[ad_1]

II. Basic Information

- Structural basis:

- Estimating path primarily based on construction

- Regardless of how diverse the shape, construction breaks all of it

- The position of construction in buying and selling

- Provide and demand basis:

- Provide and demand buying and selling technique primarily based on construction

Estimating path primarily based on construction

Shopping for low and promoting excessive versus following the pattern: which one is right?

Some consultants say that almost all of their earnings come from shopping for low and promoting excessive, whereas others declare that following the pattern is the one approach to revenue. Who’s right? From the angle of those consultants, each approaches are right as a result of they’ve their very own buying and selling logic and system to show their level.

So who’s mistaken? The followers who blindly comply with these consultants with out contemplating their very own buying and selling technique.

Nobody can utterly and logically interpret the market with a single method. Due to this fact, any internally constant market view is possible. We should always not let exterior biases affect our decision-making and hinder our skill to just accept and mirror on totally different opinions, or it is going to create boundaries to understanding.

What do merchants want?

Simply as a ship is required to cross a river and a rope is required to climb a mountain, whether or not merchants need to purchase low and promote excessive or comply with the pattern, they want applicable instruments and coaching to grasp their use.

Earlier than selecting a buying and selling software, it is very important examine and analysis till discovering one which fits you. Upon getting chosen a software, you could belief it firmly, as wavering between choices will solely lead to losses.

Is selecting tops and bottoms playing or predicting the market?

Selecting tops and bottoms belongs to the class of swing buying and selling, which works towards the pattern of the present cycle however is totally with the pattern of the bigger cycle (multi-periodicity is past the scope of this text).

Straight getting into the market at a key level of the bigger cycle is dangerous, so it’s safer to attend till the market varieties the next excessive/low level earlier than getting into. Many occasions, the upper excessive/low level happens in a deep retracement place, the place the risk-to-reward ratio is much like that of selecting tops and bottoms, however the security issue is increased.

To know find out how to catch the upper excessive/low level, it’s best to know market construction.

What’s market construction?

To guage the path of the market, no indicators are wanted, solely whether or not the worth breaks by way of in the identical path repeatedly.

For instance, when the worth breaks by way of the earlier excessive after which retraces, the expectation is for the next excessive/low level (HL) to type after which proceed to interrupt upwards. The identical precept applies to a downtrend.

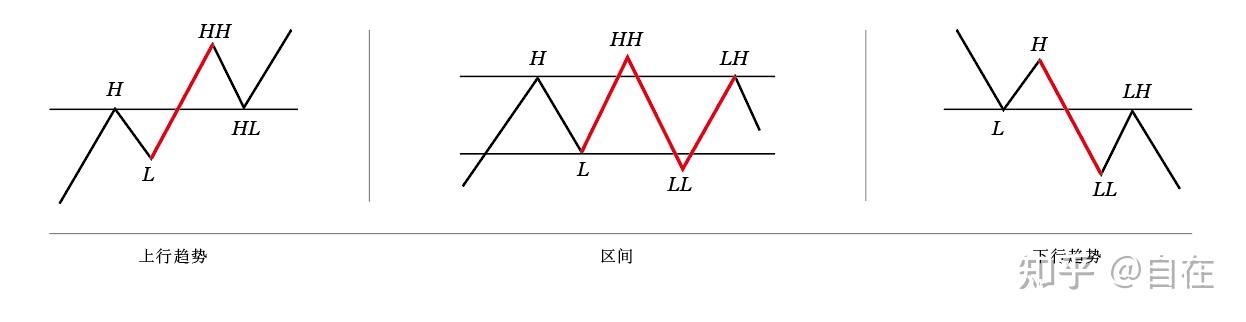

The breakthrough-retracement-breakthrough construction varieties the fundamental construction of the market[1]. In response to Dow Concept, the market construction could be simplified into the next three theoretical fashions[2]:

HH=Greater Excessive, HL=Greater Low; LH=Decrease Excessive, LL=Decrease Low

Uptrend: The worth breaks by way of the earlier excessive (marked by a pink line) to type a HH, retraces with out breaking the earlier low, after which continues to interrupt upwards to type an HL.

