[ad_1]

Ben Broadbent, deputy governor of the Financial institution of England, gave a speech this week wherein I agreed with some (however on no account all) of what he stated.

His argument was summarised on this assertion:

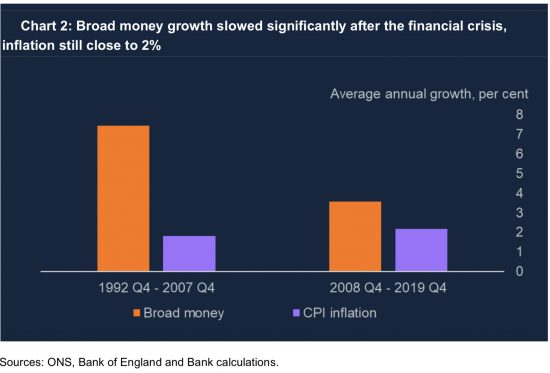

Definitely the very strongest claims – that QE inevitably results in speedy development of business financial institution deposits (M4), on a par with that within the central financial institution‘s steadiness sheet; and that this, in flip, inevitably results in extreme inflation – are usually not nicely supported by the proof. Broad cash grew greater than twice as quickly within the first fifteen years of inflation concentrating on (when there was no QE) than within the decade or so after the monetary disaster (when there was tons). And common inflation, in each durations, was near 2%.

In impact, the argument he made was that the creation of latest cash by the Financial institution of England beneath cowl of the quantitative easing course of, didn’t end in inflation.

He developed this thesis utilizing a number of charts:

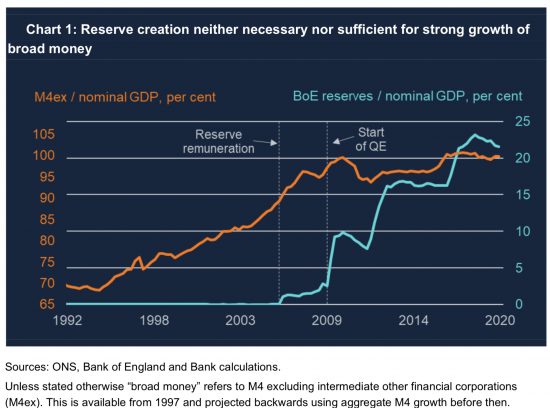

The argument made, based mostly on this chart, is that the expansion in central financial institution, base, slender or reserve account cash (they’re, successfully, all the identical factor, with all of it being constrained throughout the Financial institution of England inter-bank settlement cycle via the central financial institution reserve accounts) is just not associated to the expansion in industrial financial institution or broad cash, which is what is definitely used within the financial system wherein all of us function. It is a notable and acceptable suggestion.

Broadbent bolstered the declare by suggesting that the worldwide monetary disaster modified the sample of cash creation, however doing so didn’t end in inflation:

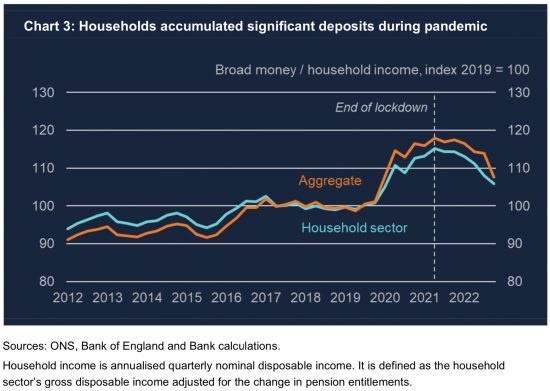

The purpose he then famous was that the affect of Covid was that some in society did save utilizing broad or industrial bank-created cash:

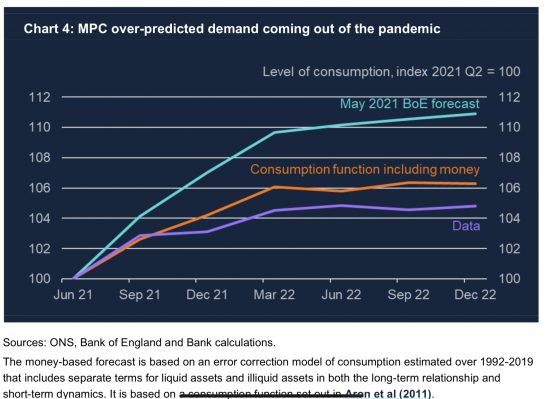

What the Financial institution then anticipated was that folks would then spend that pent-up cash. That is what those that declare the QE created inflation additionally counsel. Nevertheless, as Broadbent notes, that tendency to spend was a lot smaller than anticipated:

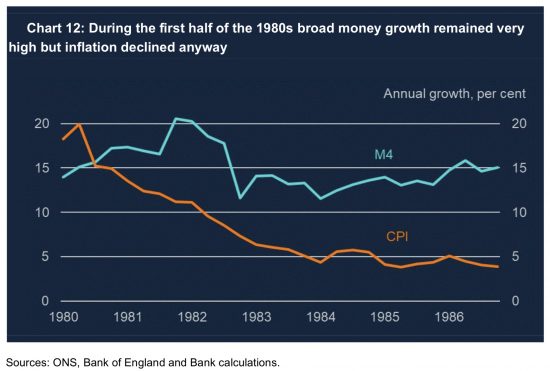

Broadbent then used a New Keynesian, and so deeply neoclassical, rationalization for what did occur within the macroeconomy. From this he concluded that, firstly, it was exterior shocks that created this inflation and, secondly, like Huw Tablet, he thinks we should settle for that we’re worse off consequently. I don’t agree with the explanations he gave, however what I do agree with is his conclusion that central financial institution cash creation, not to mention broad cash creation, is just not intently (if very a lot in any respect) linked to inflation. His Chart 12 offered help:

Cash provide development was excessive. Inflation was not. On the very least, the speed of circulation of cash dropped dramatically. The plain rationalization for that’s rising inequality. He didn’t say so.

The place I do agree with Ben Broadbent is that there isn’t a apparent proof that QE did in any approach end in inflation. I believe it’s time to dismiss that argument.

[ad_2]