[ad_1]

Finally Friday’s shut, the DJ Industrial (US30) was damaging on the 12 months, regardless of its robust efficiency to shut the week. As of 30 December 2022 it had closed at 33,147, about 0.16% greater than the final buying and selling session (33,093). Compared, the SP500 is up 9.52% YTD, the Nasdaq 30.95%. Throughout 2022 the US30 had fallen 8.78%.

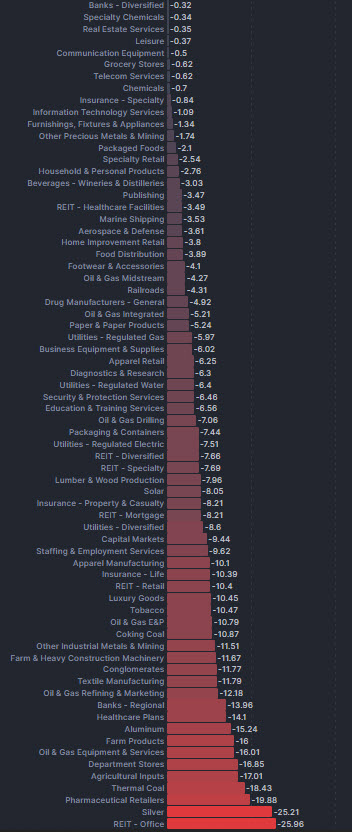

Greater than half of the 30 names within the index have carried out negatively this 12 months, and a few of them are well-known. Among the many  worst performers are some shopper items giants, akin to P&G (-4.06%), Johnson & Johnson (-12.62%), but in addition Coca Cola (-5.27%) and Nike (-8.12%). The industrial sector didn’t fare any higher, with Caterpillar (-11.59%) and conglomerates akin to 3M and Honeywell (-9.59%) heavy; then there was the healthcare-related sector (Walgreens Boots –19.67%, United Well being -9.18%, Amgen -17.40%). The identical has been seen in IT names akin to IBM (-8.52%) and Verizon (-11.17%), financials akin to Goldman Sachs (-3.31%) and power firms like Chevron (-14.16%).

worst performers are some shopper items giants, akin to P&G (-4.06%), Johnson & Johnson (-12.62%), but in addition Coca Cola (-5.27%) and Nike (-8.12%). The industrial sector didn’t fare any higher, with Caterpillar (-11.59%) and conglomerates akin to 3M and Honeywell (-9.59%) heavy; then there was the healthcare-related sector (Walgreens Boots –19.67%, United Well being -9.18%, Amgen -17.40%). The identical has been seen in IT names akin to IBM (-8.52%) and Verizon (-11.17%), financials akin to Goldman Sachs (-3.31%) and power firms like Chevron (-14.16%).

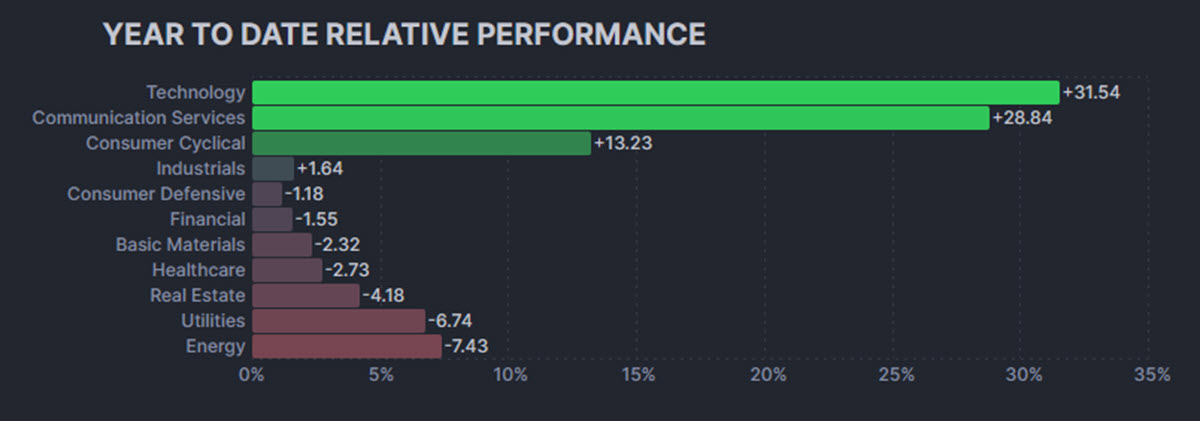

Specializing in sector efficiency, we are able to see that Vitality has suffered essentially the most (definitely given the decrease commodity costs), adopted by Utilities, Actual Property, Healthcare, Primary Supplies, and Financials. All of the good points got here from Expertise, Communication Companies (whose group consists of names akin to Google, Alphabet and even Netflix) and Shopper Cyclical (pushed by Amazon and Tesla).

