[ad_1]

Are you attempting to find out your stage of economic satisfaction or dissatisfaction? In any case, when you’re extra happy financially, you also needs to be happier and fewer harassed. Excellent news! The FS Wealth Actuality Ratio (FSWRR) will provide help to quantify your emotions and reveal the unhappiest cities in America!

The core attribute concerning the FS Wealth Actuality Ratio is about managing expectations. In any case, happiness equals actuality minus expectations. The upper your expectations, the decrease your happiness. The higher the fact in comparison with expectations, the upper your happiness.

When you go to Harvard and find yourself doing the very same work as a non-Harvard graduate does, you may really feel just a little disillusioned. However when you go to Podunk U and find yourself getting paid the identical as your Harvard co-worker, you’re most likely thrilled!

I didn’t go to Podunk U, however I did go to The School of William & Mary for under $2,800 a 12 months in tuition from 1995 – 1999. Comparable personal universities price about $22,000 a 12 months on the time.

Due to this fact, any job I acquired that paid greater than my $4/hour McDonald’s job in highschool can be a blessing. And boy did it really feel good to not have excessive expectations positioned upon my shoulders.

The Monetary Samurai Wealth Actuality Ratio (FSWRR)

As a Monetary Samurai, at all times assume in derivatives. Strive to consider what’s behind and past the numbers. Once you begin pondering in derivatives, you’ll find many extra solutions and options to frequent issues.

In my article concerning the internet price quantity required to be thought of rich in numerous cities, I launched you to the Monetary Samurai Wealth Actuality Ratio (FSWRR). The increased the ratio, the unhappier you possible are and vice versa. Beneath is the ratio’s components.

FSWRR = Minimal Internet Price Required To Be Thought of Rich / Median Dwelling Value

For instance, when you imagine you want a internet price of $50 million to be joyful in a metropolis that has a median residence worth of solely $500,000, psychologically there’s possible one thing mistaken with you.

A 100:1 FS Wealth Actuality Ratio is excessive. Your expectations about how a lot happiness cash can deliver you is approach too excessive. Additional, you’ll possible by no means going to attain that stage of internet price.

Supply Of The Information

The info concerning the minimal internet price required to be thought of rich comes from Charles Schwab’s annual Trendy Wealth Survey. Your particular person opinion issues. Nonetheless, having a bigger survey is extra impactful for statistical significance and general analysis functions.

The median residence worth comes from Zillow, Redfin, St. Louis Fed, US Division of Housing And Improvement, and the Nationwide Affiliation Of Realtors. These figures are extra goal. Though apparently, no one actually can say with certainty what the median residence worth is in America.

By analyzing mass knowledge, we are able to determine which metropolis residents are happiest (most happy) and unhappiest (least happy).

Why The Median Dwelling Value Is Used

The median residence worth is used within the denominator as a result of it’s a reflection of the price of residing in your metropolis and its resident’s incomes potential. The median residence worth additionally displays the price of native items and providers, financial atmosphere, and desirability of your metropolis.

The explanation why the median residence worth in Hawaii was ~$890,000 in 2022 is as a result of Hawaii is heaven on Earth. In distinction, West Virginia’s median residence worth was solely ~$135,675 in 2022 primarily as a result of there may be much less financial alternative. Hawaii is a world vacationer attraction whereas West Virginia is just not.

Another excuse why I exploit the median residence worth of your metropolis within the ratio is due to the significance of housing. Upon getting your housing prices comparatively mounted, residing the life you need normally turns into a lot simpler. In any case, the housing expenditure is normally the largest necessity expense, adopted by meals, clothes, and transportation.

Stabilizing your housing prices is why I extremely advocate everybody get impartial property by proudly owning their main residence as quickly as you realize the place you wish to be residing for not less than 5 years. Using the inflation wave is significantly better than getting pounded by it.

With housing safety in your kids, you additionally gained’t really feel as a lot anxiousness. And among the finest causes to have cash is to fret much less about cash and survival.

The Greater The FS Wealth Actuality Ratio The Unhappier You Are

The explanation why the upper the Monetary Samurai Wealth Actuality Ratio, the unhappier you’re is because of expectations. Schwab’s Trendy Wealth Survey relies on what folks THINK is the minimal internet price required to really feel rich of their respective cities. The survey is just not based mostly on what folks have already got.

