[ad_1]

Within the endless battle of market narratives, new concepts get launched and previous concepts are resurrected as essential. One of the persistent criticisms of US equities has been how slender the positive factors have been pushed primarily by mega-cap tech shares.

You most likely know this argument as “FAANMG.”

There may be some reality to the declare that the most important firms have been pulling markets alongside; what it truly means is considerably ambiguous and topic to interpretation. The extra fascinating query is what does the relative performances of equal weight and market cap weight S&P500 imply?

Some historical past can add some colour to the controversy.

One of the influential our bodies of analysis about “How Market Tops Get Made” got here from Paul Desmond of Lowry Analysis. He famous that markets get more and more slender by cap measurement (capitalization) as longer secular bull markets strategy their ends. Particularly, we see smaller caps roll over, then mid-caps, then giant caps; the final to fall are the mega-caps.

Desmond liked to ask skilled portfolio managers “What proportion of shares would you count on could be making new highs on the high day of the bull market when the Dow Jones was making its absolute excessive?” The standard solutions had been within the 60, 70, 80% vary.

The precise reply was lower than 6%. In line with Demond, of the 14 main market tops between 1929 and 2000 inclusive, when the DJIA reached its absolute peak, the common proportion of shares additionally making new highs on that day was 5.98%.

However this doesn’t clarify the whole lot about whether or not markets are too slender or not. We are able to clarify – or rationalize, in case you want – a number of contributors to the substantial positive factors FAANMG has loved. Growing world market share added to revenues, as new applied sciences and merchandise added to profitability. The 2-decades-long slide in vital anti-trust enforcement has helped every of those giants to dominate their particular sectors.

Which brings us again to the weighting of indices.

