[ad_1]

EUR/USD: Awaiting Fed and ECB Conferences

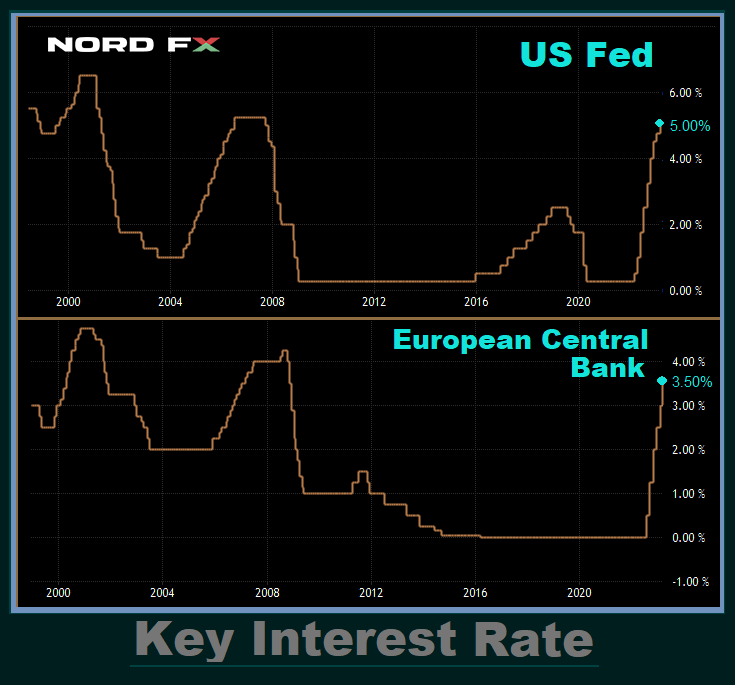

● The primary issue figuring out the dynamics of the US Greenback Index (DXY) and, consequently, the EUR/USD pair final week was… silence. If lately, the speeches of Federal Reserve representatives have been nearly a very powerful market information, then a silence regime has been in impact since April 21. Main as much as the press convention by Fed Chairman Jerome Powell following the FOMC’s Might assembly, all officers are instructed to keep up silence. Only some days stay till the FOMC (Federal Open Market Committee) assembly, the place a choice relating to the regulator’s future financial coverage shall be made, scheduled for Might 2/3. Moreover, on Thursday, Might 4, there shall be a gathering of the European Central Financial institution, the place an rate of interest resolution may also be made. Basically, the upcoming five-day interval guarantees to be, on the very least, not boring.

● After all, macroeconomic information and occasions from either side of the Atlantic prompted sure fluctuations in EUR/USD final week. Nevertheless, the ultimate consequence was near zero: if on Friday, Might 21, the final chord sounded on the 1.0988 mark, then on Friday, Might 28, it was positioned not distant: on the 1.1015 stage.

One occasion value highlighting was the publication of the First Republic Financial institution (FRC) report, which ranks among the many high 30 US banks by market capitalization. It was this report that led to the greenback’s decline and the pair’s surge by greater than 100 factors on Wednesday, April 26.

It appeared that the banking disaster brought on by the tightening of the Federal Reserve’s financial coverage (QT) was starting to fade… US Treasury Secretary Janet Yellen even assured the general public of the resilience of the banking sector. However then… a brand new flare-up referred to as First Republic Financial institution (FRC). To forestall its chapter and assist its liquidity in Q1 2023, a consortium of banks transferred $30 billion in uninsured deposits to FRC. One other $70 billion within the type of credit score was supplied by JPMorgan. Nevertheless, this was not sufficient: the financial institution’s shoppers started to scatter, and FRC shares collapsed by 45% in two days and by 95% because the starting of the yr. In March alone, shoppers withdrew $100 billion from the financial institution. Thus, First Republic Financial institution has a really excessive likelihood of turning into quantity 4 within the lineup of bankrupted main US banks. And if the Fed doesn’t cease its QT cycle, there’s a very excessive likelihood that numbers 5, 6, 7, and so forth will seem on this record.

