[ad_1]

Information breaches within the monetary sector have change into a serious concern for companies and customers alike. With the rising reliance on digital transactions and information storage, it has change into extra vital than ever for monetary establishments to make sure that their information is safe. Sadly, because of the complexity of monetary techniques and the potential for malicious actors to take advantage of weaknesses in safety protocols, information breaches have gotten extra widespread on this sector. In line with American Banker, 79 monetary establishments reported information breaches affecting over 1,000 prospects in 2022. This determine is more likely to enhance within the years to come back.

Sadly, the monetary establishments themselves aren’t the one potential goal for cyberattacks. Whereas information breaches can have an effect on many shoppers directly, it is usually potential for hackers to focus on particular person customers. That is particularly widespread as extra hackers use AI-driven methods to commit cyberattacks.

This text will discover the causes of those information breaches, in addition to potential options that may be carried out to guard towards information breaches.

How Merchants Can Mitigate the Dangers of Information Breaches and AI-Pushed Cyberattacks

On-line buying and selling carries with it a sure diploma of danger. Cybersecurity is a crucial issue to contemplate when participating in on-line buying and selling. It’s important for merchants to concentrate on the potential dangers and take steps to mitigate them. This text will talk about the assorted cybersecurity dangers related to on-line buying and selling and supply methods for lowering these dangers. We will even have a look at a number of the use circumstances of AI-based instruments that may assist merchants defend their information and investments from malicious actors. It’s extra vital than ever to take the proper precautions as extra hackers are leveraging AI to reap the benefits of their victims, as this text from CNBC identified final September.

On-line buying and selling has change into a paramount a part of the funding world. Nevertheless, it’s each dealer’s proper to know that the comfort of on-line buying and selling comes with a number of dangers of cyber threats. Due to this fact, merchants should perceive the necessity for safe platforms to take all crucial precautions to guard their investments. On this article, we’ll discover the significance of safety in on-line buying and selling and spotlight some examples of safe buying and selling platforms and in the end assist the reader to have the facility to thrive over the vulnerabilities the place cyber criminals trying to exploit their accounts. You may learn this text that we beforehand coated on stopping cyberattacks.

Phishing Assaults

For sure, cyberattacks have change into extra refined and internationally focused lately, affecting monetary establishments and merchants worldwide. To place this in perspective, one of the crucial important threats going through merchants is phishing assaults, the place the assaults come within the type of an e mail or a message, often pretending to be from a official monetary establishment or perhaps a buying and selling platform. The message will most likely include a hyperlink to a pretend login web page, the place the dealer enters their login credentials, permitting the hacker to entry their account.

One such high-profile instance of such a assault comes from the 2016 hack of the Bangladesh Financial institution the place hackers despatched a pretend cost instruction to the Federal Reserve Financial institution of New York, ensuing within the switch of a whopping $81 million to defrauding accounts. Clumsy as it’s, the hack was made potential by the hackers acquiring the login credentials of Bangladesh Financial institution officers via a phishing assault.

With a view to stop phishing assaults, each dealer or establishment ought to all the time double-check the URL of the buying and selling platform they’re utilizing and keep away from clicking on hyperlinks in unsolicited emails or messages, and as a further safety measure, merchants ought to allow two-factor authentication (2FA), which requires them to enter a further code together with their login credentials.

Malware

One different important menace to merchants is malware. And sadly, malware can are available in many types, together with viruses, Trojan horses, and spy ware which is tough for even a little bit tech-savvy individual to detect generally. And as soon as put in on a dealer’s system, malware will work to gather delicate info, akin to login credentials or private info, and ship it to the hacker.

One of these assault, an enormous one occurred within the 2013 Goal breach, the place hackers put in malware on Goal’s cost processing system, permitting them to steal bank card info from tens of millions of shoppers. And to stop malware assaults, merchants ought to all the time use up-to-date antivirus software program and keep away from downloading information or software program from untrusted sources. Moreover, merchants ought to think about using a safe buying and selling platform, such because the MetaTrader 5 Net Terminal, which is designed to be safe and usually up to date to guard towards new threats.

In 2022, it was additionally reported by researchers that one among such notorious malware, Medusa Android banking Trojan’s an infection charges have elevated and that extra geographic areas have gotten focused. It’s of concern that the malware goals to steal on-line affected customers’ credentials to go on and carry out monetary fraud. The readers can discover the timeline of many such cyber incidents to know how weak even so-called very robust establishments, banks, and even block-chain non-public corporations had been. On account of these happenings, monetary establishments and merchants alike ought to take substantial and strong safety measures. Now let’s have a look at a number of methods that may support this matter.

Via Public Wi-Fi networks

Lastly, merchants ought to pay attention to the dangers related to utilizing public Wi-Fi networks. Public Wi-Fi networks are sometimes unsecured, making them a major goal for hackers trying to intercept information transmitted over the community.

An notorious instance of such a assault is the 2014 JPMorgan Chase breach. On this case, hackers accessed the financial institution’s community via a compromised worker’s laptop linked to a public Wi-Fi community. The breach resulted within the theft of non-public info from over 76 million households and seven million small companies.

To stop assaults on public Wi-Fi networks, merchants ought to keep away from logging into their accounts or transmitting delicate info whereas linked to public Wi-Fi. As a substitute, merchants ought to use a digital non-public community (VPN) to encrypt their information and defend towards interception.

