[ad_1]

In accordance with Bloomberg, the Mexican Peso (MXN) is the very best performing ‘main’ foreign money in 2023, up virtually 11% in opposition to the US greenback, at a five-year excessive and above its pre-COVID stage. No different foreign money has executed as effectively: the additionally “highly effective” Brazilian actual has risen by practically 8.5 %, whereas different rising currencies such because the ZAR or the TRY proceed to fall.

Weighted Foreign money Indices

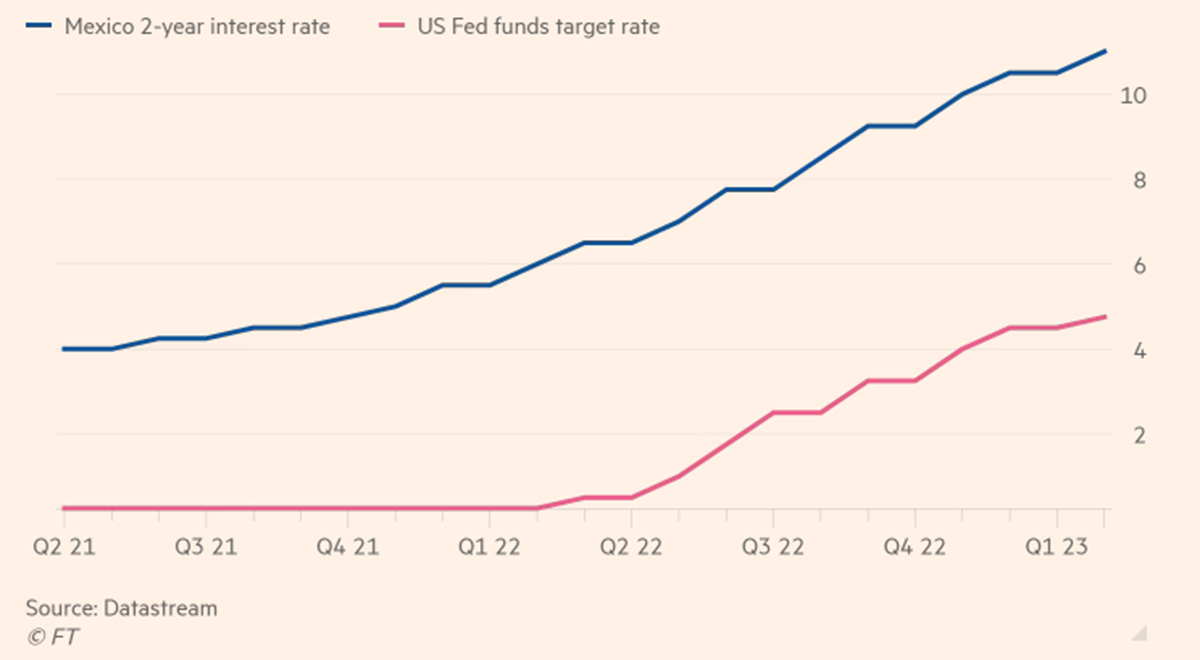

And there are some excellent causes for this: public accounts are effectively below management, with a debt/GDP ratio near 50%, and the fiscal austerity coverage promoted by President Obrador is preserving public funds deficits below management (3.8%, in step with or beneath many different superior economies). The inflation price stands at 6.25%, with the peculiarity that Mexico is used to coping with ranges barely beneath 5% (therefore no shocks) and that its central financial institution, BANXICO, has been very proactive, beginning to increase charges 9 months earlier than the FED and doing so 14 occasions in a row. The official rate of interest now stands at 11.25% and ensures a really excessive differential in comparison with different currencies. Not surprisingly, because of this mix of things, the Peso has more and more grow to be the automobile for rising market buyers wishing to borrow a foreign money with a decrease rate of interest to purchase belongings that supply larger charges of return, often called the CARRY TRADE.

The hole between Mexico and US IR is rising

And if that isn’t sufficient (which it may very well be), there are nonetheless different causes. Sharing greater than 3,000 km of border with the US and being a part of the USMCA (alongside Canada) the nation is about to be a first-rate beneficiary of corporations specializing in their provide chains nearer essential markets and away from China in a phenomenon often called “nearshoring”. That is very true within the case of the automotive business: in the previous few months alone, BMW has introduced an funding of 800 million $ to increase its manufacturing of electrical automobiles, whereas TESLA will make investments some 5 billion $ in a brand new manufacturing unit within the north of the nation. Overseas direct funding in Mexico reached $35.3bn final yr, the best stage since 2015, in response to information from the Ministry of Financial system.

Lastly, the phenomenon of remittances: Mexican emigrants within the US have at all times despatched a reimbursement dwelling: this move has reached document highs, having elevated by 12.5% within the final yr alone and now represents a whopping 4% of GDP.

Remittances to Mexico, million $

Technical evaluation

Let’s begin with a long term perspective with this weekly chart: the USDMXN after 3 years of good points sits at 17.49, in an space that was an important help in 2015 and 2016. Nevertheless, you’ll be able to simply see that in earlier years it traded at a lot decrease ranges, as little as 9.80 in 2007. That is one thing to bear in mind, given the present good fundamentals.

USDMXN – Weekly, 2007 -2023

Focusing now on the every day chart, we see that the worth is on the backside of a bearish channel that began in autumn 2021 with the RSI exhibiting a slight divergence and near the oversold zone. Maybe subsequently it isn’t the very best time to leap on the bandwagon, with the values within the 17.90 and 18.40 zone resistances being those to look at fastidiously within the case of strengthening of the USD within the quick time period. Even a value at 18.85 ranges wouldn’t compromise the long run downtrend in any respect.

USDMXN – Each day

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or ought to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]