[ad_1]

Wednesday’s inflation information has provoked a perverse response. Though inflation fell significantly, as a result of a much bigger fall was anticipated, monetary markets are actually speculating that Financial institution of England rates of interest must improve once more. As a consequence, they’ve been promoting off their holdings of presidency bonds, which reduces the value of those property, that means that the efficient price of curiosity paid upon them will increase.

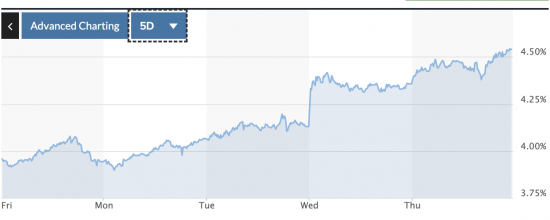

These charts from Market Watch inform the story over the previous few days and during the last yr:

The rate of interest on two-year authorities bonds has elevated by 0.5% in lower than per week. Because of this rates of interest are actually approaching these final seen in September 2022 after Kwasi Kwarteng’s disastrous outing as Chancellor of the Exchequer.

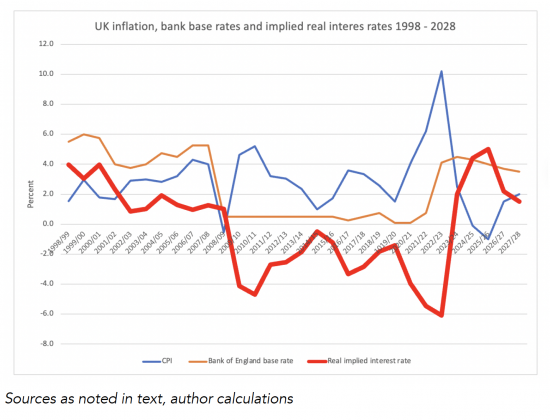

Reactions have been virtually fast. Mortgage rates of interest are actually approaching 5%. The dire financial outlook for many who should refinance their mortgages this yr has simply worsened. Expectations are that issues will get a lot worse nonetheless: markets are speculating that financial institution base charges would possibly now attain 5.5% by the top of this yr, which is able to ship an virtually unprecedented (in latest historical past) constructive rate of interest as a consequence of the Financial institution of England base price exceeding the inflation price.

I hardly want reiterate my issues about this. As Danny Blanchflower and I famous in a joint submission that we made to the Treasury Committee of the Home of Commons in March 2023, this nation can’t afford constructive rates of interest, which it has not seen since 2008:

The UK financial system has stagnated regardless of having destructive rates of interest since 2009. The possibility that it’d flourish with constructive rates of interest is near zero. Companies won’t make investments. Family incomes shall be depressed. Client spending will fall. Inquality will rise. And sustained constructive actual rates of interest, which are actually anticipated, will, after all, don’t have any influence upon inflation, which everybody nonetheless expects to have been curtailed by the top of 2024.

In that case, what we are literally saying is a dogmatic improve in charges, fuelled by market expectations of Financial institution of England response to inflation not falling as quick because the Financial institution would possibly need. That Financial institution of England response is pushed by their need to extend the speed of return to monetary capital on this nation at value to the inhabitants at giant. The consequence is what is likely to be described as a central banker-imposed demise spiral for the financial system as a complete.

That’s, after all, a method out of which, however that may require that politicians intervene, and as Ed Conway has reported for Sky this morning:

I feel we are able to all be fairly certain that Rachel Reese shall be standing proper behind Jeremy Hunt.

The consequence is that the 2 main political events on this nation, performing in cahoots with the Financial institution of England, are selecting to impose a recession on this nation with the only purpose that the wealthiest would possibly get wealthier. We have now seen something like this for the reason that days of Thatcher, however then North Sea oil saved us from destitution and nothing will now.

I fear, an ideal deal in regards to the financial system, however my sense of despair is now rising by the day.

[ad_2]