[ad_1]

Inventory markets suffered via a tough 12 months in 2022. Main indices just like the S&P 500 (SPY) and NASDAQ 100 had been down double digits throughout the board. But this easy technique confirmed a stable double-digit achieve by taking worthwhile positions in each good AND dangerous shares. This sort of balanced strategy will possible proceed to outperform in what appears to be like prefer to be a troublesome second half of 2023. Learn on beneath to seek out out extra.

2022 was one of many worst years for shares in a very long time. After a powerful begin to 2023, shares are failing to interrupt out at latest highs. What occurs the remainder of the 12 months stays to be seen. The latest rise in rates of interest together with a continued earnings recession is more likely to be an overhang that can proceed to stall shares for the ultimate two quarters of 2023.

The common annual return for shares (S&P 500) over the previous 150 years is roughly 9%, together with dividends. With out dividends it drops to only over 4.5%. Inflation shaves about half off these returns.

A return again in the direction of extra historic returns could look fairly good within the coming 12 months. Inventory choice can be essential to performing effectively in 2023, reasonably than simply shopping for any inventory -which was seemingly the best way to straightforward positive aspects up till 2022.

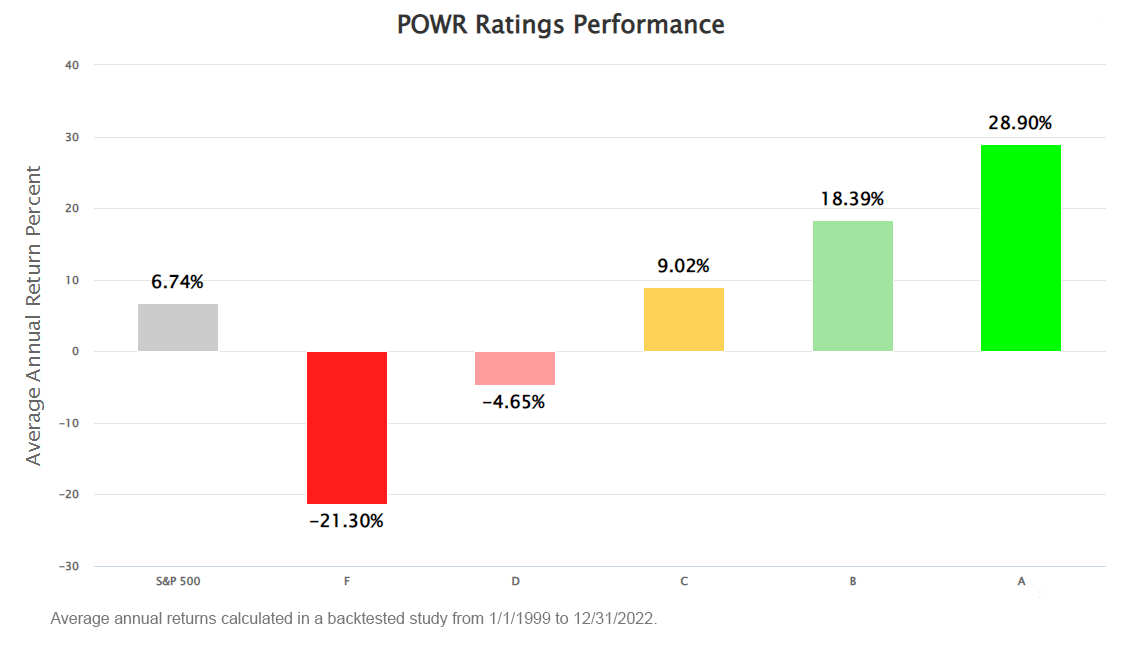

The POWR Scores can actually present buyers and merchants with a transparent edge when choosing shares. Over the previous 20 plus years, the A Rated sturdy buys within the POWR Scores have outperformed the S&P 500 by over 22% yearly.

Whereas this stage of outperformance is really eye-opening, promoting the F rated sturdy promote shares would have crushed the general market by a good larger diploma.

These lowest rated shares really fell over 21% per 12 months whereas the S&P 500 gained almost 7% yearly. This equates to an underperformance of roughly 28%! This implies the dangerous shares fell a bit worse than the nice shares rose compared to the S&P 500.

