[ad_1]

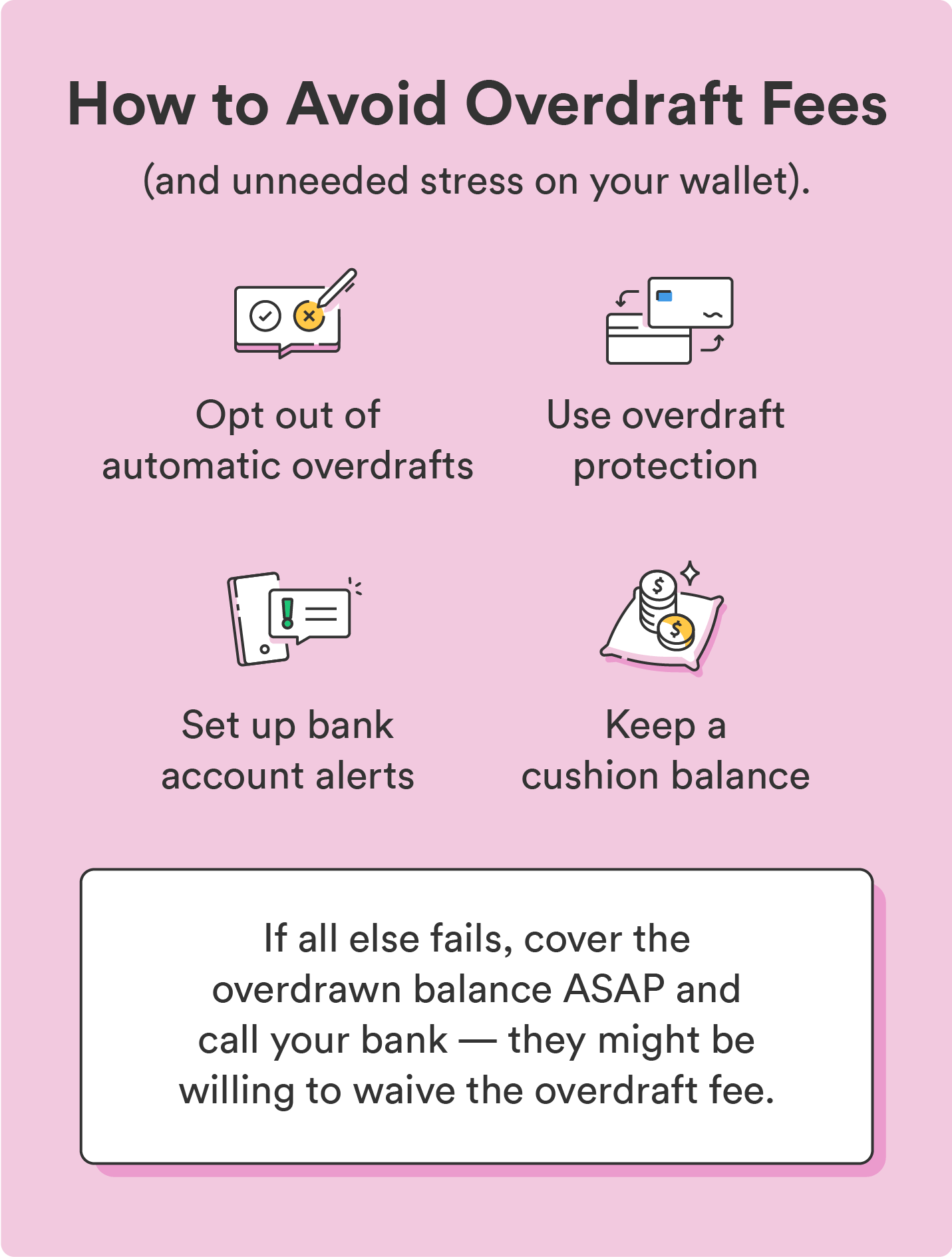

Avoiding overdraft charges is pretty easy in the event you’re proactive together with your account and funds. Use the ideas under to keep away from paying overdraft charges.

1. Choose out of computerized overdrafts

While you open a checking account, banks could provide the choice to opt-in for computerized overdrafts. Meaning you’ll be able to reject computerized overdrafts, stopping you from ever having to pay an overdraft payment within the first place.

This disclosure is normally within the paperwork the financial institution supplies if you open the account — search for it within the part overlaying account opening disclosures.

The caveat to this technique is that in the event you opt-out, you’ll don’t have any method to cowl a purchase order exceeding your obtainable stability. The financial institution will return any failed funds to you as “unpaid” — until you join overdraft safety, which we’ll focus on under.

2. Use overdraft safety (hyperlink to a secondary account)

When you have a financial savings account or a second checking account tied to your important account, take into account signing up for overdraft safety in case your financial institution gives it (not all do). However what’s overdraft safety?

Overdraft safety is a service that means that you can hyperlink your important checking account to a different account, like your financial savings or a secondary checking account. This manner, the financial institution will pull funds out of your secondary account to cowl an overdrawn cost — and enable you keep away from an overdraft payment.

That stated, there should be a payment for this service, however it’s possible decrease than the price of an overdraft cost.

3. Arrange account alerts

One frequent cause individuals wind up with overdraft charges is that they carry a low account stability. A straightforward answer is to arrange account alerts so that you all the time know when your stability drops previous a specific amount.

4. Use a service that doesn’t cost overdraft charges

Whereas some banks nonetheless cost overdraft charges, lots have eradicated them. Should you’re susceptible to frequent overdraft costs, take into account switching to a financial institution with decrease or no charges to eradicate the problem.

5. Cowl the overdrawn cost as quickly as potential

It’s finest to cowl overdrawn costs as quickly as potential — particularly in the event you financial institution someplace that may dismiss the overdraft payment in the event you pay the unfavourable stability inside a enterprise day. Verify together with your financial institution to see if they provide this.

Should you can’t discover a solution on their web site, name customer support — even when your financial institution doesn’t formally provide this service, it’s value asking if it could get your overdraft payment cleared.

[ad_2]