Vary-bound: The worth doesn’t have a transparent directional expectation.

Downtrend: The worth breaks by way of the earlier low to type a LL, retraces with out breaking the earlier excessive, after which continues to interrupt downwards to type a LH.

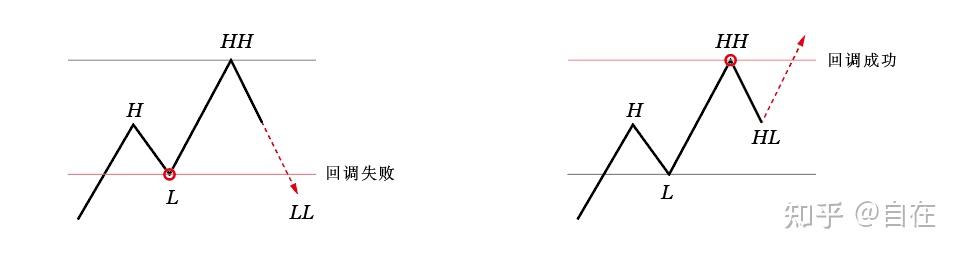

Let’s delve a bit deeper and have a look at the connecting a part of the 2 pattern actions – the retracement:

Retracement failure mannequin:

No matter whether or not you select to commerce breakouts or retracements, you must perceive the corresponding failure patterns as enhances. For instance, if you wish to commerce breakouts, it’s essential to perceive breakout failures, and if you wish to commerce retracements, it’s essential to be conversant in retracement failures.

If the retracement is profitable, the prevailing pattern will proceed. If the retracement fails, the pattern will stall or reverse. Nonetheless, retracement failure doesn’t essentially imply that the pattern will instantly reverse. A number of situations must be mixed to verify a reversal.

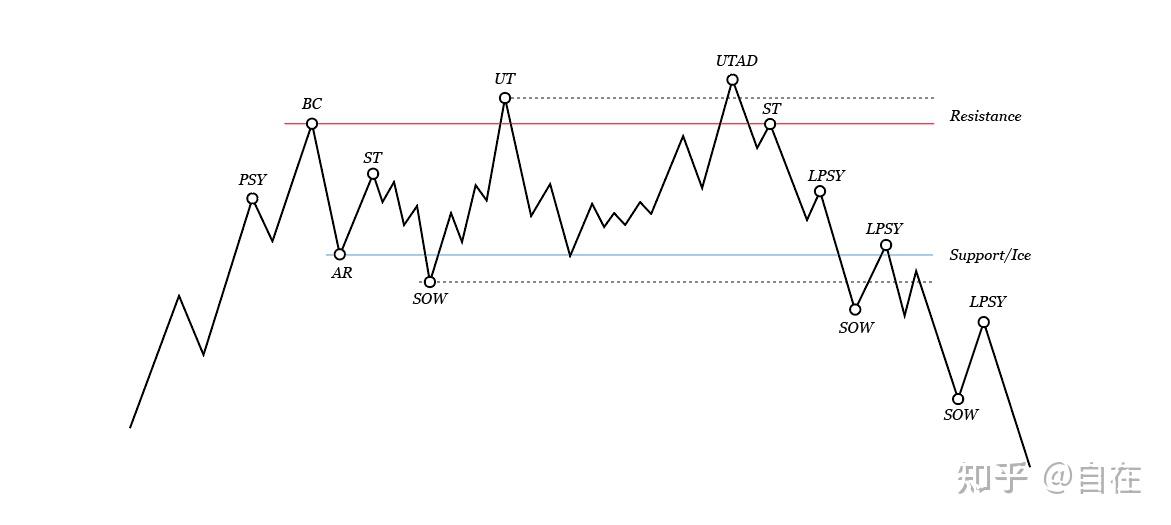

If you wish to commerce tops and bottoms, it’s essential to observe the circumstances of retracement failure extra. Take the Wyckoff mannequin for instance, please fastidiously observe the retracement failure in it:

Retracement failure is a sign that will point out a reversal of fund flows, or it might be to comb out stop-losses or seize liquidity. If it’s the former, the pattern could reverse or could present a bigger retracement; the latter could rapidly recuperate the pattern, or could reverse once more after the breakout to seize the liquidity of each lengthy and brief positions.