Nevertheless, as now we have already detailed in our earlier overview, on the assembly on Might 2/3, the important thing fee shall be raised by solely 25 foundation factors (FedWatch from CME estimates the likelihood of this at 72%). After that, the US Central financial institution is prone to take a pause. As acknowledged by the President of the Federal Reserve Financial institution of Atlanta, Raphael Bostic, “yet another improve needs to be sufficient for us to step again and see how our coverage is mirrored within the financial system.” It needs to be famous that the 25 bp fee hike has lengthy been factored into market quotations. Subsequently, instantly after the information about FRC and the surge to 1.1095, EUR/USD returned to a snug state for itself.

● On the time of writing the overview, on Friday night, April 28, analysts’ opinions have been divided as follows: 35% of them count on the greenback to weaken and the pair to rise, 50% count on it to strengthen, and the remaining 15% have taken a impartial place. As for technical evaluation, amongst oscillators on D1, 85% are colored inexperienced, 15% are neutral-grey, amongst pattern indicators, 90% are inexperienced, and 10% have modified to crimson. The closest assist for the pair is positioned within the space of 1.0985-1.1000, adopted by 1.0925-1.0955, 1.0865-1.0885, 1.0740-1.0760, 1.0675-1.0710, 1.0620, and 1.0490-1.0530. Bulls will encounter resistance within the space of 1.1050-1.1070, then 1.1110, 1.1230, 1.1280, and 1.1355-1.1390.

● Along with the aforementioned FOMC and ECB conferences, we will count on a considerable quantity of financial information subsequent week. On Monday, Might 1, the ISM Manufacturing PMI for the US shall be revealed. The following day, the worth of an identical index, however for Germany, will turn into identified. Additionally, on Tuesday, Might 2, we’ll be taught in regards to the inflation state of affairs within the Eurozone, because the Shopper Worth Index (CPI) shall be launched. Moreover, on Might 2, 3, 4, and 5, we’ll get a flurry of US labour market information. Vital indicators such because the unemployment fee and the variety of new non-farm jobs within the US (NFP) are amongst these, they’ll historically be revealed on the primary Friday of the month, Might 5.

GBP/USD: BoE vs. Fed: Who Will Win the Battle of Curiosity Charges?

● The Financial institution of England (BoE) assembly will happen every week after the Fed’s assembly, on Thursday, Might 11. Most consultants consider that the cycle of rate of interest hikes for the pound will not be but over, which helps the British foreign money.

Latest information on inflation for March contribute to those forecasts. The Shopper Worth Index (CPI) in annual phrases as soon as once more reached a double-digit determine, 10.1%, which is greater than the forecast of 9.8%. To carry this indicator beneath the psychologically vital mark of 10.0%, the BoE is very prone to proceed following the Fed’s instance. Market members count on the regulator to lift the rate of interest by 50 foundation factors on Might 11: from 4.25% to 4.75%. No simpler methods to curb inflation have been devised to this point. And if it continues to stay so excessive, it is going to hurt each the buyer market and the general UK financial system.

● For the reason that starting of April, now we have noticed a sideways pattern. Nevertheless, GBP/USD completed the previous five-day interval on the 1.2566 mark, unexpectedly breaking the higher boundary of the channel. Maybe the rationale for the soar was the closing of buying and selling positions on the finish of the month. At the moment, 75% of consultants are in favor of the greenback, and solely 25% aspect with the British pound. Amongst oscillators on D1, the steadiness of energy is as follows: 85% vote in favor of the inexperienced (with a 3rd of them being within the overbought zone), and the remaining 15% have turned neutral-grey. Development indicators are 100% on the inexperienced aspect. Help ranges and zones for the pair are 1.2450-1.2480, 1.2390-1.2400, 1.2330, 1.2275, 1.2200, 1.2145, 1.2075-1.2085, 1.2000-1.2025, 1.1960, 1.1900-1.1920, and 1.1800-1.1840. Because the pair strikes north, it is going to encounter resistance on the ranges of 1.2510-1.2540, 1.2575-1.2610, 1.2700, 1.2820, and 1.2940.

● Relating to vital statistics on the state of the UK financial system for the upcoming week, on Tuesday, Might 2, the Manufacturing Buying Managers’ Index (PMI) shall be revealed. Then, on Might 4, we’ll be taught the worth of the PMI for the companies sector in addition to the composite enterprise exercise indicator for the UK as a complete. Merchants also needs to bear in mind that there shall be a financial institution vacation within the nation on Monday, Might 1.

