[ad_1]

EUR/USD: The Greenback Continues to Sink

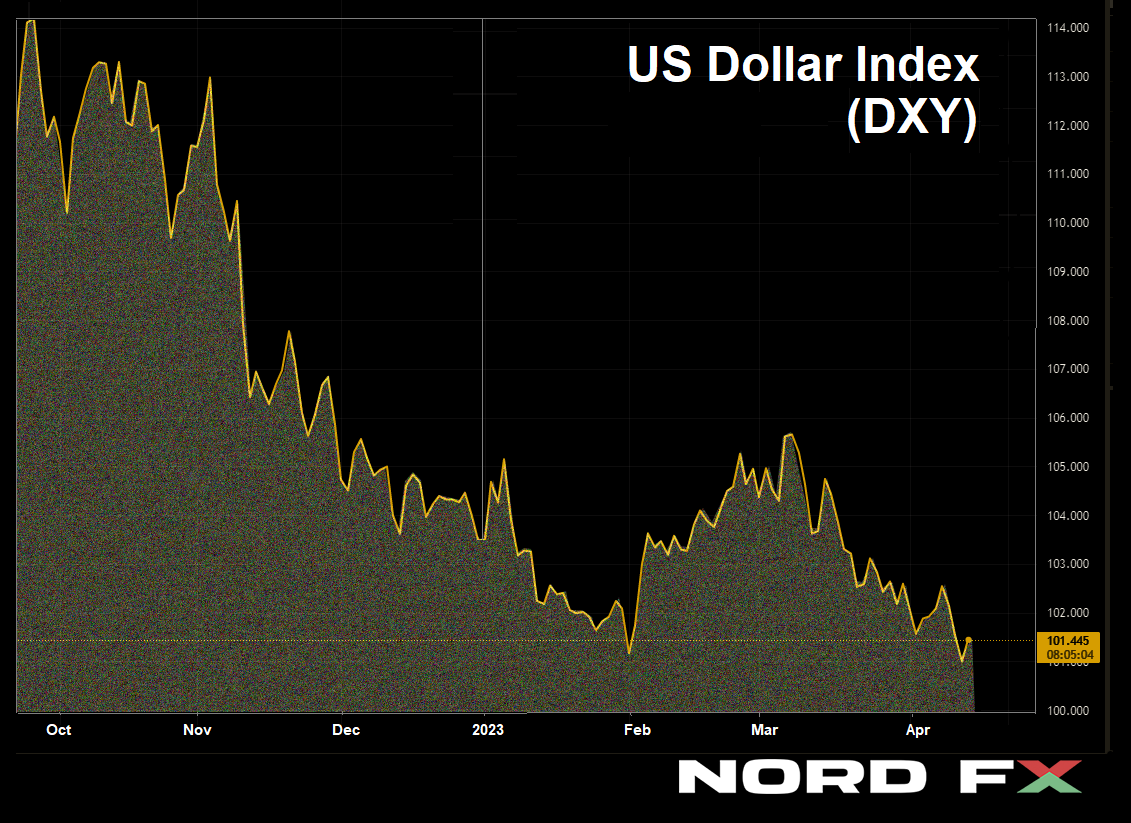

● The DXY greenback index up to date a 12-month low final week, and EUR/USD, respectively, rose to a most (1.1075) since April 04, 2022. The US forex has been falling for the fifth week in a row: the longest collection since summer time 2020.

The greenback obtained a severe blow on Wednesday, April 12, when knowledge on shopper inflation (CPI) and the minutes of the March US Federal Reserve FOMC (Federal Open Market Committee) assembly have been printed. Statistics confirmed that costs are below management and inflation within the US has been constantly slowing down for 9 consecutive months, going from 9.1% y/y to the present 5.0% y/y. The US Producer Value Index (PPI), launched a day later, additionally confirmed a lower in inflation, though on the primary stage, US worth strain nonetheless appears to be like secure.

