[ad_1]

Welcome to the the third publication of the Market’s Compass Weekly Crypto Candy Sixteen Research. The Research tracks the technical situation of sixteen of the bigger market cap cryptocurrencies. I’ve compiled the historic quantitative goal technical rating information and secondary technical indicators together with the Candy Sixteen Complete Technical Rankings and Weekly Common Technical Rating again to October of 2021. Each week the Research will spotlight the technical adjustments of the 16 cryptocurrencies that I monitor in addition to particular person highlights on noteworthy strikes in sure cryptocurrencies and Indexes.

The Excel spreadsheet under signifies the weekly change within the goal Technical Rating (“TR”) of every particular person Cryptocurrency. The technical rating or scoring system is a wholly quantitative strategy that makes use of a number of technical concerns that embrace however should not restricted to pattern, momentum, measurements of accumulation/distribution and relative power. If a person Cryptocurrency’s technical situation improves the Technical Rating (“TR”) rises, and conversely, if the technical situation continues to deteriorate, the TR falls. The TR of every particular person Cryptocurrency can vary from 0 to 50. The spreadsheet under additionally acts as a “warmth map” in that, cryptocurrencies with a TR within the vary of 1 to fifteen are highlighted in crimson, 15.5 to 34.5 are famous in blue and TRs within the vary of 35 to 50 are in inexperienced. The first take-away from this unfold sheet must be the pattern of the person TRs, both the continued enchancment or deterioration, in addition to a change in path. A sustained pattern change must unfold within the particular person TRs for it to be actionable. Secondarily a really low rating can sign an oversold situation and conversely a continued very excessive quantity may be seen as an overbought situation however, as we all know, over bought circumstances can proceed at apace and overbought securities which have exhibited extraordinary momentum can simply develop into extra overbought. Thirdly, the weekly TRs are a beneficial relative power/weak spot indicator vs. one another, as well as when the Candy Sixteen Complete Technical Rating (“SSTTR”), that has a spread of 0 to 800, is close to the underside of its vary and a person cryptocurrency has a TR that continues to be elevated it speaks to relative power. Conversely if the SSTTR is close to the highest of its latest vary and a person cryptocurrency has a TR that continues to be mired at low ranges it speaks to relative weak spot. Lastly I view the target Technical Rankings as a place to begin in my evaluation and it isn’t all the “finish recreation”.

This Week’s and 10 Week Trailing Technical Rankings of the 16 Particular person Cryptocurrencies*

*Rankings are calculated as much as Friday

As may be seen within the unfold sheet above there was a contraction within the particular person goal technical rating (TR) of the Crypto Candy Sixteen week over week in addition to the Complete Candy Sixteen Technical Rating (TSSTR). The TSSTR fell -27.7% to 416 from the earlier weeks overbought studying of 576 (chart and additional dialogue of that technical situation follows later within the Weblog).

On a Wow foundation, all sixteen Cryptocurrencies registered deterioration of their goal TRs. Three Cryptos ended the week within the “inexperienced zone” (TRs of between 35 and 50), eleven are within the “blue zone” (TRs between 15.5 and 34.5) and two ended up within the “crimson zone” (TRs between 1 and 15). The earlier week there have been 10 Crypto’s within the inexperienced zone and 6 within the “blue zone”. One other information level that’s revealing is the throughout the board technical deterioration with the common TR dropping -10. Though just a few held up higher, as may be seen from the common TR lose most had been badly dented. Polkadot (DOT) had probably the most “handles” chopped off its TR by falling -20 to fifteen from 35. For the third week in a row Ethereum (ETH) sports activities the most effective technical rating of the Candy Sixteen and the most effective relative power vs. the CCi30 Index*. Charts and feedback observe under…