However it’s not solely within the US30 that we discover such a dichotomisation: 324 out of 500 shares inside the SP500 are buying and selling beneath their 50 MA; dwelling on the elemental knowledge, we are able to additionally observe that manufacturing PMIs have been contracting for months, in distinction to providers ones.

This distinction in efficiency signifies that the financial actuality that lies beneath the indices is far much less uniform than the indices themselves and could also be hiding helpful info for our understanding of the markets and uncovering pockets of at present hidden worth. Quite the opposite, the standard well-known shares have a really excessive affect – maybe even a “harmful” one – and conceal a extra various actuality behind their stable efficiency. Briefly, we’re lastly again to a time when inventory selecting might be helpful once more.

TECHNICAL ANALYSIS

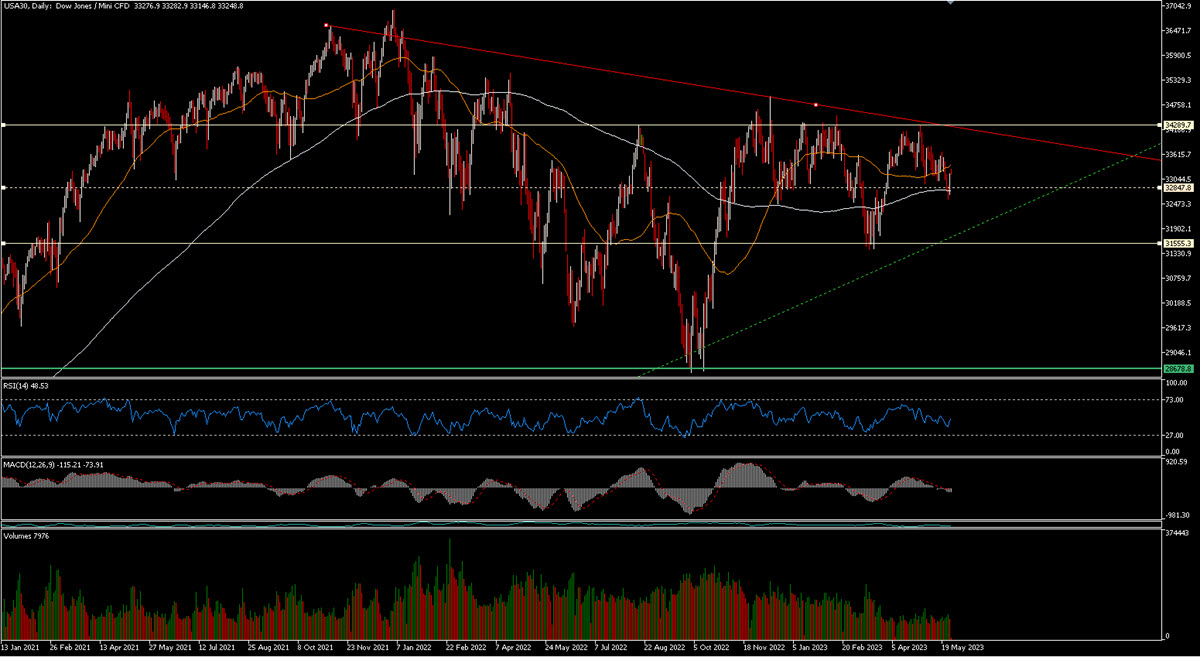

The Dow Jones, not like the opposite two main US indices, has not damaged long run pattern strains, remaining extra ”congested” and at present buying and selling on the similar space as 12 months in the past. The 2 most necessary long-term ranges are within the 31,550 and 34,300 areas: briefly, we’re at present in the midst of the ford, by which can also be the center of the MM50 and MM200. The chart is nonetheless cleaner than the one among different US indices, guaranteeing clearer technical evaluation references. The totally different relative energy – evidently – can assist us each to use the index as a hedge and to watch future sectoral repositioning (technological won’t proceed to outperform ceaselessly) which could lead on the DJIA to strengthen comparatively towards its friends.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]