[ad_1]

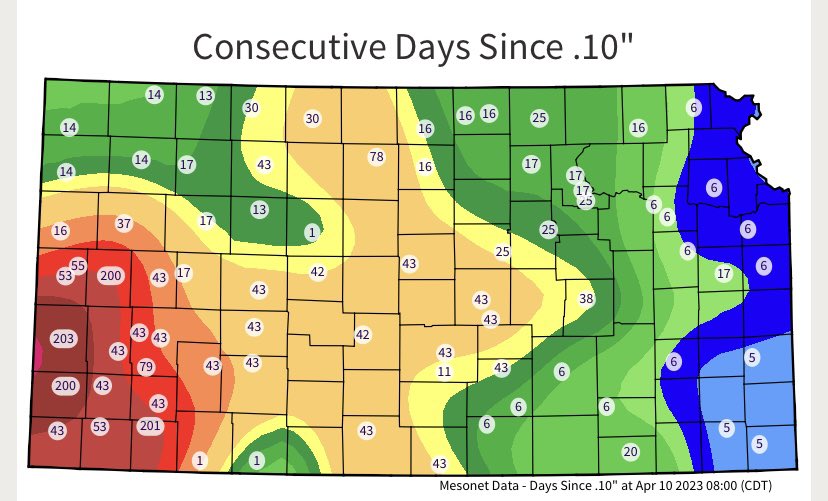

The chart exhibits what number of days have handed since any vital rain within the main crop rising areas within the U.S.

Preliminary yield estimates for this yr’s U.S. winter wheat crop have been hammered by persistent drought. 12 Southwest Kansas counties dominate the world of drought. Wheat, corn, and oats are the most important crops. But the futures costs don’t replicate these rising (pun meant) considerations.

A part of the reason being that Russia, the principle exporter of wheat, is promoting the grain at an enormous low cost.