We all know this to be the case as a result of not everyone surveyed in San Francisco in 2022 has a internet price of $5.1 million, a high 2% internet price (high 1% internet price is over $11 million). The members collectively assume $5.1 million is what is required to really feel rich. One report by the Legislative Analyst’s Workplace in 2019 had the the common internet price per resident in San Francisco at $450,000.

If in case you have a Wealth Actuality Ratio of 8, meaning you imagine you want a internet price 8X higher than the median residence worth in your metropolis to really feel rich. Cleary, attempting to construct extra wealth will take longer and be tougher than attempting to construct much less wealth.

Due to this fact, you’ll really feel extra harassed, drained, anxious, and demoralized the longer it’s a must to work and take dangers to attain what you assume you’ll must really feel rich.

Conversely, in case your Wealth Actuality Ratio is just a 3, you then really feel you solely want a internet price 3X higher than the median residence worth of your metropolis to really feel rich. Because of your decrease expectations, you don’t must work as lengthy and take as many dangers to get to your aspirational wealth quantity. You’ll be able to FIRE if you wish to since you’re extra simply happy with what you’ve gotten.

The Unhappiest Cities In America By Wealth Actuality Ratio

Primarily based on the logic {that a} increased Wealth Actuality Ratio means extra battle and fewer happiness, beneath are the newest 12 cities ranked from most happy financially to least happy financially.

Some ideas and potentialities based mostly on the rating:

- Cities with increased median residence costs are likely to have extra financially happy residents.

- Coastal metropolis residents are extra financially joyful than non-coastal metropolis residents.

- There’s possible extra wealth inequality in Houston and Dallas between the very wealthy and the center class maybe as a result of oil trade.

- LA / San Diego could have the perfect mixture of economic satisfaction with upward mobility, nice climate, and a pleasant way of life.

- Transfer to Houston, Dallas, Chicago, or Atlanta for retirement if you have already got a $2+ million internet price given the low price of residing.

- Boston residents are among the most financially happy residents regardless of excessive residence costs. However I don’t know why given the climate is tough for a 3rd of the 12 months and the Warriors gained the 2022 NBA last.

- Excessive property taxes could be a giant variable for why Houston, Dallas, and Chicago have the least financially happy folks.

- San Francisco and Seattle have the very best wealth-creation potential, which can be partly why their residents are essentially the most financially joyful.

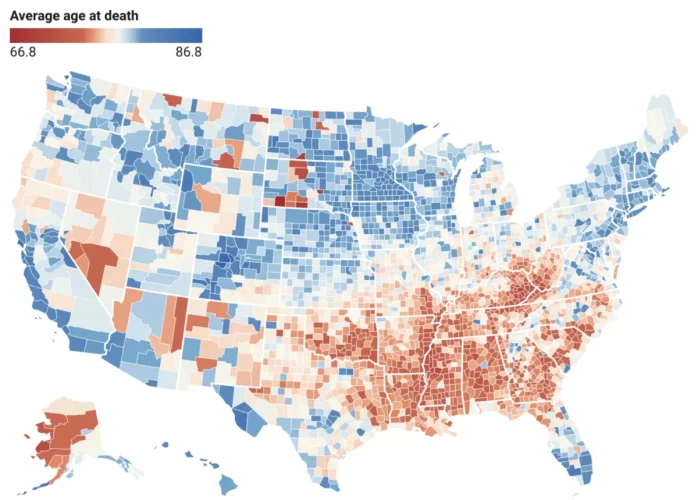

- There’s a correlation with cities with the very best satisfaction and states with the highest life expectations. And given all of us wish to dwell longer, it is a large breakthrough!

One necessary level to spotlight is that happiness can be relative. Given America is the perfect nation on the earth with essentially the most quantity of alternative, being ranked the unhappiest metropolis in America continues to be possible higher than most different cities on the earth! It’s like solely consuming salmon filets on the buffet as a result of they ran out of prime rib.

See: Why The Smartest Nations In The World Are Not The Happiest

Extra Examples Of Why A Greater Wealth Actuality Ratio Is Worse For Happiness

There was debate about whether or not a decrease ratio signifies extra happiness or not. Therefore, let’s use extra examples as to why a better FSWRR quantity results in decreased ranges of happiness.

