[ad_1]

With seconds to go within the seventh interval of the hockey recreation final night time, a objective was lastly scored within the Carolina Hurricanes vs. Florida Panthers. It was an extended recreation, a tiring recreation and solely the primary recreation of this playoff sequence. What we at all times do when a recreation goes on, is we glance again in historical past to see the place it ranks. This was the sixth longest recreation in NHL historical past. There are six extra video games within the sequence. Must be a battle!

Very similar to the sport final night time, there are occasions when shares go on prolonged runs, far exterior what is anticipated. The inventory breaks into the highest echelon of historic strikes. When a inventory goes on a historic run, there isn’t any actual method to know when it would finish. Usually a number of 5% or 10% days shut collectively let you know that you’re getting near the top of a run. May not be a closing run, but it surely is sufficient to cease the euphoria for some time. Some of the attention-grabbing markets for finding out euphoria was the dot.com growth that lasted for years.

Scott McNealy, the CEO of Solar Microsystems talked in regards to the peak and the valuation of Solar Microsystems on the Nasdaq market prime. Bloomberg interviewed Scott in March 2002 trying within the rear view mirror. This was from an interview lengthy after the highest, from Bloomberg.

At 10 instances revenues, to provide you a 10-year payback, I’ve to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I’ve zero value of products offered, which could be very onerous for a pc firm. That assumes zero bills, which is admittedly onerous with 39,000 staff. That assumes I pay no taxes, which could be very onerous. And that assumes you pay no taxes in your dividends, which is sort of unlawful. And that assumes with zero R&D for the following 10 years, I can preserve the present income run charge. Now, having executed that, would any of you want to purchase my inventory at $64? Do you understand how ridiculous these primary assumptions are? You do not want any transparency. You do not want any footnotes. What had been you pondering?

Nvidia

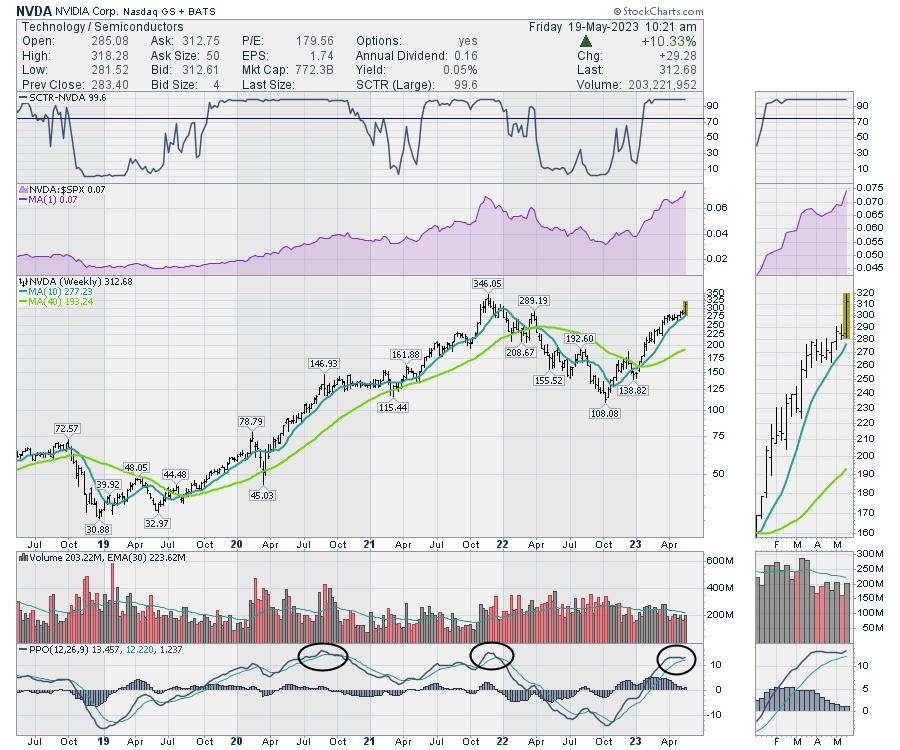

From Twitter this morning, the Worth to Gross sales ratio for NVDA is now 28. You may’t imagine all the pieces you learn on Twitter, so I went to StockCharts NVDA inventory abstract to test it out. $Market cap of $770B on gross sales of $27B. That works out to twenty-eight instances. All issues AI, all issues cloud, and NVDA resides within the candy spot.