With regard to the Fed Protocol, on the assembly on March 22, FOMC members mentioned the potential of taking a pause within the price hike cycle resulting from issues within the banking sector. Details about a potential gentle recession within the US economic system later this 12 months was additionally mentioned. Nonetheless, the speed is prone to be raised once more on the subsequent assembly of the Committee on Could 3. In response to CME FedWatch forecasts, it’s prone to develop by one other 25 foundation factors (bp) to five.25% each year.

This enhance has already been taken into consideration by the market in quotes and is unlikely to supply any help to the greenback. Furthermore, 5.25% is prone to be the height worth of the speed, till the final months of the 12 months, when it begins to say no. The futures market expects that federal funds spending will probably be 4.30-4.40% in December 2023, and they’re going to fall even decrease to 4.12-4.20% in January 2024.

● Slower inflation and the top of the Fed’s tight financial coverage cycle are placing strain on the greenback, pushing the DXY down. On the identical time, forecasts recommend that, in contrast to the Fed, the European Central Financial institution will proceed its tightening cycle for now. This was confirmed by the Member of the Board of Governors of the ECB, President of the Bundesbank Joachim Nagel. He stated on Thursday, April 13 that it’s essential to proceed elevating charges, as core inflation within the Eurozone continues to be very excessive.

● Knowledge on retail gross sales within the US launched on the very finish of the working week, on Friday, April 14 barely supported the US forex. They confirmed that gross sales, though falling, have been a lot slower than anticipated. With the forecast of -0.4% and the earlier worth of -0.2%, in actuality, the decline was -0.1%. Market contributors regarded such dynamics in favor of the greenback, and in consequence, EUR/USD ended the final week at 1.0993. On the time of writing the evaluate, on Friday night, April 14, analysts’ opinions are virtually equally divided: 45% of them count on the greenback to additional weaken, 45% count on it to strengthen, and the remaining 10% have taken a impartial place. As for technical evaluation, all oscillators and development indicators on D1 are 100% coloured inexperienced. The closest help for the pair is at 1.0975, then 1.0925, 1.0865-1.0885, 1.0740-1.0760, 1.0675-1.0710, 1.0620 and 1.0490-1.0530. Bulls will meet resistance at 1.1050-1.1070, then 1.1110, 1.1230, 1.1280 and 1.1355-1.1390.

● We count on various financial statistics from the EU subsequent week. Thus, the ZEW Financial Sentiment Index in Germany, the primary locomotive of the European economic system, will probably be printed on Tuesday, April 18. On Wednesday, we’ll discover out what is going on with inflation (CPI) within the Eurozone as an entire. On Thursday, the Minutes of the final assembly of the ECB on financial coverage will probably be printed, and on Friday, April 21, enterprise exercise indicators (PMI) within the manufacturing sector of Germany and within the nation as an entire will develop into recognized. No important macro statistics are anticipated from the US subsequent week.

GBP/USD: Issues Are A lot Higher Than Anticipated

● In opposition to the backdrop of the greenback weakening, GBP/USD nonetheless feels good, and it made one other excessive within the first half of Friday, April 14, reaching the peak of 1.2545. The pound has not traded this excessive because the starting of June 2022. Nonetheless, then, after the publication of information on retail gross sales within the US, the greenback improved its place, and the pair accomplished the five-day interval on the stage of 1.2414.

● As for the UK economic system itself, the GDP launch on Thursday 13 April confirmed that the economic system stagnated at 0.0% in February, in contrast with the forecast of 0.1% and the earlier studying of 0.3%. The expansion of manufacturing within the manufacturing business in February was additionally 0.0% towards the anticipated 0.2% and -0.1% in January, whereas the full industrial output continues to be within the unfavorable zone -0.2% towards the forecast of 0.2% and -0.5% a month earlier. On an annualized foundation, manufacturing output got here in at -2.4%, beating expectations of -4.7%. The overall quantity of business manufacturing decreased by -3.1% towards the forecast -3.7% and the earlier worth -3.2%. Knowledge on the commerce stability of products within the UK was additionally printed final week, which in February amounted to £17.534 billion, which is greater than the forecast of £17.000 billion and the earlier worth of £16.093 billion.

