[ad_1]

One of many the reason why many merchants lack the accuracy wanted to turn into persistently worthwhile is as a result of many merchants attempt to commerce towards the circulation of the market. In different phrases, they’re buying and selling towards the development. Good development following merchants alternatively know that buying and selling within the path of the development considerably will increase the probabilities that the path of the commerce can be proper. Because of this the assertion, “Commerce with the development…,” carry a number of knowledge in it.

Development continuation methods is a sort of development following technique whereby merchants commerce within the path of a longtime development. In contradiction to a development reversal technique, which goals to enter the market because the development reverses, development continuation methods look ahead to the development to be clearly established. Then, trades are taken within the path of the established development because the market provides favorable value alternatives.

Development continuation methods are very efficient as a result of it produces commerce setups which have very excessive win possibilities. It’s because buying and selling within the path of the development signifies that the market’s long-term momentum is in your favor. The trades taken should not a struggle towards the circulation of the market, slightly the trades circulation within the path that the market is shifting.

On this technique, we might be how a easy momentum indicator can be utilized to establish wonderful development continuation entry factors.

100 Pips Momentum

100 Pips Momentum or Oracle Transfer is a customized technical indicator which was developed to assist merchants establish the short-term development or momentum of the market. It’s primarily based on a pair of modified shifting common traces that are characteristically very responsive to cost motion actions, whereas on the similar time are inclined to retain the smoothness of its responses. This enables for a well timed indication of a development reversal whereas on the similar time avoiding a lot of the false indicators which can be trigger by a uneven market.

This indicator plots two shifting common traces. The quicker shifting common line is blue, and the slower shifting common line is pink. The market momentum is bullish if the blue line is above the pink line, and bearish if the blue line is beneath the pink line. Consequently crossovers between the 2 traces can be utilized as an entry sign.

Given the character of this indicator, it’s best used as a momentum reversal sign indicator. Nonetheless, it will even be a bonus if the trades are in confluence with different indications corresponding to a bounce from a serious help or resistance degree or the commerce path agrees with a long-term development.

Kumo (Ichimoku Kinko Hyo)

The Ichimoku Kinko Hyo indicator is a singular technical indicator as a result of it’s in itself an entire buying and selling system. It supplies merchants with a 360-degree perspective as to what the market development seems like. It identifies the short-term development, mid-term development, and long-term development primarily based on a number of averages primarily based on the median of value motion inside varied durations.

The Kumo is an integral element of the Ichimoku Kinko Hyo system. It’s because the Kumo represents the long-term development path.

It’s composed of the Senkou Span A (Main Span A) and Senkou Span B (Main Span B) traces.

Senkou Span A is the common of the Tenkan-sen and Kijun-sen traces, each underlying parts of the Ichimoku Kinko Hyo system, representing the short-term and mid-term tendencies.

Senkou Span B alternatively is solely the median of value motion over the previous 52 durations plotted 26 durations forward.

The long-term development path will be primarily based on how these two traces work together. The development is bullish if Senkou Span A is above Senkou Span B, and bearish if Senkou Span A is beneath Senkou Span B. As such, crossovers between the 2 could also be interpreted as a long-term development reversal. Nonetheless, this indicator is greatest used as a development path filter used to assist merchants keep away from buying and selling towards the long-term development.

Buying and selling Technique

Kumo Oracle Development Continuation Foreign exchange Buying and selling Technique is an easy development continuation technique which relies on the settlement of the long-term development and the short-term momentum primarily based on the 2 indicators talked about above.

The Kumo is used as a foundation for the long-term development. That is primarily based on how the Senkou Span A and Senkou Span B traces overlap.

The Oracle Transfer indicator alternatively is used because the entry sign primarily based on the short-term momentum which agrees with path of the long-term development. That is merely primarily based on the crossing over of the 2 traces indicating a momentum reversal which coincides with the long-term development as indicated by the Kumo.

