[ad_1]

Welcome to this week’s Flight Path.

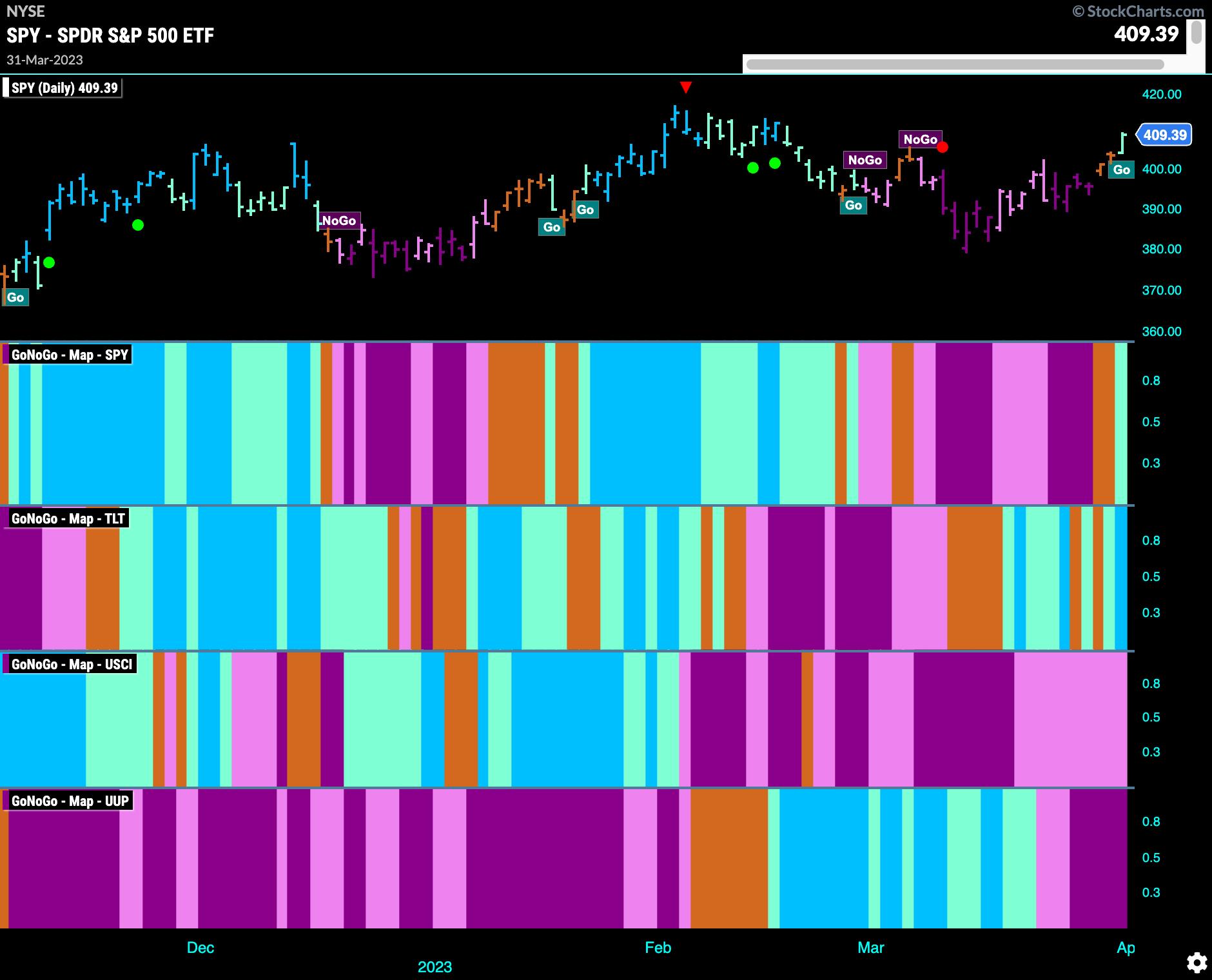

Have a look at the GoNoGo Asset map beneath. Equities have turned! There is a “Go” bar on the finish of the week that, as you may see, additionally strains up with a brand new “Go” development on the weekly chart. Treasury bond costs are additionally in a “Go” development, and the US greenback continues in its “NoGo” development. Commodities proceed to wrestle.

CHART 1: ASSET MAP. Equities have turned, as have Treasury bond costs. The US greenback and commodities proceed to wrestle.Chart supply: StockChartsACP. For illustrative functions solely.

Equities Break Out of Squeeze Into “Go” Development

The Max GoNoGo Squeeze we noticed on US equities final week was damaged this week—the GoNoGo Oscillator burst into optimistic territory, and that gave value the push it wanted to cycle via amber “Go Fish” and right into a “Go” development. There was an preliminary aqua bar on Friday as value moved larger.

CHART 2: EQUITIES BREAK OUT. The day by day chart of SPDR S&P 500 ETF (SPY) acquired a push to enter development mode.Chart supply: StockChartsACP. For illustrative functions solely.

The weekly chart continues to look robust. Final week’s aqua “Go” bar that began the “Go” development was adopted by a robust blue bar this previous week. As value places in one other larger low, the GoNoGo Oscillator broke out of a small GoNoGo Squeeze into optimistic territory on heavy quantity. Search for value to try a better excessive over the subsequent a number of weeks.

