[ad_1]

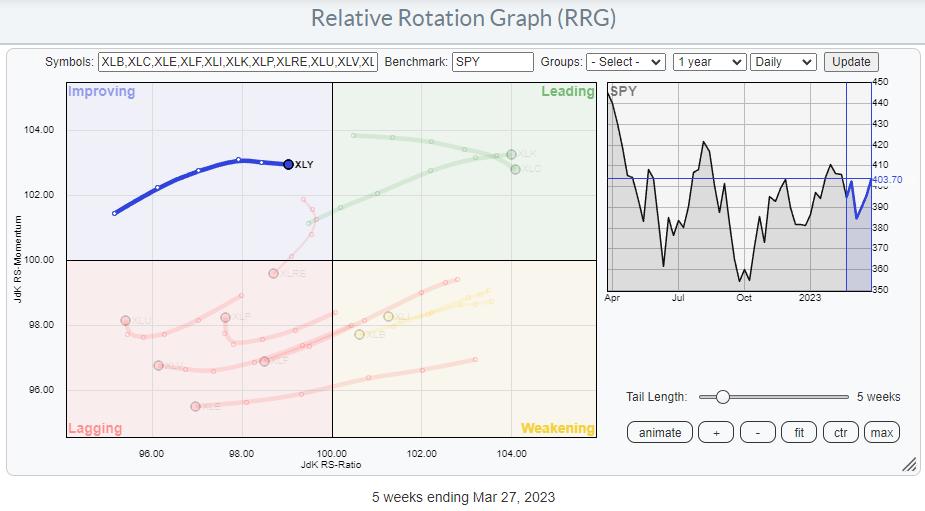

On the weekly RRG, the tail for XLY, Shopper Discretionary, is contained in the bettering quadrant and heading at an RRG-Heading of roughly 90 levels. Not perfect; someplace between 0-90 is stronger, because it signifies that the development remains to be choosing up velocity, however not mistaken both.

With solely two sectors contained in the main quadrant, XLK and XLC, it is sensible to see if we are able to determine the subsequent main sector. Shopper Discretionary appears to be a very good candidate.

Drilling into Particular person Shares

Once we dive into the members of the Shopper Discretionary sector and use XLY because the benchmark, an attention-grabbing picture exhibits up. Not one in every of these particular person shares is positioned contained in the main quadrant. That is due to the robust latest rotation of TSLA, which is pushing all different shares in the other way.

This distortion will be averted by switching to RCD, the equal-weight sector ETF for the Discretionary sector.

On this RRG, you’ll be able to see a way more evenly unfold universe. I’ve zoomed in to visualise higher the rotations which push TSLA off the grid, however we all know the place it’s.

Taking a look at this picture, fairly quickly, a number of thrilling tails will be recognized. These are highlighted within the RRG under.

Inside LEADING: MGM, LEN, NVR, ULTA, TSCO

Inside IMPROVING: TSLA, AMZN, F, CMG, GM, HLT, MAR

Inside LAGGING: MCD, ORLY, DRI

Going over the charts of those corporations, these three popped up as notably attention-grabbing.

ULTA – ULTA BEauty Inc.

After breaking out of its vary in the direction of the tip of 2022, ULTA began transferring in a pleasant rising channel and, this week, managed to take out its earlier excessive. This confirms the power of the underlying development, as it’s seen within the collection of upper highs and better lows.

The latest break of resistance is a transfer into uncharted territory, opening up far more upside potential for ULTA. On the identical time, the draw back is well-protected by the earlier resistance stage round 530 and the rising assist line that marks the channel’s decrease boundary, barely under that 530 space.

The RS line and the RRG-Strains within the chart above use RCD because the benchmark, identical to on the RRG. The secure relative uptrend and the latest flip again up in each the JdK RS-Ratio and RS-Momentum strains counsel a brand new up-leg on this relative development is underway.

AMZN – Amazon.com

THE largest inventory contained in the Shopper Discretionary sector is Amazon at virtually 25%. So it’s protected to say that “When Amazon strikes, the sector strikes.”

Trying on the chart above, we are able to see how Amazon actually halved in value from 180 again in November 2021 to 80 on the finish of 2022. The uncooked relative power for AMZN towards RCD has already began transferring in a downtrend for the reason that begin of 2021.

This resulted within the RS-Ratio line remaining under 100 for over two years. The value decline appears to have halted after the low set in December, and enhancements are beginning to develop into seen from that trough.

A primary increased low is now in place round 90, and the chart is now pushing for a break above double resistance provided by the horizontal stage, which strains up a number of highs and lows going again so far as 2018, and the falling resistance line, which runs over the value peaks since late 2021.

A break above 103-105 might be a big sign, confirming that the downtrend has ended and signaling the beginning of a brand new uptrend. It can undoubtedly assist the uncooked RS-Line to show round and get again into its still-slightly-falling channel and transfer to the higher boundary of that channel.

When Amazon turns round, that may very seemingly even be a driver for the additional motion of the S&P 500.

MCD – McDonald’s Corp

The third chart is for MCD. Though the tail remains to be contained in the lagging quadrant, it has made a pleasant flip again up and into an RRG-Heading between 0-90 levels. These rotations into a powerful RRG-Heading are all the time an indication of power, no matter which quadrant they happen. However what makes this one further attention-grabbing is the break of value to new highs, new All-Time-Highs, into uncharted territory.

In October 2022, MCD pushed above horizontal resistance round 260, however, shortly after that break, began to maneuver in a barely down-sloping vary whereas utilizing 260, the previous breakout stage, as assist. These weeks’ soar above the higher boundary of that consolidation and above the earlier highs at 278 is signaling a brand new part on this uptrend. There isn’t any overhead resistance anymore, and the draw back is protected across the 270 space, the place the previous higher boundary of the buying and selling vary can now be anticipated to supply assist.

Total, it’s attention-grabbing to see that the Shopper Discretionary sector is displaying a mixture of shares which are both very near breaking to new all-time highs or near finishing very massive basing patterns after extended downtrends. Each are robust contributors to general inventory market well being once they materialize.

#StayAlert and have an awesome weekend, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels below the Bio under.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to answer every message, however I’ll definitely learn them and, the place fairly potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative power inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Drive in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary trade as a portfolio supervisor for Fairness & Regulation (now a part of AXA Funding Managers).

Study Extra

Subscribe to RRG Charts to be notified at any time when a brand new put up is added to this weblog!

[ad_2]