[ad_1]

The inventory market stays in an uptrend after modest good points for the week, which occurred amid indicators that the financial system is slowing down whereas inflation is cooling. It was a interval marked by giant intraday strikes, nevertheless, as traders digested information that Fed officers are anticipating a light recession later this 12 months. Additionally, knowledge final week confirmed that, whereas inflation is slowing, it stays at a extremely elevated stage, which can result in extra charge hikes.

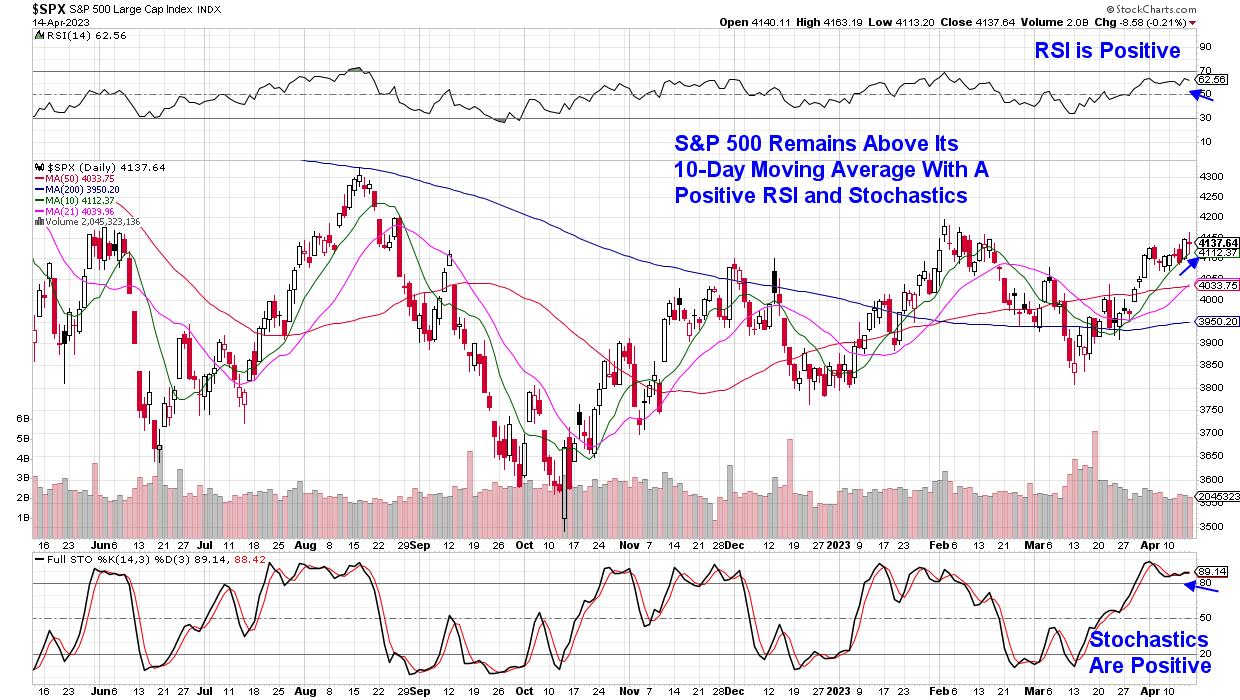

DAILY CHART OF S&P 500 INDEX

Fed charge hikes within the face of a doable recession is just not an incredible backdrop for the markets, and final week’s underperformance within the Expertise sector underscored traders’ concern. These excessive progress shares are notably weak to increased charges and fears of a slowing financial system.

Right now, investing in firms which are rising and that additionally fare properly regardless of a possible slowdown within the financial system could be an effective way to take part within the present uptrend. Specializing in shares which are additionally breaking out of a sound base could be very best, as this chart sample typically precedes additional upside value motion. Under is a main instance of a recession-proof firm that broke out of a base final month amid an improved progress outlook.

