[ad_1]

Truly, sustainability may probably be achieved by stabilizing pension debt.

The Middle’s most up-to-date situation temporary makes a powerful case for shifting the main target of fiscal sustainability for state and native pension plans from full funding to stabilizing their pension debt as a share of the economic system. Whereas full funding is tidy within the sense that, if the pension have been to close down, belongings could be out there to pay full advantages, it entails a big alternative price when it comes to forgoing public funding in infrastructure and training.

To evaluate the feasibility of shifting from full funding to stabilizing the debt, the evaluation proceeds in two steps. The primary appears to be like on the future evolution of public plans below present contribution ranges by projecting the annual money flows for a nationally-representative pattern of 40 state and native pension techniques. The second estimates the contribution will increase wanted to stabilize the ratio of pension debt to the economic system.

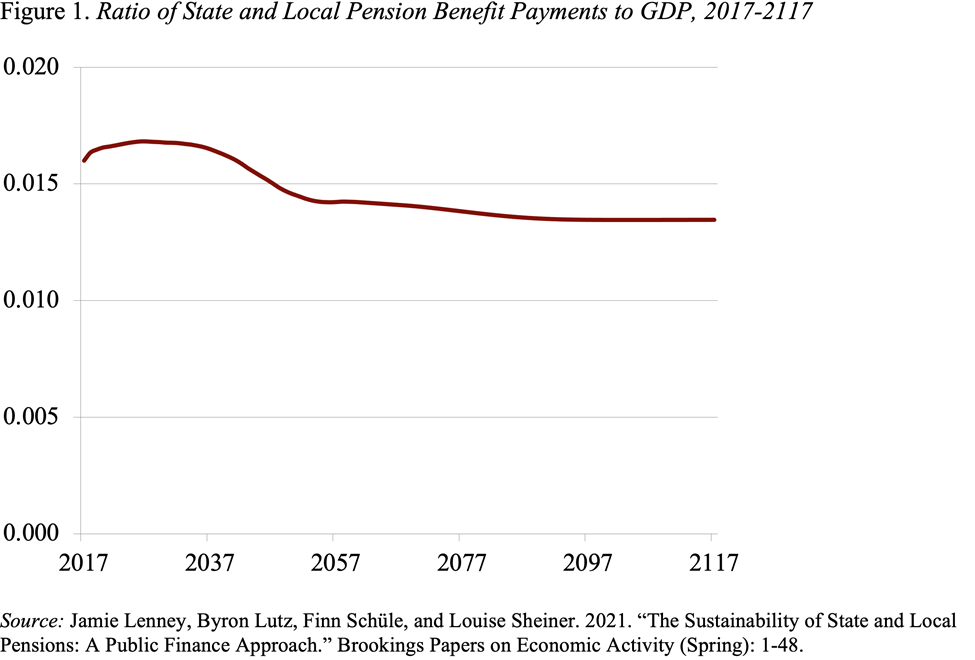

The projections below present contribution ranges yield two essential conclusions. First, regardless of the rising ratio of beneficiaries to staff, annual profit funds as a share of the economic system is already close to its peak (see Determine 1). This shocking outcome will be attributed to 2 elements. The primary issue is that the majority pension plans don’t absolutely index their retiree advantages for inflation, which lowers the actual worth of common advantages over time. The second issue is that pension plans have progressively been lowering progress in common advantages in recent times as a result of additional COLA restraints and to profit reductions for brand spanking new hires.

