[ad_1]

Hershey’s inventory has pulled again. When you missed a earlier alternative to personal the inventory, this can be your second likelihood. Discover just a few easy technical evaluation instruments that may assist decide if the inventory presents a shopping for alternative.

Are you bummed out that you simply missed a inventory buying and selling alternative? Upward-trending shares do not at all times go up. They’re recognized to drag again, and typically the value motion on the pullback may offer you a second likelihood.

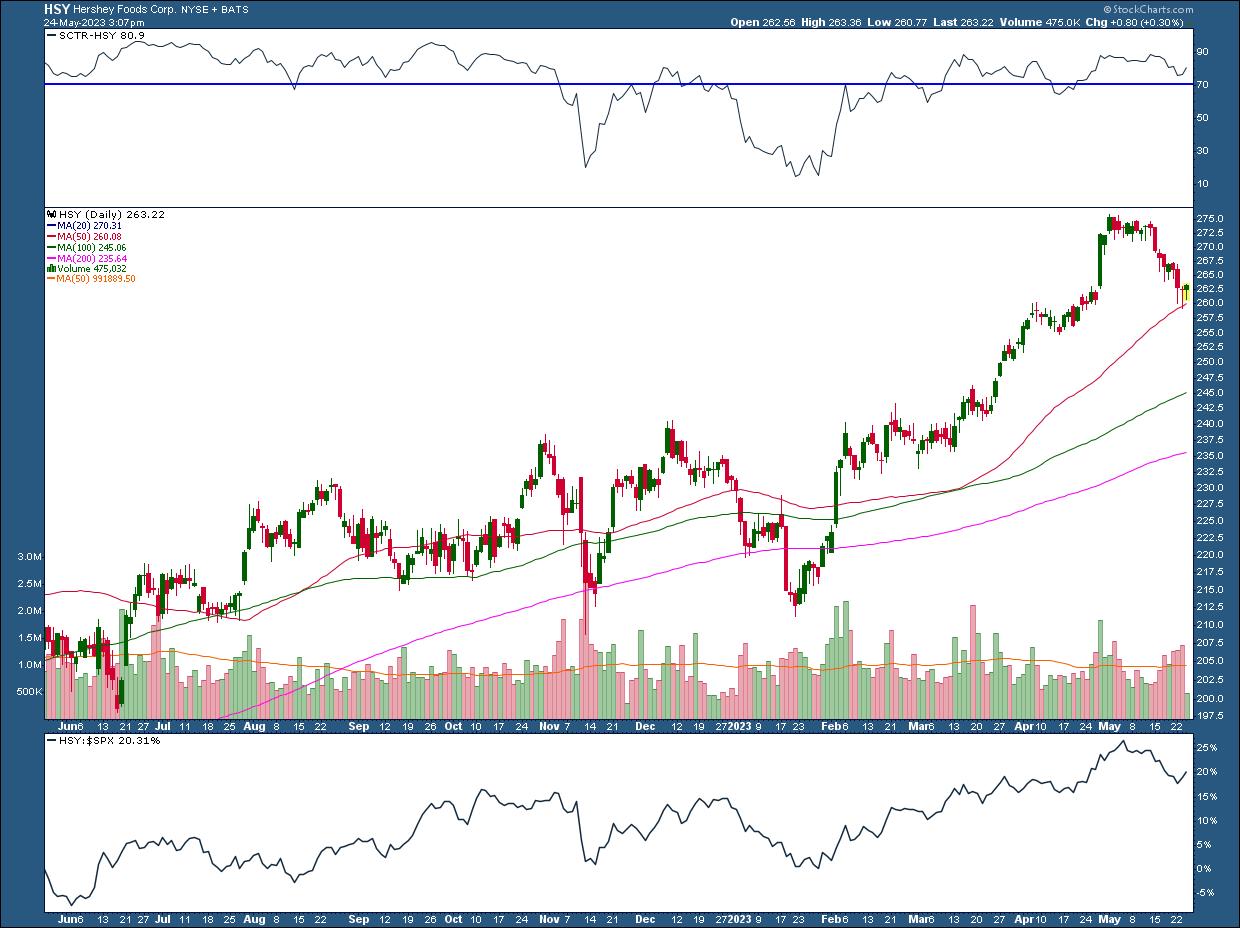

For instance, Hershey Meals Corp. (HSY) rallied from January 2023 to Might 2023. The StockCharts Technical Rating (SCTR) for HSY has, for essentially the most half, been above 70 for just a few months. It is essential to notice that, for the reason that SCTR crossed above 70 in April, it has managed to remain above the 70 degree even after the inventory worth pulled again. The inventory can also be performing nicely relative to the S&P 500 index ($SPX).

CHART 1: DAILY CHART OF HERSHEY STOCK. The inventory worth is bouncing off its 50-day transferring common. If the help degree holds, the inventory may attain a excessive of round $276.Chart supply: StockCharts.com (click on on chart for dwell model). For illustrative functions solely.

