[ad_1]

BOJ Governor Kazuo Ueda emphasised the significance of avoiding untimely financial coverage tightening, to make sure that Japan can obtain its 2% inflation goal on a sustainable foundation. Ueda spoke with reporters on the financial institution’s headquarters in Tokyo in his first group interview since taking workplace in April. Nonetheless, he additionally prompt potential changes to the Yield Curve Management (YCC) if the advantages and prices of the coverage change.

The Governor outlined doable modifications to the YCC coverage sooner or later, which might be finished in varied methods. One potential method he talked about is concentrating on bond yields within the 5-year zone as an alternative of the present 10-year zone. However he mentioned that it was not sure that the BOJ would accomplish that, how probably this was to occur or underneath what situations the BOJ would have a look at this feature as wanted.

As reported at the moment, annualized inflation in Tokyo fell to three.2% in Might, decrease than anticipated and beneath the y/y inflation reported in April, which hit 3.5%. On a month-to-month foundation, Tokyo inflation fell by 0.1%. The Shopper Value Index (CPI) excluding recent meals elevated 3.2% y/y and fell 0.1% in comparison with April. CPI excluding recent meals and vitality rose 3.9% in comparison with Might 2022 and grew 0.2% from April.

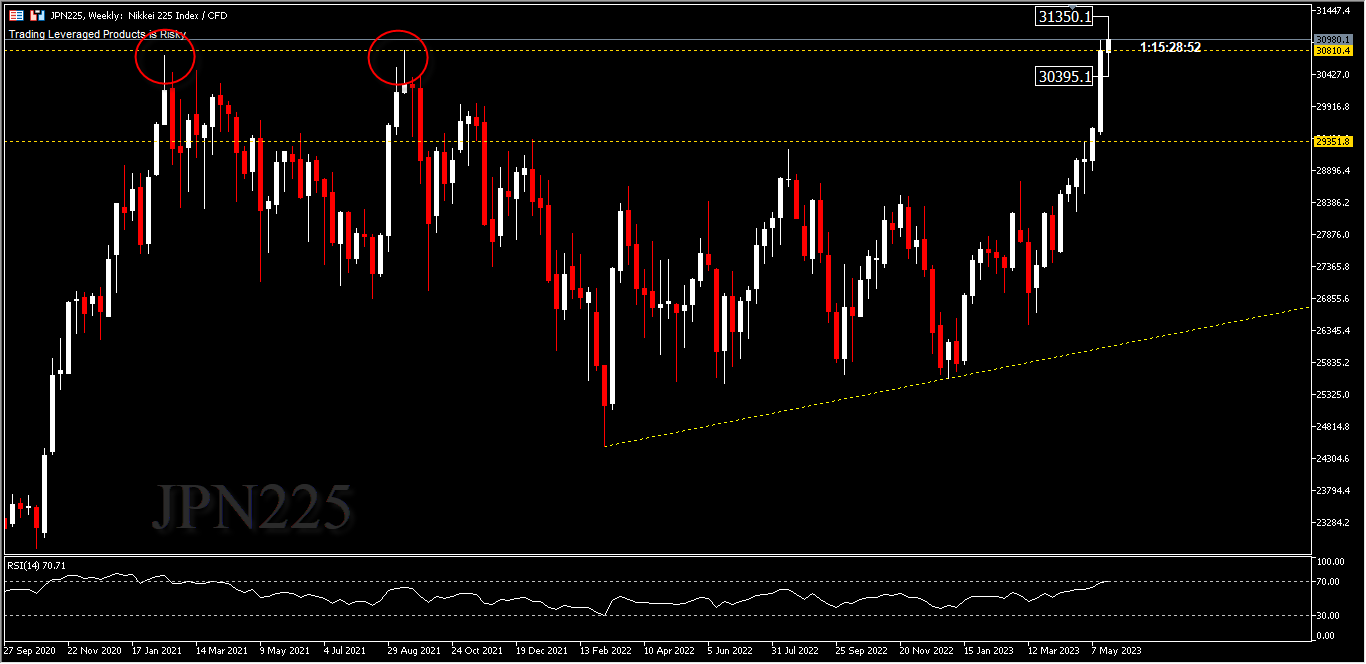

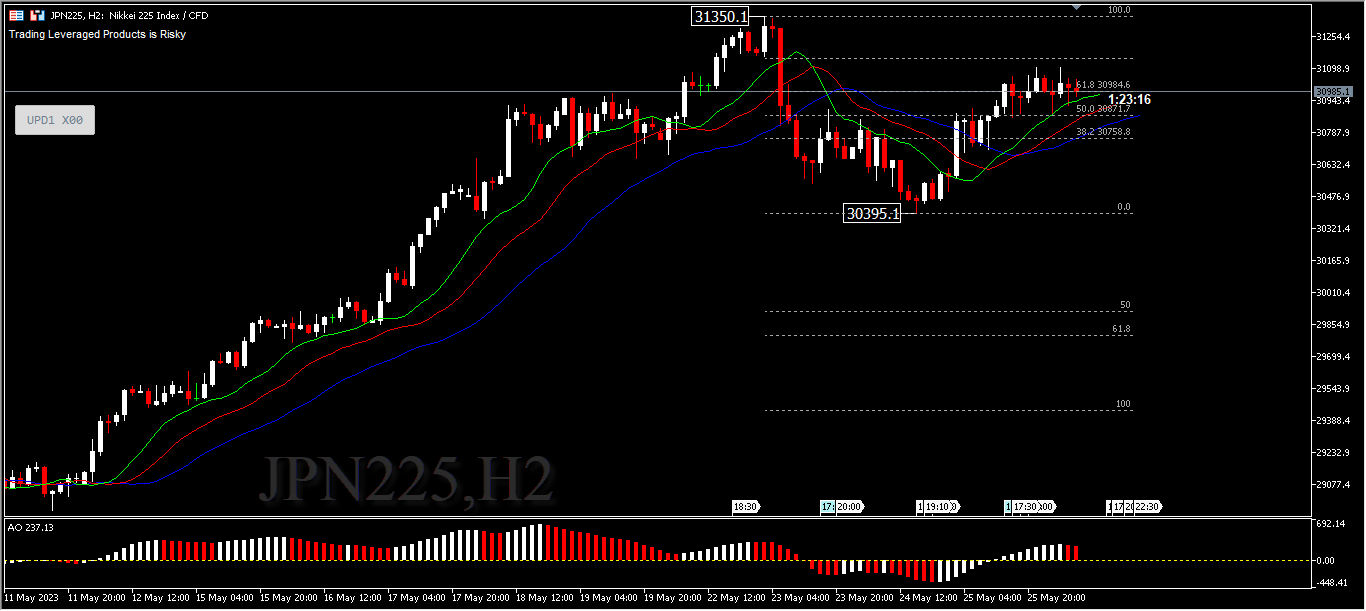

Asian equities traded combined at the moment, after inflation knowledge in Tokyo confirmed a slowdown. The JPN225 seems to be to be not transferring a lot, nonetheless buying and selling beneath its earlier excessive. Technically, a transfer to the upside might check the 31,350 peak and solely a transfer above this stage would affirm a continued bullish development and invalidate the triple high sample seen in main durations.Nonetheless a transfer beneath the 30,395 minor help might be a place to begin for a brief time period reversal, for the 30,000 spherical determine first, earlier than testing the essential 29,351 help.

In the meantime, elsewhere scores company Fitch has positioned the US credit standing on detrimental look ahead to a possible downgrade, amid fears of a scarcity of progress in the direction of a US debt ceiling deal forward of subsequent week’s deadline. The USDIndex on Thursday gained +0.35% and posted a 2-month excessive. Thursday’s better-than-expected US financial reviews on weekly jobless claims and Q1 GDP had been hawkish for Fed coverage and supported the Greenback. As well as, the surge within the 10-year T-note yield to a 2-month excessive strengthened greenback rate of interest differentials and was bullish for the Greenback.