Indicators:

- Ichimoku

- 100pips Momentum

Most well-liked Time Frames: 30-minute, 1-hour, 4-hour and each day charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

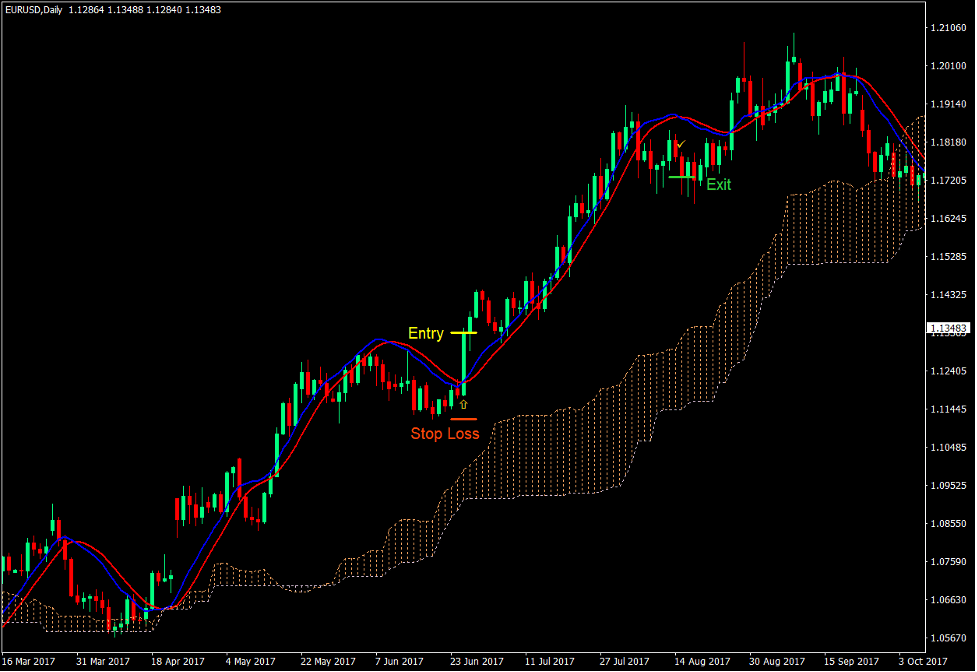

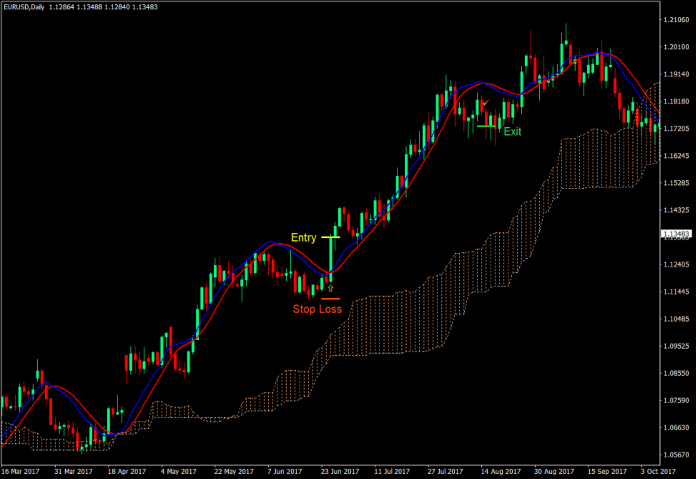

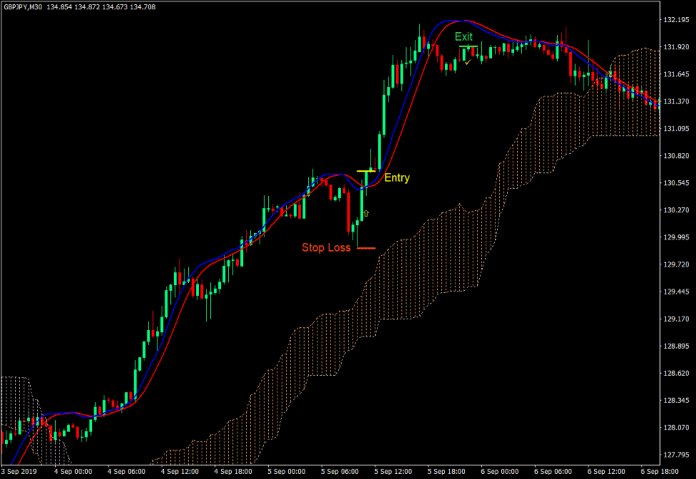

Purchase Commerce Setup

Entry

- The Senkou Span A (brown) line ought to be above the Senkou Span B (thistle) line.