- It’s extra painful to run 20 miles than it’s to run 3 miles and win the identical medal. On this case, the medal is the denominator equal to the median worth of a house.

- Persons are much less joyful if they have to work for 40 years versus working 20 years earlier than having the ability to retire to do what they love. On this case, retirement is the denominator given all of us have a restricted variety of years to dwell.

- There’s extra heartbreak if it takes you 7 years to have a child than 1 12 months. On this case, beginning a household is the denominator and all of us run out of time.

- You’re extra pissed off if it takes you 10 years to jot down the subsequent nice private finance e-book versus 2 years. On this case, being a printed creator is the denominator.

- The longer you reside in your mother’s basement after highschool or school, the extra embarrassed you may really feel. On this case, your satisfaction is the denominator.

- The longer the airplane delay in comparison with the length of your flight, the extra agitated you’re. A 3-hour delay for a one-hour flight is brutal. Nonetheless, a one-hour delay on a 12-hour worldwide flight isn’t any large deal. On this case, attending to the place you wish to go is the denominator.

Key Variable For Happiness

What’s the important thing variable in all these examples? It’s TIME!

The expenditure of time can be a key variable for my FS SEER ratio, which helps quantify your threat tolerance. The much less time you’re prepared to spend to make up in your losses, the extra conservative your investments.

Often, the longer it takes so that you can get what you need, the much less joyful you’re. Resulting from an absence of self-discipline and endurance, many people prematurely hand over earlier than the going will get good. This giving up half and by no means reaching your targets is the largest threat to happiness. The secret to your success is unwavering dedication and consistency!

Nonetheless, for these of you who study to understand the journey and who can survive a troublesome path, the rewards are sometimes a lot higher. We recognize issues extra when we have to battle arduous to attain them.

Due to this fact, the important thing to happiness is to have life like expectations. Having too excessive expectations will result in distress, because you’ll possible by no means obtain your targets. Having too low expectations will result in indifference since you didn’t battle arduous or lengthy sufficient.

Happiness, Wealth, and Life Expectancy

There’s additionally a powerful correlation with wealth and life expectancy. The richer you’re, the longer you are likely to dwell.

Discover how cities with the bottom FS Wealth Realty Ratio are also based mostly in states with the very best life expectations. Is {that a} coincidence? After all not.Happiness and cash are intertwined!

The richer and happier you’re, the longer your life expectancy and vice versa.

The Preferrred Wealth Actuality Ratio

The decrease your FSWRR the higher, up to a degree. This implies your expectations for a way a lot cash you will want to be joyful is decrease. In return, your desires will probably be extra simply happy.

Suppose again to whenever you had been in highschool or school. Though you had been poor, you might need been a lot happier as a result of so many issues don’t require needing a number of cash. I keep in mind having $200 a month to spend in Beijing, China whereas learning overseas in 1997 and was thrilled to discover a brand new nation!

Nonetheless, the ratio possible can’t be a lot beneath 1X the worth of the median residence worth in your metropolis. It’s because in case your complete internet price is the same as the median residence worth, then you will want to proceed working so as to generate revenue.

You’ll be able to’t withdraw principal from your own home with out incurring debt. Nor do you’ve gotten one other internet price asset that you need to use to generate passive revenue. If 100% of your internet price is tied up within the worth of your own home, you’re additionally on the mercy of the housing market.

At a FSWRR of 1X, you will want to outlive off Social Safety, hire out rooms in your home, or the generosity of others. Or you will want to personal a house that’s priced a lot decrease than the median worth in your metropolis.

If you’re fortunate sufficient to have a pension, it might be price rather more than you assume. The worth of a pension while you’re alive will more than likely enhance your FSWRR far above 1.

A Internet Price Equal To Two To 5 Occasions The Median Dwelling Value

It’s my opinion the perfect wealth actuality ratio is someplace between 2 – 5. Let’s say your internet price is already there. Listed here are a pair examples that make sense.

At a FSWRR of two, you would have a paid off residence price $400,000 and have $400,000 in investments producing $12,000 – $20,000 a 12 months. Your whole internet price is $800,000. As well as, you is also accumulating one other $15,000 – $20,000 a 12 months in Social Safety and dwell a snug way of life.