USD/JPY: Financial institution of Japan – Heading for Softer Extremely-Delicate Coverage

● Forecasting the rate of interest of the Financial institution of Japan (BoJ) is kind of easy and really, very boring. As a reminder, it’s at present at a destructive stage of -0.1% and was final modified on January 29 of the distant 2016, when it was lowered by 20 foundation factors. This time round, at its assembly on Friday, April 28, the regulator left it unchanged on the identical -0.1%.

However that is not all. Many market members have been anticipating that with the arrival of the brand new Central financial institution governor, Kazuo Ueda, the regulator would finally change course in direction of tightening. Nevertheless, opposite to those expectations, throughout his first press convention following his first assembly on April 28, Ueda acknowledged, “We are going to proceed to ease financial coverage with out hesitation if obligatory.” One may surprise how a lot softer it might get, but it surely seems that the present -0.1% will not be the restrict.

● The results of the BoJ governor’s phrases will be seen on the chart: in just some hours, USD/JPY soared from 133.30 to 136.55, weakening the yen by 325 factors. After all, it is nonetheless removed from the October 2022 peak, however an increase to the 137.50 stage now not appears fully unrealistic.

● The pair ended the previous week on the stage of 136.30. Relating to its near-term prospects, analysts’ opinions are distributed as follows: at present, solely 25% of consultants vote for the pair’s additional progress, 65% level in the wrong way, anticipating the yen to strengthen, and 10% merely shrug. Among the many oscillators on D1, 85% level upward (a 3rd of them are within the overbought zone), whereas the remaining 15% stay impartial. Development indicators present 90% wanting north, and 10% pointing south. The closest assist stage is within the 136.00 space. Subsequent are the degrees and zones at 135.60, 134.75-135.15, 132.80-133.00, 132.00-132.40, 131.25, 130.50-130.60, 129.65, 128.00-128.15, and 127.20. Resistance ranges and zones are at 137.50 and 137.90-138.00, 139.05, and 140.60.

● Relating to occasions characterizing the state of the Japanese financial system, none are anticipated within the coming week. Furthermore, the nation is wanting ahead to a sequence of holidays: Might 3 is Structure Day, Might 4 – Greenery Day, and Might 5 is Kids’s Day. Because of this, the dynamics of USD/JPY will rely fully on what is occurring on the opposite aspect of the Pacific Ocean, in the USA.

CRYPTOCURRENCIES: Awaiting the 2024 Halving

● BTC/USD continued to say no on Monday, April 24 and, after breaking the assist at $27,000, fell to $26,933. Market members have been already ready to see bitcoin go even decrease on the robust assist stage of $26,500. Nevertheless, it unexpectedly soared to $30,020 on April 26. The primary cryptocurrency was saved, because it has been many instances earlier than and shall be many instances once more, by a weakened greenback. The reason for the shock was the issues of First Republic Financial institution, which adopted a sequence of bankruptcies of crypto-friendly banks, as mentioned above.

The correlation between the crypto and banking industries arises due to the next chain of occasions: 1) Tightening of the Federal Reserve’s financial coverage hits banks, reducing their asset costs, lowering demand for his or her companies, and inflicting clients to flee. 2) This example creates severe difficulties for some banks and results in the chapter of others. 3) This could pressure the Fed to pause its cycle of elevating rates of interest and even decrease them. Moreover, the regulator could restart the printing press to assist financial institution liquidity. 4) Low charges and a stream of recent low cost cash result in a lower within the worth of the greenback and permit traders to direct these funds into dangerous belongings corresponding to shares and cryptocurrencies, which results in a rise of their quotes. We’ve got already seen this in the course of the COVID-19 pandemic and may even see it once more within the close to future.

● Based on former Goldman Sachs high supervisor and macro-investor Raoul Pal, the Federal Reserve (Fed) is prone to have completed its saga of elevating rates of interest. He has additionally predicted an upcoming recession that may pressure the regulator to “change course” and assist the markets by printing cash. In that case, he believes that dangerous belongings are in for an “inevitable liquidity wave.” This capital inflow will “enlighten” the crypto trade with new improvements, and the variety of individuals utilizing digital belongings will improve from the present 300 million to over 1 billion.