Many buyers and merchants will not be snug shorting shares. Limitless potential loss will increase the concern issue much more. Fortunately, the choices market gives an outlined danger answer to revenue from a pullback in shares. Places.

Proudly owning a put choice offers you the power to promote a inventory at a particular worth earlier than a sure time. The put purchaser pays cash upfront – known as the choice premium.

For example, shopping for the Apple July $155 put at $4.30 offers the customer the appropriate to promote AAPL inventory at $155 till expiration on 7/21/2023 (the third Friday in July).

The worth of those bearish put choices will improve because the inventory goes down and reduce if the inventory rises. Probably the most in danger is $430 ($4.30 premium x 100)

Shopping for put choices is a straightforward, however very efficient approach, to take a bearish stance on dangerous shares (utilizing Apple for example, not that may be a dangerous inventory).

To assist offset this bearish view, POWR Choices combines it with a bullish commerce that’s completed with a name buy.

Proudly owning a name choice offers you the power to purchase a inventory at a particular worth earlier than a sure time. The decision purchaser once more pays cash upfront – known as the choice premium.

For example, shopping for the Apple July $175 name at $4.50 offers the customer the appropriate to purchase AAPL inventory at $175 till expiration on 7/21/2023 (the third Friday in July).

The worth of those bullish name choices will improve because the inventory goes up and reduce if the inventory drops. Probably the most in danger is $450 ($4.50 premium x 100).

However as an alternative of simply combining places and calls on the identical inventory, POWR choices makes use of the ability of the POWR Scores to mix places on the bottom rated (D and F) names together with bullish calls on the very best rated (A and B) shares.

Promote the worst and purchase the best-but outline the chance.

Pairing a bearish put and bullish name collectively is named a “Pairs Commerce”. These two trades collectively mix for a way more impartial outlook.

It’s a technique we efficiently use day in and day trip within the POWR Choices Portfolio to take a extra balanced “Pairs Commerce” strategy by combining bearish places with bullish calls. It labored very effectively in 2022 and continues to work very effectively thus far in 2023.

A latest instance of this POWR Pairs strategy utilizing the ability of the POWR scores for bearish put performs and bullish name performs could assist shed some mild on issues.

Beneath is a latest POWR Pairs commerce completed within the POWR Choices Portfolio on Acuity Manufacturers (AYI) and Roblox (RBLX).

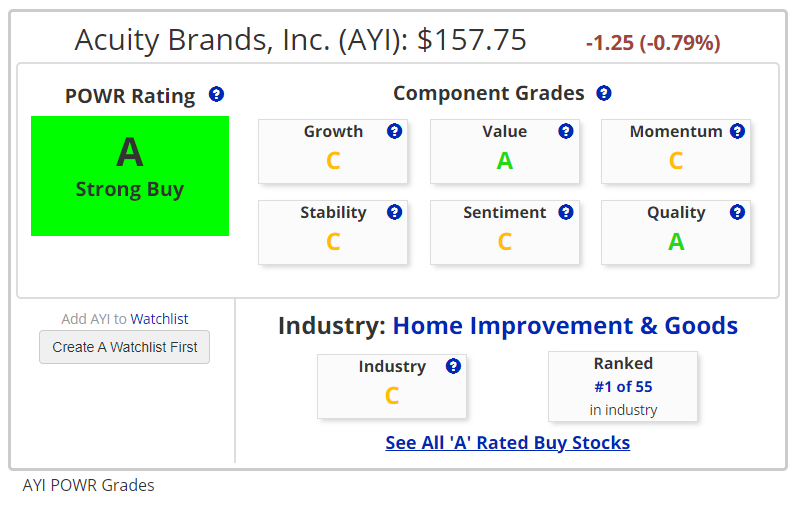

AYI was an A rated- Sturdy Purchase -stock in a C rated Business. Primary within the business. Sturdy inventory in a powerful place.