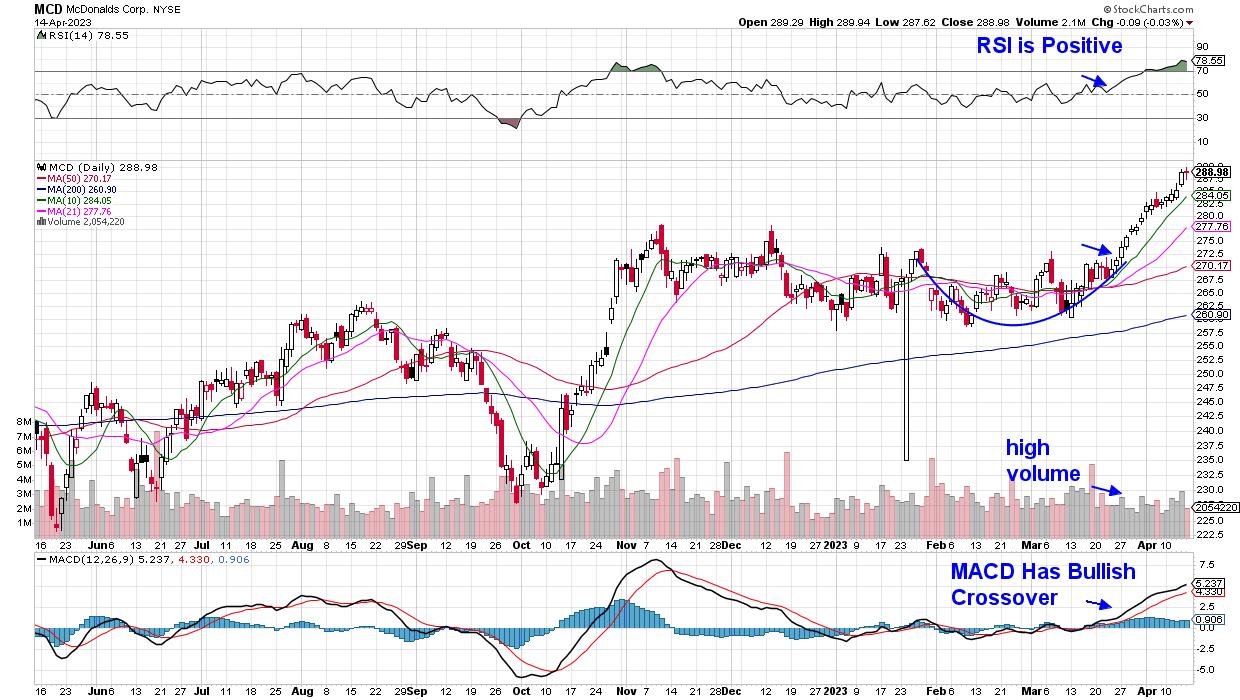

MCDONALD’S CORP. (MCD)

Subscribers to my MEM Edge Report are fairly acquainted with McDonald’s (MCD), as we added the inventory to our choose checklist of Steered Holdings in late March after its base breakout on above-average quantity. MCD’s reasonably priced menu, coupled with their working margins enhancing greater than Microsoft (MSFT) and different tech firms, had Wall Road elevating their progress outlook for the corporate into year-end. Of be aware, McDonald’s opened nearly 600 new places throughout the nice recession of 2008, whereas most eating places retreated. The inventory is in a confirmed uptrend with additional upside potential.

