[ad_1]

US inventory indexes rose on Thursday (18/05), amid growing optimism that the US will elevate its debt ceiling and keep away from default. Home Speaker McCarthy stated negotiators have been in a a lot better place in the intervening time and he noticed a debt restrict deal being thought-about within the Home subsequent week. Inventory indexes prolonged the rally with USA500 posting 9-month highs and gaining +1.07%, USA30 posting 1-week highs and gaining +0.48%, and USA100 posting 1-year highs and gaining +1.99%.

For now, share worth beneficial properties are usually influenced by constructive sentiment over the debt ceiling, whereas financial knowledge ought to restrict inventory beneficial properties. Weekly jobless claims fell greater than anticipated and the Philadelphia Fed’s Might enterprise outlook survey rose greater than anticipated. The soar in bond yields because of the Fed’s hawkish feedback is unfavourable for shares.

Transferring ahead, markets shall be watching Fed audio system intently for any additional clues as as to if or not the Fed could elevate rates of interest in June. Fed audio system have just lately adopted a hawkish stance. The Fed’s 40% probability (up from 36% yesterday) of elevating charges by 25 bps on the June FOMC assembly is being weighed.

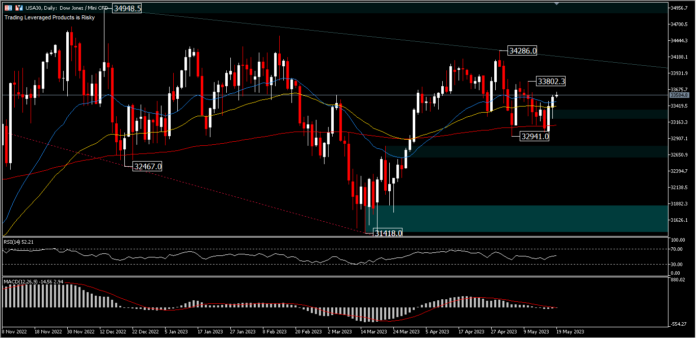

Technical Overview – USA30, D1

Worth motion is attempting to carry the value above the 200 day EMA (purple line) since forming a double backside. Presently, the index is buying and selling above its 26 day EMA (blue line), with a risk to check final week’s excessive of 33,802.30. A transfer above final week’s excessive will take the value increased to the minor high of 34,286.00. Failure to maneuver above 33,802.30 may deliver the outlook index into consolidation mode. Whereas the motion has sturdy help at 29,410.00, the index may transfer sharply to check intermediate help at 31,418.00.

RSI is at 52 and MACD is but to validate the transfer within the quick time period.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is supplied as a basic advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or ought to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]