[ad_1]

The USDIndex fell to 102.382 from an in a single day excessive of 102.752. It was weaker towards all its G10 friends apart from JPY. Shares superior barely yesterday however reverted losses this morning. A weaker than anticipated Empire State report supported expectations the Fed will pause in June, although Fedspeak was blended on that. At present throughout Asia and Europe shares moved broadly decrease. UK ILO unemployment fee unexpectedly lifted to three.9% within the three months to March from 3.8% within the prior interval.

In a single day – RBA minutes sign charges could rise once more. Topix hits 33-year excessive amid hopes for Japan shares revival. FT: “Patrons have been drawn to Tokyo shares by potential enhancements to company governance, a return to wage inflation and the perceived stability of the market in contrast with geopolitics-driven Chinese language shares.” Chinese language retail gross sales and industrial manufacturing each fell wanting expectations in April. – Instability.

- FX – USDIndex closed decrease at 102.18. EUR regular inside 1.1860-1.0880. JPY failed to interrupt 136.40. Sterling regular for 3 days at 1.2450-1.2530.

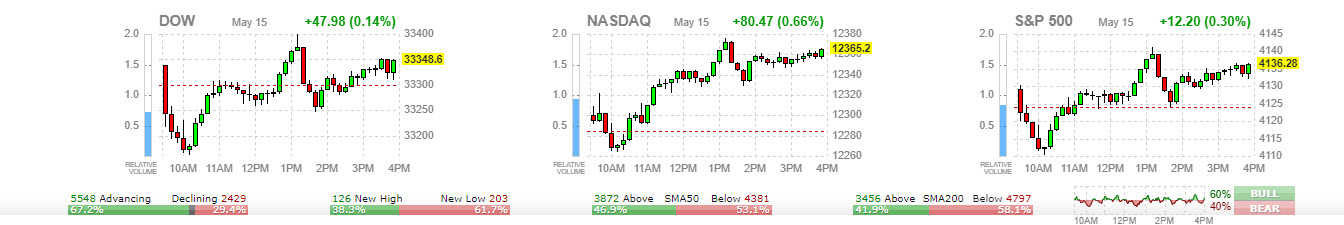

- Shares – The US100 rallied 0.65%, whereas the US500 and the US30 have been up 0.30% and 0.14%, respectively.

- Commodities – USOil – rose 0.41% to $71.40 per barrel. Gold pullback to 2002.57 this morning.

- Cryptocurrencies – BTC regular inside $26600-27600.

At present – President Biden and Speaker McCarthy have scheduled a gathering on the debt restrict. EU GDP and German ZEW, US Retail Gross sales and Canadian Inflation. Speeches: Fed’s Bostic, ECB Lagarde, Fed’s William, Logan and Mester.

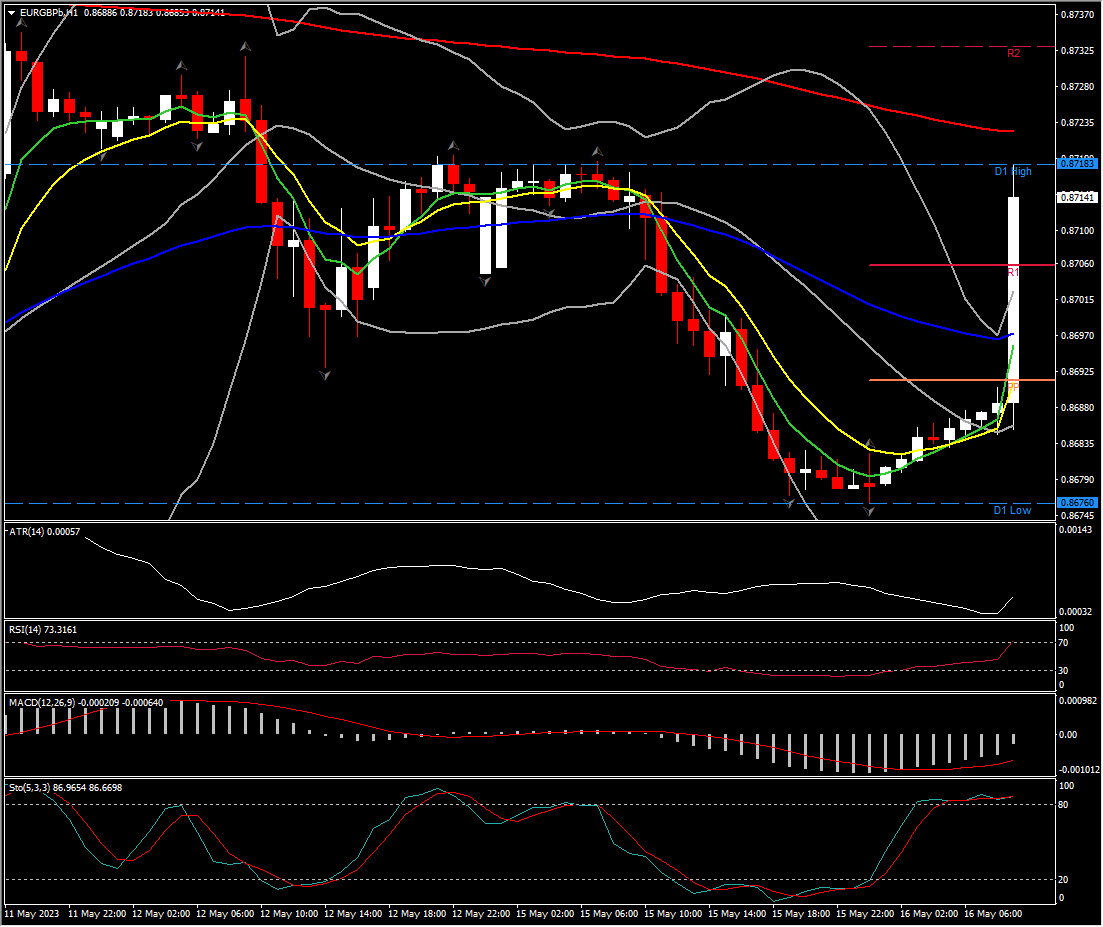

Greatest FX Mover @ (06:30 GMT) EURGBP (+0.50%). Spiked to 0.8718 from 0.8683. MAs aligned greater, however MACD histogram & sign line stay under 0, RSI 72 & rising. H1 ATR 0.00057, Every day ATR 0.00473.

Greatest FX Mover @ (06:30 GMT) EURGBP (+0.50%). Spiked to 0.8718 from 0.8683. MAs aligned greater, however MACD histogram & sign line stay under 0, RSI 72 & rising. H1 ATR 0.00057, Every day ATR 0.00473.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]