[ad_1]

A miserable ballot launch from YouGov advised this yesterday:

Which do you assume the federal government ought to prioritise?

Bringing down inflation: 51%

Stopping the financial system going into recession: 33%https://t.co/Dl1ItXXsfmBringing down inflation: 62%

Bringing rates of interest down: 22%https://t.co/h9BRBQEbOJ pic.twitter.com/eZdhkOo04u— YouGov (@YouGov) Might 26, 2023

Apparently, persons are fairly satisfied that bringing down inflation is extra necessary than avoiding recession, while beating inflation is much more necessary than slicing rates of interest.

Years of propaganda from the federal government and the Financial institution of England has satisfied those that financial sadism on those that should borrow is the worth price paying for the supposed benefit of decreasing inflation. It might appear that only a few ask the plain query, which is how rising the worth of cash can forestall the worth of cash from deteriorating.

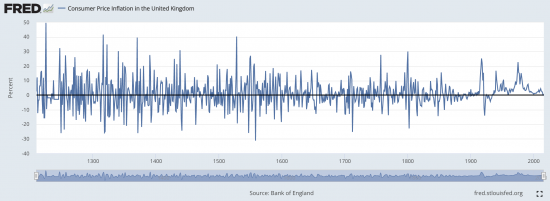

The truth is that inflation all the time goes away anyway. Take, for instance, this St Louis Fed chart which summarises information from the Financial institution of England on inflation traits in first England after which the Uk over a interval of greater than 800 years:

After a interval of inflation there has, traditionally, all the time been deflation, and even when the latter has been uncommon of late, there’s all the time a return to extra regular charges. The straightforward truth is that regardless of what politicians and the Financial institution of England declare, inflation doesn’t persist. The coverage measures put in place to supposedly sort out it solely make issues worse. However folks have been persuaded in any other case.

Economics, it appears, has not but received out of the age of mythology.

[ad_2]