[ad_1]

As we speak I current you an outline of trades made utilizing the Owl technique – sensible ranges for the EURUSD, GBPUSD and AUDUSD foreign money pairs for the week from April 24 to twenty-eight, 2023. There have been various trades, lastly the EURUSD buying and selling began, however first issues first.

For comfort and well timed receipt of alerts I exploit the Owl Good Ranges Indicator. The principle buying and selling timeframe is M15, whereas the H1 and H4 timeframes are used to verify the development path of the upper timeframe.

EURUSD evaluation

Final week EURUSD took revenge on the variety of trades of the previous few intervals. There have been no trades on Monday, market was in useless zone for the second half of Tuesday and the primary commerce was opened on Wednesday.

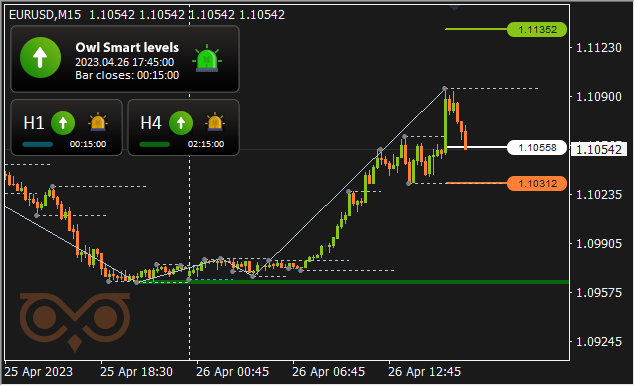

Fig. 1. EURUSD BUY 0.06, OpenPrice = 1.10558, StopLoss = 1.10312, TakeProfit = 1.11352, Revenue = -$13.78

The commerce needed to be closed on the reversal of the large arrow of the indicator, minimizing the loss, which, nonetheless, was $15.

Fig. 2. EURUSD BUY 0.49, OpenPrice = 1.10360, StopLoss = 1.10324, TakeProfit = 1.10474, Revenue = $55.42

The second commerce was opened on Thursday and was routinely closed by TakeProfit, bringing fairly a superb revenue. However the subsequent and final two trades on EURUSD have been shedding.

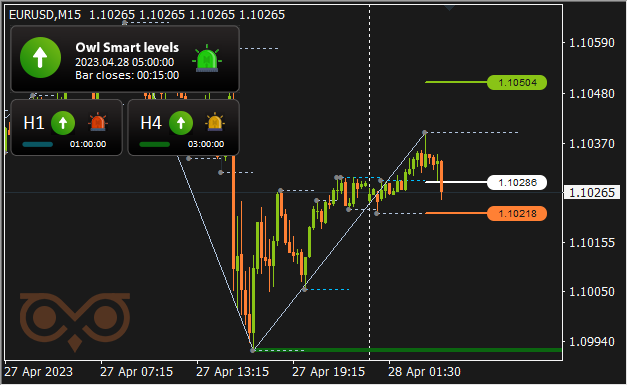

Fig. 3. EURUSD BUY 0.22, OpenPrice = 1.10524, StopLoss = 1.10456, TakeProfit = 1.10744, Revenue = -$15

Fig. 4. EURUSD BUY 0.26, OpenPrice = 1.10286, StopLoss = 1.10218, TakeProfit = 1.10504, Revenue = -$17.5

The indicator appears to have caught the upward development and instructed to open all trades on EURUSD for getting.

GBPUSD evaluation

On Monday many of the day and half of Tuesday the market was within the useless zone. Regardless of this, periodically there was a possibility to open some trades.

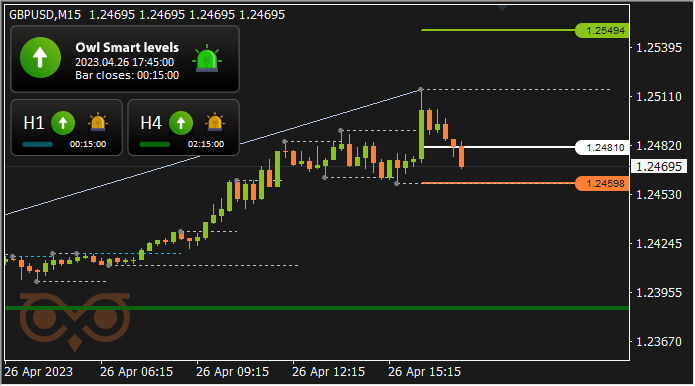

Fig. 5. GBPUSD BUY 0.52, OpenPrice = 1.24809, StopLoss = 1.24780, TakeProfit = 1.24901, Revenue = $47.59

The primary commerce on the asset was worthwhile and closed at TakeProfit. The following two trades, sadly, turned out to be loss-making.

Fig. 6. GBPUSD BUY 0,15, OpenPrice = 1,24907, StopLoss = 1,24808, TakeProfit = 1,25229, Revenue = -$9.09

The commerce needed to be closed manually to attenuate losses, because of the reversal of the large arrow of the Owl Good Ranges indicator, which warns of the change of the value path.

Fig. 7. GBPUSD BUY 0.08, OpenPrice = 1.24810, StopLoss = 1.24598, TakeProfit = 1.25494, Revenue = -$17.50

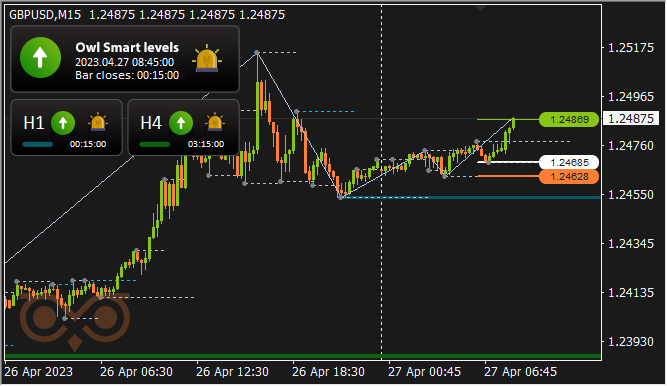

As within the case with EURUSD, final week the Owl Good Ranges indicator instructed to open all trades for getting, and the fourth commerce of the asset was particularly profitable.

Fig. 8. GBPUSD BUY 0,35, OpenPrice = 1,24685, StopLoss = 1,24628, TakeProfit = 1,24869, Revenue = $64.56

Additional on Thursday and half of Friday the market was within the useless zone, so there have been no extra trades on GBPUSD.

AUDUSD evaluation

The one commerce on AUDUSD was opened for promoting and closed at StopLoss, making a small loss.

Fig. 9. AUDUSD SELL 0.17, OpenPrice = 0.66093, StopLoss = 0.66180, TakeProfit = 0.65809, Revenue = -$15

Outcomes:

8 trades for getting, and all of them on two belongings, present that the Owl Good Ranges indicator detected an upward development and confidently provided to open trades by the development.Outcomes of the desk of trades additionally present that.

See different evaluations of the Owl Good Ranges technique:

I am Sergei Ermolov, comply with me and do not miss extra helpful instruments for worthwhile buying and selling on Forex.

[ad_2]