[ad_1]

II. Elementary Data

- Structural basis:

- Estimating course primarily based on construction

- Regardless of how different the shape, construction breaks all of it

- The function of construction in buying and selling

- Provide and demand basis:

- Provide and demand buying and selling technique primarily based on construction

Regardless of how different the shape, construction breaks all of it

The important thing to simplifying technical patterns

In technical evaluation, chart patterns play a major function, and merchants use the patterns shaped by value actions to foretell future tendencies. Widespread patterns embody head and shoulders, flags, wedges, triangles, rectangles, and others.

Drawing all types of technical chart patterns precisely is among the fundamental expertise of conventional merchants. Nevertheless, it’s a frequent false impression that technical evaluation is all about drawing traces, shapes, tendencies, helps and resistances, and turning factors.

Actually, all patterns are a part of the vary or adjustment, which is the place that pattern merchants need to keep away from and that vary merchants want. Market construction is an idea that’s adept at coping with oscillations, and it doesn’t require consideration of vary help and resistance ranges, solely ready for it.

Merchants ought to break down the market habits into varied patterns within the studying stage.Nevertheless, when buying and selling, it’s best to reverse engineer the foundations and obtain a unification of assorted patterns to make fast choices. It’s just like the butcher who can carve up an ox regardless of how it’s formed. Novice merchants don’t have to memorize and draw chart patterns themselves.

This text shares using two reversal constructions [1] to cope with varied technical patterns. The market construction consists of assorted reversal factors, i.e., wave factors/tops and bottoms. Reversal has two fundamental constructions: construction break and affirmation of upper/decrease factors.

The 2 reversal constructions are separated for higher studying, however they must be unified when utilized. Upon cautious statement, it may be seen that there’s just one reversal construction, which is the frequent level of the 2 fundamental constructions – structural breakthrough.

The true Holy Grail for merchants

Breakouts are manifested microscopically as engulfing patterns and consecutive candlesticks, and macroscopically as structural breakouts and tendencies. Breakouts characterize power, and could be seen as funds successful the sport or costs turning into unbalanced. These all imply the identical factor, and personally, I want to make use of the idea of imbalance.

Successfully figuring out and buying and selling the imbalanced factors in market construction is the important thing skill to revenue in random markets and the actual Holy Grail for merchants to achieve a bonus.

The trail to buying and selling is huge and different. What I’m sharing is only one perspective, and I solely have the expertise of a first-year buying and selling scholar. Nevertheless, utilizing different strategies didn’t yield income for me, and it was construction that led me to really step into the buying and selling threshold and catch a glimpse of the magnificent corridor of value habits. Hopefully, by means of this text, I can encourage these wandering outdoors the buying and selling threshold to discover a course ahead.

The best way to commerce patterns with construction

Market construction can’t be predicted, and requires ready for costs to maneuver, after which following the power. Nevertheless, merchants may uncover robust imbalances in sample ranges forward of time by means of statement and coaching, which falls inside the realm of non-public skill and won’t be mentioned additional on this article.

