[ad_1]

Above is an AI picture for example that whereas, on Monday, Granddad Russell (IWM) was providing a serving to hand to his spouse Granny Retail (XRT), at the moment they each regarded extra weak.

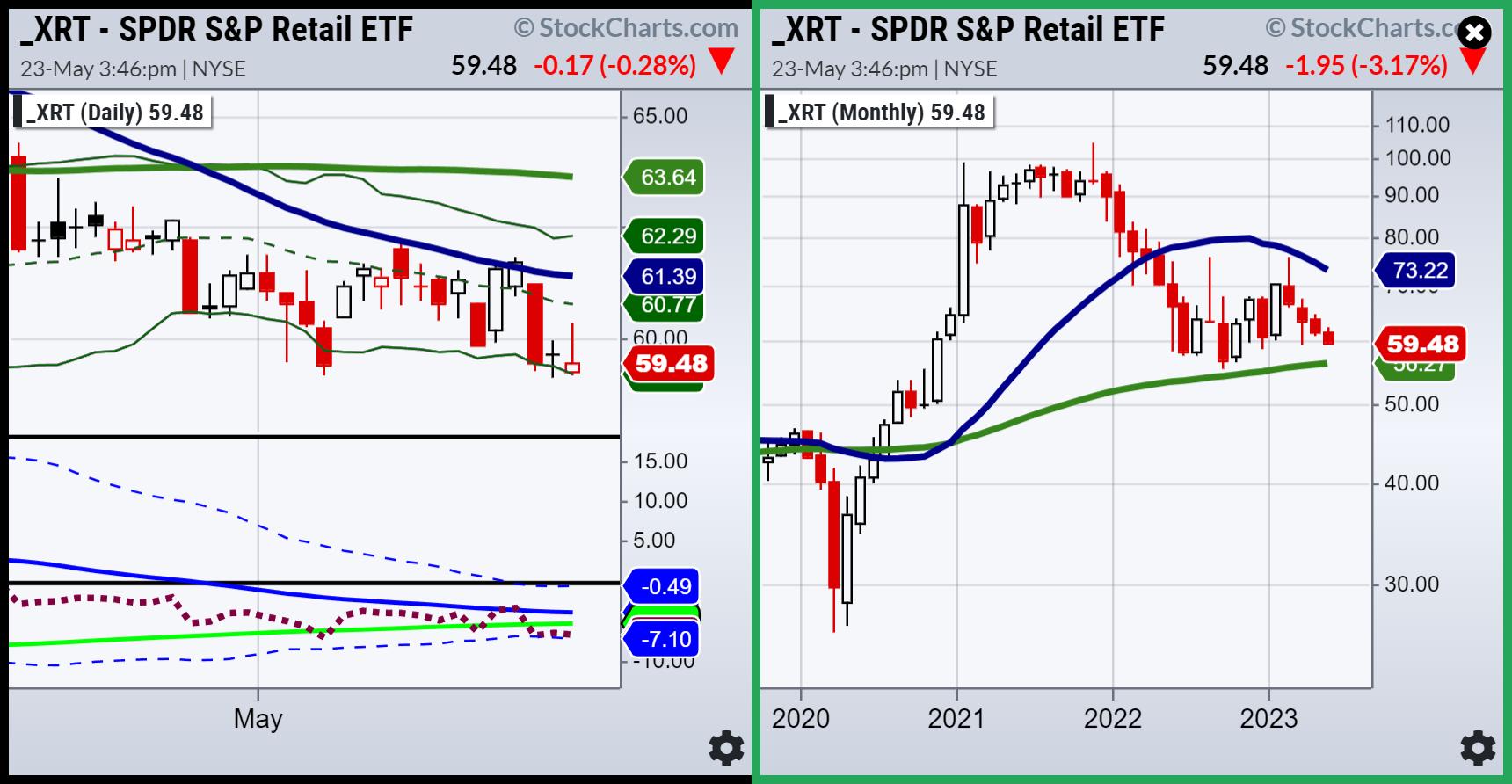

Simply because the S&P 500 didn’t clear its 23-month transferring common, we hope that IWM not solely holds its 80-month MA (inexperienced on the month-to-month chart), but additionally holds its 50-DMA (blue on the each day chart).