● Based on consultants from the British financial institution Customary Chartered, bitcoin has benefited from its standing as a “model refuge” for financial savings initially of 2023, and the present state of affairs signifies the tip of the “crypto winter”. Customary Chartered believes that latest turmoil within the banking sector, stabilization of dangerous belongings as a result of finish of the Fed’s rate of interest hike cycle, and elevated profitability within the crypto mining trade will contribute to BTC’s additional progress. As well as, the adoption of the primary EU framework for regulating crypto markets by the European Parliament might additionally assist the main cryptocurrency. The upcoming halving occasion may also affect BTC’s progress, with bitcoin probably reaching $100,000 by the tip of 2024.

● It needs to be famous that the subject of halving is turning into increasingly prevalent. The Bitcoin Archive press service reminds us that it’s lower than a yr away, with the process scheduled for April 6, 2024, as of April 24, 2023. Nevertheless, this date will not be closing and will change, because it has previously.

Some market members consider that this occasion shall be essential for the longer term worth of the flagship cryptocurrency. They consider that cycles for cryptocurrencies are constant, and BTC quotes will attain new report highs a yr or a yr and a half after halving, as occurred in earlier cycles. Others argue that the market state of affairs has modified. Bitcoin has turn into a mass phenomenon, and now “different legal guidelines and guidelines apply to the cryptocurrency”, so different components will turn into decisive, not simply the halving of mining rewards.

● It’s value noting that the second group of specialists contains Bloomberg Intelligence analyst Jamie Coutts, who predicts that the value of bitcoin will rise to $50,000 earlier than April 2024. “The value of bitcoin bottoms out when there are 12-18 months left till the halving. The construction of the present cycle is much like earlier ones. Nevertheless, many components have modified: the community has turn into considerably extra resilient, and bitcoin has by no means skilled a chronic financial downturn,” Coutts stated. If his forecast is right, the asset will admire by about 220% from the low reached final November earlier than the halving.

● The knowledgeable and dealer often called Physician Revenue reminded of his earlier assertion that the underside for bitcoin was reached on the stage of $15,400, and it’s unlikely that we’ll see one other drop to this stage. The dump in November 2022 was a whole capitulation, together with for bitcoin miners, a few of whom have been compelled to promote their cash and tools at a loss. Based on Physician Revenue, BTC is at present in an accumulation section, neither in a bull nor in a bear market. On the identical time, the specialist has suggested merchants to carefully monitor the correlation between the Chinese language inventory market and bitcoin, believing that China will carry the ban on cryptocurrencies and legalize them, which may have a really optimistic long-term impact on their worth.

One other analyst underneath the nickname DonAlt additionally excludes a drop in BTC/USD to the lows of November 2022. On the identical time, he permits for a correction all the way down to $20,000, which, in his opinion, shall be a great stage to replenish the reserves of the principle cryptocurrency.

● It has been some time since we quoted the favored analyst underneath the nickname PlanB, identified for his Inventory-to-Stream (S2F) mannequin. He continues to claim that the predictions he makes primarily based on this mannequin proceed to come back true. “Earlier than the halving, we will count on $32,000 for bitcoin, then $60,000. Then [after the halving] $100,000 will turn into the minimal, and the utmost fee might attain $1 million. However on common, after the following halving, the BTC fee ought to attain $542,000,” wrote PlanB. On the identical time, the analyst emphasised that the behaviour of the crypto market absolutely corresponds to S2F, so its critics are merely unfounded.

It’s value noting that PlanB will not be alone in his super-optimistic predictions for the value of bitcoin, which legendary Warren Buffett referred to as “rat poison squared.” Robert Kiyosaki, the writer of the favored guide Wealthy Dad Poor Dad, believes that the worth of the flagship cryptocurrency will rise to $500,000 by 2025. And at Ark Make investments, wanting a decade forward, they named a determine of $1 million per coin.

● As of the night of Friday, April 28, BTC/USD is buying and selling at $29,345. The whole market capitalization of the crypto market is $1.205 trillion ($1.153 trillion every week in the past). The Crypto Worry & Greed Index has elevated from 50 to 64 factors over the previous seven days, transferring from Impartial to the Greed zone.

NordFX Analytical Group

Discover: These supplies aren’t funding suggestions or tips for working in monetary markets and are meant for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx

[ad_2]