[ad_1]

The (Walt Disney),a diversified worldwide household leisure and media enterprise based since 1923, shall launch its Q2 2023 earnings outcome on Might tenth (Wednesday), after market shut. The corporate operates by way of two essential segments: Disney Media and Leisure Distribution (DMED) and Disney Parks, Experiences and Merchandise (DPEP). The previous covers the corporate’s world movie, tv content material manufacturing and distribution actions, whereas the latter encompasses parks and experiences and client merchandise.

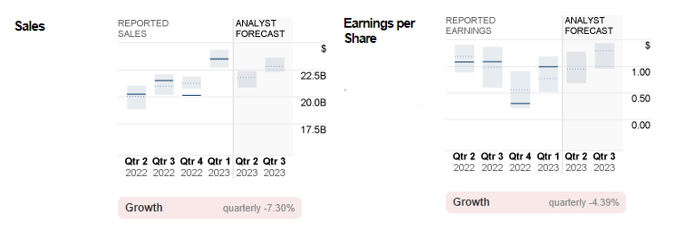

Fig.1: Walt Disney Income (in billion US {dollars}). Supply: Statista

Fig.1: Walt Disney Income (in billion US {dollars}). Supply: Statista

Walt Disney generated $23.5B income in Q1 2023, up 16.67% from the earlier quarter, and up 7.75% from the identical interval final yr. In accordance with the official report, $8.7B income was generated from the Disney Parks phase, up 21% from the earlier quarter. This additionally displays its phase working revenue being up 25% (q/q) to $3.1B, boosted by greater visitor volumes and visitor spending on the resorts, parks and cruises.

Fig.2: Revenues and Working Earnings, Disney Media and Leisure. Supply: Walt Disney

Quite the opposite, the corporate’s Media and Leisure Distribution generated a rise of just one% in complete income for the quarter to $14.8B. Each home and worldwide channels reported losses, resulting in Linear Networks down -5% (q/q) to $7.3B. Working revenue for the phase was additionally down -16% (q/q) to $1.3B. Regardless of Direct-to-Client (DTC) reporting 13% quarterly good points to $5.3B, its working losses expanded to $1.1B (beforehand $0.59B), following greater programming and manufacturing prices and a lower in promoting income. These prices have been too massive to the extent that they might not be offset absolutely by subscription income development and a lower in advertising and marketing prices.

Fig.3: Disney Plus Subscribers. Supply: Statista

Fig.3: Disney Plus Subscribers. Supply: Statista

The corporate reported a lack of roughly 2.4 million in Disney+ subscribers to 161.8 million within the earlier quarter, which is believed to have resulted from the latest value hike for the streaming service. Its different DTC merchandise, ESPN+ and Hulu, recorded a 2% improve in subscribers to 24.9 million and 48.0 million, respectively.

Fig.4: Common Month-to-month Income Per Paid Subscribers for DTC Merchandise. Supply: Walt Disney

By way of common month-to-month income per paid subscriber, Disney+ reported losses each in its home and worldwide segments, at -2% and -4%, to $5.95 and $5.62, respectively, whereas ESPN+ and Hulu have been up 14% and 2%, to $5.53 and $12.46, respectively.

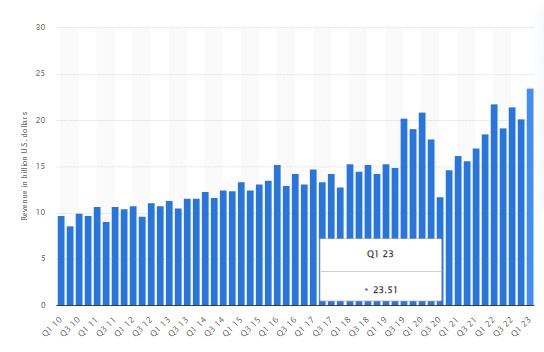

Fig.5: Reported Gross sales and EPS of Walt Disney Co. Versus Analyst Forecast. Supply: CNN Enterprise

Value-cutting measures are the essential precedence for the Walt Disney firm within the midst of recession risk. The corporate shall resume its third wave of seven,000 layoffs earlier than the start of the summer time. Additionally, there shall be a $3 billion pull again on content material spending and different non-content cuts, hopefully to show streaming companies worthwhile in the long term.

Analysts forecasts don’t look optimistic both. Consensus estimates for gross sales of Walt Disney stood at $21.8B, down -7.23% from the earlier quarter. In the identical interval final yr, gross sales was $20.3B. EPS was anticipated to stay flat at $0.95, nearly flat with the earlier quarter ($0.99) and down -12% from the identical interval final yr.

Technical Evaluation:

The #Disney (DIS.s) share value stays consolidated at a comparatively low space for the reason that latter half of 2022. It noticed its lowest level final yr at $84.05, which along with the low of March 2020 ($79.05) varieties a strong help zone to observe, if the asset breaks $91.50 prior. Breaking under the blue help zone might point out extra bearish strain, in direction of the following help at $63.80. Quite the opposite, $105.60 serves as the closest resistance. A break above this stage might encourage the bulls to check $117.75, the best level seen to this point this yr, adopted by $126.40 and dynamic resistance the 100-week SMA.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is supplied as a basic advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]