[ad_1]

April is Monetary Literacy Month. As a retail dealer or investor, you recognize the worth of training. There’s all the time a brand new approach, device, or technique to study. Refined scanning instruments might help establish shares that would enhance your buying and selling course of. Here is an instance of utilizing scan outcomes to research a inventory earlier than buying and selling it.

A terrific every day behavior for merchants is to run scans to establish shares to commerce. It is a methodical option to filter via the hundreds of ticker symbols the inventory market provides. One inventory of curiosity, which confirmed up in a scan that regarded for large-cap shares that had a StockCharts Technical Rating (SCTR) rating crossing above 80, was Boston Scientific (BSX). Let’s analyze the chart of BSX.

After struggling a setback throughout the COVID-19 pandemic, Boston Scientific (BSX) has began displaying indicators of development. The inventory has an thrilling sample forming, which might make it an amazing inventory to purchase if the expansion indicators maintain. If issues do not go within the firm’s favor, nevertheless, it’s possible you’ll need to transfer on to a different inventory in your scan outcomes.

Boston Scientific is asserting its earnings on Wednesday (April 26). Traders are doubtless ready for the outcomes earlier than they resolve to purchase or promote. Will the inventory proceed its upward transfer after it reviews?

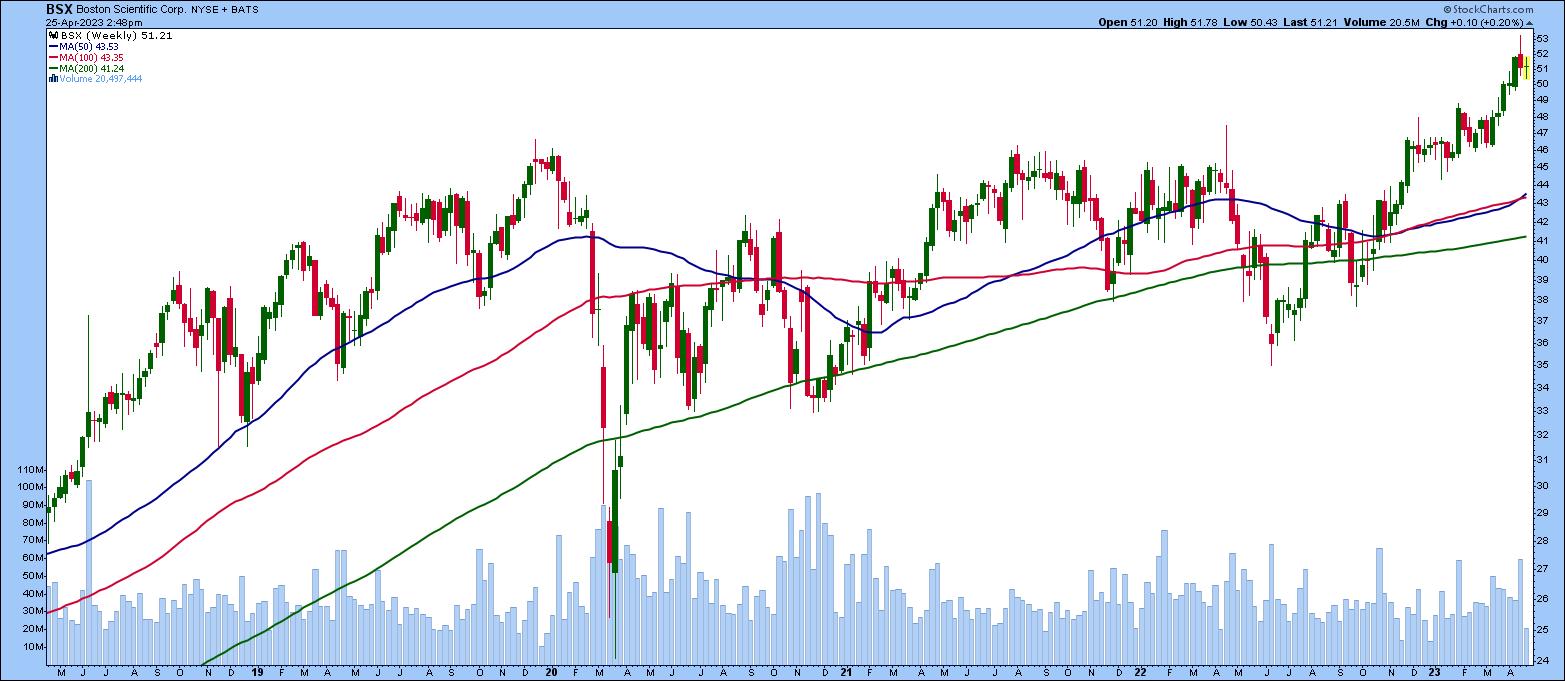

The Lengthy-Time period View of BSX Inventory

Trying on the weekly chart over 5 years, BSX is buying and selling properly above its 50-, 100-, and 200-week easy transferring averages. The 50-week easy transferring common (SMA) is crossing above its 100-week SMA. The 200-week SMA is displaying a really mild optimistic slope. A steeper upward slope can be extra confirming of an uptrend.

CHART 1: A LONGER-TERM VIEW. Boston Scientific inventory is buying and selling above its 50-, 100-, and 200-week easy transferring averages. The inventory is trending larger, however will it proceed? That will rely upon its earnings report.Chart supply: StockCharts.com. For instructional functions solely.

Zeroing In: Each day Value Motion

Let’s test the every day chart to see if the uptrend is in sync. The every day chart of BSX reveals the 50-, 100-, and 200-day SMAs sloping upward. This agrees with what the weekly chart reveals. The SCTR rating displayed within the higher panel is above 80, and relative power in opposition to the Well being Care sector, utilizing the Well being Care Choose Sector SPDR exchange-traded fund (XLV), is displayed within the decrease panel.

CHART 2: DAILY CHART OF BSX STOCK. The inventory is trending larger, but it surely stays to be seen if it should break via a key resistance degree. If it does, the inventory might go a lot larger.Chart supply: StockCharts.com. For illustrative functions solely.

Along with the general pattern, the every day chart reveals some fascinating patterns it is best to watch.