- Value motion ought to plot rising swing factors indicating an uptrend.

- Value ought to retrace and trigger the Oracle Transfer traces to briefly reverse.

- Enter a purchase order as quickly because the blue Oracle Transfer line crosses above the pink line.

Cease Loss

- Set the cease loss on the help beneath the entry candle.

Exit

- Shut the commerce as quickly because the blue Oracle Transfer line crosses beneath the pink line.

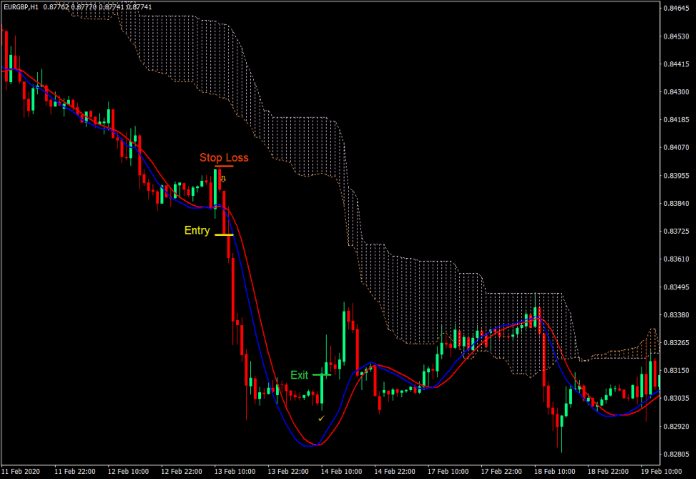

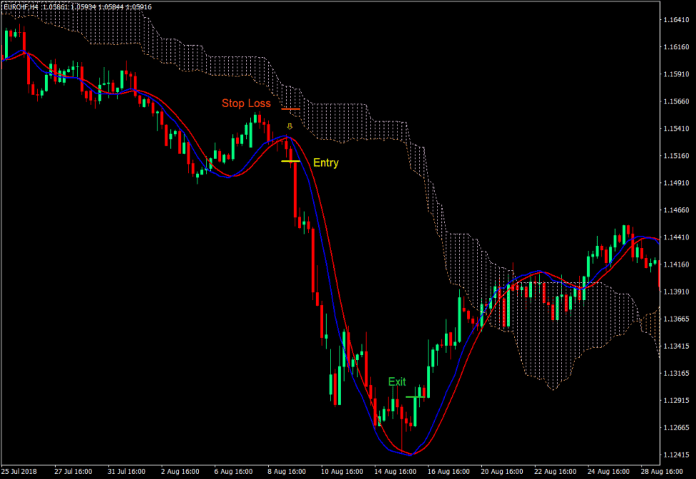

Promote Commerce Setup

Entry

- The Senkou Span A (brown) line ought to be beneath the Senkou Span B (thistle) line.

- Value motion ought to plot dropping swing factors indicating a downtrend.

- Value ought to retrace and trigger the Oracle Transfer traces to briefly reverse.

- Enter a promote order as quickly because the blue Oracle Transfer line crosses beneath the pink line.

Cease Loss

- Set the cease loss on the resistance above the entry candle.

Exit

- Shut the commerce as quickly because the blue Oracle Transfer line crosses above the pink line.

Conclusion

This buying and selling technique is a excessive chance buying and selling technique primarily based on a easy development continuation commerce setup.

The Kumo is a broadly used foundation for the long-term development. The Oracle Transfer alternatively is a really responsive short-term momentum indicator. Buying and selling primarily based on the confluence of those two complementary indicators can probably produce excessive chance commerce setups, which merchants can use to persistently revenue from the market.

Foreign exchange Buying and selling Methods Set up Directions

Kumo Oracle Development Continuation Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the gathered historical past knowledge and buying and selling indicators.

Kumo Oracle Development Continuation Foreign exchange Buying and selling Technique supplies a chance to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Primarily based on this data, merchants can assume additional value motion and regulate this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

The way to set up Kumo Oracle Development Continuation Foreign exchange Buying and selling Technique?

- Obtain Kumo Oracle Development Continuation Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Kumo Oracle Development Continuation Foreign exchange Buying and selling Technique

- You will notice Kumo Oracle Development Continuation Foreign exchange Buying and selling Technique is offered in your Chart

*Notice: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]