[ad_1]

One of many areas of the market that continues to battle is oil. OPEC lately pushed the value of WTI crude above a previous excessive, however that has not held.

I received an fascinating e-mail this morning from an oil and gasoline good friend asking why his inventory has dropped 20% lately. It was a small Canadian Oil and Gasoline firm, however the identical ideas work throughout the spectrum.

Let’s use an organization like ConocoPhillips (COP). The inventory continues to make decrease lows and decrease highs. The relative power proven in purple continues to underperform. Till the inventory can begin outperforming the S&P 500, it’ll be troublesome to draw capital. The outperformance would present when this space chart in purple begins to show up. Momentum proven by the PPO is rolling over right here at an analogous stage to late January. That might change at any time, but it surely hasn’t began but.

So is that this an remoted image? Let us take a look at the crude oil markets. Right here is Brent crude. Brent continues to underperform the $SPX, and has been caught with a worth excessive round $87. The latest March transfer by OPEC received worth again as much as the highs of the vary, but it surely could not escape. Momentum (PPO) is rolling over.

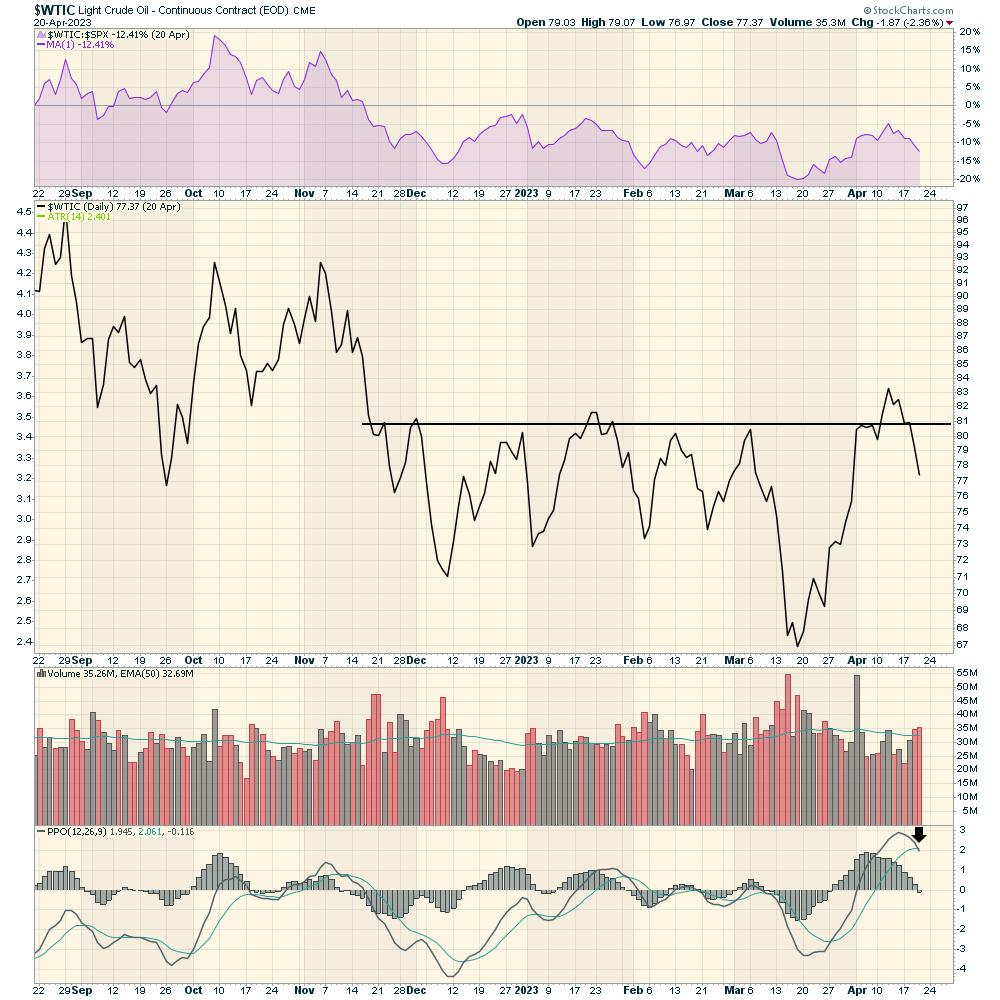

On this facet of the world, we concentrate on WTI. Right here is the chart for $WTIC, which continues to underperform the $SPX as properly. Nevertheless, worth truly broke out above the earlier highs round $81. Presently, this appears like a failed breakout. Failed breakouts are sometimes a greater clue as to the course and, at this level, decrease appears to be successful. What would it not take to alter my thoughts? If oil could make the next low after which get again above the $81 stage, that makes the value motion much more fascinating. PPO is rolling over, suggesting the momentum is waning.