Immediately’s Core PCE report, because the Fed’s favoured measure of inflation, will probably be within the highlight. The next-than-expected studying will improve market expectations for one more Fed hike, marking a really sharp distinction to the BOJ’s ongoing free financial coverage.

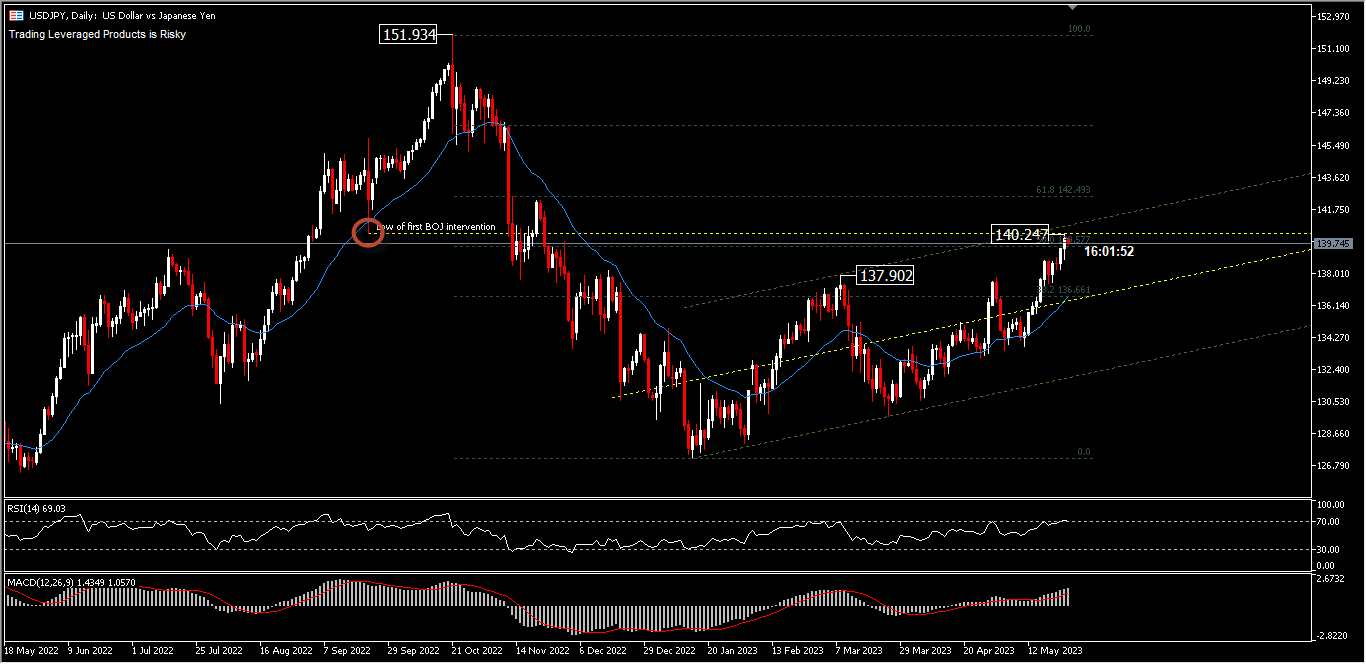

USDJPY, D1 continues to rise inside a bullish channel. The pair has now surpassed this yr’s excessive and on the time of writing, the value has retreated barely from the 140.24 reached in yesterday’s buying and selling, close to the 50% FR stage of the October 2022 peak drawdown and January 2023 low.

A transfer above the current excessive might check the 61.8% FR stage (142.49). Technically, the bulls’ try to ascertain a development continues to be validated by the 26-day transferring common. RSI is at overbought ranges and MACD is on monitor.

Wanting again, the present worth is beneath the low of the primary intervention by the BOJ in September 2022. So this stage is sort of calculated, that means that if the value fails to maneuver additional upwards and as an alternative reverses downwards, it might foil the bulls’ plans. A break again beneath the bullish channel and the earlier resistance turned help at 137.80 will take away the short-term bullish bias.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is offered as a basic advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]