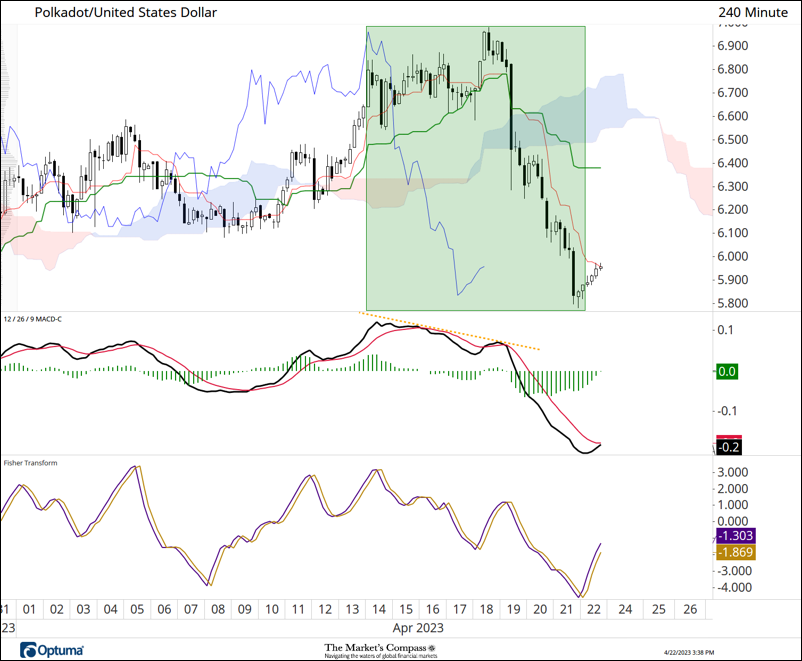

The inexperienced field highlights the value motion in DOT from Friday to Friday. On Tuesday of final week DOT went on to a brand new swing excessive however as may be seen, MACD was signaling a lack of upside momentum (yellow dashed line) regardless of the upper value pivot which gave a clue, by non-confirmation, that the transfer greater wouldn’t be sustainable and {that a} value retracement was within the playing cards. Breaking assist on the Kijun Plot (stable inexperienced line) and Cloud assist on Wednesday recommended {that a} correction of a bigger diploma was creating. On the time of penning this word on Saturday afternoon, a feeble bounce had unfolded and each the Fisher Rework and MACD have begun to show however the technical injury has been formidable and the 6.10/6.20 stage will seemingly cap any continuance of the counter pattern rally for the foreseeable future.

*The CCi30 Index is a registered trademark and was created and is maintained by an unbiased staff of mathematicians, quants and fund managers lead by Igor Rivin. It’s is a rules-based index designed to objectively measure the general development, each day and long-term motion of the blockchain sector. It does so by monitoring the 30 largest cryptocurrencies by market capitalization, excluding secure cash (extra particulars may be discovered at CCi30.com).

Ethereum reached a 2023 excessive of two,146.50 final Sunday earlier than final week’s 14% value drop (Sunday’s excessive to Saturday’s low) however relative to the CCi30 Index ETH has held up much better than any of the opposite 15 Cryptos we monitor in these pages. This may be seen within the backside panel in chart above and under within the string of relative power charts).

Additional Measurements of Relative Power and Weak point within the Candy Sixteen

“What’s in Your Pockets?”

A take a look at the relative power/weak spot of the Crypto Candy Sixteen versus the CCi30 Index.

Binance (BNB), ChainLink (LINK) and TRON (TRX) have recovered from their 7-month Relative Power lows versus the CCi30 Index this previous week and are again above each their shorter and long term shifting averages.