We are able to have a look at the oil producers ETF (XOP), which continues to weaken and has not been capable of get again to prior highs, though OPEC has taken 3 million barrels per time off the market.

Nevertheless, for me, oil is without doubt one of the higher financial indicators, and these charts above all look weak, confirming the issue for the broader financial system. Financial exercise is declining and oil is telling us, very clearly, that demand is weaker.

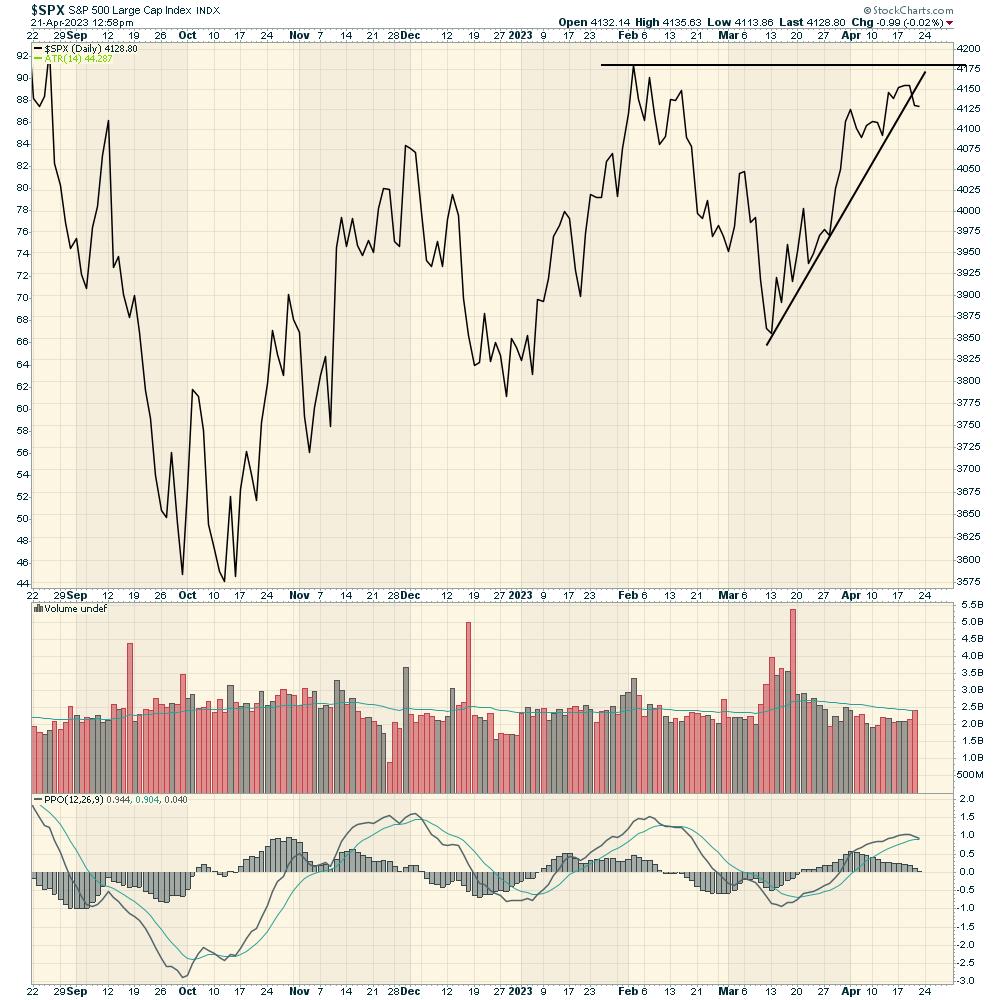

After I have a look at the $SPX, this chart is beginning to see what oil is saying. It’s testing prior highs, however, after three weeks right here, it’s struggling to interrupt out to date. PPO is rolling over, and people promote alerts have been fairly useful indicators for upcoming market weak spot.

This isn’t a doom and gloom forecast. It simply exhibits the market is attempting to cost the financial slowdown, and crude continues to inform us that demand is slowing. When oil and oil producers begin to base and breakout to the upside, I will be much more snug concerning the broader financial system beginning to speed up.

Greg Schnell, CMT, MFTA is Chief Technical Analyst at Osprey Strategic specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Based mostly in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an energetic member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).

Subscribe to The Canadian Technician to be notified each time a brand new submit is added to this weblog!

[ad_2]