[ad_1]

Quite a lot of my latest conversations on The Last Bar have associated to the battle introduced within the markets in April 2023. Traditional measures of market development, from the Coppock Curve to the Zweig Breadth Thrust to my very own Market Development Mannequin, are all giving a robust constructive sign on development power. However a deeper dive into the situations for small-caps or defensive sectors or recessionary durations counsel that the fairness indexes are mainly pricing in an irrational and unlikely restoration, regardless of clearly unfavorable situations.

In my view, a technical indicator sign shouldn’t be a single second, however fairly entails three specific steps. In our upcoming FREE webcast, “Three Steps to Each Sign,” we’ll break down the setup, the set off and the affirmation utilizing latest examples. Do not miss this chance to improve your use of technical evaluation to higher determine worthwhile alternatives! Enroll HERE.

So who’s proper?

As we speak, we’ll break down 5 measures of market situations, a lot of which counsel additional warning at this level, regardless of the seasonal power that normally performs out within the month of April.

The Market Development Is Most Necessary

The primary knowledge sequence on right now’s chart is undoubtedly a very powerful, and that’s the value of the S&P 500 index. I used to be informed early on from mentors like Ralph Acampora to focus first on the development within the S&P 500. Every thing else comes after that!

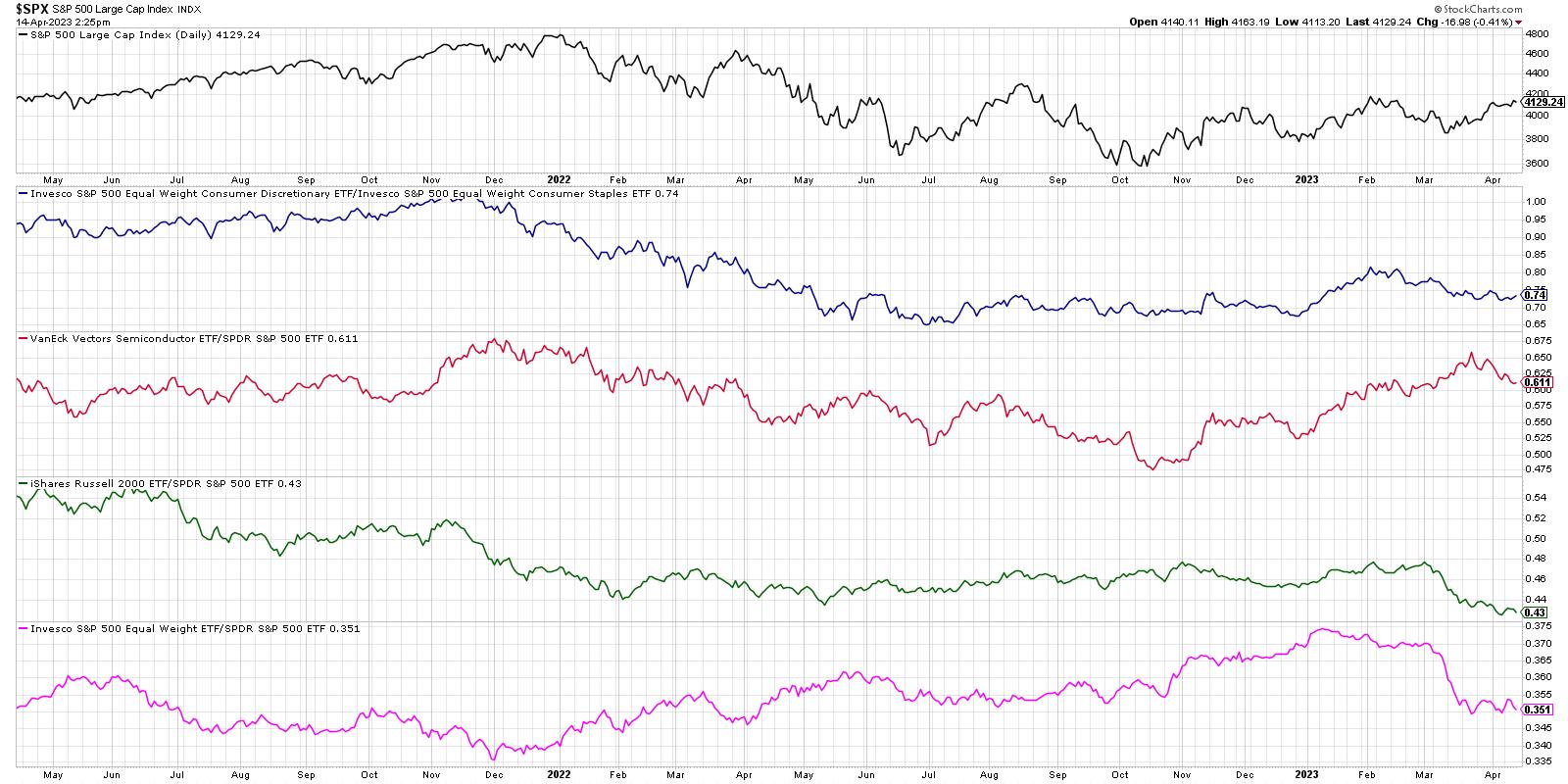

The highest panel within the chart is the closing value of the S&P 500, which arguably aggregates all the uncertainty I outlined above. I consider the SPX is an efficient illustration of the sentiment of fairness buyers, however I additionally acknowledge {that a} small variety of mega-cap shares have an outsized influence on the efficiency of this specific index.

The S&P 500 completed the week above 4100, which implies we’re as soon as once more testing the November 2022 and February 2023 highs. Will the SPX have sufficient upside momentum this time round to energy by means of to a brand new swing excessive? The reply could also be sure, however that reply is actually not clear right now.

Defensive Sectors Are Main

I used to be requested not too long ago about which sectors are inclined to do properly throughout recessionary durations. I answered that three sectors are inclined to carry out the most effective on this kind of setting: Shopper Staples, Utilities, and Well being Care. After all, these are all pretty defensive sectors, and signify services and products that you’d almost definitely nonetheless spend cash on no matter market situations and your personal monetary state.