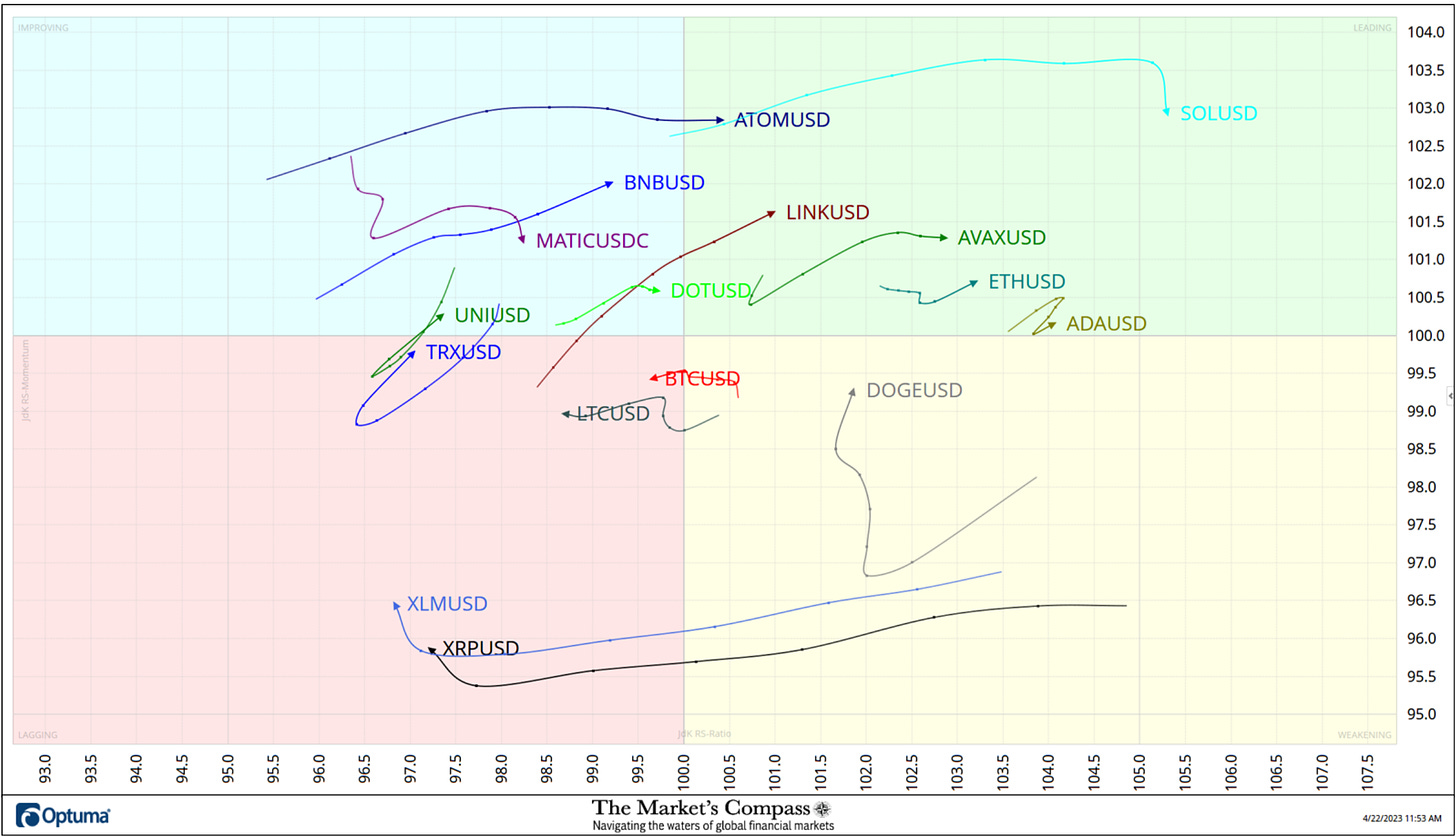

Relative Rotation Graph of the Candy Sixteen

The Relative Rotation Graph, generally known as RRGs had been developed in 2004-2005 by Julius de Kempenaer. These charts are a singular visualization instrument for relative power evaluation. Chartists can use RRGs to investigate the relative power traits of a number of securities towards a typical benchmark, (on this case the CCi30 Index) and towards one another over any given time interval (within the case under each day because the finish of the tip of final week. The ability of RRG is its capability to plot relative efficiency on one graph and present true rotation. All RRGs charts use 4 quadrants to outline the 4 phases of a relative pattern. The Optuma RRG charts makes use of, From Main (in inexperienced) to Weakening (in yellow) to Lagging (in pink) to Bettering (in blue) and again to Main (in inexperienced). True rotations may be seen as securities transfer from one quadrant to the opposite over time. That is solely a short rationalization of the best way to interpret RRG charts. To study extra see the put up scripts and hyperlinks on the finish of this Weblog.