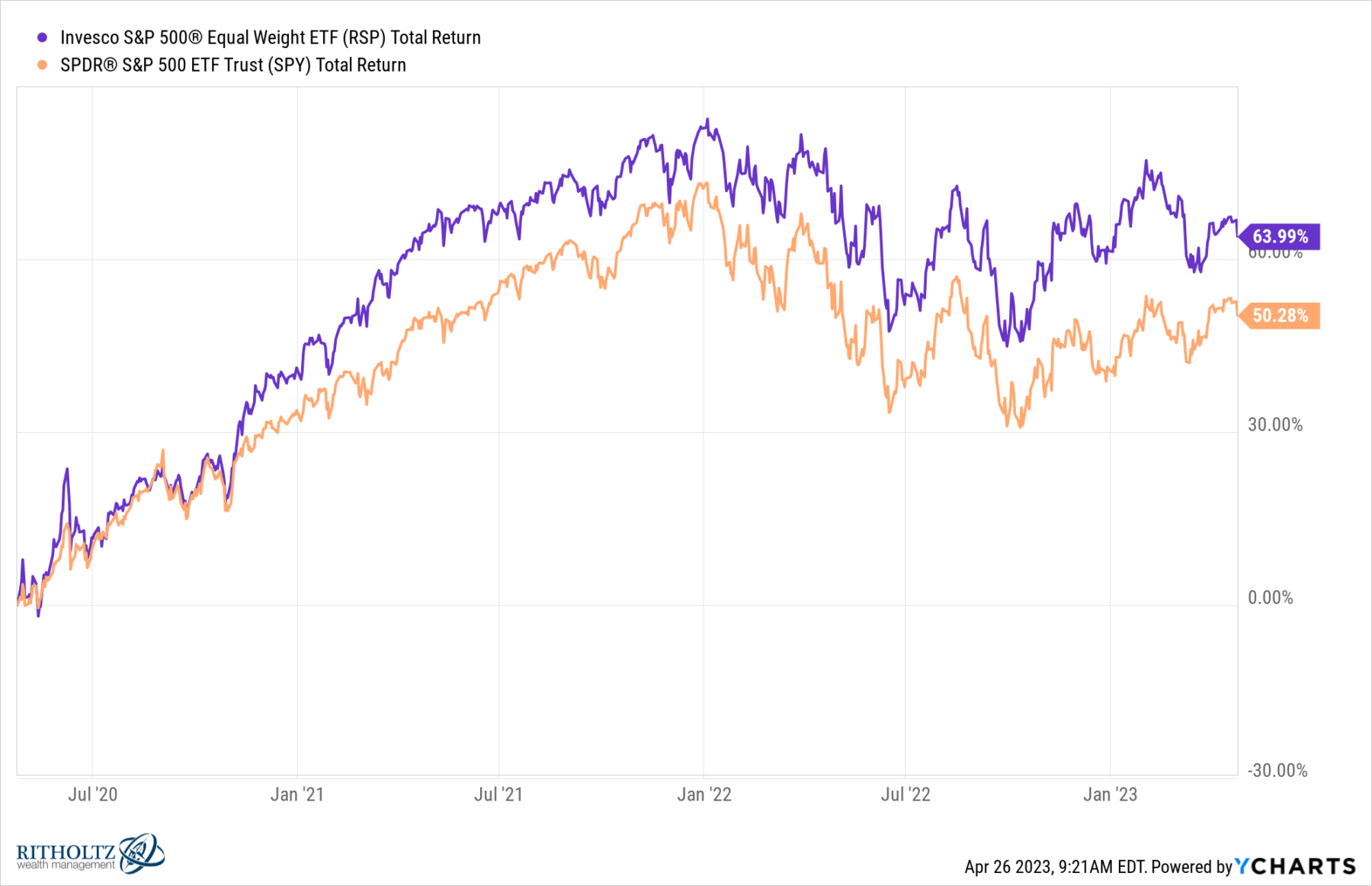

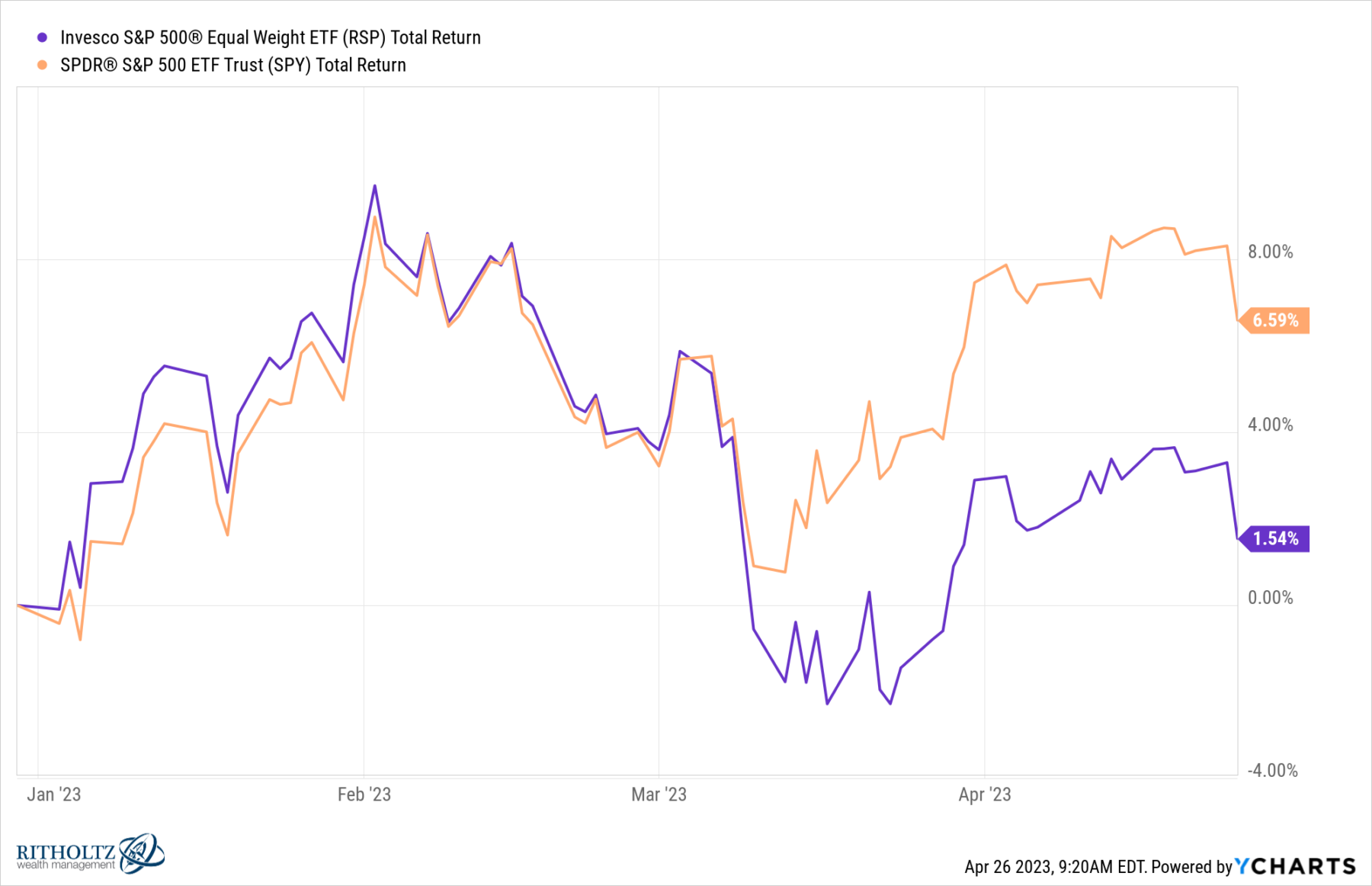

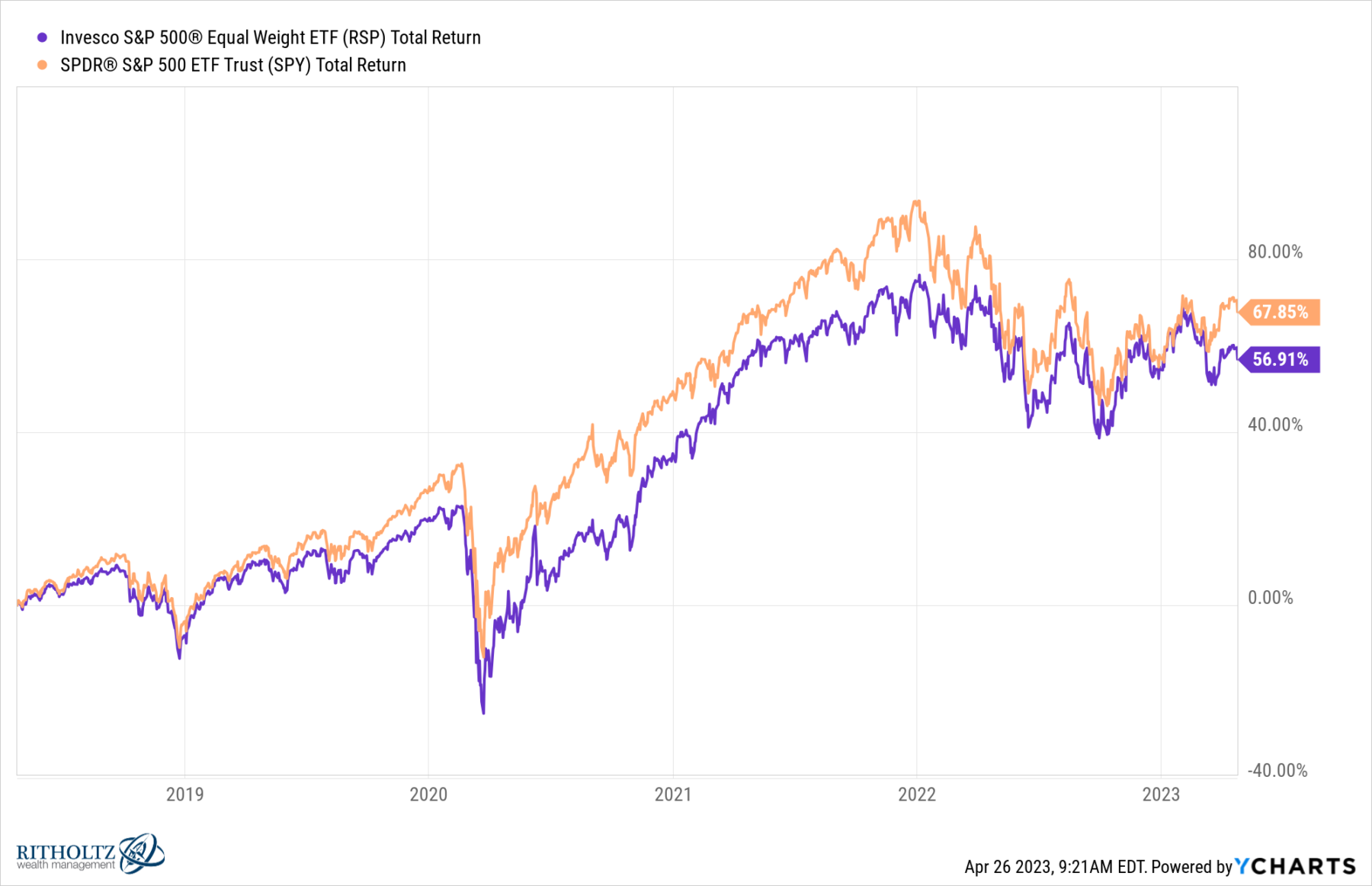

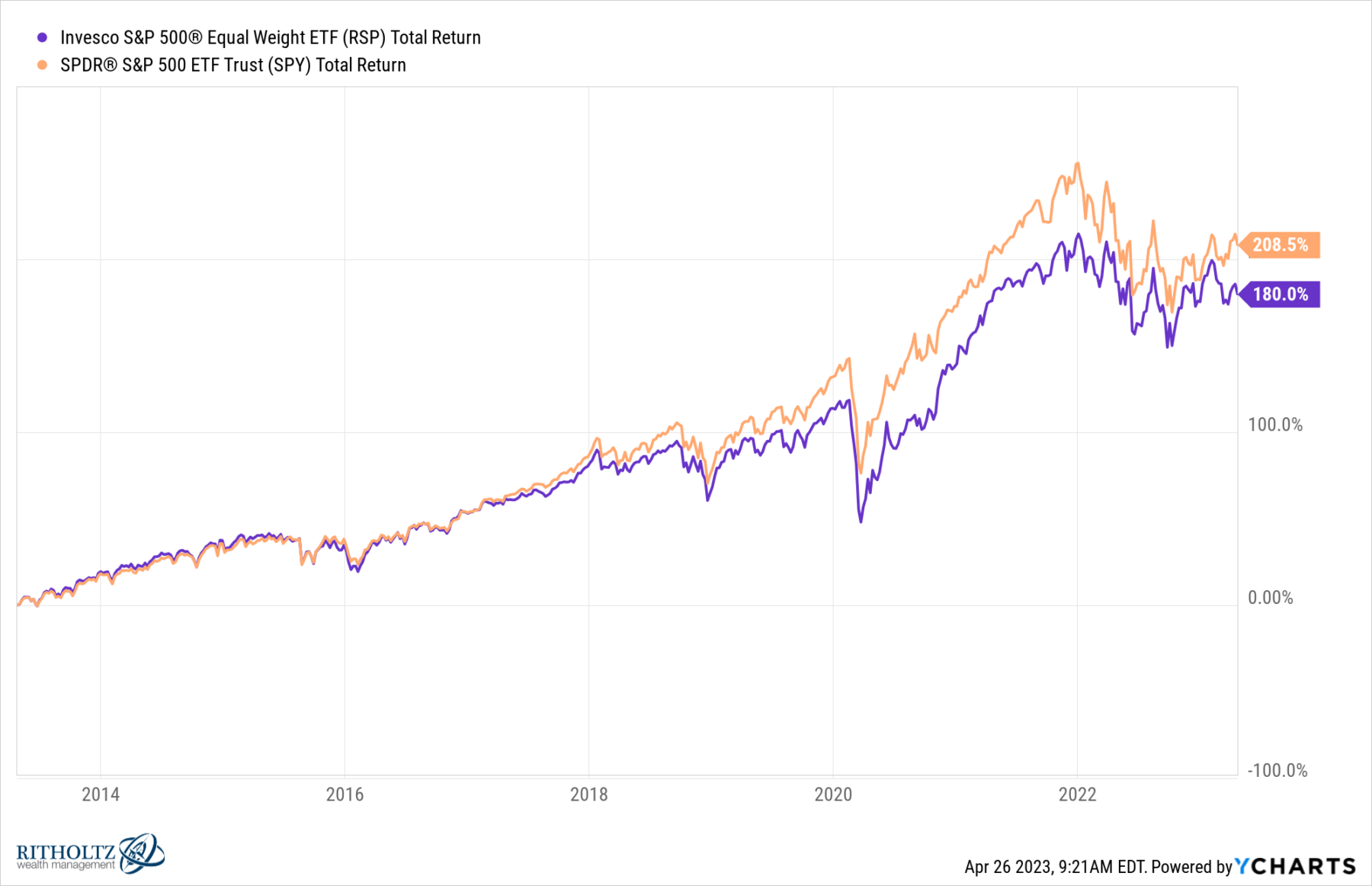

Let’s use 2 ETFs for our efficiency comparisons: SPY and RSP.1 12 months-to-date, cap-weighted is forward by 500 bps – 6.6% to 1.5%. However once we look again 3 years, the equal weight has almost tripled that benefit: 64% to 50%. It’s noteworthy that this era contains almost all the large big-cap run-up following the pandemic backside in March 2020 and the 30% crash tech shares suffered in 2022. If we glance long run, the cap-weighted return to dominance: greater than 10% for five years (67.9% vs 56.9%) and even larger 28% over 10 years (280.5% vs 180.0%). See charts right here.

There may be all the time a very good motive to note when markets get too slender on the finish of a protracted bull market, particularly as main indices make all-time highs. However which may be a special set of circumstances than what we’re witnessing in latest mega-cap efficiency at this time.

Beforehand:

How Market Tops Get Made (March 12, 2014)

2021: Small, Medium & Giant Cap Returns (January 4, 2022)

Prime 5 Shares: What Does This Imply? (December 16, 2021)

The right way to Mislead with Knowledge, Giant Firm Version (November 12, 2021)

See additionally:

This awfully fragile slender no-good rally (FT, April 25, 2023)

MiB: Paul Desmond of Lowry’s Analysis (October 24, 2015)

Q&A: Paul Desmond of Lowry’s Studies & Half II (February 18-19, 2011)

___________

1. SPDR® S&P 500 ETF Belief (SPY) for market cap, and Invesco S&P 500 Equal Weight (RSP) for no cap-weighted.

12 months-to-Date S&P 500: Market cap weight (SPY) versus Equal Weight (RSP)

5 Years S&P 500

10 Years S&P 500

[ad_2]