What do all these numbers say? Along with the information on enterprise exercise (PMI), which grew to become recognized on April 03 and remained above 50 factors, all these statistics give traders hope that the British economic system is ready to keep away from a recession. Which, in flip, helps the place of the nationwide forex. This was confirmed on April 13 by British Treasury Secretary Jeremy Hunt, who stated that the financial outlook appears to be like brighter than anticipated. “Because of the steps we now have taken, we’ll keep away from a recession,” he assured the viewers.

● The Financial institution of England (BoE) Chief Economist Hugh Tablet’s feedback have been fairly optimistic as properly. In response to him, though “the precise path of inflation could also be extra uneven than we count on,” the Central Financial institution nonetheless forecasts a lower in CPI in Q2 of this 12 months. “The newest figures are considerably disappointing,” stated Hugh Tablet, “however they’re much higher than the BoE’s forecasts made on the finish of final 12 months.” The economist additionally famous that the UK banking system stays very sound and resilient, and inflationary dynamics is a key issue figuring out the route of BoE’s financial coverage.

● In the meanwhile, 75% of consultants aspect with the pound and count on additional progress of the pair, the remaining 25% aspect with the greenback. Among the many oscillators on D1, the stability of energy is as follows: 65% vote in favor of inexperienced (10% give overbought indicators), 10% have turned purple and 25% choose impartial grey. Among the many development indicators, the benefit can be on the aspect of the greens, they’ve 65%, the enemy has 35%. Help ranges and zones for the pair are 1.2390-1.2400, 1.2330, 1.2275, 1.2200, 1.2145, 1.2075-1.2085, 1.2000-1.2025, 1.1960, 1.1900-1.1920, 1.1800-1.1840. When the pair strikes north, it can face resistance at ranges 1.2440-1.2455, 1.2480, 1.2510-1.2540, 1.2575-1.2610, 1.2700, 1.2820 and 1.2940.

● Among the many occasions of the approaching week, the calendar can and will word the publication of the most recent unemployment knowledge in the UK on Tuesday, April 18. On Wednesday, the worth of the Client Value Index (CPI) will develop into recognized, and on Friday the statistics on retail gross sales and enterprise exercise (PMI) within the UK will probably be printed.

USD/JPY: Financial institution of Japan Is an Island of Stability

● Since final December, USD/JPY has been shifting in a reasonably huge sideways vary of 129.00-138.00. (An exception is the transient strengthening of the yen to 127.15 in mid-January). The pair ended the final week virtually in its very heart, on the stage of 133.75, which signifies the absence of serious drivers able to giving the pair a strong acceleration in a single route or one other.

● We’ve got repeatedly written that even after Haruhiko Kuroda, Governor of the Financial institution of Japan (BoJ), leaves his publish, the Central Financial institution “will proceed to help his enough and expedient coverage.” This was as soon as once more confirmed by Kazuo Ueda, the brand new head of the regulator, who took workplace on April 9. He acknowledged on the G20 assembly that he would help the present ultra-soft financial coverage. As well as, Ueda stated that core shopper inflation in Japan, which is at the moment solely about 3%, is prone to fall beneath 2% within the second half of this fiscal 12 months. Market contributors concluded from these phrases that there isn’t any level in preventing it by elevating charges for the Financial institution of Japan, and due to this fact it’s not value anticipating a reversal of the BoJ price within the foreseeable future. (Recall that economists at Societe Generale and ANZ Financial institution anticipated that this might nonetheless occur someplace round June).

