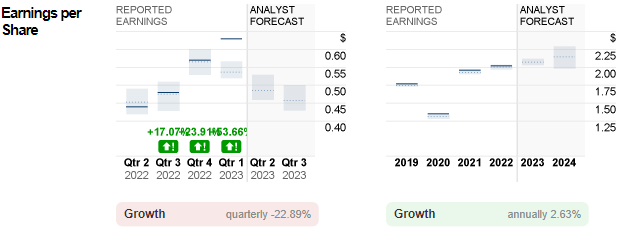

Technical Evaluation:

#HewlettPackard (HPE.s) rebounded increased after gaining floor at a 12 months low of $13.65. The asset is at the moment testing the 100-day SMA. A greater than anticipated earnings end result might propel the share worth increased, in the direction of $16 (FR 23.6% prolonged from the lows in Sept 2022 to the highs in Dec 2022), adopted by the resistance zone shaped by the highs in April 2022 ($16.39 and $16.55.) In any other case, if worth breaks beneath $15.20 (FR 38.2%), it may indicate a bearish continuation wherein sellers might proceed to push the value decrease, in the direction of the following assist at $14.60 (FR 50.0%) and $13.95 (FR 61.8%).

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a basic advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]