[ad_1]

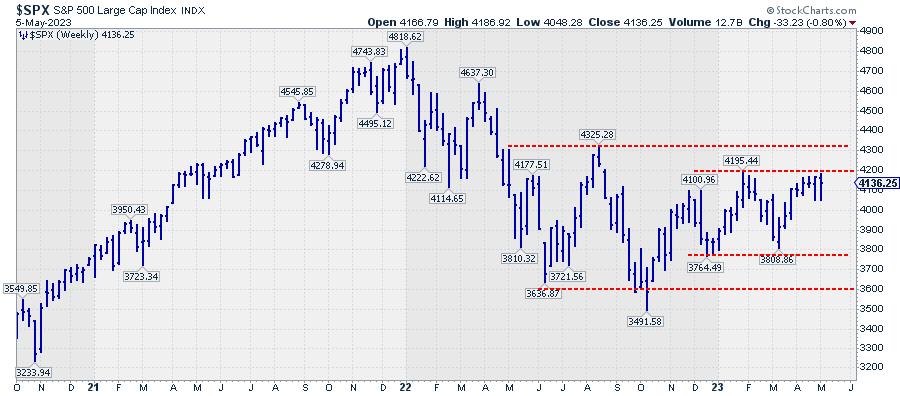

Whereas the S&P 500 struggles to push past its overhead resistance within the space round 4200, cash is rotating out of offensive sectors into defensive AND delicate.

On the weekly chart, two buying and selling ranges are beginning to emerge. The primary one is the extra slender one, between roughly 3800-4200. The second is just a little broader and reveals up between 3600 and 4300.

Within the close to time period, a break above 4200 will very seemingly discover resistance solely 100 factors larger, whereas a break beneath 3800 will discover renewed help close to 3600.

Zooming in on the day by day chart for $SPX, you possibly can seen that, within the final two weeks, a brand new help degree has emerged at 4050. The actionable takeaways from these observations are twofold. In case 4200 provides approach, a rally could also be anticipated in the direction of the following overhead barrier close to 4300, whereas draw back threat shall be restricted by the previous resistance, now help, close to 4200. On the flip aspect, when the current lows at 4050 are damaged downward, an extra decline towards the decrease boundary of the vary close to 3800 appears to be within the playing cards.

Given the robust seasonality for the S&P 500 in Could as mentioned in Sector Highlight final Tuesday, together with the market holding up effectively regardless of some information grenades being dropped right here and there, I’m leaning in the direction of an upward break.

Beneath the hood, an attention-grabbing sector rotation is underway.

