[ad_1]

VIX rose via the week, and so did the NIFTY. Over the previous 5 classes, the Indian fairness markets continued to inch larger, exhibiting a whole lot of resilience, and ended with a modest acquire over the week. Over the previous a number of weeks, the persistently low ranges of VIX have remained a priority; this volatility gauge violated its pre-pandemic 2020 lows when it closed beneath 11 ranges. This indicator additionally rose; the markets continued to pile up some positive aspects as nicely. The NIFTY 50 index moved in a 289.40 factors vary and ended in the direction of its excessive level slightly below the important thing resistance ranges. The headline index closed whereas posting web positive aspects of 245.80 factors (+1.36%) on a weekly foundation.

Markets stay at an important juncture from a technical standpoint. On short-term charts, NIFTY has resistance within the 18300-18350 zone, as indicated by the Choices knowledge. Nonetheless, trying on the weekly charts, there’s a sturdy sample resistance within the 18450-18500 zone; until this zone is taken out comprehensively, no runaway up strikes are anticipated. This very factor, if seen with a special perspective, means all upsides within the NIFTY, if any, shall stay capped in nature. INDIAVIX rose by 4.53% to 12.85 throughout the week; it nonetheless stays comparatively at a lot decrease ranges.

Monday is prone to see a quiet begin to the week; the degrees of 18390 and 18490 are prone to act as potential resistance factors. The helps would are available on the 18180 and 18000 ranges.

The weekly RSI is at 59.58; it has marked a brand new 14-period excessive, which is bullish. Nonetheless, it stays impartial and doesn’t present any divergence in opposition to the value. The weekly MACD is bullish and above the sign line.

The sample evaluation of the weekly charts exhibits that, by transferring in the direction of the 18500 ranges, it’s making an attempt to type and take a look at a triple-top; any transfer in the direction of the 18500-18600 ranges will see the NIFTY testing this stage for the third time since October 2021. Whereas any significant breakout might lend extra power to the Index, as of now, the zone/stage of 18500 is a really sturdy resistance for the Index. As of now, this zone stands as a really stiff resistance for the Index until taken out convincingly.

All in all, regardless that each the Indices; Nifty and BankNifty, are posting incremental highs, markets stay weak to consolidation at present ranges. With none corrective retracement or any consolidation, the current up-move has gotten a bit unhealthy. BankNifty has been comparatively a lot stronger; it might proceed to comparatively outperform the NIFTY, however any corrective transfer shall make this index extra unstable and prone to profit-taking bouts. As of now, there aren’t any indicators to recommend the onset of any main corrective transfer, however markets are weak to some consolidation and corrective actions.

It’s strongly really useful that one should proceed to method the markets on a extremely selective observe. It will be prudent to remain invested in defensive, low-beta, and comparatively stronger shares. Total, whereas persevering with to maintain leveraged exposures at modest ranges, a cautious outlook is suggested for the day.