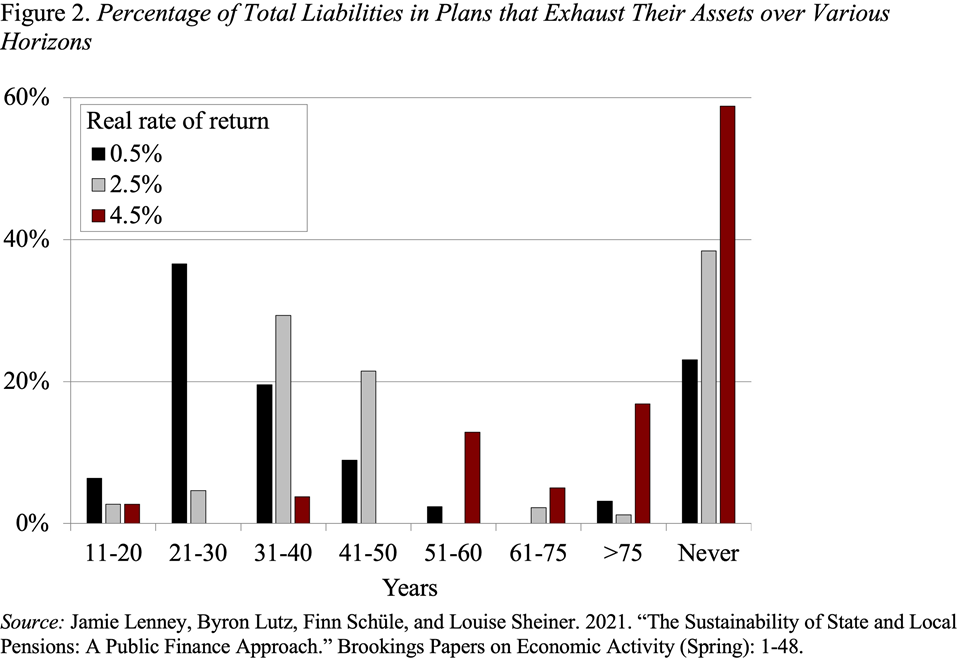

The opposite predominant conclusion, when it comes to pension belongings, is that almost all of plans don’t face an imminent disaster within the sense that they’re more likely to exhaust their belongings inside the subsequent twenty years (see Determine 2). However a sizeable share may exhaust their belongings inside 30 years below the low-real-return state of affairs. And even below the high-return state of affairs, greater than 40 p.c are susceptible to depleting their belongings over longer time horizons. Thus, changes shall be needed.

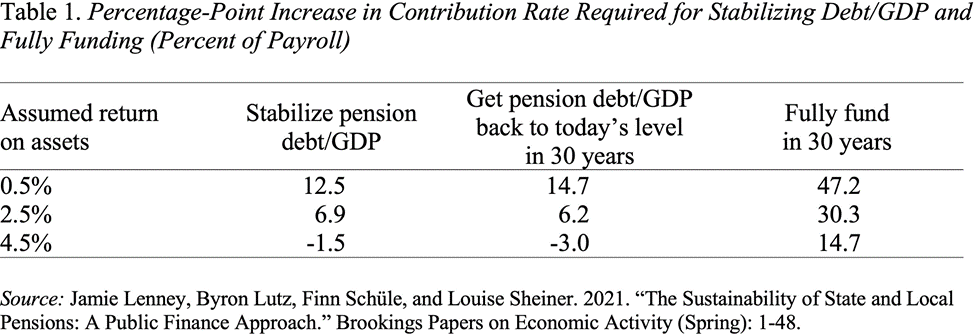

How massive do these changes must be? The required improve within the contribution fee to stabilize the debt-to-GDP ratio is 12.5 proportion factors when belongings yield 0.5 p.c; 6.9 proportion factors with a return of two.5 p.c; and contributions could possibly be reduce with a return of 4.5 p.c (see Desk 1). The numbers look very related with a purpose of getting the debt/GDP ratio again to at the moment’s stage in 30 years. To place these contribution modifications into context, combination pension contributions elevated by 10 proportion factors between 2009 and 2019. The ultimate column in Desk 1 reveals that the required percentage-point improve in contribution charges to completely fund these plans could be 4 or 5 occasions bigger.

The analysis summarized in this temporary is definitely not the final phrase on the subject. Certainly, different researchers have critiqued varied elements of the evaluation. However, persevering with with establishment or more and more stringent full-funding insurance policies additionally has prices. So, hopefully the essential thought introduced within the temporary is a step in the direction of constructing a extra sustainable framework for managing state and native pension plan liabilities.

[ad_2]