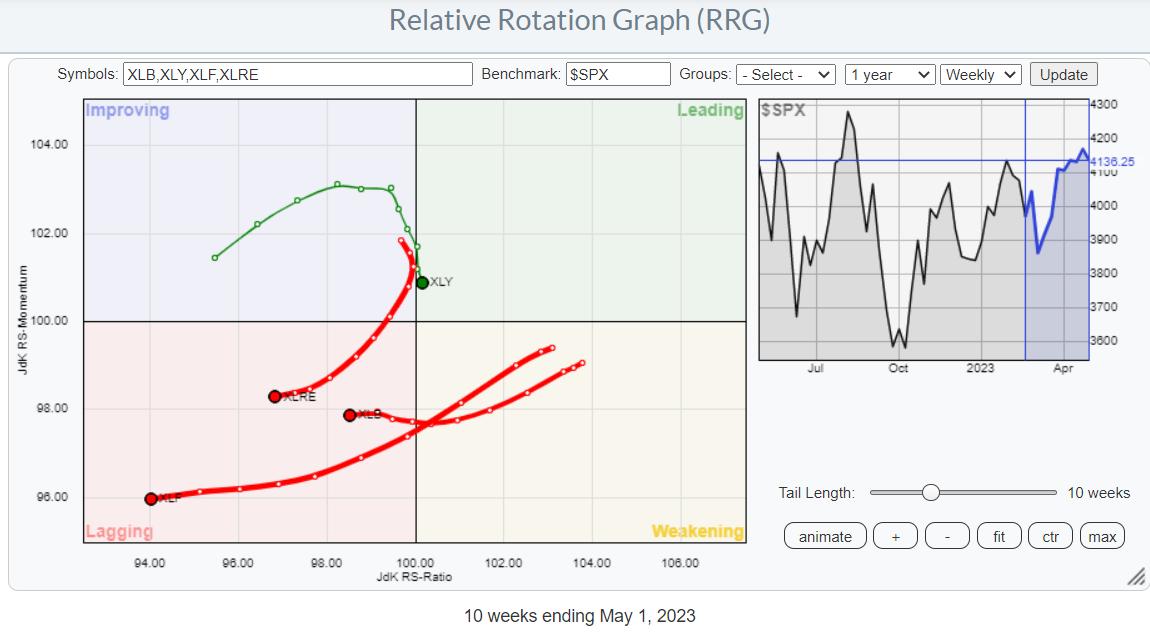

Offensive Sectors

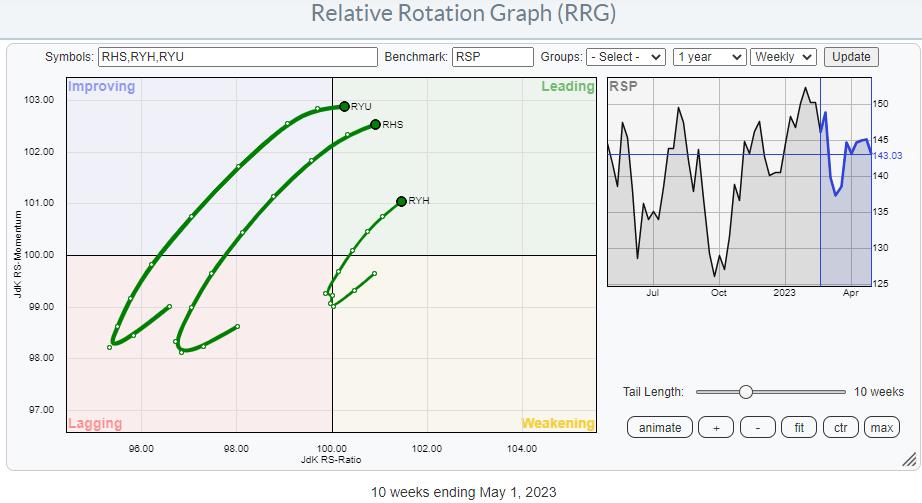

The RRGs above present the rotation for cap-weighted offensive sectors versus the rotation of their equal-weight counterparts. The damaging rotation is clearly seen in each charts, justifying the conclusion that buyers are shifting away from the extra cyclical shares in the meanwhile.

