[ad_1]

Among the many primary beneficiaries of the rally that befell within the fairness markets in the previous few hours, after optimism grew late Wednesday afternoon about an imminent answer to the debt ceiling deadlock, had been the US indices, led by the Nasdaq (+1.81%) which rose to 11-month highs. Essentially the most shocking indices in yesterday’s session had been the DAX (+1.31%) – which at one level climbed to inside 100 factors of its ATH – and particularly the JPN225, which rose to a 33-year excessive within the 30,900 zone. As well as – in a 2-year view – world indices have returned to outperform US ones after not less than 10 years.

Relative Efficiency, US500 (g) – GER40 (b) – JPN225 (o), 12/21 – Now

The explanations for the Japanese index’s greatest weekly rally since Nov2022 – that took it up 5.1% from the Might 12 shut – are usually not completely clear. Certain, there have been some good, better-than-expected GDP knowledge this week, and in addition the Overseas Funding in Japanese Shares determine on Thursday morning confirmed a brisk $808.3 billion improve in flows; the inflation determine of three.5% y/y additionally bore witness to a ”sizzling” financial system. There’s the anecdotal issue that Warren Buffett, on a go to to the Land of the Rising Solar final month, introduced that Berkshire Hathaway had persistently elevated its investments in Japan’s 5 largest buying and selling homes. They’re conglomerates with pursuits in every part from logistics to actual property, frozen meals, aerospace, and newer investments similar to EVs and renewable power and Buffett himself in contrast them to Japanese Berkshires. When one of many world’s most well-known traders expresses his appreciation, the remainder of the market listens with curiosity. Final however not least, the weak point of the Yen in opposition to the USD in all probability helped this latest dash, as is normally the case. Nevertheless, there should be another components.

Technical Evaluation

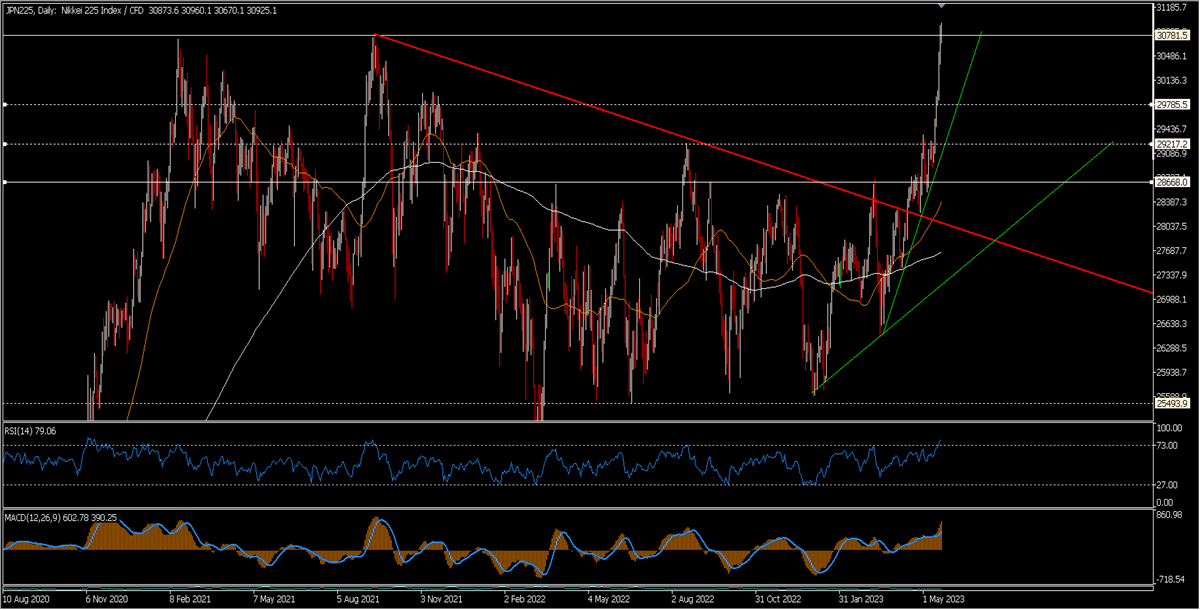

Within the following each day chart from 2021 onwards, we will see the earlier post-1990 highs, reached in February and November 2021 respectively. We will additionally see how on the finish of March the earlier bearish development was first examined (the worth had gone as much as 28700), then lastly damaged with conviction and retested over the past 2 weeks of April. Since then, helped by the upside break of 28.7k, the JPN225 has risen parabolically to the purpose the place the RSI (14) is sort of strongly overbought at 78.86. When such a powerful motion takes place, fairly often there may be technical market causes similar to a change within the positioning by mid-term traders above some key ranges that triggers the fast closing of brief trades and provides to the power of the consumers, throwing gasoline on the hearth.

The 50-day and 200-day shifting averages are each positively inclined however indicators are overbought and chasing the worth is a dangerous technique. A consolidation at these ranges might be to be anticipated, probably even a pullback. A primary attention-grabbing assist is within the 30250 space, then there’s 29800. The steepest bullish trendline (inexperienced) presently passes by 29200 and this stage additionally represents a 38.2% FIB retracement of the rally which began from the lows of 15-16 March. Merchants will doubtless look ahead to some strong end-of-the day affirmation.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a normal advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]