[ad_1]

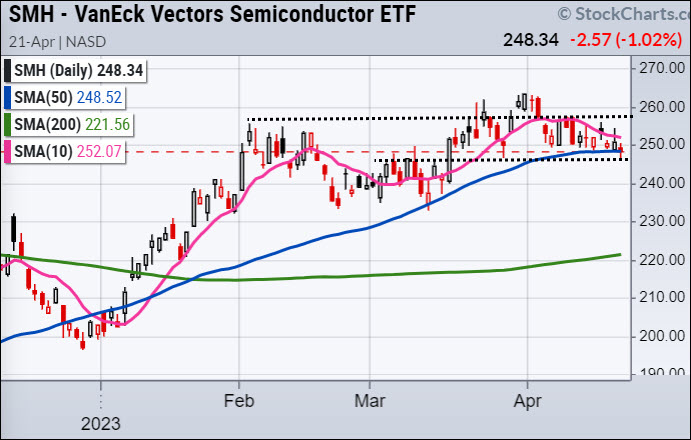

Heads up, you would not comprehend it by its day by day chart, however the SMH is skating on some very skinny ice.

For the reason that market’s lows in October 2022, the SMH has been one of many current bull rally’s earliest and most influential supporters, however the identical indicators that led its flip up final Fall have turned down this Spring. That is probably unhealthy information for the uptrend in SMH and the final market pattern. Whereas it seems to be just like the SMH is sitting comfortably on its 50-DMA, there are indications it could break, and, if it does, these indicators counsel it will not come proper again.

Trying on the chart under, you may see the day by day chart of the SMH sitting on its 50-DMA with three indicators under it – MG Management, MG Actual Movement 50/200, and MG Actual Movement 10/50. If you happen to’re accustomed to these indicators, the circles and arrows ought to let you know the entire story.

If you happen to’re new to the MarketGauge indicators…

The only type of evaluation is that the inexperienced circles point out a bullish change, the crimson circles point out a bearish change, and consequently, the value pattern ought to proceed within the indicated course. The best approach to measure a significant continuation or change within the value pattern’s course is a break of the 50- or 200-DMA, as indicated by the arrows.

The abstract is that Management turned bearish in early April and MG Actual Movement, which is a momentum indicator, has been diverging in a bearish means since early March. This divergence grew to become extra bearish when SMH made a brand new excessive, whereas RM 10/50 was not capable of commerce greater than its 50-DMA. It is a large warning check in Actual Movement. Because of this, the bearish inflection level is a transparent break of the 50-DMA in value.

If the 50-DMA breaks, it is prone to proceed to slip till Actual Movement and/or Management present a bullish posture.

It’s potential for SMH to keep away from breaking the 50-DMA and resume its uptrend; if that occurs in a dependable means, then Management ought to flip up (blue over crimson) and RM 10/50 dots ought to commerce over its blue transferring common. Till then, SMH is skating on very skinny ice.

For extra detailed buying and selling details about our blended fashions, instruments and dealer schooling programs, contact Rob Quinn, our Chief Technique Guide, to be taught extra.

IT’S NOT TOO LATE! Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-Guide in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for day by day morning movies. To see up to date media clips, click on right here.

Mish and Benzinga focus on the present buying and selling ranges and what would possibly break them.

Mish discusses what she’ll be speaking about at The Cash Present, from April 24-26!

Mish walks you thru technical evaluation of TSLA and market circumstances and presents an motion plan on CMC Markets.

Mish presents two shares to have a look at on this look on Enterprise First AM — one bullish, one bearish.

Mish joins David Keller on the Thursday, Could 13 version of StockCharts TV’s The Last Bar, the place she shares her charts of excessive yield bonds, semiconductors, gold, and regional banks.

Mish joins Wolf Monetary for this Twitter Areas occasion, the place she and others focus on their experiences as former pit merchants.

Mish shares her views on pure fuel, crude oil and a number of ETFs in this look on CMC Markets.

Mish talks what’s subsequent for the financial system on Yahoo! Finance.

Mish joins Bob Lang of Explosive Choices for a particular webinar on what merchants can count on in 2023!

Rosanna Prestia of The RO Present chats with Mish about commodities, macro and markets.

Mish and Charles Payne rip by means of a lot of inventory picks in this look on Fox Enterprise’ Making Cash with Charles Payne.

Coming Up:

April 24-Twenty sixth: Mish at The Cash Present in Las Vegas — two shows and a ebook giveaway

April twenty eighth: Dwell Teaching Full Dealer and TD Ameritrade with Nicole Petallides

Could 2nd-Fifth: StockCharts TV Market Outlook

- S&P 500 (SPY): Tight vary to observe this week; 410-415 on a closing foundation.

- Russell 2000 (IWM): 170 assist, 180 resistance.

- Dow (DIA): Over the 23-month MA 336–support to carry.

- Nasdaq (QQQ): 312 assist, over 320 higher.

- Regional banks (KRE): 44 now pivotal resistance.

- Semiconductors (SMH): 258 resistance with assist at 246.

- Transportation (IYT): Nonetheless underneath the 23-month MA with 232 resistance, 224 assist.

- Biotechnology (IBB): 130 main pivotal area–135 resistance.

- Retail (XRT): 58-64 buying and selling vary to interrupt a method or one other.

Geoff Bysshe

MarketGauge.com

President

Geoff Bysshe is the co-founder and President of MarketGauge.com. For almost 20 years, he is developed buying and selling merchandise, companies, methods and programs whereas additionally serving as a buying and selling mentor for MarketGauge clients. He additionally supplies common commentary and buying and selling instruction within the MarketGauge weblog. Geoff is a former floor-trader who was a member of the FINEX buying and selling the U.S.

Be taught Extra

Subscribe to Mish’s Market Minute to be notified every time a brand new put up is added to this weblog!

[ad_2]