[ad_1]

The actual reply is that every one state and native employees must be lined by Social Safety.

A new report from the Congressional Analysis Service seems to have rekindled the controversy surrounding the Windfall Elimination Provision (WEP). This provision reduces Social Safety advantages for employees receiving important authorities pensions from jobs not lined by Social Safety. A companion provision – the Authorities Pension Offset (GPO) – makes comparable changes for his or her spouses and survivors.

The WEP and GPO infuriate state and native staff, who really feel like they’re unfairly being denied advantages. My view is that these provsions are well-intentioned – albeit imperfect – makes an attempt to unravel an fairness concern that arises as a result of about 25-30 % of state and native employees aren’t lined by Social Safety.

Exclusion from Social Safety creates two forms of issues. First, staff missing protection are uncovered to a wide range of gaps in fundamental safety – most notably within the areas of survivor and incapacity insurance coverage. Second, uncovered state and native employees can acquire minimal protection below Social Safety and – till the introduction of the WEP in 1983 – might revenue from the progressive profit construction, which was designed to assist low-wage employees.

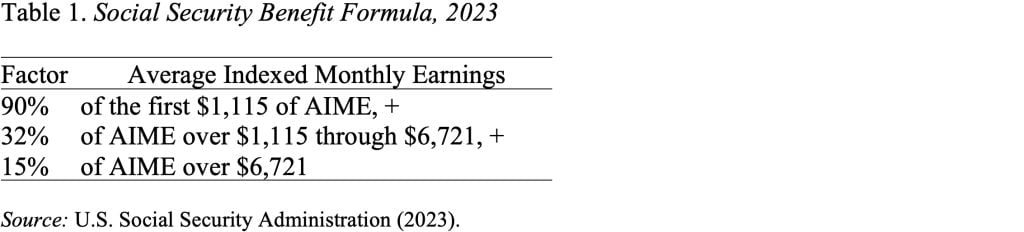

To see how that occurs, have a look at the Social Safety profit formulation. It applies three elements to the person’s common listed month-to-month earnings (AIME). Thus, an individual’s profit can be the sum of 90 % of the primary $1,115 of AIME, 32 % of AIME between $1,115 and $6,721, and 15 % of AIME over $6,721 (see Desk 1).

Since a employee’s month-to-month earnings are averaged over a typical working lifetime (35 years), a high-wage earner with a brief time frame in lined employment appears to be like precisely like a low-wage earner. Each would have 90 % of their earnings changed by Social Safety.

Equally, a partner who had a full profession in uncovered employment – and labored in lined employment for under a short while or in no way – can be eligible for the partner’s and survivor’s advantages.

The WEP is designed to get rid of these inequities by decreasing the primary issue within the profit formulation from 90 % to 40 %; the 32 % and 15 % stay unchanged. It’s not an ideal answer – the profit lower is proportionately bigger for employees with low AIMEs, no matter whether or not they have been a high- or low-earner of their uncovered employment. Albeit, the WEP does assure that the discount in advantages can’t exceed half of the employee’s public pension, which protects these with low pensions from uncovered work. (It is usually value noting that the WEP doesn’t have an effect on advantages for survivors.)

To make the WEP fairer, Rep. Kevin Brady (R-TX) has repeatedly launched laws with a brand new formulation. First, the common Social Safety elements can be utilized to all earnings – each lined and uncovered – to calculate a profit. The ensuing profit then can be multiplied by the share of the AIME that got here from lined earnings. Such a change would produce smaller reductions for the decrease paid and bigger reductions for the upper paid. And people would obtain the upper of their profit below a present legislation WEP or the proportional formulation. That may be a higher strategy. Rep. Richard Neal (D-MA) launched an analogous invoice in 2021. Whereas the WEP could possibly be improved, the forces for eliminating it are formidable. This standoff raises the query whether or not it’s well worth the bother of making an entire new process when the actual reply is to increase Social Safety protection to all state and native employees. Common protection would supply higher safety for employees, get rid of the fairness drawback, and permit us to place this contentious concern behind us.

[ad_2]