[ad_1]

The primary mover benefit that turned Block-owned Afterpay loved since its launch 9 years in the past is about to finish, with the world’s most dear tech firm, Apple, set to turn out to be Australia’s main buy-now-play-later (BNPL).

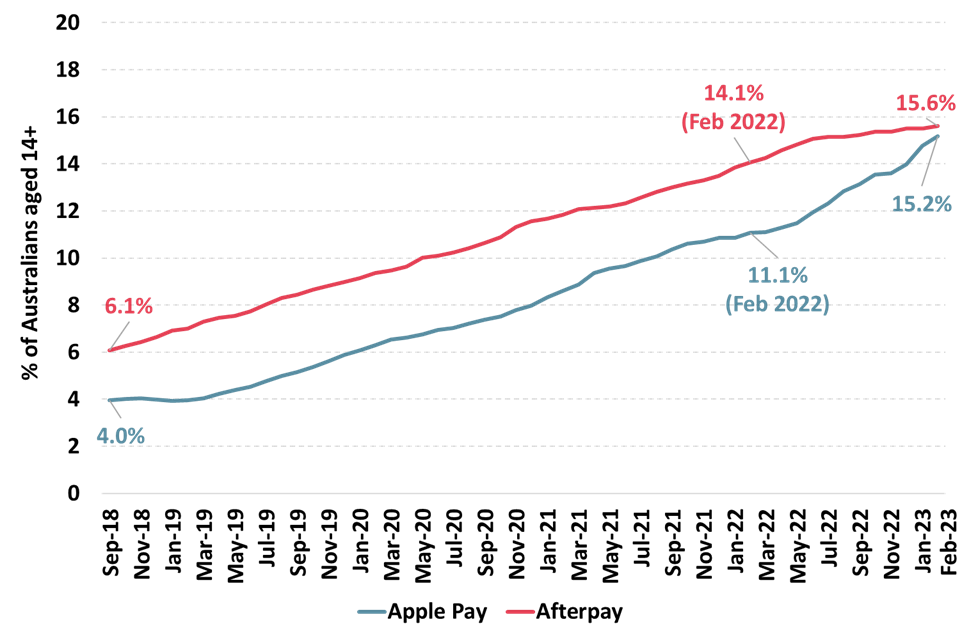

The Roy Morgan Digital Funds Report reveals it’s taken simply 7 years for Apple Pay to construct its native market penetration, with round 3.2 million Australian customers (15.2% of the inhabitants), simply behind Afterpay at 3.3 million customers (15.6%), with the smartphone answer resulting from overtake the Australian fintech inside months.

Apple Pay has grown 4.1% factors in 12 months, from 11.1% of Australians in February 2022 to fifteen.2% a 12 months later, as Afterpay’s progress started to flatline over the past six months, simply as Apple Pay’s consumer progress accelerated. Afterpay grew by 1.5% up to now 12 months from from 14.1% in February 20232 – a rise of 1.5% factors in a 12 months.

Roy Morgan CEO Michele Levine mentioned the speedy progress in utilization of each Apple Pay and Afterpay sits in distinction to the digital fee service market leaders PayPal and BPAY, that are utilized by way more Australians, however haven’t seen such speedy progress lately.

Simply 28 months in the past, Afterpay’s Australian consumer penetration sat at 6.1%, Apple Pay’s at 4%.

Utilization in a median 12 months of digital fee providers Apple Pay & Afterpay (2018-2023)

Source: Roy Morgan Single Supply, October 2018 – February 2023.

Levine mentioned the big variety of digital fee providers out there immediately attraction to very completely different shoppers

“The digital fee providers market is a aggressive one as we have now seen lately with each Latitude Pay and openpay exiting the ‘buy-now-pay-later’ market in current months as rates of interest elevated and competitors out there intensified. Latitude Pay was taken off-line simply this week,” she mentioned

“General consciousness of ‘buy-now-pay-later’ providers akin to Afterpay, Zip and Klarna is excessive with the sector probably the most well-known sort of digital fee service – now 18 million Australians (84%) say they’re conscious of those providers. Nevertheless, solely 4.3 million Australians (19.9%) have used a ‘buy-now-pay-later’ service within the 12 months to February 2023.

“The utilization of ‘buy-now-pay-later’ providers nonetheless trails properly behind extra conventional digital fee providers akin to ‘on-line fee platforms’ PayPal, Visa Checkout and Masterpass. Practically half of Australians, 10.2 million (47.5%), used an internet fee platform within the 12 months to February 2023 – regardless of decrease general consciousness.”

This week ASX-listed Zip, the chief of a peloton trailing Apple and Afterpay within the BNPL area, introduced a cope with US tech-ercise platform Peloton, which dropped its current BNPL supplier, Affirm, for Zip.

Afterpay was acquired in late 2021 by US funds platform Sq. for A$39 billion. The enterprise subsequently rebranded as Block (ASX: SQ2) in a twin ASX/NYSE itemizing. Block’s share value has fallen round 43% on the ASX over the past 12 months

The digital fee providers Roy Morgan measures embody PayPal, BPAY, Afterpay, Humm, Apple Pay, Zip, Google Pay, Submit billpay, Visa Checkout, masterpass, Western Union, Klarna, fitbit pay, Garmin Pay, paywear, Samsung Pay, Commbank Faucet & Pay, ANZ, NAB Pay, Bankwest Halo and Cryptocurrencies akin to Bitcoin, Ethereum, Tether, Ripple and Cardano.

[ad_2]