Does that imply it would dump? Completely not. Something might occur. It might double from right here. What might probably drive a inventory to such excessive market valuations relative to earnings?

Synthetic Intelligence (AI)

How the world has modified. I grew up on a farm and Synthetic Insemination was AI. Western Breeders Corp was delivery temperature managed packages world broad for AI. However that may be a totally different AI. As we speak, one thing has modified and AI is synthetic intelligence.

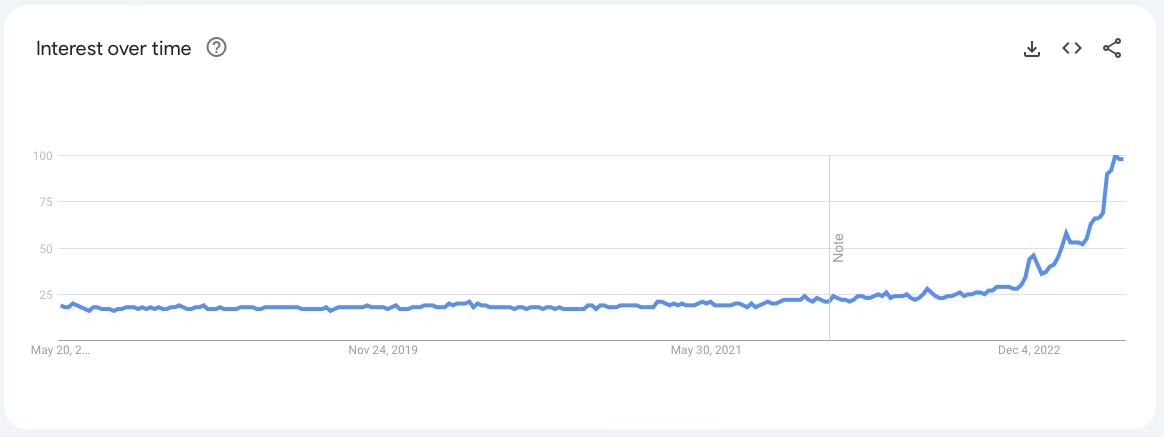

We’re coming into the massive recreation of AI. If you take heed to an earnings name, you go in understanding that each workers author of earnings speaking factors has been including ‘AI’ to each paragraph. These speaking factors for the decision make sure that the world is aware of the corporate is prepared for the longer term. That is the search pattern for AI over the previous 5 years. It solely began accelerating within the final 6 months.

The latest SPAC growth final 9 months from mid 2020 to March 2021. Keep in mind these heady inventory surges? That was a pandemic induced money surplus as all of the keep at dwelling merchants needed to purchase the following large factor. What might probably examine to that run?

How about Nvidia. NVDA. It’s a lovely chart. Subsequent week we might retest the highs of 2021. The inventory had 4 weeks of again to again large good points into the 2021 prime.

The PPO could be very stretched and sitting close to the highs of the earlier two PPO peaks. Curiously, the quantity is nowhere close to as large. I’ll level out that in each of the earlier large rallies, it was effectively after a breakout from a consolidation, not the primary week after a consolidation, that the inventory topped. This might run a complete lot longer.