Actual Movement, our proprietary indicator that allows you to see hidden energy or weak spot throughout market traits, reveals momentum nonetheless above its 50 and 200-DMAs. It additionally stays, regardless of the value drop, in a bullish diversion, which means momentum is okay.

But, with at the moment’s selloff, and contemplating we would have hit the highest of this yr’s buying and selling vary in SPY, Granny stays a priority.

Granny XRT fell in worth nearer to the March low. Momentum although is now going sideways sitting on the Bollinger band, maybe preparing for a imply reversion. That may be a greater signal for everybody if XRT holds right here and turns increased.

These two key Members of the family within the Financial Trendy Household are usually not solely telling a story–they are the story. And that story displays a skinny veil of optimism, however with sufficient doubt that, except each transfer increased from right here, the market may return to risk-off. That’s, till SPY assessments the decrease areas of its persistent buying and selling vary.

For extra detailed buying and selling details about our blended fashions, instruments and dealer schooling programs, contact Rob Quinn, our Chief Technique Advisor, to be taught extra.

IT’S NOT TOO LATE! Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-E book in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for each day morning movies. To see up to date media clips, click on right here.

Mish and Caroline focus on income and dangers in a time the place sure sectors are engaging investments on TD Ameritrade.

Powell eyes a pause, Yellen hints on the want for extra fee hikes, and debt ceiling talks face challenges… what a option to finish the week, as Mish discusses on Actual Imaginative and prescient’s Each day Briefing for Could nineteenth.

Mish supplies a roundup of the commodities and foreign money pairs to look at this week on CMC Markets.

Mish explains how the Retail ETF is at a vital degree on Enterprise First AM.

On this video, Mish walks you through the Greenback, Euro, GBP, Gold, Silver and extra.

Mish walks you thru the basics and technical evaluation legitimizing a meme inventory on Enterprise First AM.

On this look on Fox Enterprise’s Making Cash with Charles Payne, Mish and Charles focus on if economic system has contracted sufficient with assist in place, and current 3 inventory picks.

Mish covers the buying and selling vary and some of her current inventory picks on Enterprise First AM.

In this look on Actual Imaginative and prescient, Maggie Lake and Mish focus on present state of the market, from small caps to tech to gold.

Coming Up:

Could twenty fourth & twenty fifth: Mario Nawfal Twitter Area

Could twenty fifth: Wolf Monetary Twitter Area

Could thirty first: Singapore Radio with Kai Ting 6:05pm ET MoneyFM 89.3.

June 2nd: Yahoo Finance

- S&P 500 (SPY): 23-month MA 420; assist 415.

- Russell 2000 (IWM): 170 assist, 180 resistance.

- Dow (DIA): 336 the 23-month MA.

- Nasdaq (QQQ): 336 cleared or the 23-month MA; now it is all about staying above.

- Regional Banks (KRE): 42 now pivotal resistance, 37 assist.

- Semiconductors (SMH): 23-month MA at 124 now extra within the rear-view mirror.

- Transportation (IYT): 202-240 largest vary to look at.

- Biotechnology (IBB): 121-135 vary to look at from month-to-month charts.

- Retail (XRT): This could possibly be the brand new harbinger like KRE was in March. Poor Granny.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Schooling

Mish Schneider serves as Director of Buying and selling Schooling at MarketGauge.com. For almost 20 years, MarketGauge.com has offered monetary info and schooling to 1000’s of people, in addition to to giant monetary establishments and publications equivalent to Barron’s, Constancy, ILX Methods, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary folks to observe on Twitter. In 2018, Mish was the winner of the Prime Inventory Decide of the yr for RealVision.

Subscribe to Mish’s Market Minute to be notified every time a brand new put up is added to this weblog!

[ad_2]