[ad_1]

Introduction

Buying and selling within the monetary markets could be a daunting activity for rookies. The huge quantity of data and evaluation that must be performed will be overwhelming. To assist simplify the method, many merchants flip to automated buying and selling instruments comparable to MQL5 indicators and Skilled Advisors (EAs). Nevertheless, selecting the best sign or EA will be difficult. On this article, we’ll present some recommendations on the right way to choose the correct MQL5 sign or EA on your buying and selling plan.

What’s an MQL5 Sign?

MQL5 Alerts is a service offered by MetaQuotes, the developer of the MetaTrader buying and selling platform. It’s a social buying and selling community that permits merchants to repeat trades of profitable merchants from around the globe. MQL5 indicators will be purchased or bought within the MQL5 Market, and will be executed routinely in your buying and selling account.

Tip #1: Examine the Portfolio Monitor File

When deciding on an MQL5 sign, it’s essential to examine the portfolio observe document. The portfolio observe document ought to have a minimal of 6 months of buying and selling historical past. It’s also necessary to examine the revenue and loss (P/L) and the drawdown of the sign.

Drawdown is the proportion decline of the account stability from the very best peak to the bottom trough. A drawdown of greater than 25% is taken into account excessive and needs to be prevented. A excessive drawdown might imply that the technique utilized by the sign is excessive threat and will result in important losses.

Tip #2: Examine the Sign Supplier’s Background

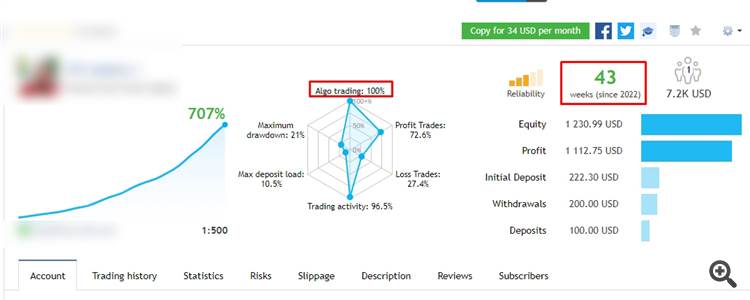

It’s also important to examine the background of the sign supplier. If the sign supplier makes use of an Skilled Advisor (EA) to execute trades, it is strongly recommended to decide on a sign supplier who can also be an EA developer. This ensures that the EA used within the sign is updated with the newest market situations and buying and selling methods. The best way to make sure that an MQL5 Sign is run by an Skilled Advisor is to have a look at the proportion worth of Algo Buying and selling. Ensure the Buying and selling Algo of an Skilled Advisor is 100% which signifies that the sign is definitely executed by an Skilled Advisor with none intervention by the dealer. If AlgoTrading shouldn’t be 100% or lower than 100%, you may make certain that the account shouldn’t be run by an Skilled Advisor or there’s a technical drawback that causes the worth of AlgoTrading to drop.

Determine 1. Instance of a sign portfolio within the pink Algo Buying and selling field, the size of time this buying and selling account was run utilizing an Skilled Advisor, and the drawdown worth on the Sign.

Tip #3: Monitor the Sign Efficiency Commonly

After deciding on an MQL5 sign, it’s important to watch the sign’s efficiency repeatedly. This ensures that the sign continues to be performing in accordance with the preliminary expectations. A sign that has been worthwhile prior to now might not essentially stay worthwhile sooner or later.

Tip #4: Use a Threat Administration Technique

Utilizing a threat administration technique is significant in buying and selling. It ensures that you don’t lose all of your capital in a single commerce. It’s endorsed to make use of a hard and fast proportion of your buying and selling account stability per commerce. This proportion needs to be primarily based in your threat tolerance and buying and selling type.

What’s an Skilled Advisor?

An Skilled Advisor (EA) is an automatic buying and selling system that executes trades primarily based on a algorithm. It’s programmed within the MQL language and can be utilized on the MetaTrader platform. EAs can be found within the MQL5 Market and will be bought or rented for a charge.

Tip #5: Attempt the Demo Model of the EA

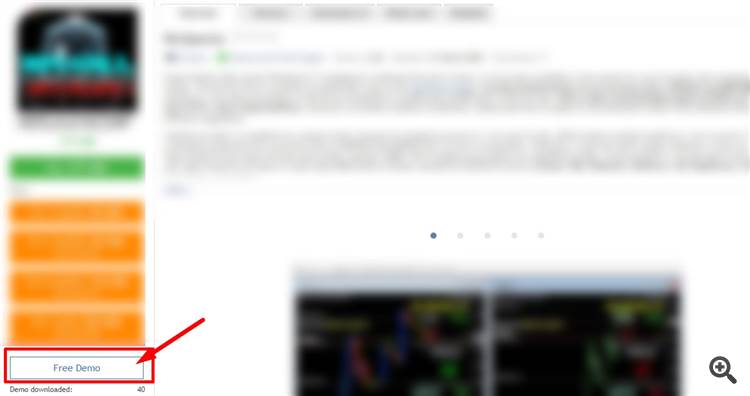

Earlier than shopping for an EA, it’s important to attempt the demo model of the EA. The demo model permits you to take a look at the EA’s efficiency on historic knowledge with out risking your capital. It’s endorsed to check the EA on a minimum of one yr of historic knowledge. Within the instance beneath, once you select an Skilled Advisor on MQL5 Market, on the left aspect, you’ll discover a hyperlink to attempt the Demo model offered. You possibly can backtest utilizing the Technique Tester offered by the Metatader 4 or Metatrader 5 terminal.