Hershey’s inventory has had an attention-grabbing journey, reaching a excessive of $275.81 on Might 1. Shopper demand for sweets and different candy and salty snacks has elevated, as indicated within the firm’s current earnings calls. Plus, the corporate pays dividends to its shareholders. Take a look at the Image Abstract software within the StockCharts charting platform for dividend information.

Zeroing In: Day by day Worth Motion in HSY Inventory

Since reaching its Might excessive, the inventory has traded sideways in a slim vary for a few weeks till it offered off, bringing its worth near its 50-day transferring common (MA).

- If the help of this transferring common holds, the inventory may bounce again and revisit its highs.

- If the SCTR stays above 70 and the inventory’s relative efficiency in opposition to the S&P 500 continues to be sturdy, there’s an opportunity HSY may transfer larger. So, in the event you missed out on the sooner rally, this could possibly be one other alternative.

The draw back: The inventory may transfer decrease to its 100-day MA. If the SCTR and relative energy drop, any reversal of the downward pattern could be void for some time. Issues can at all times change.

A Weekly Perspective of HSY Inventory

The weekly chart of HSY exhibits that the upward pattern remains to be in play. It helps to take a look at the final two events when the SCTR skilled sharp dips under the 70 degree. In each these cases—November 2022 and January 2023—the inventory fell to its 50-week MA and rebounded. However the worth is kind of a methods from the 50-week MA, so, on this case, it will be useful so as to add a shorter interval MA to the chart. Within the chart under, you see a 25-week, which was added as a result of worth hugged it fairly carefully in the course of the rally from 2020.

CHART 2: WEEKLY CHART OF HERSHEY STOCK. The weekly chart exhibits the long-term upward pattern remains to be transferring larger.Chart supply: StockCharts.com (click on on chart for dwell model). For illustrative functions solely.

- The SCTR is above the 70 degree, which is a constructive indication for the inventory worth to maneuver larger. If worth stays at or above the 25-week MA and the SCTR stays above 70, there is a fairly good likelihood the inventory will proceed to rally.

- The 50-, 100-, and 200-week transferring averages are trending decrease.

- The 50-period transferring common overlay on the relative efficiency, with respect to the $SPX, is trending upward, which is one other constructive indication for an upward pattern.

How one can Commerce HSY Inventory

- Going again to the every day chart, if the inventory stays above its 50-day MA, search for an up day with higher-than-average quantity. If there is a follow-through of not less than yet another worth bar, it may current a shopping for alternative.

- The upside goal on the every day chart could possibly be its excessive of slightly below $276.

- So long as the SCTR and relative energy in opposition to the S&P 500 index keep the place they’re or go larger, your lengthy commerce can stay in play. Shopper demand for Hershey’s merchandise is vital, so it is essential to comply with the corporate’s earnings calls. In an inflationary atmosphere, shoppers could resolve to not forgo the sweets and sweet. Any indicators of slowdown may end in a selloff within the inventory.

When you open an extended place in HSY, you might not want to put too tight of a cease loss. There are just a few months earlier than Hershey’s subsequent earnings name. It depends upon your threat tolerance degree. If the inventory developments larger, set trailing stops, and if in case you have a big place measurement, take income incrementally if situations warrant such a technique.

Different Shares From the Scan

Listed below are another shares that confirmed up on the large-cap SCTR scan.

- Las Vegas Sands Corp. (LVS)

- Noble Corp. (NE)

- O’Reilly Automotive, Inc. (ORLY)

- Palo Alto Networks Inc. (PANW)

- Restaurant Manufacturers Worldwide Inc. (QSR)

- Twilio Inc. (TWLO)

- VeriSign, Inc. (VRSN)

Trying Again at AMZN

On Might 16, Amazon.com, Inc. (AMZN) was the featured SCTR scan candidate. Let us take a look at how that inventory is performing.

CHART 3: DAILY CHART OF AMZN. When you had opened an extended commerce when worth broke above $113.84, you are most likely nonetheless holding your positions. A break under the dashed inexperienced horizontal line may alter the image.Chart supply: StockCharts.com (click on on chart for dwell model). For illustrative functions solely.

AMZN broke above the $113.84 degree (dashed horizontal inexperienced line). Since then, it has pulled again and bounced off the inexperienced dashed line. When you had opened an extended place barely above $113.84, you are most likely holding on to that inventory. The SCTR is nicely above the 70 degree, and the inventory’s efficiency in opposition to the benchmark S&P 500 is rising.

A change in any of the above standards could possibly be a cause to take not less than some positions off the desk.

SCTR Crossing Scan

[country is US] and [sma(20,volume) > 100000] and [[SCTR.large x 76] or [SCTR.large x 78] or [SCTR.large x80]]

Credit score goes to Greg Schnell, CMT, MFTA.

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to teach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra

Subscribe to Do not Ignore This Chart! to be notified every time a brand new put up is added to this weblog!

[ad_2]