- Development path. In late September 2022, BSX began trending larger, with a collection of upper highs and better lows. In mid-December, the upward value motion slowed, and the inventory value went via a consolidation interval. It began trending decrease, however broke above that downward trendline on February 1, 2023 on larger than common quantity. It regarded like the start of an uptrend, however the upward value motion stalled, and the inventory trended decrease.

- Upward transfer resumes. On March 14, value broke above the second downward trendline. This time, the inventory value stayed above the downward-sloping trendline and continued transferring larger. The inventory value stayed above the third trendline up till April 21, when the inventory had a large selloff and closed under the upward-sloping trendline. The inventory’s value dropped on heavy quantity. Since then, the trendline has been appearing as a resistance degree.

- Help and resistance. After falling under the upward-sloping trendline on very heavy quantity, will the inventory break again above the trendline and resume its uptrend? Boston Scientific’s earnings outcomes might maintain the important thing. Let’s have a look at if the third time’s the appeal.

The Ready Interval Begins

So long as the SCTR rating stays above the 70 degree, value breaks out above the resistance of the upward-sloping trendline, and Boston Scientific’s efficiency with respect to the Well being Care sector stays sturdy, the inventory might transfer larger, using on a optimistic earnings report. But when Boston Scientific’s earnings are lower than mark, the inventory might fall to its 50-day SMA, and even decrease to its 100- or 200-day SMA.

The inventory is buying and selling near its all-time excessive. So, if the earnings report is favorable and the inventory strikes larger on sturdy quantity, there could possibly be numerous upside potential. If that state of affairs performs out and also you resolve to enter an extended place, place a cease loss slightly below that upward-sloping trendline. A transfer under that trendline might ship the inventory decrease.

Different Shares from the Scan

BSX was only one instance. There are different shares from the identical scan that you possibly can analyze. Here is a listing of a few of them.

- Cardinal Well being, Inc. (CAH)

- Clorox Co. (CLX)

- Chipotle Mexican Grill Inc. (CMG)

- Basic Mills (GIS)

- Hershey Meals Corp. (HSY)

- Eli Lilly & Co. (LLY)

- Pinterest Inc. (PINS)

The Backside Line

Scans are highly effective instruments that each dealer or investor ought to use, and they are often as easy or advanced as you need them to be. You’ll be able to attempt utilizing among the Predefined Scans obtainable on the StockCharts platform, or you possibly can create considered one of your individual. Add that to all the pieces you’ve got discovered throughout Monetary Literacy Month.

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to teach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra

Subscribe to Do not Ignore This Chart! to be notified each time a brand new put up is added to this weblog!

[ad_2]