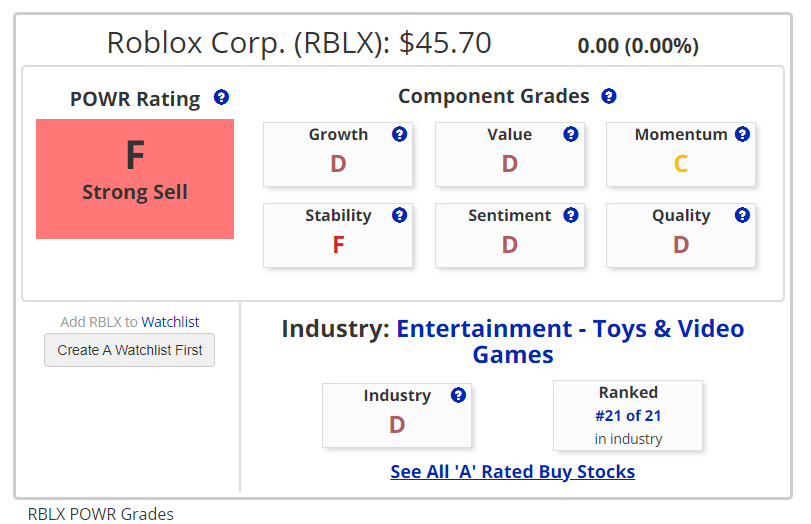

RBLX was an F rated -Sturdy Promote – inventory in a D rated business. Ranked on the backside within the business group as effectively, so just about the worst of the worst.

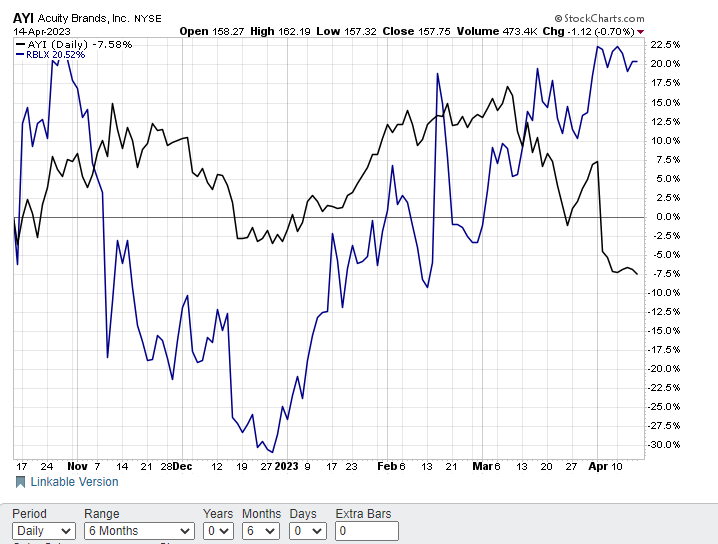

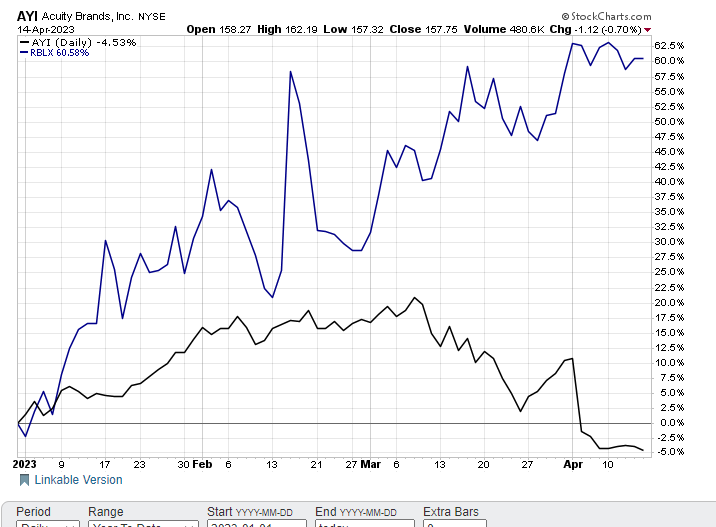

But over the previous few weeks, a lot decrease rated Roblox had been outperforming a lot larger rated Acuity by a large margin.

Actually, for the reason that starting of the 12 months A rated AYI was decrease by virtually 5% whereas F rated RBLX screamed a lot higher-up 60%!.