● Concerning the fast prospects for USD/JPY, analysts’ opinions are distributed as follows. In the meanwhile, 40% of consultants vote for the additional motion of the pair to the north, 50% level in the other way and 10% choose neutrality. Amongst oscillators, 75% level upwards at D1 (a 3rd of them are within the overbought zone), 10% look in the other way and 15% are impartial. For development indicators, 85% level to the north, the remaining 15% level to the south. The closest help stage is positioned within the zone 132.80-133.00, then there are ranges and zones 132.00-132.40, 131.25, 130.50-130.60, 129.65, 128.00-128.15 and 127.20. Ranges and resistance zones are 134.00, 134.90-135.10, 135.90-136.00, 137.00, 137.50 and 137.90-138.00.

● As for the discharge of any vital statistics on the state of the Japanese economic system, it’s not anticipated this week.

CRYPTOCURRENCIES: Weak Greenback Is Sturdy Bitcoin

● Bitcoin rose above $30,000 on Tuesday, April 11, for the primary time since June 2022. This occurred resulting from instability within the banking sector and expectations that mega-regulators, primarily the Fed, will droop elevating rates of interest. The MSCI World Index rose to its highest level since early February by Friday, April 14. This confirmed the truth that worldwide traders are ready for the American, and sooner or later, for different main Central Banks to curtail the coverage of quantitative tightening (QT). In opposition to this background, the primary cryptocurrency continues to outperform different main asset courses, reminiscent of gold or oil. As well as, BTC has surpassed many prime cryptocurrencies by way of dynamics.

In the midst of the week, the bears had an opportunity to return BTC/USD to the help of $29,000. Nonetheless, the FRS saved it from falling once more: the printed Minutes of the March FOMC assembly, coupled with macro statistics from the US, weakened the greenback, swinging the scales in favor of bitcoin.

The expansion of BTC quotes pulls up all the crypto market. The overall market capitalization of cryptocurrencies has grown by greater than 55% because the starting of 2023, rising above $1.2 trillion. Nonetheless, regardless of this, it nonetheless stays properly beneath the all-time excessive of $2.9 trillion recorded in November 2021.

● A number of consultants directly expressed their opinion on what occurred on April 11. Michael Van De Poppe, a widely known strategist and founding father of the funding firm Eight, famous that bitcoin efficiently handed the $28,600 take a look at, which led to a breakthrough in resistance and reached $30,000. An analyst with the nickname PlanB tweeted that each one the objectives he set again in October 2022 have now been achieved. At the moment, the professional predicted that BTC quotes would overcome $21,000, $24,000, after which $30,000. And one other standard blogger and analyst, Lark Davis, careworn that the time will quickly come when shopping for bitcoins for lower than $30,000 will appear as improbable as shopping for BTC at $3,000 now.

● As of this writing, Friday night April 14, BTC/USD is buying and selling at $30,440. The overall capitalization of the crypto market is $1.276 trillion ($1.177 trillion every week in the past). The Crypto Worry & Greed Index rose from 64 to 68 in seven days and continues to be within the Greed zone. However what’s subsequent?

● A well known analyst below the nickname PlanB famous that bitcoin has left the deep bear zone and is on the very starting of a brand new bull market. In response to PlanB, the Inventory to Stream (S2F) mannequin he developed continues to be related. The professional claims that bitcoin fundamentals will ultimately permit it to rise above the all-time excessive (ATH) of $69,000 set in November 2021. PlanB has beforehand predicted bitcoin will rise from $100,000 to $1 million after the 2024 halving. (Recall that the S2F (stock-to-flow ratio) mannequin for predicting the BTC price measures the connection between the obtainable provide of an asset and its manufacturing quantity and has been repeatedly criticized by members of the crypto neighborhood).

● Larry Lepard, managing associate at Boston-based fairness agency Fairness Administration Associates, additionally appears to be like extraordinarily optimistic within the long-term outlook. In response to him, the greenback will depreciate over the following 10 years, and residents will start to actively put money into cryptocurrencies, gold and actual property. The provision of bitcoins is proscribed, so the digital asset will develop into a extremely sought-after funding automobile and can profit from the collapse of the fiat forex. “I consider that the worth of bitcoin will go up rather a lot. I feel it can first attain $100,000, then $1 million and ultimately rise to $10 million per coin. I’m positive my grandchildren will probably be shocked at how wealthy individuals who personal only one bitcoin develop into,” Lepard stated in an interview.