At a FSWRR of 5, your internet price is $2,500,000 if the median worth of a house in your metropolis is $500,000. You possibly can afford to hire a pleasant residence for $50,000 a 12 months if you want. Your $2,500,000 internet price might generate $75,000 – $125,000 of passive revenue a 12 months alone.

Personally, I’m just a little extra formidable and grasping, which is why capturing for a FS Wealth Actuality Ratio of 5 feels acceptable for me. After a couple of 5, I’m joyful to begin decumulating my wealth so as to not die with an excessive amount of.

To get particular, if the median residence worth in San Francisco is $1.8 million in 2023, having a $9 million internet price is kind of adequate. And having a internet price of $5.4 million (FSWRR 3) is fairly good too.

How To Use The FS Wealth Actuality Ratio For Your Metropolis

Let’s say you don’t dwell in one of many cities above. How are you going to use the FS Wealth Actuality Ratio that can assist you confirm how a lot internet price it is best to accumulate to really feel rich?

Monetary Samurai reader Mapuana asks,

Simply curious when you’ve got any thought how Hawaii suits into this? Having been raised there and left for a number of causes, price being one in all them. I simply questioned the way it match.

The first step is to search out the median residence worth in Hawaii = $835,000 (Zillow estimate 2023). Then multiply by the a number of vary of different comparable cities. The vary is 3X – 10X for the 12 largest cities in America. Due to this fact, Hawaiian residents would wish between $2,505,000 to $8,350,000 to really feel rich.

Nonetheless, given Hawaii is the perfect place on Earth, one might argue a a number of beneath 3 works. Hawaii climate is wonderful. The seashores and mountains are free. General, Hawaiian residents dwell longer and are much less harassed.

Due to this fact, I might say most Hawaiian residents want at most $2,505,000 to really feel rich (FSWRR 3). However a Wealth Actuality Ratio of two equaling $1,670,000 might be loads for many residents.

How To Use The FS Wealth Actuality Ratio To Decide Your Monetary Satisfaction

To quantify your monetary emotions, give you a minimal internet price you assume is required to be rich and divide it by your metropolis’s median residence worth.

Let’s say I’m delusional and assume I want $50 million to really feel rich despite the fact that I dwell in a $1 million home and spend lower than $200,000 a 12 months. My Wealth Actuality Ratio would equal 50. I’m possible by no means going to be happy with my wealth.

As a substitute, I ought to most likely shoot for a minimal internet price of between $5 – 10 million, a stage many individuals imagine is sufficient to have generational wealth. And if I have already got a minimal internet price of between $5 – $10 million, then I must study to be extra appreciative of what I’ve.

- 1 – 3 Wealth Actuality Ratio means you’re extraordinarily happy financially.

- 3.1 – 5 Wealth Actuality Ratio means you’re happy financially.

- 5.1 – 10 Wealth Actuality Ratio means you’re barely dissatisfied along with your funds.

- 10.1 – 20 Wealth Actuality Ratio between means you’re dissatisfied along with your funds.

- 20+ Wealth Actuality Ratio means you’re extremely dissatisfied along with your funds or are very cash hungry

You Could Need To Make investments In The Unhappiest Cities

The unhappiest cities even have among the highest cap charges and lowest valuations. These two elements together with optimistic demographic developments are why I’ve been investing in heartland actual property since 2016.

The Wealth Actuality Ratio really makes me much more bullish on investing in cities equivalent to Houston and Dallas as a result of it reveals its residents are hungry for extra wealth! And if you end up hungry for extra money, you’ll work arduous to make extra both at your job or by rising what you are promoting. Extra earnings means extra revenue and better residence costs.

The one downside now’s rising provide and declining demand after a rise in mortgage charges. However looking for single-family or multi-family offers in locations like Houston and Dallas over the subsequent 12 months appears engaging.

You’ll be able to seek for particular person offers in Houston, Dallas, and different excessive Wealth Actuality Ratio cities on numerous personal actual property funding platforms. Or you possibly can put money into a non-public fund that invests primarily within the Sunbelt by Fundrise.

The wonderful thing about investing in personal actual property is to take a position anyplace with out having to maneuver. Additional, you’ll earn revenue or distributions passively as you diversify your actual property holdings.