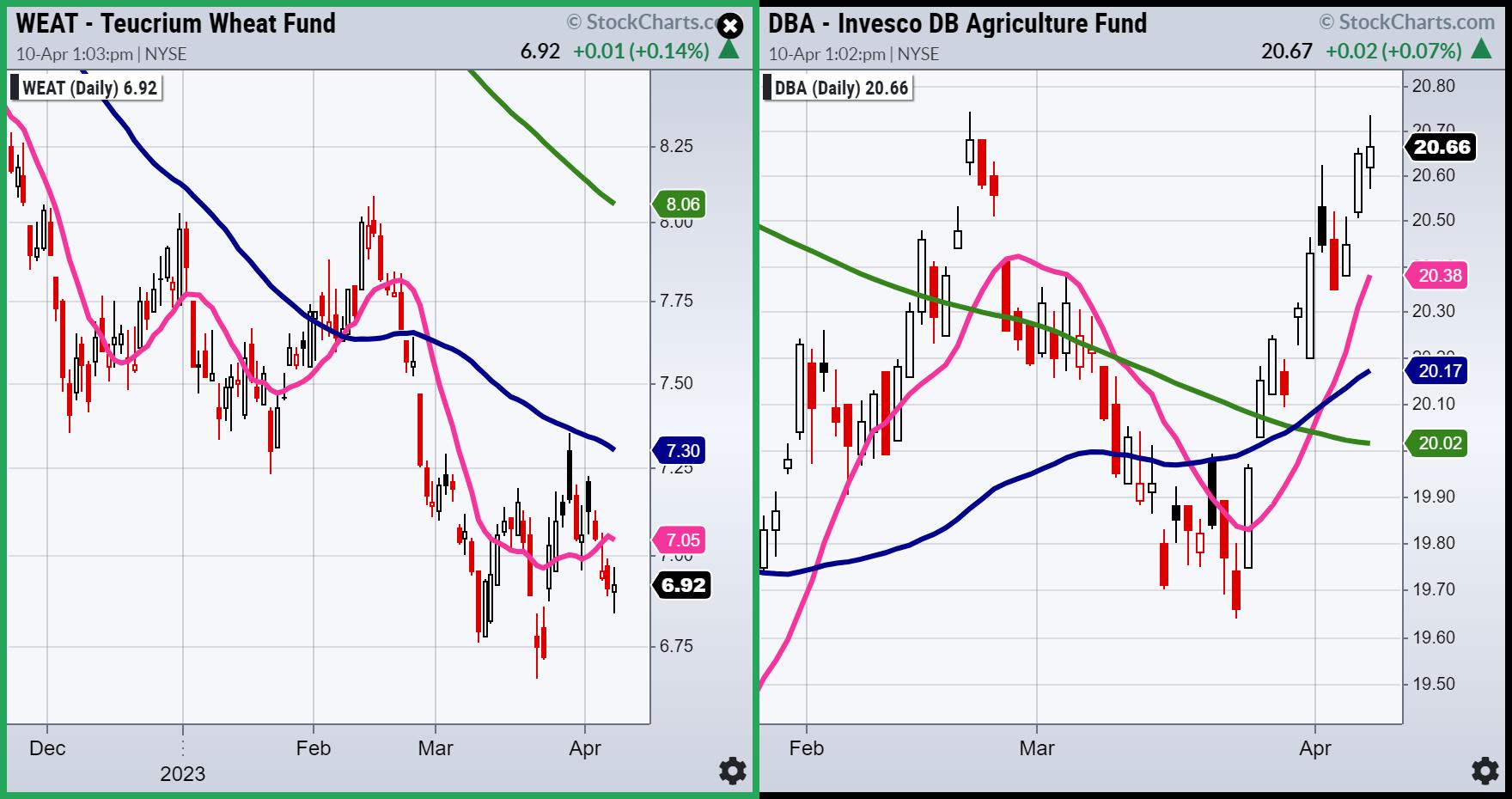

Nonetheless, a few weeks in the past on March twenty eighth, we featured the agricultural ETF DBA as a purchase alternative. And over this previous weekend, our Market Outlook mentions that one large danger off indicator is that the “Delicate Commodities (DBA) made a golden cross proper as they’re operating into multi-month technical resistance and are already at probably overbought ranges on each value and momentum. based on Actual Movement. Nonetheless, if DBA takes out the $21 degree, then it will sign a breakout of a multi-year base.”

So right here we’re with drought, technical resistance, and one other very low danger entry for wheat or WEAT the ETF.

Over the weekend, we wrote about Regional Banks (KRE) as a possible double backside and key to this data-heavy week. As a aspect notice, KRE remained inexperienced on Monday. One other push increased, and most of the picks from the weekend’s Every day also needs to work out.

Again to mom nature, although — 2 charts and a couple of distinct views. The chart on the left is of WEAT, the ETF for wheat futures. In a day by day timeframe, it’s in a bearish section. Nonetheless, it’s holding the March low and, via the cyan line, might arrange for an extended with an excellent cease level.

DBA, in a powerful bullish section, now has 2 tops at 20.75 (right now and in February). Ought to that clear, 22.00 is the following goal.

Lastly,

Be part of Mish together with Bob Lang from Explosive Choices for a technique session for 2023!

- When: Tuesday, April 11

- Time: 4:30 ET

Click on right here to order your seat now!

On this presentation, you will uncover Mish and Bob’s outlook on:

- Latest occasions which have affected the markets – and their long-term impacts;

- What we would anticipate from the Fed’s financial coverage and rate of interest hikes this yr;

- The world of commodities;

- And most significantly: How one can strategy buying and selling for the rest of 2023.

Carry your questions, as a result of these classes are uncommon, interactive, and vigorous!

For extra detailed buying and selling details about our blended fashions, instruments and dealer schooling programs, contact Rob Quinn, our Chief Technique Marketing consultant, to be taught extra.

IT’S NOT TOO LATE! Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-Guide in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for day by day morning movies. To see up to date media clips, click on right here.

Mish and Charles Payne rip via a lot of inventory picks in this look on Fox Enterprise’ Making Cash with Charles Payne.

Mish talks Past Meat (BYND) on this look on Enterprise First AM.

On this visitor look on the Madam Dealer podcast, recorded March 20, Mish shares her journey from particular schooling trainer to commodoties dealer and now buying and selling educator. Hear her insights on the spring 2023 market circumstances and the best way to harness the fitting abilities to succeed.

Comply with Mish as she breaks down present market circumstances for her buddies throughout the pond on CMC Markets.

Mish talks about Dominion Vitality with Angela Miles in this look on Enterprise First AM.

Coming Up:

April eleventh: Webinar with Bob Lang and Twitter Areas with Mario Nawfal (8am ET)

April thirteenth: The Last Bar with David Keller on StockCharts TV and Twitter Areas with Wolf Monetary

April 24-26: Mish at The Cash Present in Las Vegas

Might 2-5: StockCharts TV Market Outlook

- S&P 500 (SPY): 405 help and 410 pivotal.

- Russell 2000 (IWM): 170 help, 180 resistance nonetheless.

- Dow (DIA): By 336.25 might go increased.

- Nasdaq (QQQ): 325 resistance, 314 10-DMA help.

- Regional banks (KRE): 41.28 March 24 low held, now has to clear 44.

- Semiconductors (SMH): 247 is probably the most vital help.

- Transportation (IYT): Held weekly MA help and now should clear 224.

- Biotechnology (IBB): Nice job altering phases to bullish, however should verify over 130.

- Retail (XRT): Do not wish to see this break beneath 59.75; greatest if clears 64.50.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Schooling

Mish Schneider serves as Director of Buying and selling Schooling at MarketGauge.com. For practically 20 years, MarketGauge.com has supplied monetary data and schooling to hundreds of people, in addition to to giant monetary establishments and publications corresponding to Barron’s, Constancy, ILX Programs, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary folks to observe on Twitter. In 2018, Mish was the winner of the Prime Inventory Choose of the yr for RealVision.

Subscribe to Mish’s Market Minute to be notified every time a brand new publish is added to this weblog!

[ad_2]