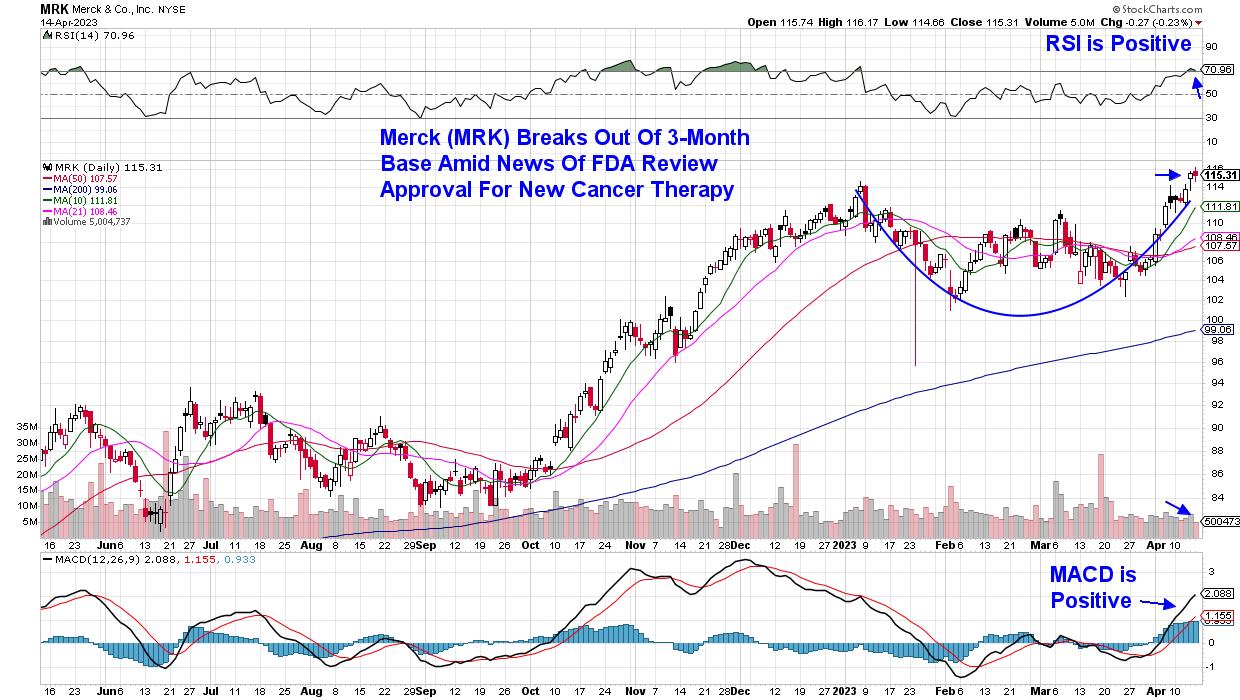

Under is Merck (MRK), which broke out of a 3-month base final week amid information that the FDA has accepted their Keytruda-based remedy for superior GI most cancers for evaluate. This information provides to the corporate’s exceptionally deep drug pipeline, which has analysts calling for above-average earnings progress over the following 5 years. The two.5% yielder can also be buying and selling at 15 occasions trailing 4 quarter earnings, which is under the common P/E for shares within the S&P 500.

DAILY CHART OF MERCK (MRK)

Healthcare shares additionally outperformed throughout 2008 and, whereas we’re not calling for a recession that will likely be anyplace near what befell again then, priority tells us that modern drug firms can fare properly regardless of a tough financial backdrop. MRK has optimistic momentum, with its RSI and MACD above 50 and headed increased, and final week’s base breakout places the inventory ready to commerce increased.

Whereas Expertise shares have underperformed over the previous two weeks, the sector stays in an uptrend with choose areas posting strong good points. My MEM Edge Report has a number of top quality Expertise shares on the Steered Holdings Record which have been outpacing the broader markets and are poised to proceed to take action. We’ll stick with these shares so long as they continue to be in an uptrend.

If you would like quick entry to my Steered Holdings Record, in addition to be saved on prime of our detailed market and sector rotation evaluation throughout these uneven occasions, use this hyperlink for a 4-week trial of my twice weekly MEM Edge Report at a nominal price.

Warmly,

Mary Ellen McGonagle, MEM Funding Analysis

Mary Ellen McGonagle is knowledgeable investing advisor and the president of MEM Funding Analysis. After eight years of engaged on Wall Road, Ms. McGonagle left to grow to be a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with purchasers that span the globe, together with massive names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Study Extra

Subscribe to The MEM Edge to be notified every time a brand new put up is added to this weblog!

[ad_2]