Determine 2. Place of the Skilled Advisor demo model hyperlink on MQL5 Market

Tip #6: Examine the Drawdown of the EA

Just like the MQL5 sign, it’s essential to examine the drawdown of the EA. A drawdown of greater than 25% is taken into account excessive and needs to be prevented. It’s also important to examine the revenue issue of the EA. The revenue issue is the ratio of the gross revenue to the gross loss.

Tip #7: Monitor the EA Efficiency Commonly

After buying an EA, it’s important to watch the EA’s efficiency repeatedly. This ensures that the EA continues to be performing

in accordance with expectations and isn’t experiencing any points. Monitoring the EA repeatedly may also enable you determine any modifications that must be made to the EA or your buying and selling plan.

Tip #8: Use a VPS for Automated Buying and selling

Utilizing a Digital Personal Server (VPS) for automated buying and selling will be useful. A VPS permits your buying and selling platform and EA to run 24/7 with out interruption, guaranteeing that your buying and selling plan is executed in accordance with your technique. A VPS additionally offers a steady web connection and reduces the chance of energy outages or pc crashes.

Tip #9: Have Reasonable Expectations

When utilizing automated buying and selling instruments comparable to MQL5 indicators or EAs, you will need to have life like expectations. No buying and selling technique is 100% worthwhile, and losses are inevitable. It is very important have a sensible revenue goal and to not anticipate to get wealthy fast. A worthwhile buying and selling plan takes effort and time to develop, and you will need to be affected person and constant in your strategy.

Tip #10: Keep away from Over-Optimization

Over-optimization is the method of making a buying and selling system that’s particularly designed to suit historic knowledge. That is performed through the use of advanced algorithms and adjusting parameters to suit previous market situations. Whereas this may occasionally end in spectacular backtesting outcomes, it doesn’t essentially imply that the system will carry out nicely sooner or later. In actual fact, over-optimized methods are sometimes too inflexible and rigid to adapt to altering market situations.

To keep away from over-optimization, you will need to use a easy and strong buying and selling system that may adapt to altering market situations. Keep away from utilizing too many indicators or parameters, and as an alternative concentrate on the basics of the market and the particular situations that you’re buying and selling in.

Tip #11: Contemplate the Dealer’s Buying and selling Circumstances

When deciding on a sign or EA, you will need to contemplate the dealer’s buying and selling situations. This consists of elements comparable to spreads, commissions, and order execution velocity. Buying and selling with a dealer that has excessive spreads or commissions can considerably scale back your profitability, whereas gradual order execution can result in missed buying and selling alternatives.

To make sure that you’re buying and selling with a dealer that gives optimum buying and selling situations, you will need to do your analysis and evaluate completely different brokers. Search for a dealer that provides aggressive spreads and commissions, quick order execution, and dependable buyer help.

Tip #12: Use A number of Alerts or EAs

Utilizing a number of indicators or EAs may also help diversify your buying and selling portfolio and scale back the chance of counting on a single buying and selling system. By utilizing a number of indicators or EAs, you may benefit from completely different buying and selling methods and market situations.

When utilizing a number of indicators or EAs, you will need to be certain that they don’t seem to be correlated and that they don’t seem to be buying and selling the identical forex pairs or markets. It’s also necessary to make use of correct threat administration strategies, comparable to adjusting lot sizes or utilizing a portfolio strategy.

Tip #13: Keep Knowledgeable About Market Information and Occasions

Staying knowledgeable about market information and occasions may also help you make knowledgeable buying and selling choices and modify your buying and selling plan accordingly. This consists of monitoring financial knowledge releases, central financial institution bulletins, and geopolitical occasions.

By staying knowledgeable about market information and occasions, you may anticipate potential market strikes and modify your buying and selling technique accordingly. This may also help you keep away from surprising losses and benefit from worthwhile buying and selling alternatives.

Tip #14: Constantly Consider and Enhance Your Buying and selling Plan

Lastly, you will need to constantly consider and enhance your buying and selling plan. This consists of monitoring the efficiency of your indicators or EAs, adjusting your threat administration technique, and making modifications to your buying and selling plan as wanted.

By constantly evaluating and bettering your buying and selling plan, you may keep forward of the market and adapt to altering situations. This may also help you obtain long-term profitability and success within the foreign exchange market.

Conclusion

In conclusion, selecting the best MQL5 sign or EA will be difficult for rookies. By following the guidelines talked about on this article, you may improve your possibilities of deciding on a worthwhile sign or EA that matches your buying and selling plan. Bear in mind to at all times monitor the efficiency of your sign or EA repeatedly and use a threat administration technique to guard your capital. With the correct strategy, automated buying and selling instruments could be a worthwhile addition to your buying and selling plan.

[ad_2]