[ad_1]

The media is concentrating on the supposed efforts being made by the Financial institution of England to manage inflation however which are literally meant to extend rates of interest to the purpose the place they’re at their highest stage since earlier than the 2008 world monetary disaster.

I’m not within the slightest bit satisfied that the Financial institution of England now has any critical goal with regard to the management of inflation. They admit that their fashions do not work in relation to forecasting what inflation may be.

They’re very clearly not succeeding in exercising any management, which is unsurprising when the instruments accessible to them are wholly unsuited for the duty, however they use them, nonetheless.

The apparent conclusion to attract consequently is that they’re both incompetent, or have one other agenda. I’m going to be beneficiant and can assume that it’s the second of those two choices. The actual agenda is to extend rates of interest, come what could.

There may be very sturdy proof to assist that speculation. I solely had to take a look at the quarterly report of the Financial institution of England Asset Buy Facility, which manages the bonds acquired by the Financial institution of England underneath the quantitative easing programme to discover this information:

That desk reveals the worth of belongings acquired by the APF at 31 December 2022.

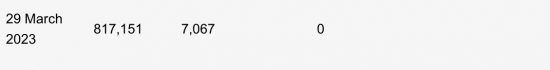

By 31 March 2023, the desk appear like this, utilizing the identical headings::

Over that quarter the APF bought £5.8 billion of personal sector bonds and £19 billion of presidency bonds.

The intention of those gross sales – and most particularly the gilt gross sales – which did nothing to assist fund the federal government – was to suppress the worth of gilts in monetary markets. And as anybody who’s conversant in monetary markets will know, the rate of interest earned on a gilt at a second in time strikes inversely to its value, so if the Financial institution of England is promoting vital portions of guilts on high of those the federal government already thinks it must promote to supposedly finance its day-to-day actions then the result’s that the rate of interest is compelled upwards.

There was no motive for the Financial institution of England to hunt gilts at this second. It may simply as simply have held onto these gilts till markets had been calmer. But it surely bought them anyway understanding that to take action would assist obtain its goal of pushing charges upwards, the place it has each intention that they need to keep.

After which we get headlines like this within the Guardian:

The Financial institution should be delighted. They are going to be much more happy {that a} supine Chancellor has stated that he’ll assist all their plans.

I feel this is class warfare. This recession will hardly contact the wealthy. Many will see their actual incomes rise. The bulk within the nation will undergo. What different conclusion can I come to when this disaster is being manufactured fairly intentionally and wholly unnecessarily by the Financial institution to impose devastation on hundreds of thousands?

[ad_2]