In reference to this forecast, the businessman fears that the authorities will put spokes within the wheels of the crypto business, making an attempt to decelerate the expansion within the reputation of digital belongings. For instance, officers might elevate taxes on earnings from bitcoin buying and selling and tighten regulation of cash to make it more durable for startups to enter the market. Nonetheless, Lepard is assured that bitcoin will be capable of overcome these difficulties and achieve the long term.

● Many analysts agree that long-term macro circumstances do level to a potential rise in BTC. However their estimates are rather more restrained in relation to the present rally. This is because of the truth that bitcoin liquidity is now a lot decrease than in the identical interval final 12 months. That is manifested in a larger worth dispersion among the many main exchanges. (Within the earlier evaluate, we wrote that on the one hand, there is a rise in buying and selling volumes, and however, a lower in BTC liquidity to a 10-month low).

Though, in fact, the prospects for this 12 months will largely rely on the actions of the main Central banks led by the Fed. Recall that the document capitalization of the crypto market in November 2021 was additionally the results of the actions of this regulator, which then flooded the economic system with an enormous quantity of low-cost cash (the M2 financial unit grew by 39%, which is an anomaly by historic requirements). Furthermore, rates of interest have been close to zero ranges on the time, which led to the emergence of a bubble out there for dangerous belongings, together with shares and digital currencies. The Fed then moved from quantitative easing (QE) to quantitative tightening (QT) by means of the quickest interest-rate hike cycle in 40 years, and… the bubble burst.

● Talking concerning the prospects of the flagship cryptocurrency, it’s not possible to not point out those that nonetheless contemplate it a bubble and predict its ultimate collapse. Dieter Wermuth, an economist and associate at Wermuth Asset Administration, stated final week that the economic system can be higher and less complicated with out bitcoin. In his opinion, these dangerous investments are related to social prices, and the cryptocurrency itself doesn’t contribute to world prosperity. If we contemplate bitcoin as a forex, then, given the excessive volatility and lack of actual use, BTC is doomed to failure. On this vein, it is sensible to ditch bitcoin altogether: it may very well be good for shared prosperity, as investing in cryptocurrencies is wasteful and takes away funds from total financial progress. As well as, bitcoin creates social inequality, permits for cash laundering, tax evasion, and may be very power intensive resulting from mining. Dieter Wermuth even known as bitcoin “the largest local weather killer.”

Cryptocurrency opponents obtained sudden help from … synthetic intelligence. ChatGPT Bot spoke concerning the formation of a recession-resistant funding portfolio. In response to a doc printed by the Gold IRA Information, it beneficial allocating 20% for gold and different treasured metals. The remainder of its hypothetical portfolio consisted of bonds (40%), “defensive” shares (30%) and money (10%). The chatbot didn’t point out cryptocurrencies, a lot to the delight of well-known bitcoin critic and gold advocate Peter Schiff. “In any case, synthetic intelligence is fairly sensible. It didn’t advocate any bitcoin deposit,” this investor wrote.

● By the best way, answering the query of which cryptocurrency is probably the most promising immediately, ChatGPT didn’t title bitcoin, however ethereum. Synthetic intelligence, in fact, didn’t know concerning the newest occasions, nevertheless it appears to have hit the mark. Within the final evaluate, we detailed the Shapella exhausting fork, which is able to permit validators to withdraw the frozen ETH cash they’ve invested and locked on the community over the previous 3 years in change for curiosity. Traders and merchants have been frightened that an unlock may lead to an enormous promoting wave and, in consequence, a pointy drop within the worth. Nonetheless, we’re nonetheless seeing the other course of: on Could 13, ETH/USD rose above $2,000, and on the night of Friday, April 14, it’s buying and selling within the $2,100 zone.

NordFX Analytical Group

Discover: These supplies will not be funding suggestions or tips for working in monetary markets and are meant for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx

[ad_2]