[ad_1]

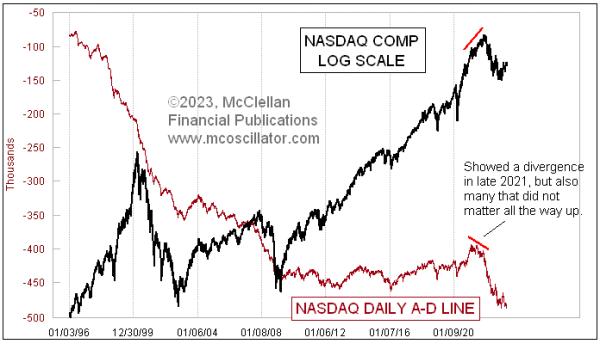

Final week, I addressed the divergence that was evident between the share value of QQQ and its equal-weighted cousin, QQEW. Each of these ETFs are designed to trace the shares within the Nasdaq 100 Index (NDX). This similar divergence is obvious on this week’s chart, which reveals the each day A-D Line for the part shares which make up the Nasdaq 100 Index.

An A-D Line is a cumulative working whole of all each day Advances and Declines. It adjustments every day by the worth for the each day breadth (A-D). As a result of it’s describing the behaviors of a inhabitants of shares, it’s in a class of indicators often known as a “diffusion index.”

Years in the past, I began a venture to compile knowledge on the entire part shares within the NDX, simply because I assumed it could be attention-grabbing to trace the A-D knowledge and different knowledge. It was quite a lot of work fetching value knowledge on these 100 shares, plus going again so far as I may to trace adjustments within the elements of that index and assemble the value knowledge on the departed points. It stays an ongoing job to maintain up with splits and index part adjustments.

The A-D knowledge for the NDX shares turned out to be surprisingly not as helpful as I had hoped. More often than not, it does regardless of the NDX itself is doing. The entire level of an A-D Line is to get completely different solutions from what costs are saying, and hopefully some helpful divergences at essential turning factors. So if a selected A-D Line simply does no matter costs are doing, there’s not a lot worth in learning it. One can nonetheless get helpful info from the A-D knowledge in different methods, corresponding to wanting on the acceleration happening. Due to that, the McClellan Oscillator primarily based on these A-D knowledge is sort of helpful, and I function it repeatedly in my Each day Version.

One thing completely different is occurring now, and we’re seeing a uncommon divergence between the NDX A-D Line and the NDX itself. This virtually by no means occurs, which makes it all of the extra noteworthy, and the message is that there’s an uncommon disagreement proper now between the large cap shares like Apple (AAPL) and Microsoft (MSFT), which drive the value stage of the NDX, versus the conduct of the opposite index elements.

An A-D Line is helpful as a result of it helps us detect the well being of the liquidity stream, which impacts all shares. However good or unhealthy liquidity impacts the small and least-deserving ones first. So when illiquidity comes round, it picks off the weak first, whereas the robust can nonetheless muscle their approach in to get a drink. Within the A-D knowledge, each inventory will get an equal vote, the weak ones the identical because the robust ones. That’s the reason the messages one can get from A-D knowledge can typically be so helpful.

This level can’t be made, nevertheless, for the message from the A-D Line for the general Nasdaq market. It has such a tremendously bearish bias that it makes any messages one would possibly take from it unreliable. I prefer to stump fellow analysts typically by asking, “When was the final time that the Nasdaq’s A-D Line made a brand new all-time excessive?” It is a trick query, as a result of the Nasdaq’s A-D Line began downward from the start of the info in 1972 and it has by no means made it again to that stage. So it has not ever made a brand new all-time excessive.

This adverse bias stems from the truth that the Nasdaq has looser itemizing requirements than the NYSE (the A-D Line for which could be very helpful). If a inventory goes to come back public after which go broke, it’s extra probably to try this on the Nasdaq, and each down day from IPO to delisting contributes to the Declines column.

It may possibly nonetheless be helpful typically to trace the acceleration happening within the Nasdaq’s A-D knowledge, and so a McClellan Oscillator for these knowledge may be helpful. However the uncooked A-D Line is so unreliable within the messages it provides as to be functionally unusable. With that mentioned, I’ll be aware that the general Nasdaq’s A-D Line this week made one other new all-time low. So it’s undoubtedly NOT saying that there’s hidden energy out there.

Subscribe to High Advisors Nook to be notified every time a brand new submit is added to this weblog!

[ad_2]