This arrange ideally for a POWR Pairs commerce. Shopping for bullish calls on the big-time underperforming Sturdy Purchase AYI and bearish places on the vastly outperforming Sturdy Promote RBLX.

The expectation was for the unfold between the 2 to converge again in the direction of a extra regular comparative efficiency with AYI outperforming RBLX.

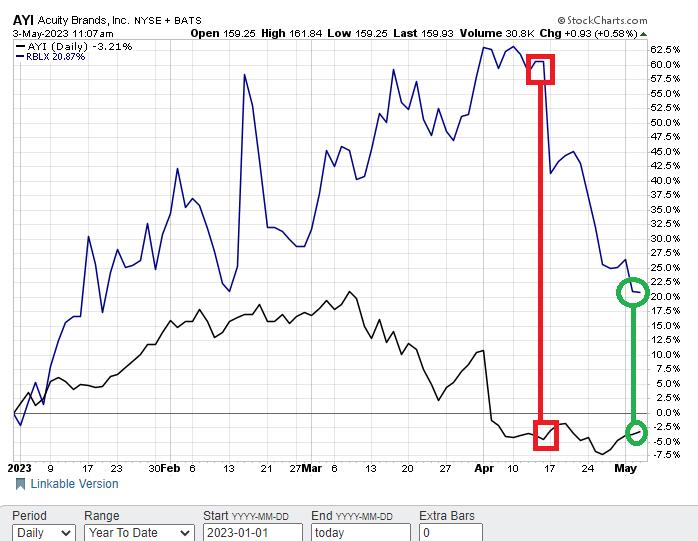

That proved to be the case. RBLX dropped sharply whereas AYI traded sideways. The unfold converged from over 60% at commerce inception (purple) to 25% at shut out (inexperienced).

POWR Choices closed out the POWR Pairs commerce for a $210 total achieve. $40 loss on the AYI calls and a $250 achieve on the RBLX places. Commerce took 16 days from begin to end. Over a 20% achieve on the $970 invested in each the AYI calls ($500) and RBLX places ($470). Not dangerous for just a few weeks work on a impartial commerce.

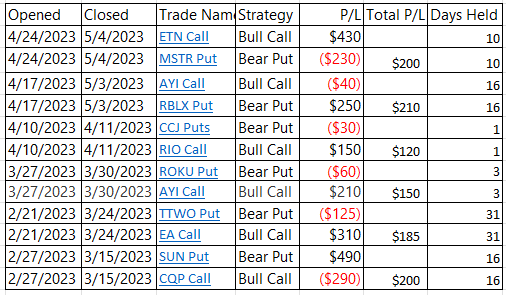

This desk beneath exhibits the newest six closeouts for POWR Choices. All 6 had been total profitable trades with a holding interval averaging only a few weeks. All similar to the AYI/RBLX POWR Pairs commerce.

The flexibility to say nimble and be extra impartial has served the POWR Choices Portfolio thus far. Our buying and selling confirmed stable positive aspects since inception versus losses for shares in that very same time-frame.

Utilizing the POWR scores to assist us choose the most effective of the most effective shares to be bullish on with name buys, together with the worst of the worst shares to be bearish on with put purchases, will possible proceed to show worthwhile in 2023.

What To Do Subsequent?

If you happen to’re searching for the most effective choices trades for at the moment’s market, you must positively try this key presentation Commerce Choices with the POWR Scores. Right here we present you how one can persistently discover the highest choices trades, whereas minimizing danger.

Utilizing this easy however highly effective technique I’ve delivered a market beating +55.24% return, since November 2021, whereas most buyers have been mired in heavy losses.

If that appeals to you, and also you need to be taught extra about this highly effective new choices technique, then click on beneath to get entry to this well timed funding presentation now:

Commerce Choices with the POWR Scores

This is to good buying and selling!

Tim Biggam

Editor, POWR Choices E-newsletter

SPY shares fell $0.44 (-0.11%) in after-hours buying and selling Friday. Yr-to-date, SPY has gained 8.31%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the complicated world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer. Tim is the editor of the POWR Choices publication. Be taught extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The put up Revenue From the Greatest AND Worst Shares! appeared first on StockNews.com

[ad_2]