Other than Phishing assaults, Malware assaults, and Ransomware assaults, there are additionally dangers, assaults, and threats akin to Distributed denial of service (DDoS) assaults, Insider threats, Weak passwords, Unsecured networks and gadgets, Social engineering assaults, Third-party safety dangers which one must be afraid of. To stop them listed below are some measures which an previous or new dealer or establishment ought to make obligatory and observe.

Multi-factor authentication

To spotlight once more, one-way merchants can defend themselves is through the use of safe buying and selling platforms. These platforms supply options akin to multi-factor authentication, encryption, and safe login procedures to make sure merchants’ accounts stay protected against unauthorized entry.

GDPR

Compliance with laws such because the Basic Information Safety Regulation (GDPR) is an important characteristic and key attribute of protected and safe buying and selling platforms. By guaranteeing that merchants’ info is safe, the GDPR minimizes the probabilities of information breaches by introducing tips for dealing with and storage.

To remain forward within the sport, each dealer must also pay attention to platforms that supply wealthy safety features like superior order administration and a variety of technical indicators. Making knowledgeable selections can reduce the chance of dropping cash if merchants reap the benefits of these options.

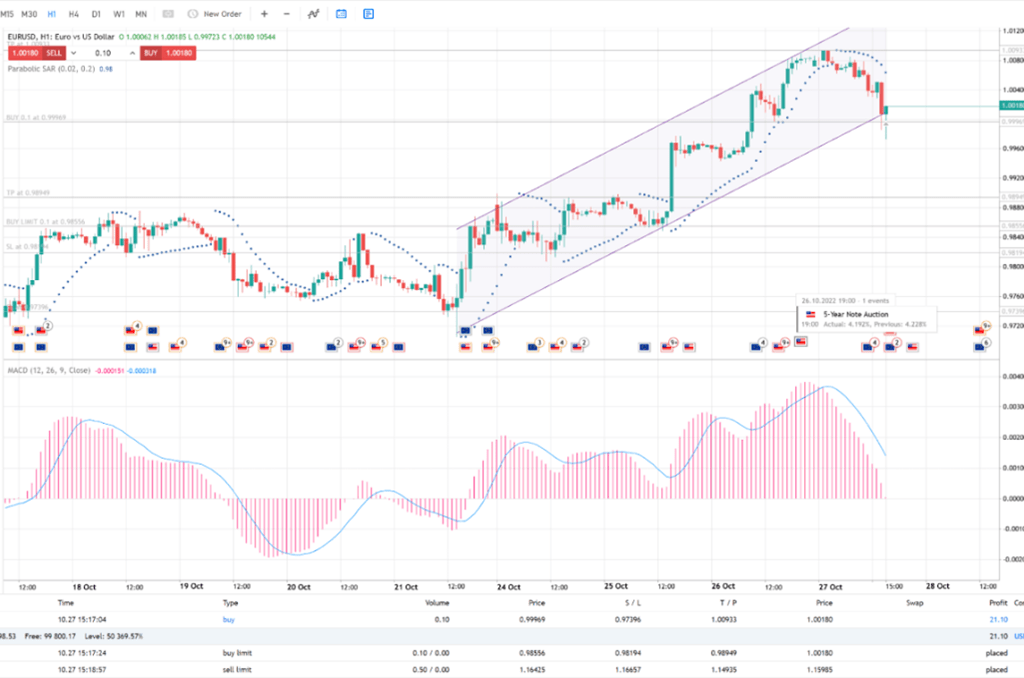

Buying and selling on-line may be tough, and searching for a dependable on-line buying and selling platform is usually a daunting activity however discovering the proper platform could make all of the distinction. Take, as an illustration, the MetaTrader 5 Net Terminal not solely does it adhere to GDPR tips, however it additionally presents superior encryption know-how to maintain your information secure. And prime of that, one can entry it from any system, with out having to obtain any software program. This Net Terminal, adheres to 6 ideas of safety, together with the most recent encryption know-how, information safety, and safe login procedures, with that we will say it’s a new customary for on-line buying and selling and for a grateful portfolio, because it additionally permits merchants to work straight from their browsers.

And that’s not all, It was re-created from scratch, to work even sooner; and with market depth and technical indicators, an online terminal makes it straightforward to make knowledgeable selections and keep forward of the curve. It’s no marvel why it’s rapidly changing into the go-to platform for merchants of all ranges. Therefore, all the time prioritize safety when selecting a web based buying and selling platform.

Buyers Should Cut back the Dangers of Cyberattacks and Information Breaches When Making Trades On-line

Merchants ought to prioritize safety that’s up-to-date when selecting a web based buying and selling platform. Merchants face important dangers from cyber threats, together with phishing assaults, malware, and assaults on public Wi-Fi networks. Cyber threats are a major danger for merchants within the digital age. To guard towards these threats, merchants ought to all the time be vigilant and take steps to safe their accounts, akin to utilizing two-factor authentication, up-to-date antivirus software program, safe buying and selling platforms and others, and merchants ought to conduct thorough analysis to seek out the most effective platform for his or her wants. By taking these steps, merchants may also help defend themselves from cyber-attacks and commerce with confidence understanding that their accounts are safe.

[ad_2]