The ratio of offense vs. protection within the shopper house (second panel down) has clearly been favoring Shopper Staples because the February market peak. So even because the market has rallied in latest weeks, protection remains to be outperforming offense.

Semiconductors have been one of many strongest teams off the October 2022 market low, and whereas the relative power of the SMH remains to be in an uptrend, we’re seeing a little bit of a pullback in latest weeks. This can be an essential chart to observe for a draw back reversal, notably utilizing trendline help.

Smaller Shares Are Nonetheless Struggling

Probably the most regarding knowledge sequence on this chart are the ultimate two, which observe the relative efficiency of the small-cap Russell 2000 ETF and relative efficiency of the equal-weight S&P 500 ETF. Each of those ratios have been shifting decrease over the past eight to 10 weeks, indicating the underfperformance of small- and mid-cap shares vs. large- and mega-cap names.

Why is that this an essential measure of market danger?

When institutional buyers are able to tackle extra danger of their portfolio, they have a tendency to search for larger beta, larger danger, and extra speculative firms. The small-cap and mid-cap house is stuffed with rising development tales with long-term development potential. So when these shares are performing properly, it means that buyers are able to tackle extra danger. That doesn’t seem like the case not too long ago, the place buyers are as a substitute favoring extra established and fewer dangerous shares like AAPL, MSFT, and others!

Can the market go larger from right here? Completely. And given the decrease volatility with the SPX poking above 4100, there’s a very actual chance that we see an upside follow-through. However to really feel extra assured on potential for additional upside, I might need to see affirmation from a number of the indicators introduced within the chart above.

Wish to digest this text in video format? Head on over to my YouTube channel!

RR#6,

Dave

P.S. Able to improve your funding course of? Try my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any manner signify the views or opinions of some other particular person or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers decrease behavioral biases by means of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor choice making in his weblog, The Conscious Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency centered on managing danger by means of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and knowledge visualization to determine funding alternatives and enrich relationships between advisors and shoppers.

Be taught Extra

Subscribe to The Conscious Investor to be notified every time a brand new publish is added to this weblog!

[ad_2]