[ad_1]

There is a easy skilled dealer’s tactic for anticipating intraday market reversals close to the degrees that later grow to be the excessive or the low of the day. This tactic labored completely at calling at present’s excessive of the day in SPY (and the QQQ, IWM, and DIA). This easy indicator works even higher when the market’s sector rotation leads the transfer prefer it did at present, so let’s begin there.

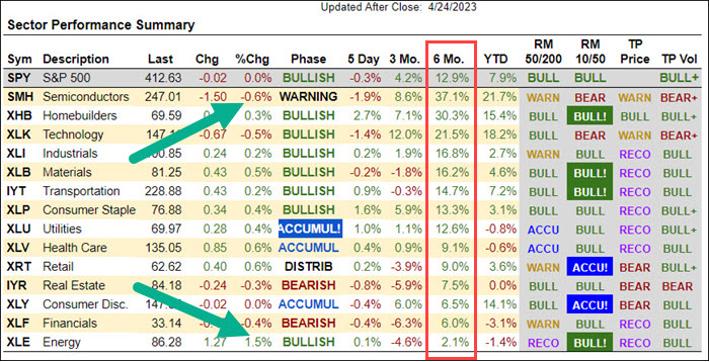

At the moment’s picture is our sector abstract desk, which yow will discover totally free within the “Huge View” part of marketgauge.com. The desk is ranked by 6-month change (outlined in pink) as a result of we have discovered that timeframe to be important when gauging the persistence of developments. As you’ll be able to see, there was an attention-grabbing sample of market rotation at present (identified by the inexperienced arrows).

The sample is solely that the main sector (during the last 6 months), SMH, was at present’s largest loser on a share foundation, whereas in distinction, the weakest sector, XLE, was at present’s largest winner. In an in any other case quiet, uneven day, this sector rotation bookended the temper of merchants who have been targeted on bespoke inventory tales like earnings that did not translate right into a common market pattern.

Should you learn yesterday’s version of this text, “SMH Bulls Are Skating On Skinny Ice,” weak spot on this main sector should not come as a shock. Should you’re additionally conscious of our easy techniques for anticipating intraday market reversals and pattern days, then the pattern days in each SMH and XLE shouldn’t come as a shock, though they have been bucking their longer-term developments.

The straightforward tactic I am referring to that lets you anticipate every day highs and lows and pattern days is the right use of the Opening Vary indicator.

The 2-sentence tutorial for understanding the Opening Vary is as follows…

The high and low of the primary half-hour of the day can be important assist and resistance, and you need to search for reversal patterns at these ranges. If the market displays a confirmed breakout past the O.R. excessive or low, it’s typically a pattern day.

With that in thoughts, take a look at the intra-day charts of SMH and XLE. Discover within the SMH chart that, when the worth broke the OR low, it trended decrease. Within the XLE chart, when the worth broke the OR excessive it rallied, retraced to the OR excessive space, then resumed its pattern larger.

Now let us take a look at the reversal on the excessive of the day within the SPY chart beneath.

Discover I am displaying you the QQQ chart too. The straightforward superior Opening Vary tactic for anticipating a market reversal is to search for divergences within the indexes on the Opening Vary ranges. The pink circles present an instance of the SPY trying to interrupt over the OR excessive, whereas the QQQ demonstrates a big detrimental divergence. If you see a divergence like this, anticipate the SPY to reverse.

Should you contemplate the 2 units of charts collectively, you’ll be able to see how the SHM began the day on a optimistic be aware, however by no means made an try to maneuver over its OR excessive just like the SPY, indicating that the market’s chief was not bullish at present. This contributed to the weak spot within the QQQ.

Intraday buying and selling patterns aren’t only for day merchants. At the moment’s SMH chart is an effective instance of utilizing the Opening Vary to keep away from shopping for right into a weak day within the main sector, however…

After all, should you’re studying this text every day, you already know it is not a superb time to be shopping for SMH for different causes. 😊

For extra detailed buying and selling details about our blended fashions, instruments and dealer training programs, contact Rob Quinn, our Chief Technique Advisor, to be taught extra.

IT’S NOT TOO LATE! Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-E-book in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Observe Mish on Twitter @marketminute for inventory picks and extra. Observe Mish on Instagram (mishschneider) for every day morning movies. To see up to date media clips, click on right here.

Mish and Benzinga focus on the present buying and selling ranges and what would possibly break them.

Mish discusses what she’ll be speaking about at The Cash Present, from April 24-26!

Mish walks you thru technical evaluation of TSLA and market circumstances and presents an motion plan on CMC Markets.

Mish presents two shares to take a look at on this look on Enterprise First AM — one bullish, one bearish.

Mish joins David Keller on the Thursday, Might 13 version of StockCharts TV’s The Ultimate Bar, the place she shares her charts of excessive yield bonds, semiconductors, gold, and regional banks.

Mish joins Wolf Monetary for this Twitter Areas occasion, the place she and others focus on their experiences as former pit merchants.

Mish shares her views on pure gasoline, crude oil and a collection of ETFs in this look on CMC Markets.

Mish talks what’s subsequent for the economic system on Yahoo! Finance.

Mish joins Bob Lang of Explosive Choices for a particular webinar on what merchants can anticipate in 2023!

Rosanna Prestia of The RO Present chats with Mish about commodities, macro and markets.

Mish and Charles Payne rip by numerous inventory picks in this look on Fox Enterprise’ Making Cash with Charles Payne.

Coming Up:

April 24-Twenty sixth: Mish at The Cash Present in Las Vegas — two shows and a e-book giveaway

April twenty eighth: Stay Teaching Full Dealer and TD Ameritrade with Nicole Petallides

Might 2nd-Fifth: StockCharts TV Market Outlook

- S&P 500 (SPY): Tight vary to look at this week: 410-415 on a closing foundation.

- Russell 2000 (IWM): 170 support-180 resistance.

- Dow (DIA): Over the 23-month MA, 336-support to carry.

- Nasdaq (QQQ): 312 assist, over 320 higher.

- Regional Banks (KRE): 44 now pivotal resistance.

- Semiconductors (SMH): 258 resistance with assist at 246.

- Transportation (IYT): Nonetheless beneath the 23-month MA with 232 resistance, 224 assist.

- Biotechnology (IBB): 130 main pivotal area-135 resistance.

- Retail (XRT): 58-64 buying and selling vary to interrupt a method or one other.

Geoff Bysshe

MarketGauge.com

President

Geoff Bysshe is the co-founder and President of MarketGauge.com. For practically 20 years, he is developed buying and selling merchandise, providers, methods and programs whereas additionally serving as a buying and selling mentor for MarketGauge clients. He additionally gives common commentary and buying and selling instruction within the MarketGauge weblog. Geoff is a former floor-trader who was a member of the FINEX buying and selling the U.S.

Study Extra

Subscribe to Mish’s Market Minute to be notified at any time when a brand new publish is added to this weblog!

[ad_2]