CHART 3: WEEKLY CHART OF SPY. Value may try a better excessive over the subsequent few weeks.Chart supply: StockChartsACP. For illustrative functions solely.

Treasury Yields Stay in “NoGo”

Treasury yields continued to color “NoGo” bars this week, albeit weaker pink ones. It has but to retest the assist ranges from every week in the past. GoNoGo Oscillator is now again on the zero line. It stays to be seen if it finds resistance. If it does, value may transfer decrease in an try and set new lows.

CHART 4: 10-YEAR US TREASURY YIELDS IN “NOGO” MODE. The GoNOGo Oscillator is again on the zero degree, which may act as a resistance degree.Chart supply: StockChartsACP. For illustrative functions solely.

On the weekly chart the development is exhibiting uncertainty with a second consecutive amber “Go Fish” bar. GoNoGo Development exhibits value has fallen out of the “Go” development that was in place for over a yr. The GoNoGo Oscillator is again beneath the zero line as effectively, indicating bearish momentum.

CHART 5: WEEKLY CHART OF 10-YEAR US TREASURY YIELDS. General, Treasury yields are indicating bearish momentum.Chart supply: StockChartsACP. For illustrative functions solely.

US Greenback Sees “NoGo” Development Strengthen

GoNoGo Development painted stronger purple bars this week because the development within the US greenback intensified. The GoNoGo Oscillator is in damaging territory, however not oversold. Search for this development to proceed as value seems to strategy prior lows.

CHART 6: INVESCO DB US DOLLAR INDEX BULLISH FUND (UUP) DAILY CHART. The development is down and can doubtless proceed as value seems to hit prior lows.Chart supply: StockChartsACP. For illustrative functions solely.

The weekly chart exhibits that the bigger timeframe development remains to be a “NoGo”. Portray one other robust purple “NoGo” bar, you possibly can see that GoNoGo Development is bound of the present development. The GoNoGo Oscillator is using the zero line for an additional week because the climbing grid of GoNoGo Squeeze climbs to its max. It is value watching to see through which path the squeeze is damaged.

CHART 7: WEEKLY CHART OF UUP SHOWS “NOGO” STRENGTHENED. The US greenback continues to say no on the weekly timeframe. The GoNoGo Squeeze Oscillator is on the zero line.Chart supply: StockChartsACP. For illustrative functions solely.

Oil Stays in Robust “NoGo” Development

America Oil Fund ETF (USO) sees its GoNoGo Development paint one other robust purple “NoGo” bar whilst value rallied final week. Properly beneath prior highs, the development stays in place. The GoNoGo Oscillator has once more risen to check the zero line from beneath on heavy quantity. Will this degree act as resistance? One thing to keep watch over.

CHART 8: OIL PRICES MAY TREND LOWER. Keep watch over the GoNoGo Oscillator’s resistance degree at zero.Chart supply: StockChartsACP. For illustrative functions solely.

Gold Consolidates Features

SPDR Gold Shares ETF (GLD) noticed extra “Go” bars this week, as value moved largely sideways since making a brand new excessive. Value is consolidating above prior highs from January, and the GoNoGo Oscillator has been in optimistic territory for the reason that new development emerged. Now, it is testing the zero line from above. The query is that if it will discover assist on the zero line.

CHART 9: GOLD LOOKS TO BE CONSOLIDATING. Look to see if value motion finds assist on the GoNoGo Oscillator zero line.Chart supply: StockChartsACP. For illustrative functions solely.

Sector RelMap

Under is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Development to the relative energy ratios of the sectors to the bottom index. Taking a look at this map, you possibly can see the place the relative outperformance is coming from and which sectors are lagging on a relative foundation. Three sectors are outperforming the bottom index this week—$XLK, $XLC, and $XLP are portray “Go” bars.

CHART 10: WHICH SECTORS ARE LEADING AND/OR LAGGING? The GoNoGo RelMap exhibits that this week, three sectors, Know-how, Communications Providers, and Shopper Staples, outperform the bottom index. Chart supply: StockChartsACP. For illustrative functions solely.

Alex Cole, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software program developer. Over the previous 15 years, Alex has led technical evaluation and information visualization groups, directing each enterprise technique and product improvement of analytics instruments for funding professionals.

Alex has created and carried out coaching applications for giant firms and personal purchasers. His educating covers a large breadth of Technical Evaluation topics, from introductory to superior buying and selling methods.

Study Extra

Tyler Wooden, CMT, co-founder of GoNoGo Charts, is dedicated to increasing using information visualization instruments that simplify market evaluation to take away emotional bias from funding selections.

Tyler has served as Managing Director of the CMT Affiliation for greater than a decade to raise traders’ mastery and talent in mitigating market threat and maximizing return in capital markets. He’s a seasoned enterprise govt targeted on academic know-how for the monetary providers business. Since 2011, Tyler has offered the instruments of technical evaluation around the globe to funding corporations, regulators, exchanges, and broker-dealers.

Subscribe to GoNoGo Charts to be notified each time a brand new submit is added to this weblog!

[ad_2]