Preserve Your Wealth Expectations Cheap

After I graduated school, all I hoped for was a $30,000 a 12 months job. After I acquired a $40,000 a 12 months job at Goldman Sachs in 1999, I used to be thrilled! Nonetheless, I quickly discovered that $40,000 didn’t go very far residing in Manhattan. Hourly, I used to be making minimal wage. Due to this fact, I wished extra.

Each time I made extra money, I used to be happier for about three months at most. Then it was again to my regular state of happiness. Lastly, in 2012, I made a decision I had sufficient and retired.

Regardless of dropping 80% of my revenue for the primary 12 months, I used to be happier as a result of I used to be free. Having the ability to drive to the park and skim a e-book as a substitute of entering into to the workplace at 6 am made up for my misplaced revenue.

After I left work in 2012, I used to be proud of my internet price. If I wasn’t, I might have stored on working. I anticipated my internet price to develop pretty conservatively, within the 4% – 5% vary a 12 months.

Nonetheless, the following 10-year bull run offered higher progress. This upside shock has offered for higher happiness.

Preserve Low Expectations For Your Endeavors Too

At the moment, I proceed to attempt to preserve my expectations measured.

For instance, earlier than beginning to write Purchase This, Not That in 2020, I instructed myself I simply wished to complete. The e-book was a bucket checklist merchandise to assist common FS readers construct extra wealth and make my household proud.

It was arduous sufficient juggling children, Monetary Samurai, and e-book writing throughout a pandemic. We had pulled our son from preschool for 18 months. Anticipating BTNT to even be a bestseller would take away from my pleasure of writing.

Nonetheless, as soon as I completed writing the e-book in 2022 and obtained the superior bodily copies in my hand, my expectations went approach up! It was a stupendous e-book that gives a wealth a data.

Then I began pondering, why can’t this be a world bestseller? It rocks! The overseas rights within the Arab nations, China, Taiwan, Hong Kong, and Macau have already been negotiated.

As my expectations for my e-book elevated, so did my anxiousness! It’s hilarious the way it’s so arduous to maintain our hopes and goals contained. However we preserve preventing as a result of something is feasible!

In the long run, Purchase This, Not That grew to become an instantaneous Wall Road Journal bestseller. Hooray! However when is it going to get large in France?!

The Want For Extra Cash Wants To Be Fastidiously Measured

If I had a objective of retiring with $10 million once I was in my 20s or 30s, then I’d actually be depressing as a result of must work for a lot of extra years. As a substitute, I left when my internet price was about $3 million.

$3 million might generate sufficient to offer for a fundamental way of life, not a lavish one in San Francisco. I knew what my upside was and determined it wasn’t price it.

After you’ve acquired your fundamentals lined, when you dwell in a developed nation, your life is sort of much like a lot wealthier folks. Positive, the tremendous rich could have bigger properties and fly in luxurious on a regular basis. Nonetheless, the very wealthy revert to their regular state of happiness too.

I’ve one pal who might be price $200 million and makes $25 million a 12 months. He flew first-class to London ($20,000+) to go watch the Wimbledon tennis match. Entrance row tickets price anyplace between $10,000 – $20,000 a day, relying on the spherical. I’m positive he’s having numerous enjoyable.

However I’m additionally having numerous enjoyable enjoying with my children and watching Wimbledon on my comparatively cheap 4K TV! Moreover, flying is a PITA!

We must always attempt to be extra happy with what we have now. Wanting much less is the straightforward path to feeling rich. All the time take into consideration how a lot of your life vitality is getting sucked away by spending time incomes incrementally extra money that you simply don’t want.

Ask your self whether or not the marginal effort is price it. If it’s not, then please have the braveness to just accept sufficient!

Reader Questions

Readers, what do you concentrate on my Wealth Ratio? Are you able to argue how a better Wealth Ratio is definitely a mirrored image of happier folks? What’s your Wealth Ratio and do you agree with the varied ranges? Which cities are the unhappiest and happiest in your opinion?

For extra nuanced private finance content material, be part of 60,000+ others and join the free Monetary Samurai publication. Monetary Samurai is among the largest independently-owned private finance websites that began in 2009. To get my posts in your inbox as quickly as they’re revealed, join right here.

[ad_2]