[ad_1]

My mid-week morning prepare WFH reads:

• What to Know About TurboTax Earlier than You File Your Taxes This Yr: Don’t get tricked into paying for tax prep for those who don’t must. Find out how the largest tax preparation firms have suppressed free filling choices for years. (ProPublica)

• The Bloomberg Terminal Simply Acquired a ChatGPT-Model Improve: The brand new know-how is designed to make looking out the terminal easier. (Institutional Investor) see additionally How Will AI Change Investing? I Requested a Chatbot: Are analysts toast? Will alternatives to search out mispriced securities disappear? Is my fund bloated? ChatGPT kisses and tells. (Morningstar)

• Traders Offered REITs in Response to the Banking Disaster. They Could Have Overreacted. “We’re much less centered on the dangers to REITs and extra centered on the place personal market property valuations are going,” says Cohen & Steers’ Wealthy Hill. (Institutional Investor)

• There’s Precisely One Good Motive to Purchase a Home: Proudly owning a house gained’t make you cheerful. Filling it with love will. (The Atlantic)

• How You Can Seize a 0% Tax Charge: The zero fee on funding earnings is commonly ignored. Make sure that it’s in your tax instrument package. (Wall Road Journal)

• Not even flawed: predicting tech: “That’s not solely not proper; it’s not even flawed” – Wolfgang Pauli. (Benedict Evans)

• Trump’s Web Value Plunges $700 Million As Reality Social Flops: The previous president’s fortune dropped from an estimated $3.2 billion final fall to $2.5 billion at the moment. The largest cause? His social media enterprise, as soon as hyped to the moon, has come crashing down, erasing $550 million from his internet price—to this point. (Forbes)

• All of the Massive (and Small!) Information From Watches & Wonders Geneva 2023: 2023 (Bloomberg) see additionally The Greatest New Watch Designs of 2023: Listed here are the highest timepieces from the annual Watches and Wonders commerce present in Geneva. (Wall Road Journal)

• FLASHBACK: When right-wing pundits thought political hush cash funds have been against the law: “The info are that he broke marketing campaign finance legal guidelines and that he lied to cowl it up,” Fox Information’ Sean Hannity mentioned. (Widespread Info)

• A Assortment of Cherry Blossoms: Spring began a little bit greater than per week in the past, and the Northern Hemisphere has begun to heat; flowers and timber are blooming. Gathered under are some latest pictures of individuals having fun with themselves amongst groves of flowering cherry-blossom timber in Tokyo; Munich; Washington, D.C.; and extra—indicators of hotter days to return. (The Atlantic)

Make sure you try our Masters in Enterprise interview this weekend with Ken Kencel, founder and CEO of Churchill Asset Administration. The personal credit score agency manages $46 billion in personal capital and is an affiliate of Nuveen, the $1.1 trillion asset supervisor of TIAA. Churchill was the highest U.S. personal fairness lender in 2022 and was “Lender of the Yr” in accordance with M&A Advisor. Kencel was named considered one of personal credit score’s 20 energy gamers.

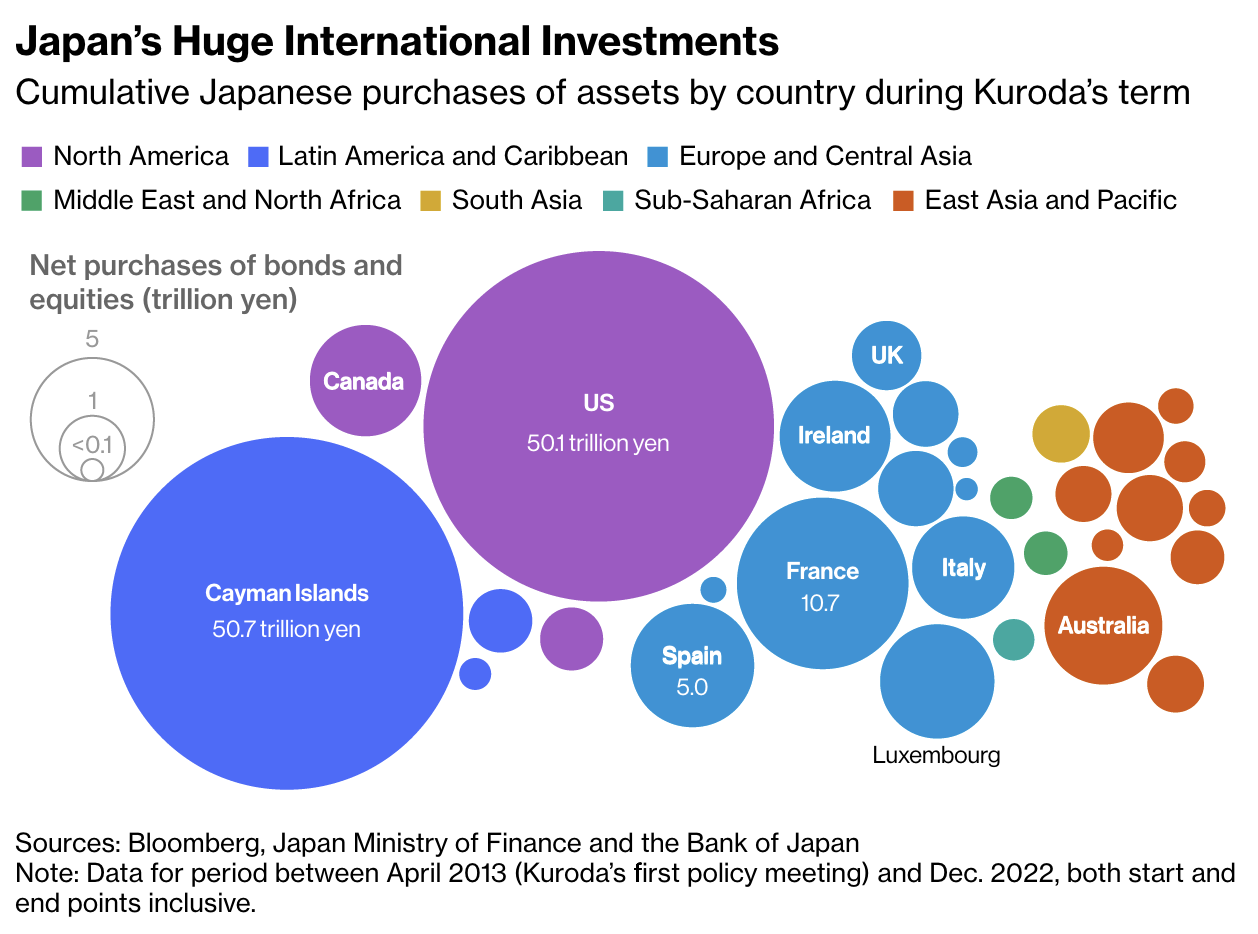

A $3 Trillion Risk to World Monetary Markets Looms in Japan

Supply: Bloomberg

Join our reads-only mailing checklist right here.

[ad_2]