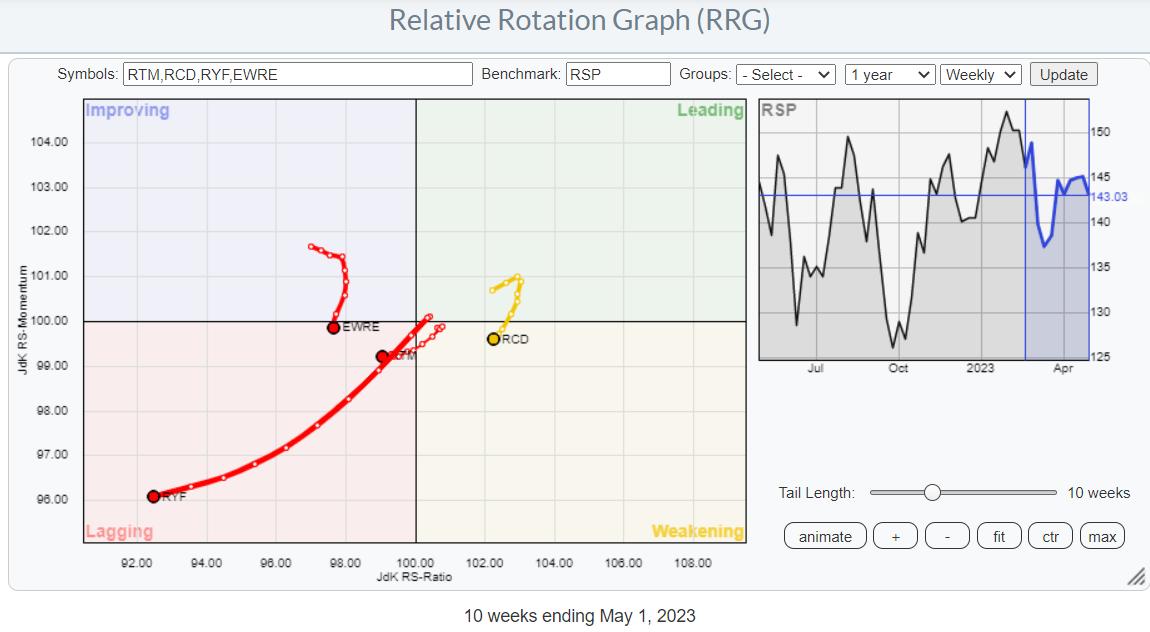

Defensive Sectors

These two RRGs present the rotation for the defensive sectors, and though the rotational patterns are all constructive, therefore in favor of defensive sectors. It’s clearly seen that the equal-weight sectors are forward of the cap-weighted sectors. This means that the cap-weighted defensive sectors have lately been held again by the larger-weight shares in them, whereas the equal-weight sectors have been already exhibiting a rotation that took them via enhancing and effectively into the main quadrant.

Such a rotation normally indicators a extra risk-off state of affairs, which might be in keeping with the statement of cash flowing out of offensive sectors (into defensive) however does not likely align with the S&P pushing in opposition to resistance and trying to break larger.

That is the place the third group of sectors is available in.

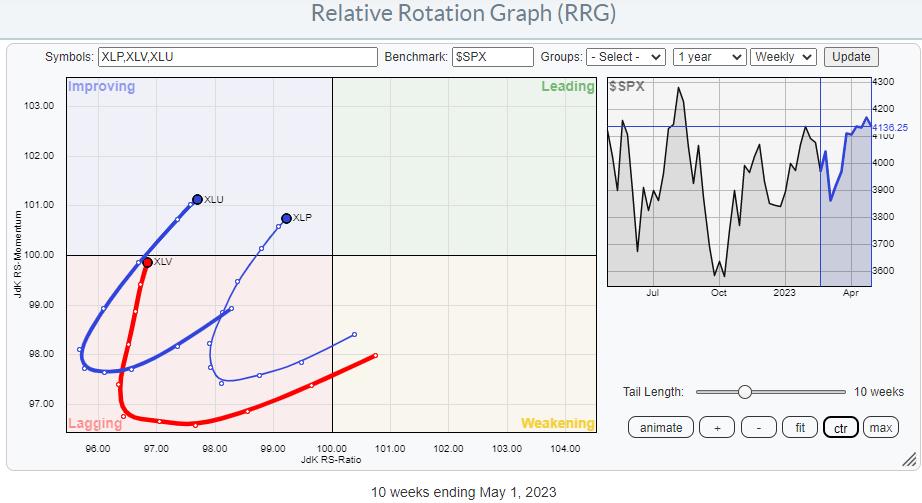

Delicate Sectors

This group of delicate sectors, which consists of Data Expertise, Communication Companies, Industrials, and Power, appears to be the decisive issue in the meanwhile.

