[ad_1]

Folks within the U.S. reported $8.8 billion of economic fraud in 2022 to the Federal Commerce Fee, and whereas the FTC obtained fewer studies, 2.4 million versus 2.9 million in 2021, the general financial determine is 30% increased than 2021. Financial institution switch or cost fraud amounted to $1.6 billion in 2022.

Whenever you increase this globally, Cable’s co-founder Natasha Vernier advised TechCrunch that monetary crime turns into a $4 trillion drawback. And one Vernier, co-founder Katie Savitz and the Cable group have been engaged on it since 2021.

Vernier defined that banks and fintechs must first have controls in place to mitigate threat, Controls can embody Know Your Buyer checks, sanctions, screenings, transactions and monitoring, the entire choices that distributors like Unit21 and Alloy do.

A few decade in the past, banks had been receiving fines by regulators for having “insufficient monetary crime controls,” and whereas the variety of these fines dropped off as monitoring distributors got here in, some banks are nonetheless receiving fines for having “ineffective controls,” Vernier mentioned. That’s as a result of there’s a second requirement that regulated monetary establishments have to fulfill, which is to independently check if their controls really work.

“To date this has been achieved totally manually,” she mentioned. “Banks and fintechs manually pattern a tiny proportion of accounts to try to see if these controls are working. That’s what we’ve automated, and we consider we’re the primary and solely automated answer obtainable for the time being.”

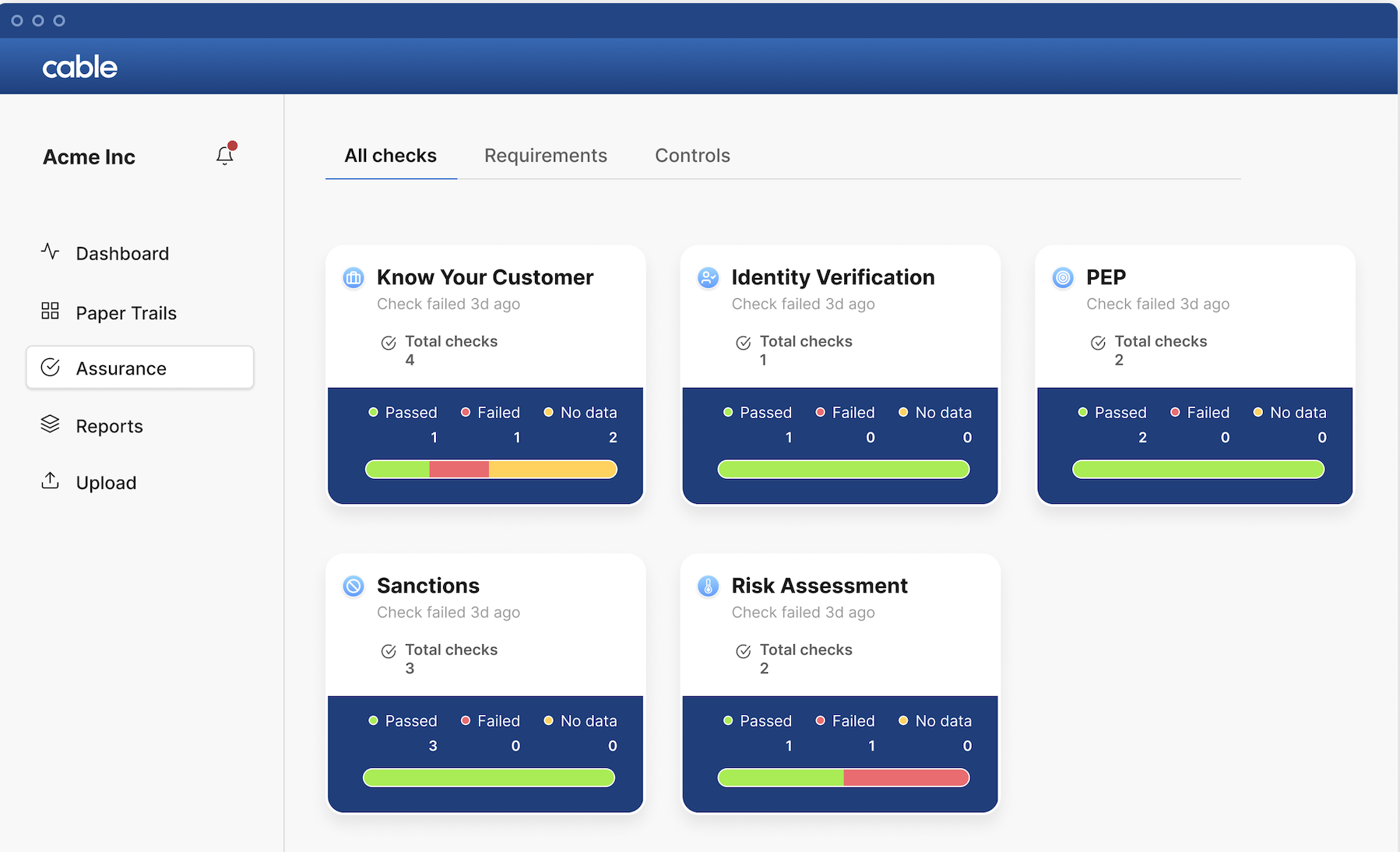

Cable’s monetary crime threat evaluation dashboard (Picture credit score: Cable)

This makes Cable’s platform, which offers automated assurance and threat evaluation, complementary to lots of the monetary crime distributors. It permits banks and fintechs to watch all of their accounts — not only a fraction as earlier than — to know, in actual time, if they’re compliant with rules and if their failure controls are working as anticipated to fight breaches.

Cable additionally offers Banking-as-a-Service organizations oversight on the fintech companions they work with — keep in mind, most fintechs don’t have banking licenses and due to this fact work with banks to supply monetary providers.

Prior to now 12 months, the corporate elevated its income 5 instances, and since 2021, attracted prospects, together with Axiom Financial institution, Quaint Oak Financial institution and Griffin on the banking aspect, and fintech and crypto corporations, together with Tide and Ramp.

“Fintechs should work with banks to, in essence, borrow their license,” Vernier mentioned. “That’s the place we’re discovering actual traction and one of many areas that the OCC (Workplace of the Comptroller of the Foreign money) is especially centered on proper now: banks which can be lending their license to fintechs. They should perceive the effectiveness of the controls at these fintechs, and our product is completely suited to that use case.”

At present, Cable introduced an $11 million Sequence A, led by Stage 2 Capital and Bounce Capital, with participation from current investor CRV. The brand new funding offers the corporate simply over $16 million in whole funding.

The capital permits the corporate to rent throughout product, engineering, information and go-to-market groups and likewise speed up its product improvement. Vernier mentioned that the corporate has solely constructed out 1% of the merchandise and options on its two-year roadmap.

In the meantime, Vernier mentioned because the banking trade strikes ahead, it should proceed so as to add extra methods for customers to take care of their funds fairly than simply conventional banks. And with that will probably be extra scrutiny from regulators for improved oversight, which is why she mentioned it’s the “excellent time for Cable to lift extra money and speed up.”

“Regulators are significantly considering effectiveness testing, but additionally, simply the volatility within the banking trade proper now, with COVID and if we’re in a recession or not, there may be elevated monetary crime,” Vernier mentioned. “We’ve actually seen, globally, a rise in fraud and different sorts of monetary crime over the previous couple of years. And, as real-time funds get rolled out within the U.S., we’ll see extra monetary crime.”

[ad_2]