Total Market

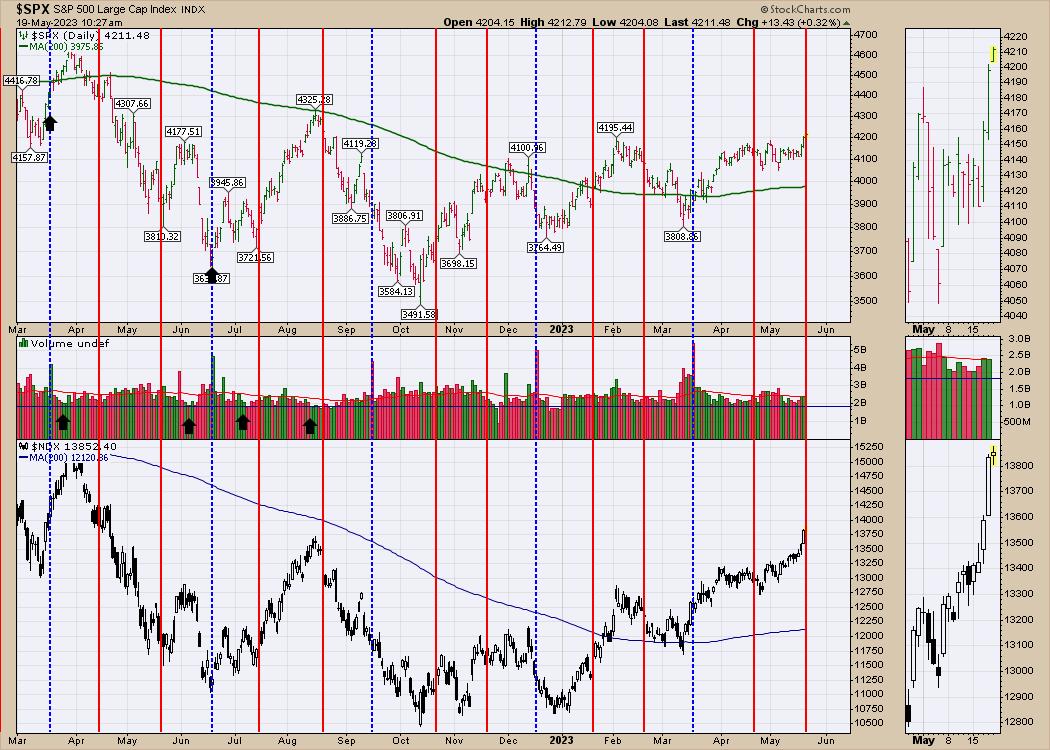

With that stated, the market has gone from a sideways grind for six weeks to euphoria in 4 days. Has it ever been this euphoric? That is nothing. It’s barely the beginning of a rally. We would not have to look again at historical past very far. The vertical traces mark the choices expirations. Some have been ignored and a few have been value respecting. March 2022, Might, June, July, October and March 2023 had been good upside reversals. April 2022, August, December and February had been draw back reversals. My solely remark is to concentrate on the potential for reversals on choices expiration.

I’m glad we lastly resolved to the upside. Fairly frankly, trying on the indexes, it appears like greater is the brand new course. What’s the one fly within the ointment?

Bond Yields

Every week, I look by the charts for intermarket clues as to what’s going on. The ten 12 months yield is beginning to speed up greater. The underside panel is the yield PPO. When the 10-year Yield PPO moved above zero and/or above a pattern line close to zero, it additionally marked some turning factors for shares over the past 1.5 years. We’re at that second on Friday. Whereas I’m not in a position to attract a vertical line on the April 2022 $SPX excessive, discover how the PPO for the ten Yr stayed above zero all the best way to the July low within the fairness markets.

The chart has not been capable of stall the market, and pessimism is lifting, mine included.

I just like the up week we had, with some optimistic days again to again. Bullish except we see among the bond stress begin to dampen inventory enthusiasm. Clearly, shares like NVDA are main us greater, and that would proceed. Banks, power, software program have all turned greater and I really feel like these could also be higher entries than a semiconductor identify at 28x income.

Extra within the weekly publication to shoppers, which is obtainable for $7 overlaying the primary month at Osprey Strategic.

Greg Schnell, CMT, MFTA is Chief Technical Analyst at Osprey Strategic specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Primarily based in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an energetic member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).

Subscribe to The Canadian Technician to be notified at any time when a brand new publish is added to this weblog!

[ad_2]