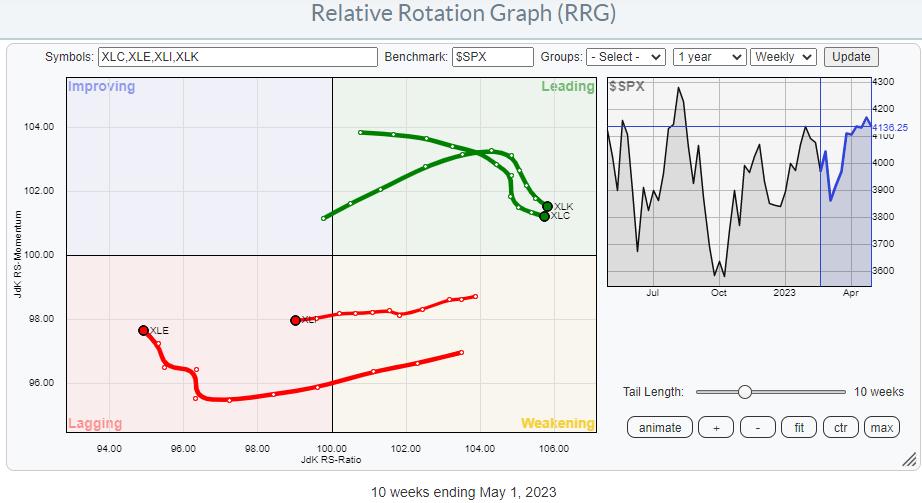

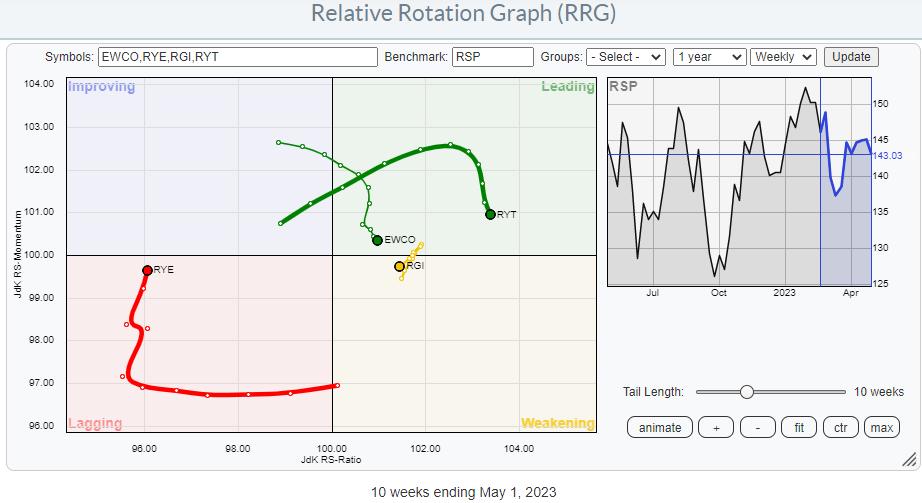

The 2 RRGs above present the energy of Data Expertise and Communication Companies. Each the cap-weighted and equal-weighted variations are contained in the main quadrant. With Expertise being the biggest sector within the universe, this creates a giant constructive pull for the S&P 500 itself.

Within the cap-weighted index, Industrials and Communication Companies are just about related with 8%, which offsets this rotation on the cap-weighted RRG. On the equal-weight RRG, the distinction in place between RGI and XLI means that bigger shares are dragging down XLI whereas the industrials sector, usually, stays on the right-hand aspect of the RRG.

Conclusion

All in all, the present sector rotation reveals a transfer from offense to protection, which warrants some warning with regard to the S&P 500. Nonetheless, the present energy of, particularly Expertise, Communication Companies, and to a lesser diploma, Industrials, ideas the dimensions to the constructive aspect and makes me search for an upward break and an preliminary transfer towards 4300.

#StayAlert and have an amazing weekend, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to reply to each message, however I’ll definitely learn them and, the place moderately doable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Power in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Be taught Extra

Subscribe to RRG Charts to be notified at any time when a brand new publish is added to this weblog!

[ad_2]