[ad_1]

The frequent chorus, “Promote in Might…” provides this month a foul rap, nevertheless it would not deserve it.

Might is traditionally one of many least unstable months of the 12 months, as measured by its closing common return within the S&P 500. Since 1970, its common return is simply .49%. Contemplating December, January, and April are three of the highest 4 finest performing months of the 12 months, the market in all probability deserves a relaxation by Might.

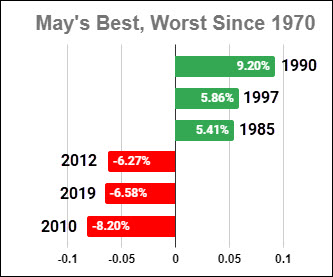

Nonetheless, Might would not all the time relaxation, and it isn’t missing in historic volatility, as you may see from the chart above of the very best and worst performing months of Might within the final 50 years.

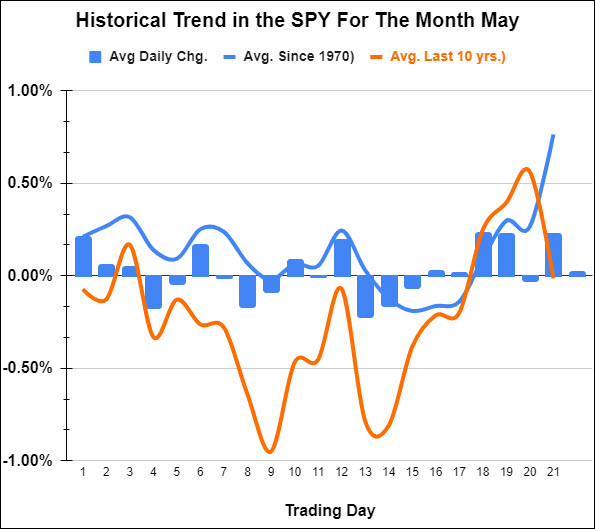

There’s additionally an fascinating historic pattern in Might’s efficiency intra-month. It tends to be weak to begin, then rally within the latter a part of the month. Apparently, the patterns during the last 10 and 50 years are related, in that Might has tended to backside across the similar day of the month in each timeframes.

As you may see within the chart under, the developments of each the crimson line (10 years) and blue line (since 1970) each backside out across the 13-Fifteenth buying and selling day of the month.

The thirteenth buying and selling day of the month shall be Might seventeenth. With a Fed announcement, earnings from AAPL, and an employment report all this week, Might might get off to a wild begin. If historical past is any information, and the market pulls again this week, search for a bounce across the ninth buying and selling day of the month (Might eleventh) after which a rally into the top of the month beginning after Might seventeenth.

For extra detailed buying and selling details about our blended fashions, instruments and dealer training programs, contact Rob Quinn, our Chief Technique Guide, to study extra.

IT’S NOT TOO LATE! Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-E-book in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for day by day morning movies. To see up to date media clips, click on right here.

Mish and Nicole Petallides talk about cycles, stagflation, commodities and a few inventory picks on this look on TD Ameritrade.

Mish talks films and streaming shares with Angela Miles on Enterprise First AM.

Mish and Charles talk about zooming out, stagflation and picks outperforming shares on this look on Making Cash with Charles Payne.

Everyone knows at this level how troublesome the market has been with all the various opinions concerning recession, inflation, stagflation, the market’s going to return again, the market’s going to break down – advert nauseam. What in regards to the individuals caught in the course of a variety certain market? Mish presents her prime selections for shorts and longs on the Friday, April 21 version of StockCharts TV’s Your Day by day 5.

Mish and Benzinga talk about the present buying and selling ranges and what would possibly break them.

Mish discusses what she’ll be speaking about at The Cash Present, from April 24-26!

Mish walks you thru technical evaluation of TSLA and market situations and presents an motion plan on CMC Markets.

Mish presents two shares to have a look at on this look on Enterprise First AM — one bullish, one bearish.

Mish joins David Keller on the Thursday, Might 13 version of StockCharts TV’s The Last Bar, the place she shares her charts of excessive yield bonds, semiconductors, gold, and regional banks.

Mish joins Wolf Monetary for this Twitter Areas occasion, the place she and others talk about their experiences as former pit merchants.

Mish shares her views on pure gasoline, crude oil and a number of ETFs in this look on CMC Markets.

Mish talks what’s subsequent for the economic system on Yahoo! Finance.

Mish joins Bob Lang of Explosive Choices for a particular webinar on what merchants can anticipate in 2023!

Rosanna Prestia of The RO Present chats with Mish about commodities, macro and markets.

Coming Up:

Might 2nd-Fifth: StockCharts TV Market Outlook

- S&P 500 (SPY): 23-month MA 420

- Russell 2000 (IWM): 170 assist – 180 resistance

- Dow (DIA): Over the 23-month MA-only index

- Nasdaq (QQQ): 329 the 23-month MA

- Regional Banks (KRE): 43 now pivotal resistance

- Semiconductors (SMH): 246 the 23-month MA

- Transportation (IYT): 202-240 greatest vary to observe

- Biotechnology (IBB): 121-135 vary to observe from month-to-month charts

- Retail (XRT): 56-75 buying and selling vary to interrupt a method or one other.

Geoff Bysshe

MarketGauge.com

President

Geoff Bysshe is the co-founder and President of MarketGauge.com. For practically 20 years, he is developed buying and selling merchandise, companies, methods and methods whereas additionally serving as a buying and selling mentor for MarketGauge prospects. He additionally gives common commentary and buying and selling instruction within the MarketGauge weblog. Geoff is a former floor-trader who was a member of the FINEX buying and selling the U.S.

Be taught Extra

Subscribe to Mish’s Market Minute to be notified at any time when a brand new publish is added to this weblog!

[ad_2]