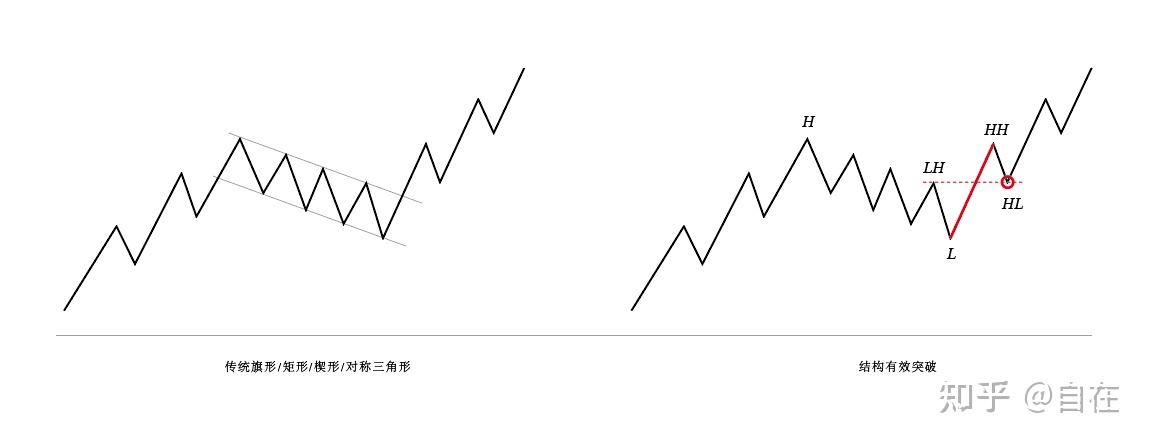

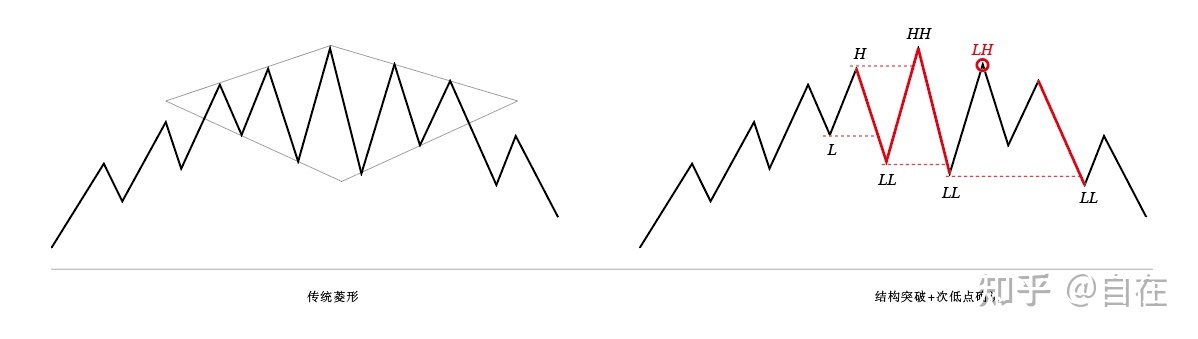

From a structural perspective, the processing technique for flag patterns, rectangular patterns, and wedge patterns is similar. There are three variations of triangle patterns, two of which, symmetrical triangles and ascending/descending triangles, are much like flag patterns. Solely increasing triangles and diamonds require examples to elucidate. There are two variations of head and shoulder patterns, one being an ordinary head and shoulders, and the opposite being the identical as double tops/bottoms.

Flags/Rectangles/Wedge/Symmetric Triangles

Conventional evaluation makes use of trendlines or channels to evaluate, however mischievous candlesticks all the time cross trendlines, so the rule is added to disregard shadows and solely draw trendlines/channels primarily based on closing costs.

When utilizing structural buying and selling, the primary focus is on whether or not costs break by means of the earlier construction. For instance, on the fitting facet of the determine under, the purple strong line breaks by means of the earlier excessive and varieties a better excessive level, which could be thought of as an entry level on the purple circle.

I have to level out two issues: 1. Coming into the market on the HL level within the purple circle is a dangerous entry. It’s extra more likely to anticipate a break above HH after which enter on a pullback. 2. After the purple line breaks, the pullback could not essentially retest the construction precisely, it might pull again deeper or shallower, however so long as a subsequent low is shaped, it’s thought of legitimate.

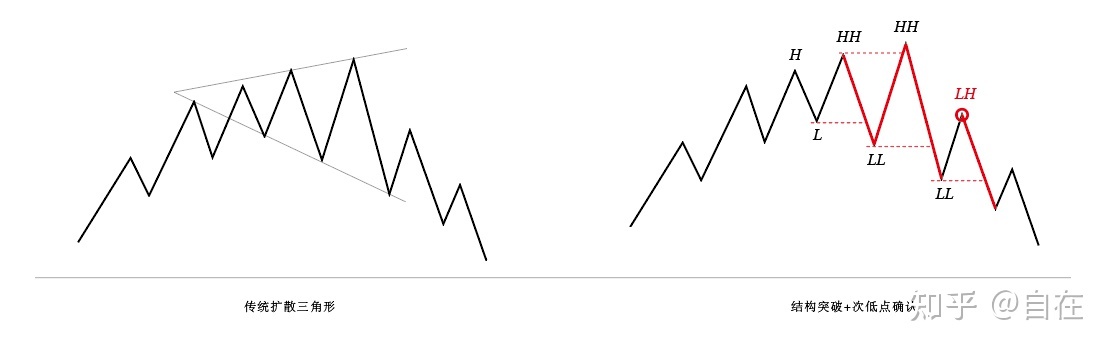

Broadening triangles/diamonds

Broadening triangles/diamonds could get away in each instructions and require affirmation of a subsequent excessive or low earlier than buying and selling. Within the instance on the fitting within the determine under, a subsequent excessive is confirmed on the purple circle (confirmed by means of structural breakout), indicating the course of the market.

Head and shoulders patterns/double tops and bottoms

Reference:

- ^ “The best way to catch tops and bottoms: an introduction to market construction” SMC Buying and selling Half 2 – Buying and selling Programs – 10 April 2023 – Merchants’ Blogs (mql5.com)

- ^ “Variations” refers back to the totally different dealing with strategies in the course of the formation of the sample.

[ad_2]