Sector Evaluation for the Coming Week

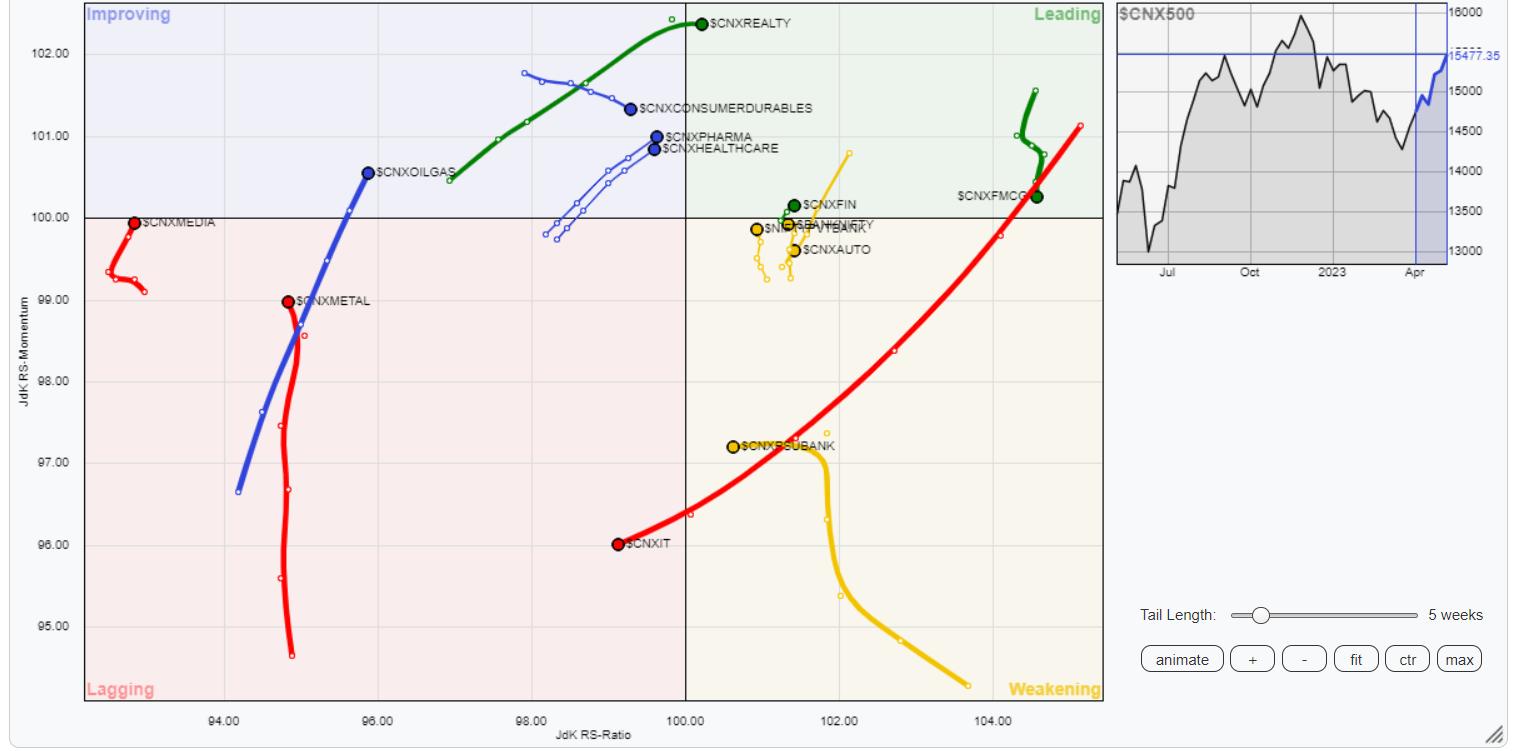

In our take a look at Relative Rotation Graphs®, we in contrast numerous sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

The evaluation of Relative Rotation Graphs (RRG) exhibits that Companies, Realty, Infrastructure, PSE, Midcap 100, and FMCG keep contained in the main quadrant, all besides Realty Index are exhibiting a decline of their relative momentum in opposition to the broader markets. These pockets might proceed to indicate resilience; nonetheless, sturdy relative outperformance could be troublesome to come back in.

NIFTY Auto, BankNifty, and PSU Banks stay within the weakening quadrant; they proceed to indicate enchancment of their relative momentum in opposition to the broader NIFTY 500 Index.

The NIFTY IT Index has rolled contained in the lagging quadrant. It’s prone to comparatively underperform the markets. The Metallic and Media Indices are contained in the lagging quadrant and are exhibiting enchancment of their relative momentum, however the efficiency of the Metallic house could also be adversely affected by an up-move within the US Greenback Index.

The Vitality Index is seen firmly positioned contained in the enhancing quadrant together with the Consumption and Pharma Index. These pockets might present resilient efficiency in opposition to the broader markets.

Essential Notice: RRG™ charts present the relative power and momentum of a gaggle of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used immediately as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience consists of consulting in Portfolio/Funds Administration and Advisory Companies. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Companies. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Shoppers. He presently contributes every day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Day by day / Weekly Market Outlook” — A Day by day / Weekly Publication, presently in its 18th yr of publication.

Subscribe to Analyzing India to be notified every time a brand new put up is added to this weblog!

[ad_2]