The 7-day RRG Chart above reveals the development in two of the three aforementioned Cryptos which have recovered on a relative foundation vs. the CCi30 Index because the finish of final week. Each LINK and BNB are getting into or are about to enter the Main Quadrant together with Cosmos (ATOM). Dogecoin (DOGE) is bettering and is popping greater within the Weakening Quadrant whereas each Ripple (XRP) and Stellar (XLM) have accelerated into Lagging Quadrant from Weakening final week.

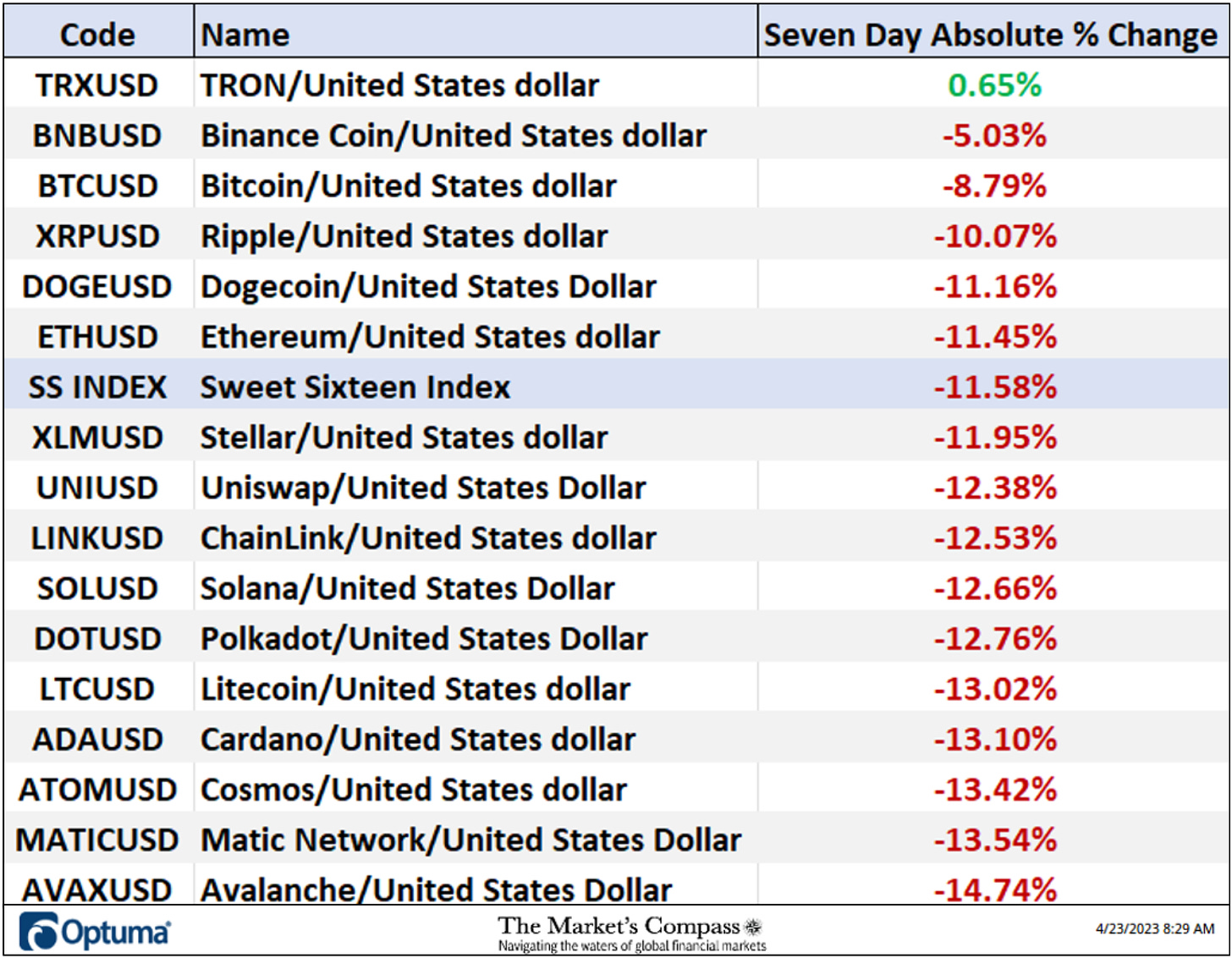

Seven Day Absolute % Value Change*

*Sunday to Sunday AM

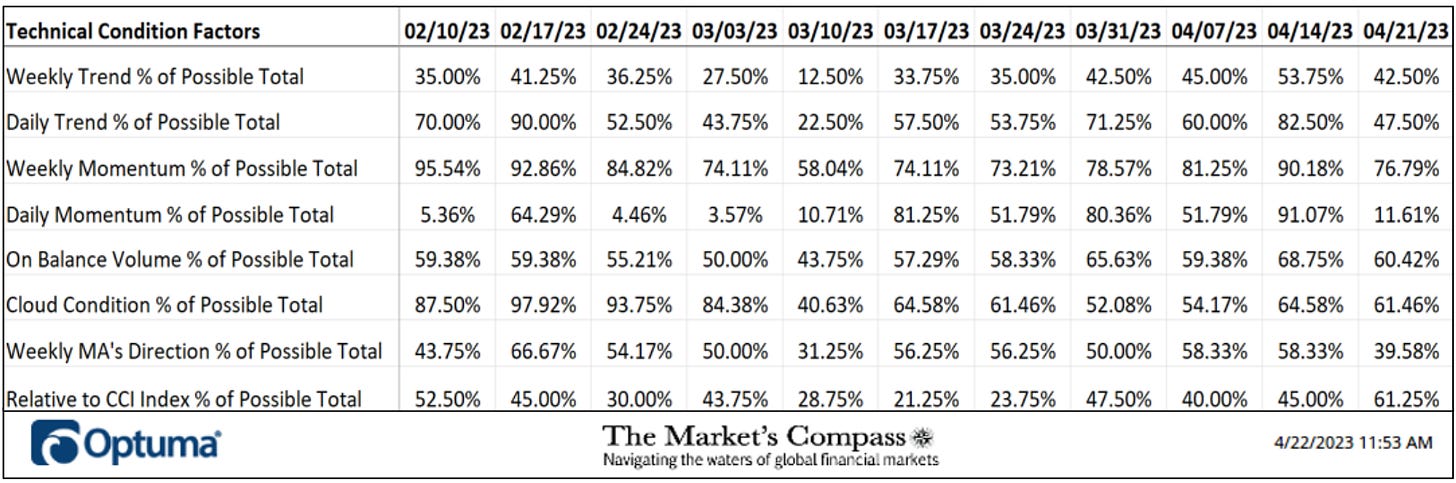

The Technical Situation Issue adjustments because the week ending February tenth

There are eight Technical Situation Elements (“TCFs”) that decide particular person TR scores (0-50). Every of those 8, ask goal technical questions (see the spreadsheet posted above). If a technical query is optimistic an extra level is added to the person TR. Conversely if the technical query is damaging, it receives a “0”. Just a few TCFs carry extra weight than the others such because the Weekly Development Issue and the Weekly Momentum Think about compiling every particular person TR of every of the 16 Cryptocurrencies. Due to that, the excel sheet above calculates every issue’s weekly studying as a p.c of the doable complete. For instance, there are 7 concerns (or questions) within the Day by day Momentum Technical Situation Issue (“DMTCF”) of the 16 Cryptocurrencies ETFs (or 7 X 16) for a doable vary of 0-112 if all 16 had fulfilled the DMTCF standards the studying could be 112 or 100%.

