[ad_1]

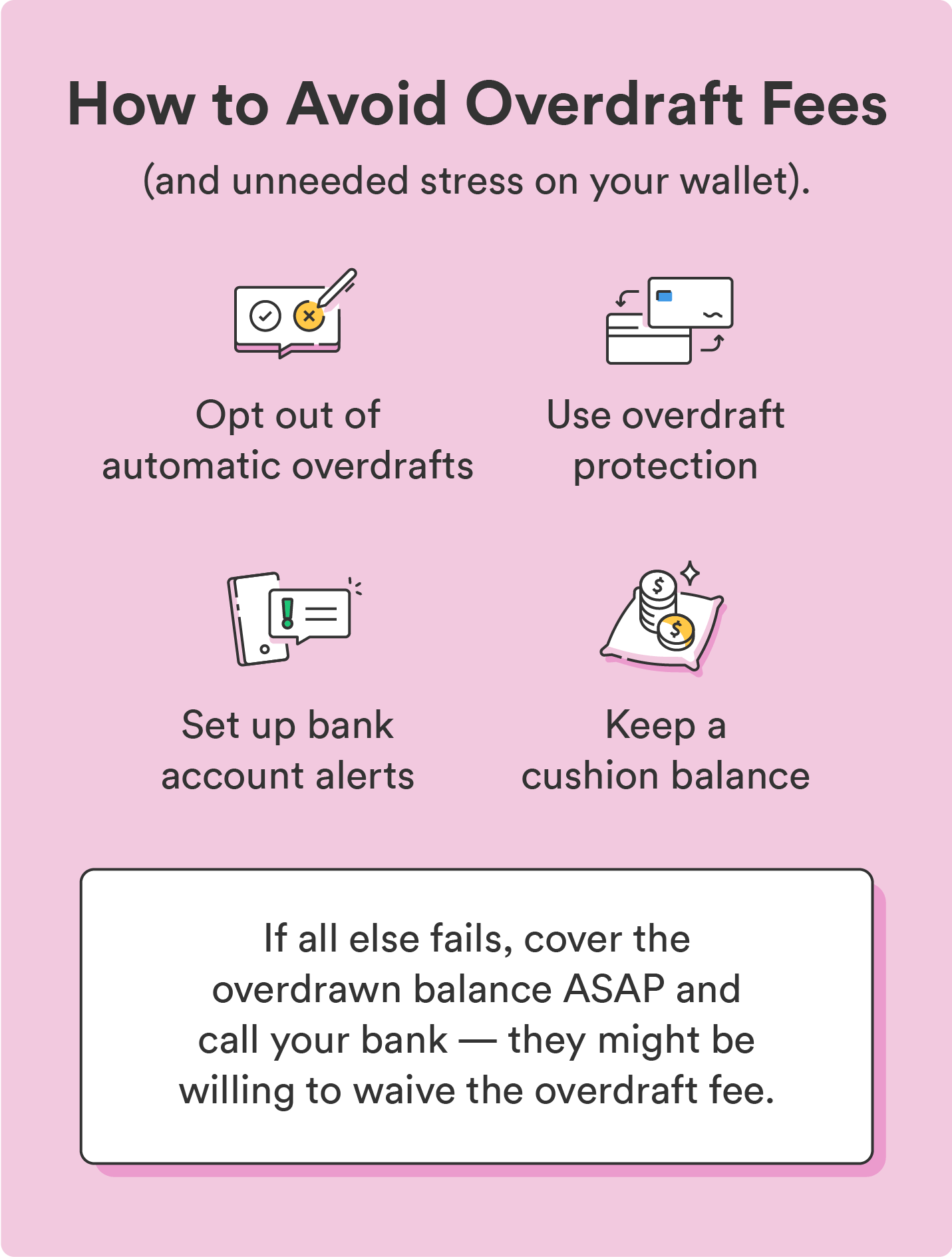

Avoiding overdraft charges is pretty easy in the event you’re proactive together with your account and finances. Use the ideas beneath to keep away from paying overdraft charges.

1. Decide out of computerized overdrafts

Whenever you open a checking account, banks might provide the choice to opt-in for computerized overdrafts. Meaning you may reject computerized overdrafts, stopping you from ever having to pay an overdraft payment within the first place.

This disclosure is often within the paperwork the financial institution offers while you open the account — search for it within the part masking account opening disclosures.

The caveat to this technique is that in the event you opt-out, you’ll haven’t any option to cowl a purchase order exceeding your accessible steadiness. The financial institution will return any failed funds to you as “unpaid” — except you join overdraft safety, which we’ll focus on beneath.

2. Use overdraft safety (hyperlink to a secondary account)

When you have a financial savings account or a second checking account tied to your fundamental account, think about signing up for overdraft safety in case your financial institution provides it (not all do). However what’s overdraft safety?

Overdraft safety is a service that lets you hyperlink your fundamental checking account to a different account, like your financial savings or a secondary checking account. This fashion, the financial institution will pull funds out of your secondary account to cowl an overdrawn cost — and assist you to keep away from an overdraft payment.

That stated, there should still be a payment for this service, however it’s doubtless decrease than the price of an overdraft cost.

3. Arrange account alerts

One frequent motive folks wind up with overdraft charges is that they carry a low account steadiness. A straightforward resolution is to arrange account alerts so that you at all times know when your steadiness drops previous a specific amount.

4. Use a service that doesn’t cost overdraft charges

Whereas some banks nonetheless cost overdraft charges, loads have eradicated them. If you happen to’re vulnerable to frequent overdraft fees, think about switching to a financial institution with decrease or no charges to eradicate the problem.

5. Cowl the overdrawn cost as quickly as potential

It’s finest to cowl overdrawn fees as quickly as potential — particularly in the event you financial institution someplace that may dismiss the overdraft payment in the event you pay the unfavourable steadiness inside a enterprise day. Examine together with your financial institution to see if they provide this.

If you happen to can’t discover a solution on their web site, name customer support — even when your financial institution doesn’t formally supply this service, it’s price asking if it might get your overdraft payment cleared.

[ad_2]