For those who perceive the content material of retracement failure above, we’ll proceed to debate additional.

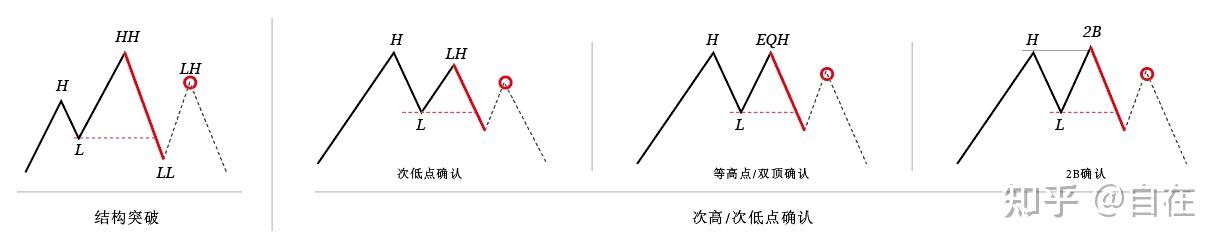

What’s a reversal construction?

Studying to successfully establish reversal constructions is among the stipulations for capturing tops and bottoms (retracement failure is a prerequisite for reversal constructions).

Reversal constructions primarily have two varieties:

- Construction breakout (retracement failure)

- Affirmation of secondary excessive/low factors (together with double tops/bottoms and shadow false breakouts)

Value breaking within the path of the pattern known as a pattern, is breaking towards the pattern a reversal? Please contemplate the similarities and variations between the 2 reversal constructions in mild of retracement failure.

Construction breakout

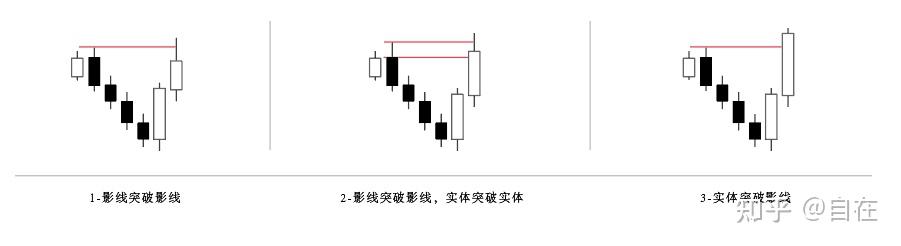

On the micro degree, there are three predominant conditions of worth breaking construction, all of which could be thought-about as legitimate breakouts, however I choose the latter two:

Please contemplate the momentum and take into consideration which breakout is stronger? [3]

After-class reflection:

Why do technical books (particularly inventory market books) like to spend so much of time telling candlestick tales primarily based on worth charts?

Is “Japanese Candlestick Charting Strategies” actually appropriate for newbies? Can one get began by memorizing 100 candlestick combos?

Reference:

- ^That’s, the N-shaped construction. As well as, there are lots of ideas of technical evaluation, which, like human language, can have totally different names, however all check with the identical content material. I’ll attempt to use frequent vocabulary to keep away from growing the understanding value.

- ^It’s referred to as a theoretical mannequin as a result of precise tendencies are not often so easy. Simplification is for the aim of facilitating understanding, please take note of the variations between principle and actuality.

- ^Not all weak breakouts are ineffective, they’re all legitimate breakouts and could be chosen in keeping with private preferences to filter the market.

[ad_2]