This previous week a 11.61% studying within the DMTCF was registered for the week ending April twenty first, or 13 of a doable complete of 112 optimistic factors. The week earlier than the DMTCF studying had risen to a overbought studying of 91.07% or 102 of 112 optimistic factors (overbought studying vary from 85% to 100%). The present studying leaves the DMTCF within the short-term oversold vary between 0% and 15%.

As a affirmation instrument, if all eight TCFs enhance on every week over week foundation, extra of the 16 Cryptocurrencies are bettering internally on a technical foundation, confirming a broader market transfer greater (consider an advance/decline calculation). Conversely, if extra of the TCFs fall on every week over week foundation, extra of the “Cryptos” are deteriorating on a technical foundation confirming the broader market transfer decrease. Final week 7 TCFs fell and one moved greater confirming the transfer decrease within the broader Cryptocurrency market.

The CCi30 Index with This Week’s Candy Sixteen Complete Technical Rating “SSTTR” Overlaid

The Candy Sixteen Complete Technical Rating (“SSTTR”) Indicator is a complete of all 16 Cryptocurrency rankings and may be checked out as a affirmation/divergence indicator in addition to an overbought oversold indicator. As a affirmation/divergence instrument: If the broader market as measured by the CCi30 Index continues to rally and not using a commensurate transfer or greater transfer within the SSTTR the continued rally within the CCi30 Index turns into more and more in jeopardy. Conversely, if the CCi30 Index continues to print decrease lows and there’s little change or a constructing enchancment within the SSTTR a optimistic divergence is registered. That is, in a vogue, is sort of a conventional A/D Line. As an overbought/oversold indicator: The nearer the SSTTR will get to the 800 stage (all 16 Cryptocurrencies having a TR of fifty) “issues can’t get a lot better technically” and a rising quantity particular person Crypto’s have develop into “stretched” there’s extra of an opportunity of a pullback within the CCi30. On the flip aspect the nearer to an excessive low “issues can’t get a lot worse technically” and a rising variety of Crypto’s are “washed out technically” and an oversold rally or measurable low is nearer to being in place. The 13-week shifting common in Pink smooths the unstable SSTTR readings and analytically is a greater indicator of pattern.

Regardless of final week’s pullback within the CCi30 Index, the 10-month base constructing course of continues. I used to be by no means shocked to see a value retracement unfold final week. The SSTTR had entered overbought territory in live performance with value approaching potential resistance on the Higher Parallel (stable gold line) of the Schiff Modified Pitchfork (gold P1 by P3). I selected that Pitchfork variation as a result of value revered the Higher Parallel (then assist) in June of final yr (yellow circle). The 13-Week Shifting Common (crimson line) has begun to roll over nevertheless it additionally did so in March earlier than the following leg greater. I now mark key assist at first the Decrease Parallel of the Schiff Modified Pitchfork (at present 7200) and subsequent on the P3 swing low. Remembering that my technical thesis is that this a base constructing course of, I nonetheless imagine that the CCi30 Index will simply problem value resistance ultimately June/July highs on the 10,000 /11,000 stage within the weeks forward.

Charts are courtesy of Optuma whose charting software program permits anybody to visualise any information together with RRG Charts and our Goal Technical Rankings. Cryptocurrency value information is courtesy of Cryptowatch.

The next hyperlinks are an introduction and an in depth tutorial on RRG Charts…

https://www.optuma.com/movies/introduction-to-rrg/

https://www.optuma.com/movies/optuma-webinar-2-rrgs/

To obtain a 30-day trial of Optuma charting software program go to…

A 3 half tutorial sequence on Andrews Pitchfork could also be learn at my site…. www.themarketscompass.com

[ad_2]